1.7B Liquidated. What’s Next?

Liquidations wiped the board clean. Now Solana treasuries, wallet tokens, and DeFi revenue leaders are setting up for a major Q4.

The best way to support me is to share this newsletter. Thank you!

Hey Friend!

Crypto just had a $1.7 billion liquidation event. $1.6 billion of that came from long positions. Over 400,000 traders got their positions nuked, including one poor soul who lost a $12.7 million BTC/USDT bet on OKX.

This all happened as BTC dipped 2.5 percent back to $112,000 and ETH dropped over 6 percent to $4,000.

The Fed cut rates. Markets were supposed to pump. Instead, crypto went sideways and then fell off a cliff.

Some are already calling for further downturn. I still think short-term price predictions are astrology for men. The only real truth is this: More liquidity equals higher prices and macro seems still strong(ish). But first, the leverage tourists had to go.

Let’s get into the broader picture and how to set up for the next week:

️ ⚡ On today's Episode:

📈 Market Update – $1.7B in liquidations rock the market, $1.6B from longs. BTC slips to ~$112K, ETH tanks over 6% to $4K despite the Fed cutting rates. Market expected a pump, got pain instead. Historical September patterns mix with Q4 setup optimism.

🔊 Project Updates – MetaMask and Rabby hint at tokens. USDai raises cap to $500M. Hyperliquid’s $HYPE faces a 45% supply cut proposal. Plasma launches stablecoin neobank. Giza & Pendle debut Pulse agent for DeFi treasuries.

🐂 Alpha Insights – Solana’s DAT flywheel is on fire with $3.7B in corporate $SOL buys. Jupiter is stacking $295M annualized revs, becoming a Solana super-app.

The current state of the market.

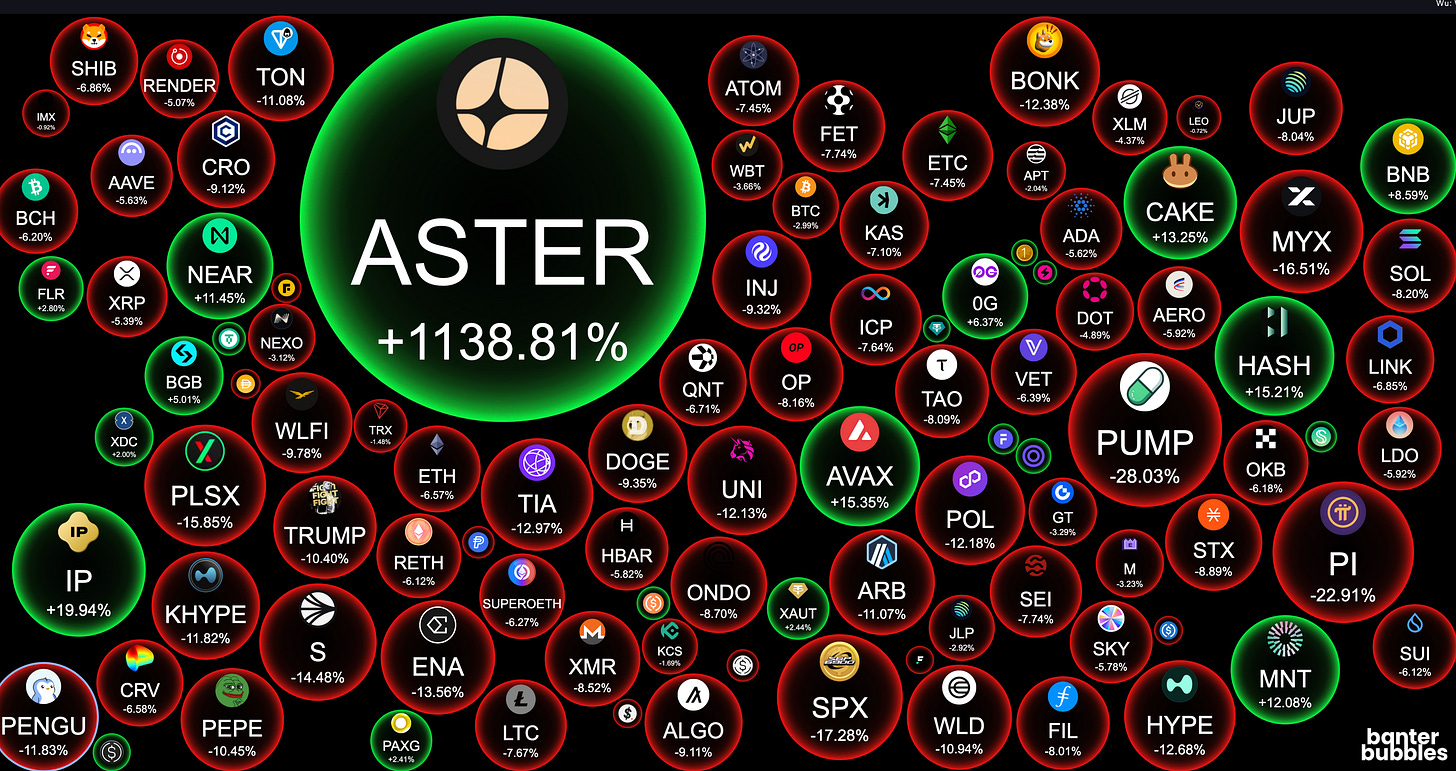

Weekly Crypto Bubbles

→ Can you spot the big winner of the last 7 days? Aster the new perp Dex supported by Binance and CZ himself ripped to the moon. The crime cycle does not end.

Market Overview

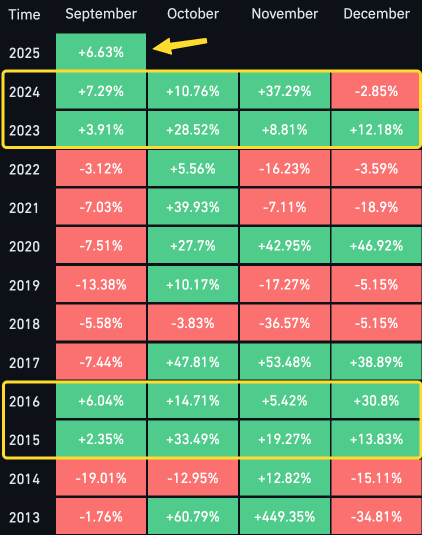

September is usually crypto’s version of a horror movie. Historically, it’s been the worst month for Bitcoin. But this time? BTC washolding up surprisingly well. If it closes green, that sets the stage for a historically strong Q4.

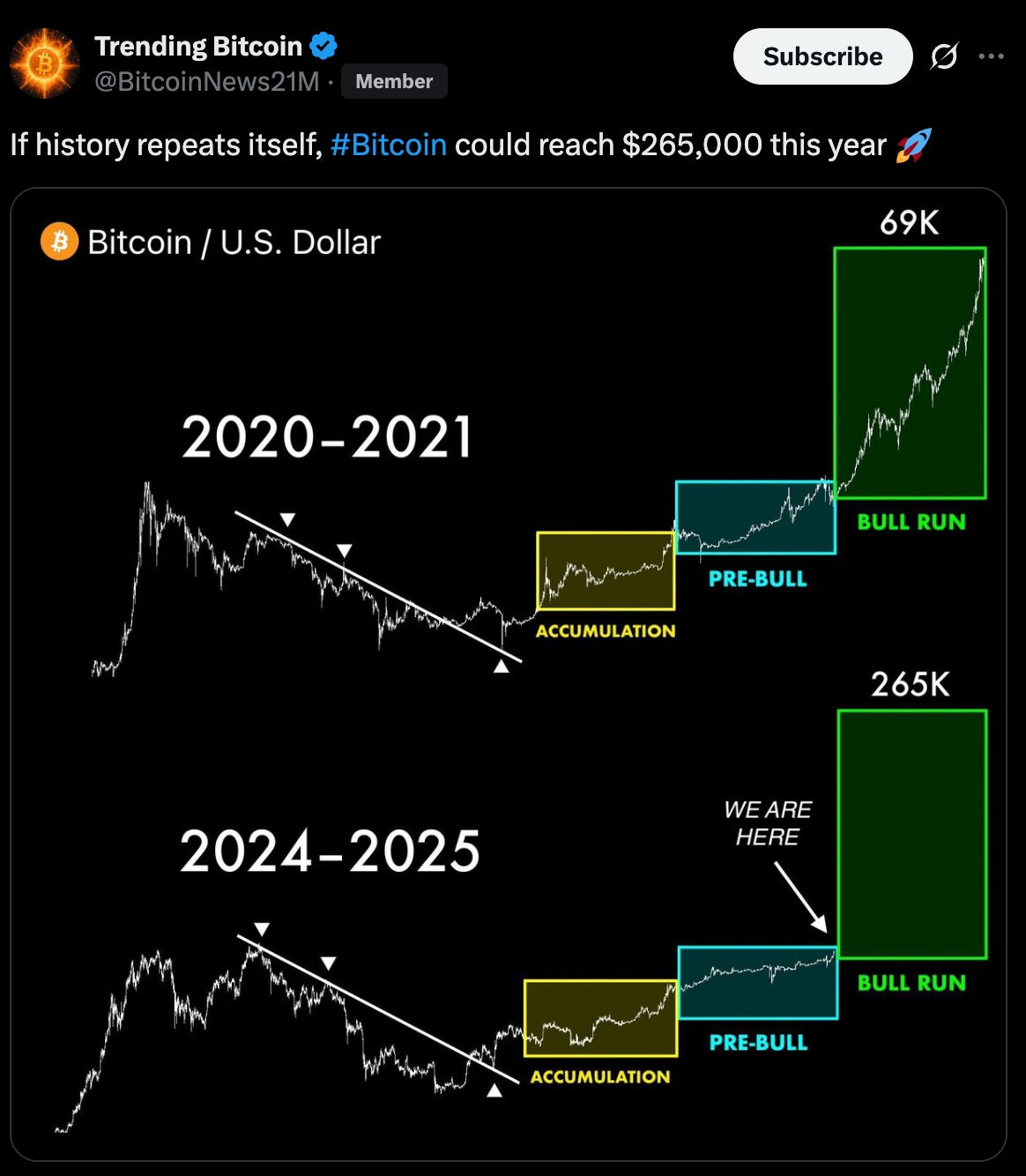

Over on Twitter, some are acting like we’re still early in the bull run.

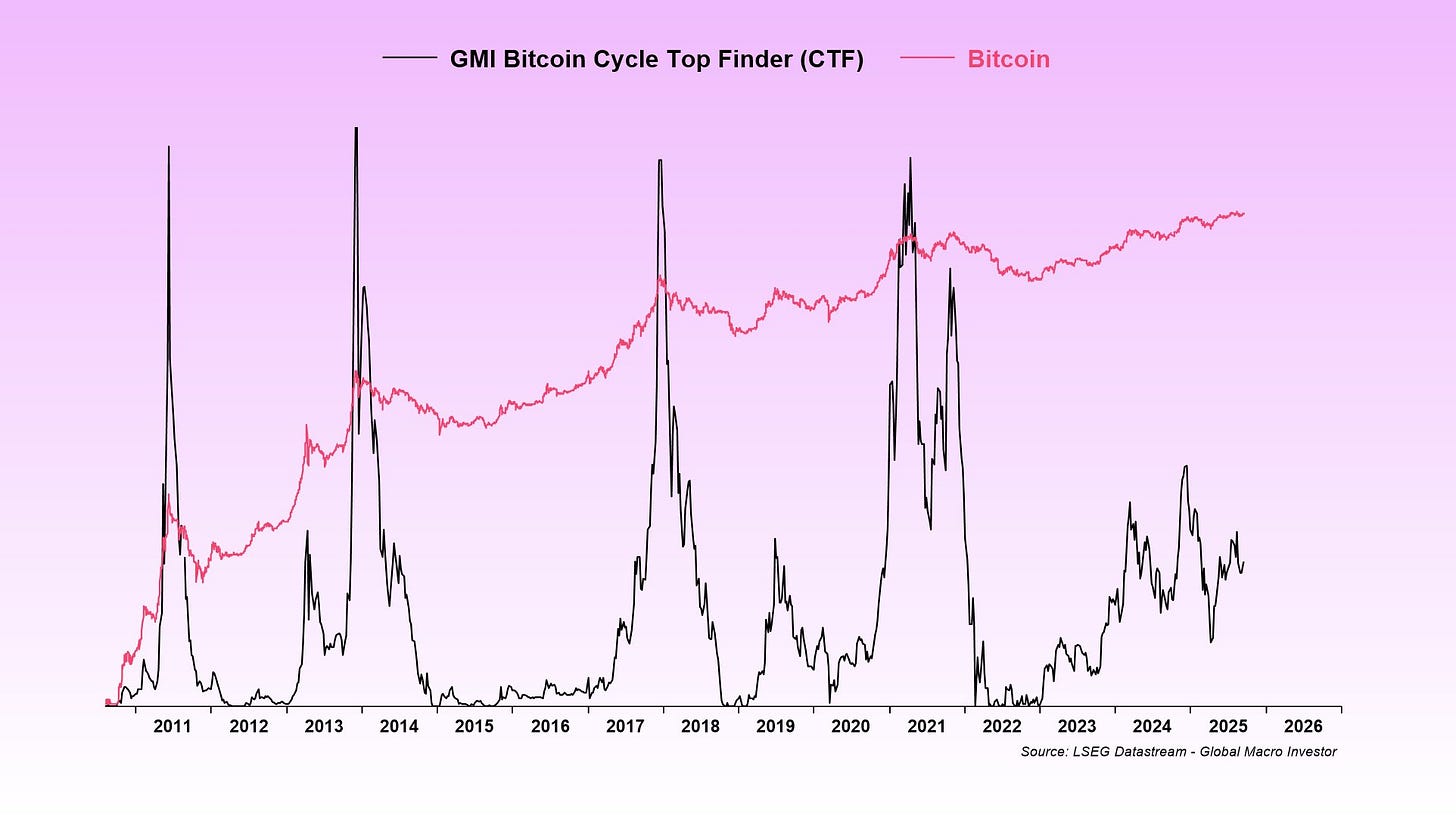

That’s backed up by sentiment tools like Raoul Pal’s “top indicator,” which still shows plenty of room before this cycle tops out.

Still, I’m not fully convinced. Some late-cycle signals are stacking up fast:

DOGE and XRP just got their first spot ETFs

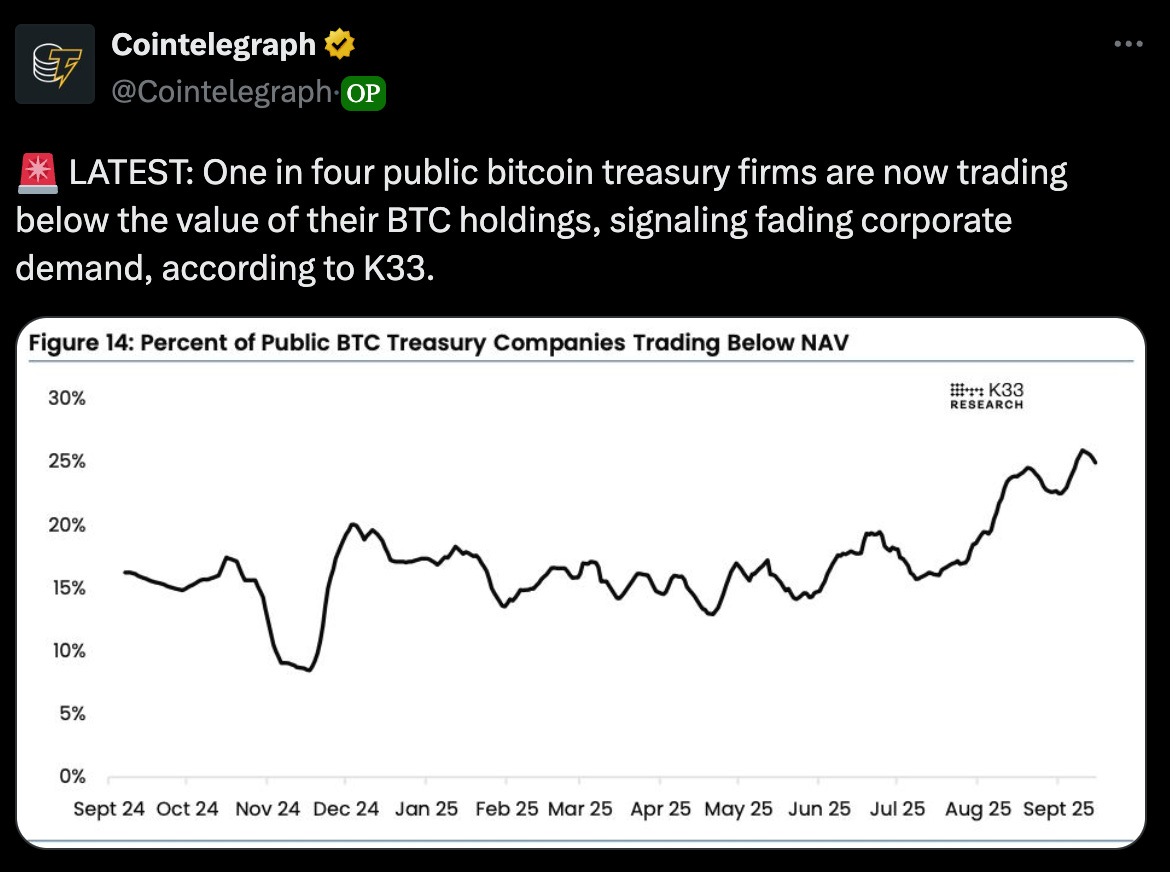

25 percent of BTC-treasury companies are now underwater on their holdings

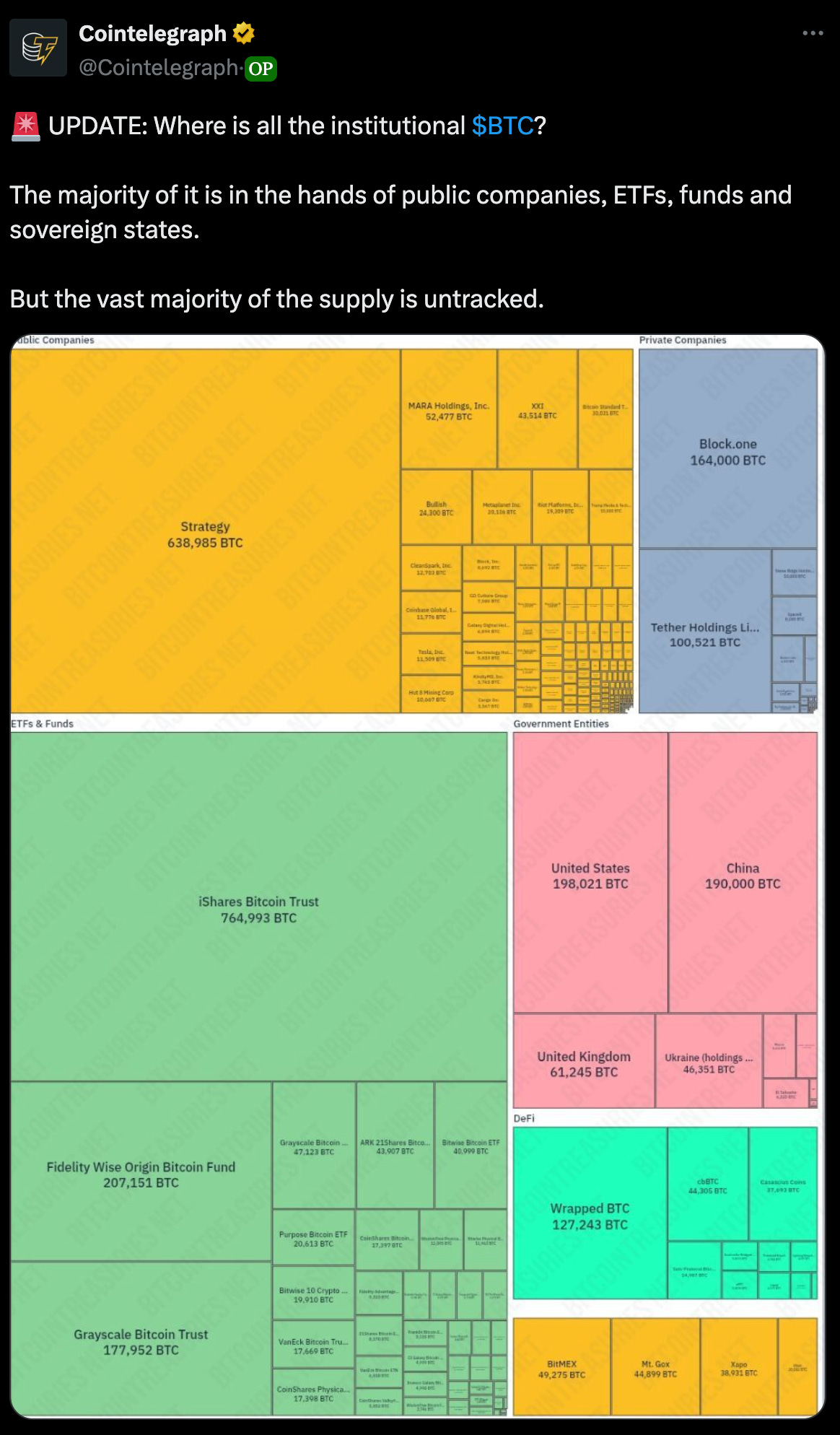

Institutional adoption is already way past what most expected for this stage of the cycle

Right now, I feel between both sides. Too bearish for the bulls, too bullish for the bears. That usually means I’m in the right spot.

Here’s how I see it. If the macro cycle extends, the crypto cycle will too.

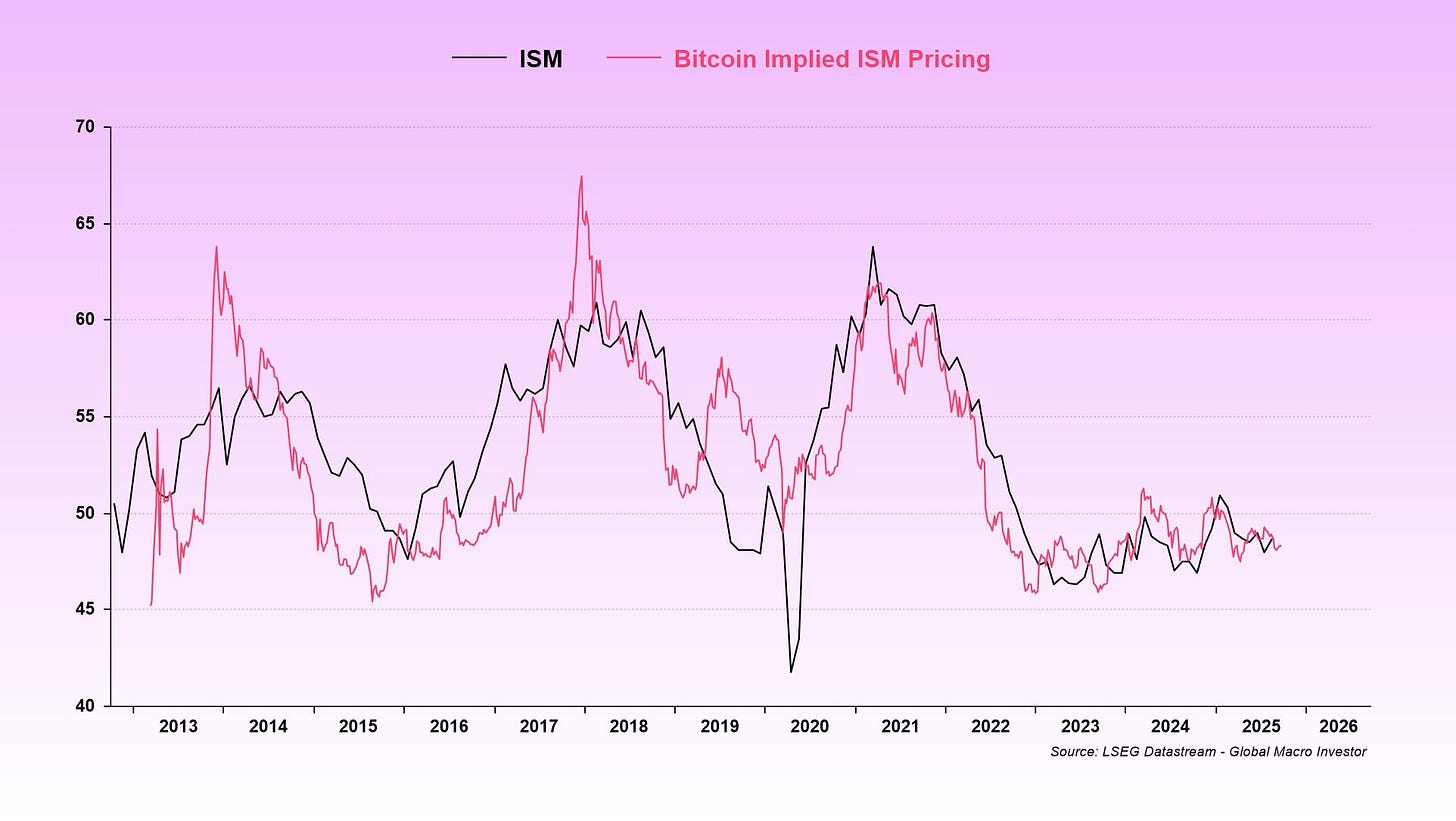

There’s good arguments for this like the ISM Manufacturing Index which tracks the health and activity of the US manufacturing sector. It’s correlation with Bitcoin is still strong and holds until proven otherwise.

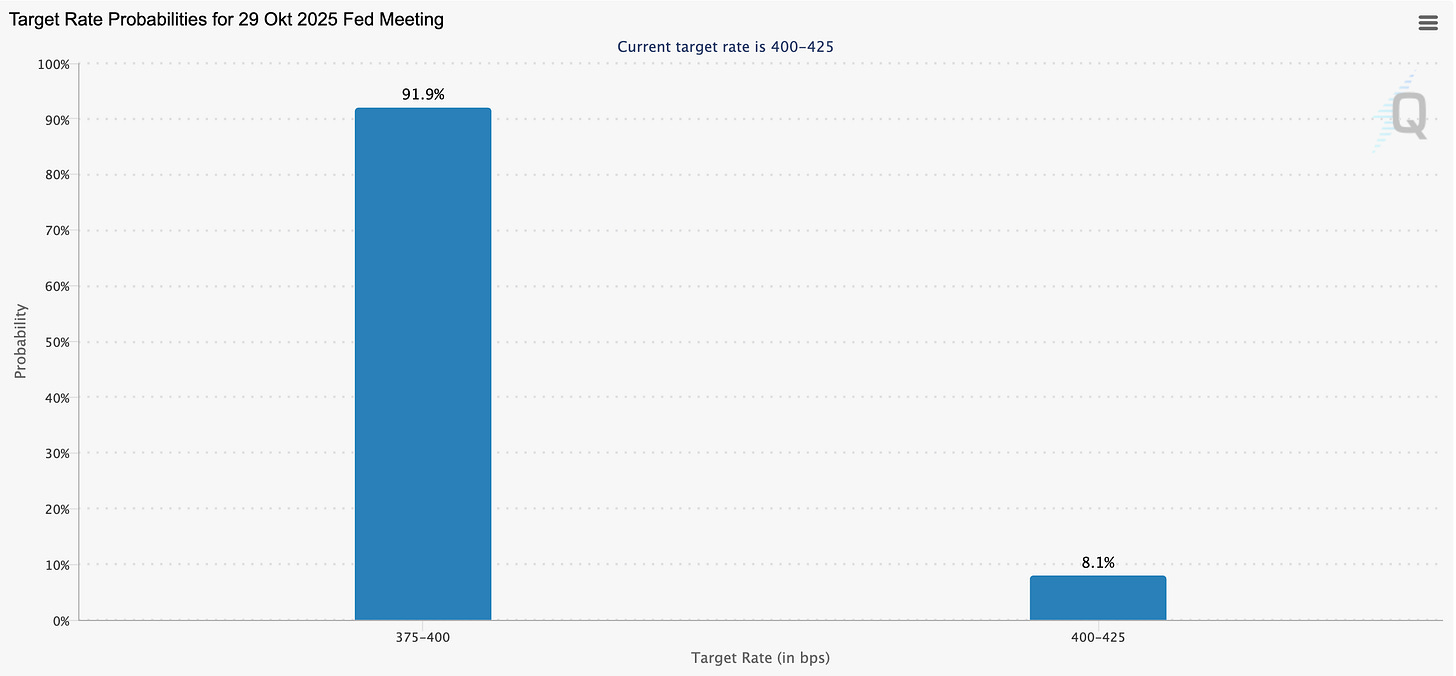

Bitcoin is a macro asset now. And with the odds of an October Fed rate cut climbing past 91 percent, liquidity should keep flowing.

But we still can be a bit worried about Stocks and Gold pumping while BTC dips…

Honestly, what’s up with Gold? Since 2024 it outperformed BTC 👀 …

No worries, we’ve seen this before. It actually happened last year too. And once Stocks and Gold topped out and consolidated, crypto took off to New Highs. The same setup could be forming now.

The charts agree. RSI just hit oversold on the 4-hour. Long liquidations wiped out $1.7B in 24 hours. Last three times this happened, it marked at least a local bottom.

Two of those led straight to new ATHs. This time price also held the 200-day SMA. That’s not bearish. That could be the preparation for the next leg up.

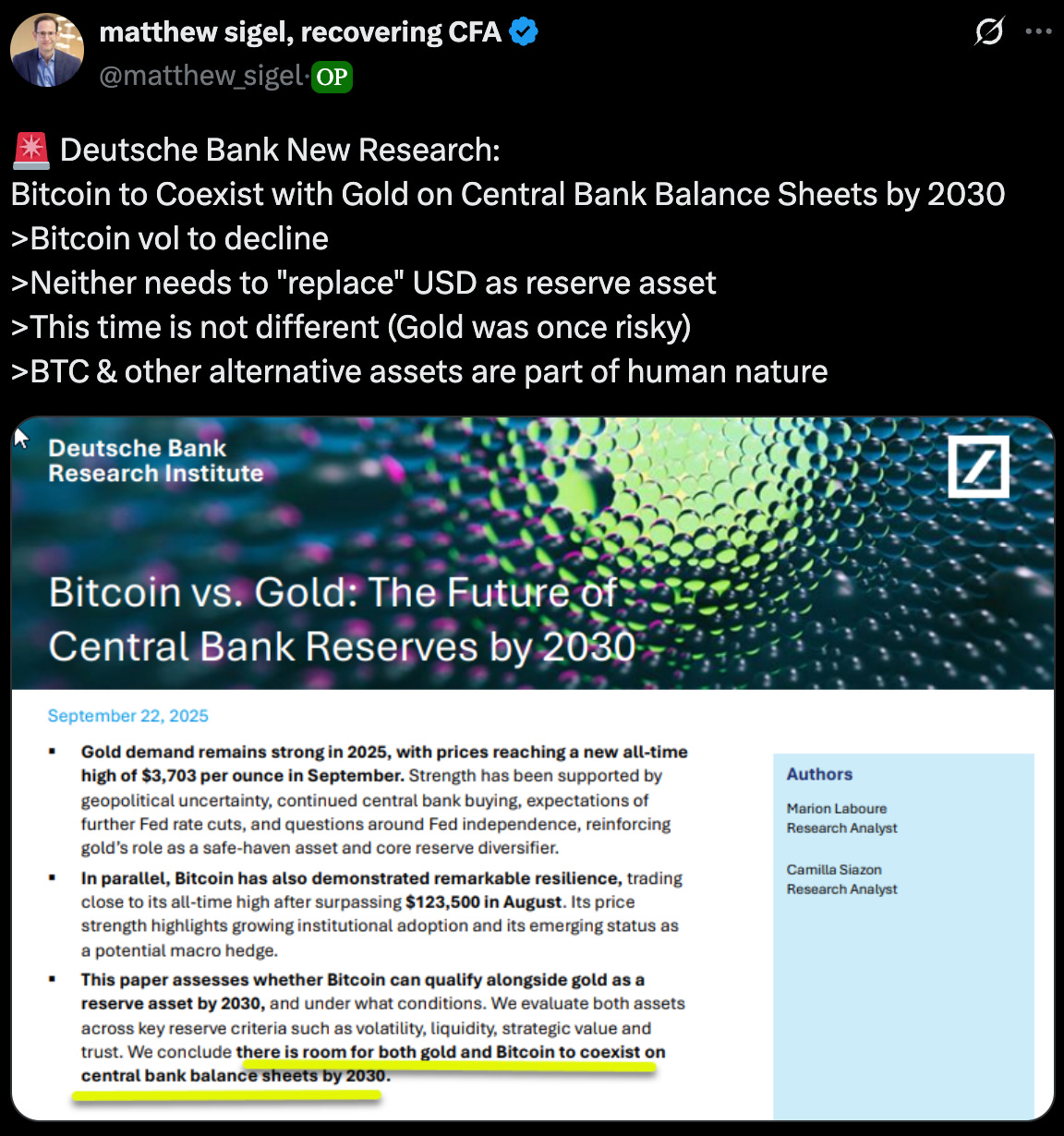

Long-term, Bitcoin of course feels inevitable. Gold sits on central bank balance sheets. BTC will too. The question isn’t if. It’s when.

Market Pulse & Flows

The Inflows

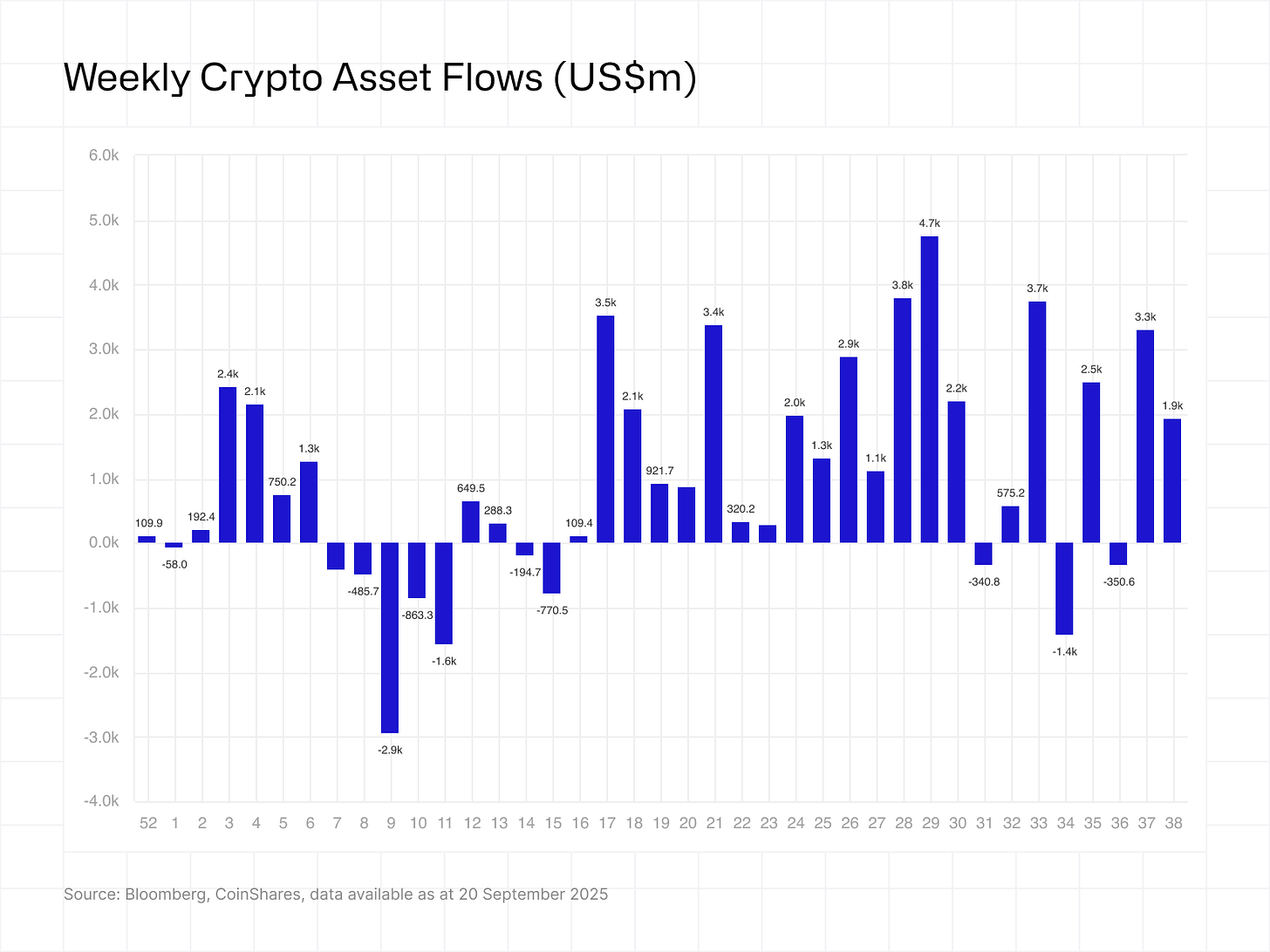

Digital asset investment products saw $1.9B in inflows last week. Bitcoin pulled in $977M, Ethereum followed with $772M, and even Solana and XRP showed up with $127M and $69M respectively.

Where’s it coming from?

🇺🇸 US: $1.8B

🇩🇪 Germany: $51.6M

🇨🇭 Switzerland: $47.3M

🇨🇦 Canada: $21M

No complains on this front!

Who Sold?

Of course Short-term holders were the ones who flinched. No surprise there. They sold more than 15k BTC mostly at a loss.

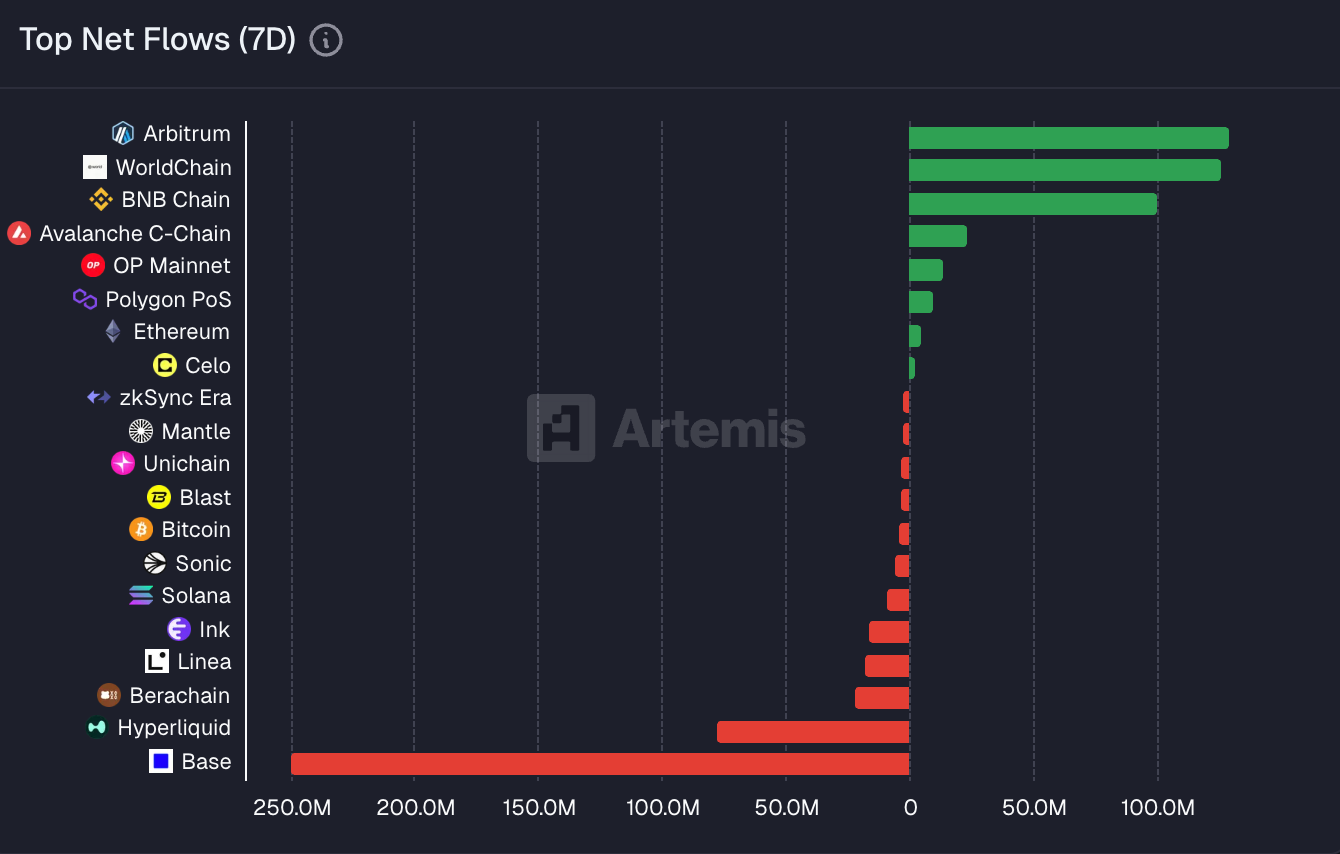

Bridge Flows

Bridge flows show us which eco is hot.

Hyperliquid flows are negative for the first time in a while and Solana’s flow trend has slowed down. The capital rotation is happening to Arbitrum, WorldChain, BNB Chain and even Avalanche.

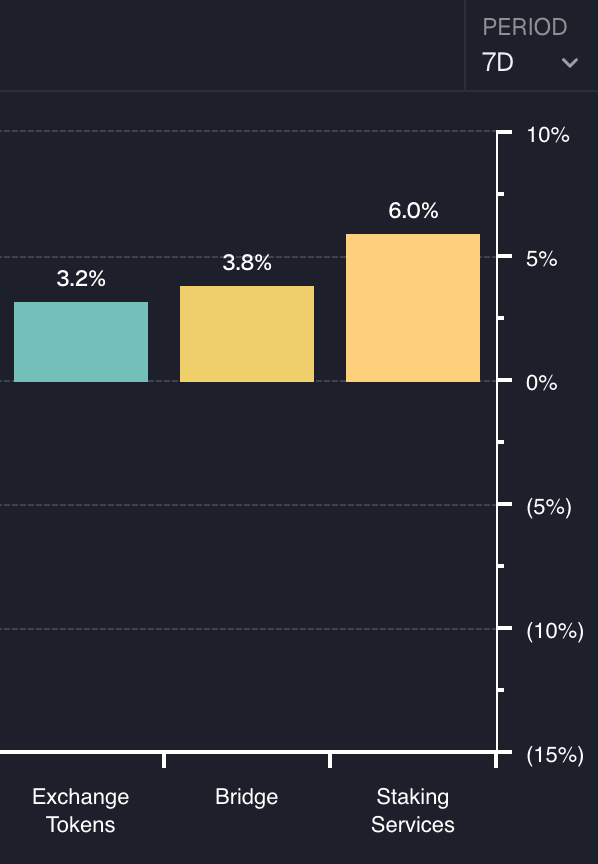

And finally a bit zoomed out. Here’s the snapshot of which sectors are actually delivering:

Sector Performance

1/ Staking Services (+6.0%)

Mostly EigenCloud doing the heavy lifting here. Everyone thought the Google Cloud announcement would be the spark. Nope. The real pump came right after the Fed cut rates.

2/ Bridge (+3.8%)

Wormhole doing the heavy lifting here with the catalyst Wormhole 2.0 Tokenomics Upgrade

Impact: Introduces W Reserve funded by protocol fees, caps supply at 10B, adds staking yield (4% base), shifts unlocks to bi-weekly.

Why Bullish: Links W token value to actual usage. Cuts sell pressure, adds real yield. Analysts calling it the “infra token yield machine.” TVL now above $345M.

3/ Exchange Tokens (+3.2%)

Trust Wallet Token doing the heavy lifting here, but BNB and Bitget Token also performed well. Actually Mantle’s MNT might be missing and it’s by far the best L2 and also kind of an exchange token for Bybit.

Trust Wallet Token (TWT) (+61%): Revamped tokenomics and Q4 roadmap turned TWT into a utility beast—staking, fee cuts, and DeFi hooks. CZ signal boosted. Now leading the wallet wars.

BNB Chain (BNB) (+5.7%): Q3 upgrades (gasless payments, AI wallets, MEV shield) made BNB Chain smoother than ever. Usage keeps surging. Feels like early-cycle BNB again but there’s tons of crime involved. CZ keeps shilling tickers and Binance lists weird small caps. I am fading it but only because I have no edge.

Bitget Token (BGB) (+3.8%): Morph Layer 2 deal triggered a $1B burn and deflation shock (77% supply cut). Now Morph’s gas and governance token.

The biggest updates across top crypto projects.

🪙 Wallets Are Waking Up

MetaMask

On Sept 18, Consensys CEO Joe Lubin confirmed that MetaMask will launch a token. $MASK will tie into MetaMask’s decentralization goals, and could reward users based on past activity like swaps, staking, or Portfolio use. Lubin also hinted that holding LINEA tokens could lead to other drops down the line. With 30M+ active users, this could become one of the largest wallet-based airdrops in crypto history. Timing? “Sooner than you think.”

Rabby

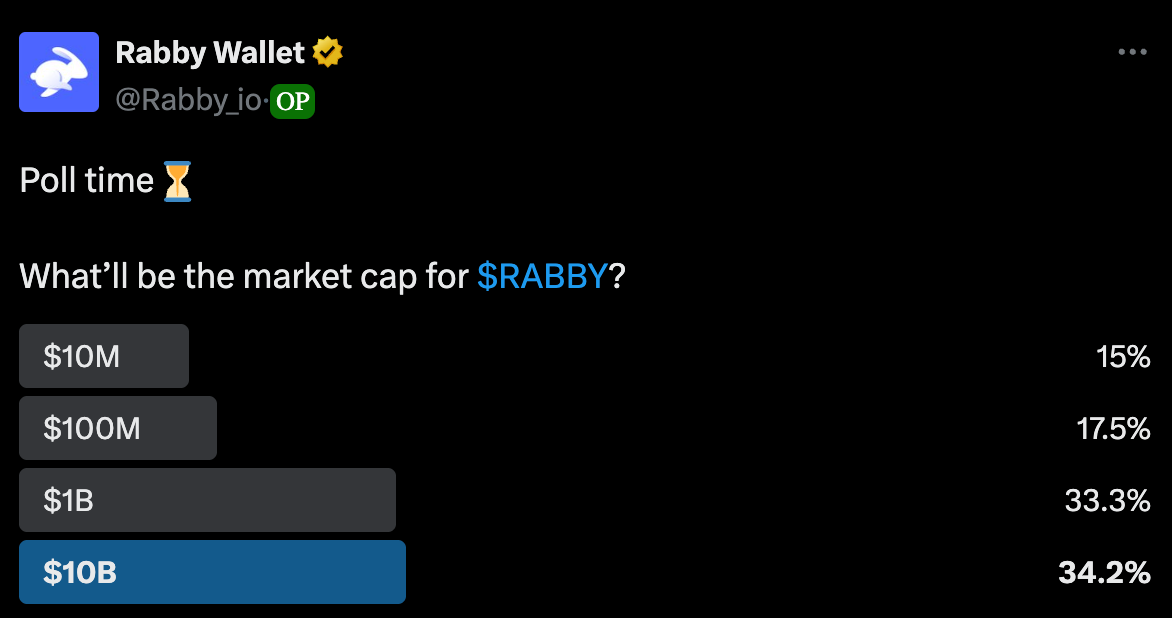

One day later, Rabby posted a poll teasing its own token, $RABBY. While there’s no TGE date, the project ran a points system in early 2024 and still displays totals to users.

Rabby and DeBank share the same team, so speculation around a combined airdrop is heating up. In the meantime, Rabby just launched perp trading powered by Hyperliquid, adding another feature to farm.

TLDR: Wallet tokens are officially a thing again. MetaMask is setting the tone, and Rabby looks ready to follow and Rainbow Wallet also seems to drop a token soon. If you’ve used either, check your points and start racking up transactions. This could be extremely lucrative.

Hyperliquid Update: $HYPE Supply Reduction

Speaking of Hyperliquid above, community members Jon Charbonneau and Hasu proposed slashing $HYPE’s total supply by 45%. The plan? Burn 421M unminted tokens that were allocated to emissions and community rewards. This is still in proposal phase, but if passed, it’s a massive future supply shock.

Plasma: Stablecoin Neobank Incoming

$XPL is preparing for its mainnet beta on September 25, launching Plasma One – a neobank and card product built natively for stablecoin users. This adds real-world UX to stablecoin rails, targeting the “crypto checking account” use case.

Giza x Pendle: Meet Pulse

Giza dropped a new agent called Pulse. It’s built in partnership with Pendle and auto-optimizes your PT (Principal Token) portfolio. Think: AI treasury management for DeFi yield strategies.

USDai Caps Raised to $500M

USDai increased its deposit cap to $500M on Sept 23. They’ve publicly said there are no more planned raises for now. Their Allo points program is still live, so if you’re yield hunting with stablecoins, this is worth a look.

Good opportunities I discovered.

Alpha 1: Ready for BASE?

Base founder Jesse Pollack just dropped a bomb: They’re exploring a native token.

Crypto Twitter went straight into “stimulus check” mode. Base is one of the top 3 chains by activity. Everyone’s touched it. So of course, everyone thinks they’re owed a fat airdrop.

But pump the brakes. The chance of a $BASE token in 2025 is close to 0.

Which actually isn’t bad news. No token this year means more time to farm.

Now, before you go full degen, understand this: Base already has around 250 million wallets. So unless you’re deep onchain, your personal airdrop slice might be thin. Still, ignoring $BASE entirely would be a miss.

Here’s how I’m playing it: Shifting organic activity over to Base.

Lending? Moving positions to Morpho on Base.

Swapping? Doing it through Base DEXes especially Aerodrome.

Bridging? Using the official mainnet bridge—only 650K wallets have done it. That already puts you in the top 2.6%.

Some easy apps to get volume going:

Zora – mint and list

Virtuals – trade agent tokens

Aerodrome – provide LP

Bankr – mess around with it on Farcaster apps

Morpho – lend cbETH or cbBTC

Looking for projects without tokens (double airdrop potential):

Basename - get a name

YO Protocol - earn yield

Just interacting with these could generate hundreds of unique txs, which might help later if Base goes the Arbitrum-style airdrop route.

No promises, of course. They could roll out a points program tomorrow and pivot the whole game. Still, this move already boosted Base’s ecosystem. SOL bridge is coming too, which means Solana liquidity might start flowing in.

Bottom line: $BASE isn’t confirmed yet, but Base Season might be back.

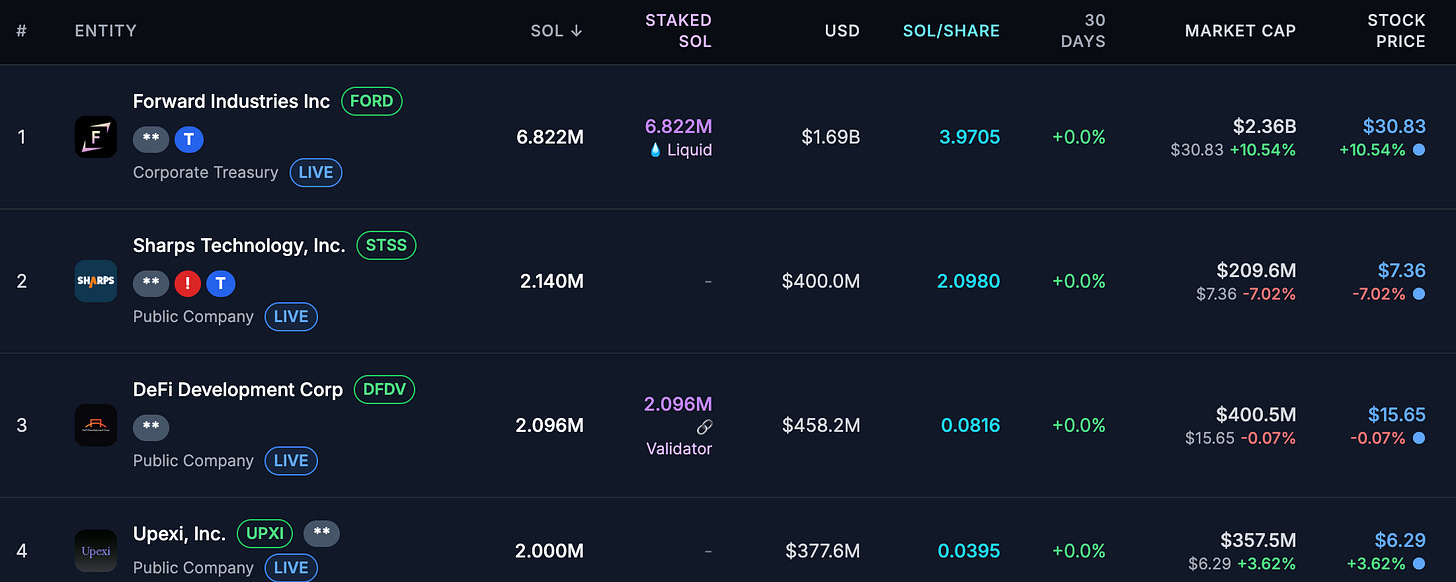

Alpha 2: Solana DATs: The Yield-Powered Flywheel

Solana just turned the DAT meta into a high-yield machine and might be even more interesting for institutions and companies than Ethereum for the moment.

Digital Asset Treasuries (DATs) — public companies stacking $SOL — aren’t just buying for exposure anymore. They’re farming on-chain yield. The playbook is clean: raise fiat off-balance-sheet, buy $SOL, stake or deploy to DeFi at 7–8% APY, and grow SOL-per-share. It’s boringly effective — and it’s working.

DAT holdings ballooned from $1.5B to $3.72B in under a month, now totaling ~17M $SOL. That’s a +130% jump since early September. And only ~1% of SOL supply is currently locked. There’s serious 10x potential here.

The Two Big Guns

$HSDT (Helius Medical Technologies) – Pantera & Summer Capital’s vehicle

Closed $500M PIPE on Sept 18, plus $750M in warrants

Already bought 760K $SOL (~$167M avg. ~$220)

Trading at ~$20.79 with mNAV ~1.2x

Dan Morehead (Pantera) advising; Cosmo Jiang on the board

$FORD (Forward Industries) – Multicoin, Jump, Galaxy’s turbo-DAT

Closed $1.65B PIPE on Sept 11

Bought 6.82M $SOL (~$1.58B avg. $232), including $1M on DFlow

Filed for $4B ATM equity program on Sept 17

Trading at ~$30 with mNAV ~1.5x

From Sept 5–12, $SOL ran from ~$200 to $240 — right in $FORD’s buy window. Even after a cooldown, it’s holding strong at ~$227, with $4B+ in pending DAT inflows softening broader market pressure.

Why It Matters

$SOL Price: ETH 2021 Vibes… But Smarter

ETH’s 2021 treasury pump (2.5K → 4.8K) was driven by the hope for more Wallstreet adoption and Ethereum powering TradFi onchain. Solana’s setup has better yield mechanics:

6.2% staking inflation + 1.8% MEV = 8% total APY

Compoundable without dumping

Some buys (Pantera’s $1.1B bag) stay off-market, but still: analysts see 5–10M $SOL ($1–2B) in net demand by year-end

VanEck’s price target? $520 by EOY.

Arca’s CIO? Calls $SOL the “most obvious long” for a 200% rip.

DeFi: Liquidity Engine Goes Brrrr

Solana TVL hit an ATH of $14B+ on Sept 23, led by:

Jupiter – $3.4B

Kamino – $3.3B (lending)

Jito – $3.2B (staking)

$FORD’s treasury is 13% of Solana TVL. If even 20–30% gets deployed, that’s $300–500M in fresh liquidity.

So the DAT → DeFi pipeline could look like this:

Borrow at 5% from banks

Deploy at 10%+ onchain

Expect flows into Multicoin darlings:

Jito – for MEV staking

Kamino – for yield strategies

Plus DePIN experiments like Helium

The Big Picture

This isn’t just a new wave of HODLing — it’s capital working.

More TVL → higher yields → bigger DAT inflows → stronger price floor.

The SEC is actively exploring tokenized treasuries, and Solana already clocks 3.7M Daily active wallets and 23B txs YTD. It’s DeFi’s fastest chain, now with the institutional narrative to match.

DAT consolidation is likely (20+ projects → 3–4 mega-DATs), but the flywheel has started. With ETF rumors circling for October 2025, Solana’s macro moment could be here.

This is leading us to more actionable alpha

Jupiter: The Super-App Play

Jupiter isn’t just aggregating swaps for a while, it’s aggregating everything.

And it’s doing it on Solana with the speed and ambition most teams can only dream about.

Let’s break it down:

📈 Revenue: Real & Growing

Jupiter’s not a narrative coin. It’s a revenue machine.

Q2 revenue: $38.4M

Annualized revenue: $295M

And that’s with zero token incentives. Zero VC. Just raw, onchain demand.

Perps, swaps, Ultra Mode — it’s stacking fees across verticals. Now also: lending. Then more.

📱 Super-App in Motion

Jupiter is becoming the frontend for the Solana economy:

Ultra: delta-neutral yield vaults

Perps: degens go here now

jupSOL: 5M SOL staked, 11.5% share

Pro: onchain trends, real-time alpha

Portfolio: clean, aggregated views

Studio: token launchpad + memecoin engine

Onboard: fiat rails, mobile-first UX

And it’s all syncing with Jupiter Mobile — 300K+ downloads already.

🧩 The Final Boss: TradFi Rails

If Jupiter wants to actually compete with a fintech like Robinhood and become a Super App helping newbies onboard it needs fiat primitives.

That means banking. Bill pay. Credit. Undercollateralized lending.

Easiest route: Banking-as-a-Service. Skip the license, launch faster, and plug in trad rails through partners.

It’s how Robinhood scaled. Jupiter could follow the same playbook.

🪙 $JUP: Token Engine Kicking In

50% of protocol revenue goes to $JUP buybacks. At this pace, it’s ~$15M/month.

But there’s $27M in monthly unlocks until 2026 — team + early investors which puts a lot of sell pressure on the token, so it’s not an easy hold.

That’s the real overhang.

Still, Meow (cofounder) has locked 280M $JUP until 2030. That’s conviction.

And January 2026 brings “Jupuary” — a 700M token airdrop (~22.5% of supply). Expect a selloff, but also massive attention.

📊 Valuation: Cheap if You Believe

Current market cap: ~$1.47B

Fully diluted valuation: ~$3.32B

Next 12mo supply-adjusted: ~$2.15B

Annual revenue: ~$300M

Revenue multiple: ~7x

Competitors:

Cowswap: ~11x

Hyperliquid: ~14x

Aave: ~35x

If Jupiter closes the TradFi gap? This multiple rerates hard.

🧠 TL;DR

Jupiter’s not a swap site. It’s Solana’s UI layer — with native yield, perpetuals, and serious UX.

Revenue is real. Buybacks are live. Execution is fast.

TradFi rails are the unlock. Banking, payments, credit.

$JUP looks cheap vs comps — but dilution and Jupuary will test diamond hands.

If you ever wanted a crypto super-app, it’s already here.

→ That’s why I’m holding and staking JUP since the beginning of 2024. If Solana sees the next leg up, JUP should outperform it.

📈 Ultimate Exit Strategy → clear frameworks to secure profits when the top is near. No more bag-holding into the next winter.

🧠 Stoic Mindset Coaching → practical tools to keep calm when the market goes manic and everyone else loses their head.

🧑💼 Weekly Community Vote → YOU decide which project gets the deep dive next. No shills, no noise, just alpha.

📹 2× Weekly Market Update Videos → skip the endless charts, get the exact signals that matter delivered straight to you.

💬 Premium Daily Support Chat → personal access to me for questions, strategy tweaks, and sanity checks in real time.

👉 Don’t just read along — get the playbook, the tools, and the community that makes the difference between surviving and thriving in this cycle.

That’s it for today’s episode, thank you for being here!

Till next time, stay safe!

Great article. I appreciate your honesty and clear communication “Right now, I feel between both sides. Too bearish for the bulls, too bullish for the bears. That usually means I’m in the right spot.”

But my question is do you or how can you rotate capital from BTC to alt season mode coins like ETH, SOL and memes. Or high conviction coins MEANS you never sell BTC and possibly ETH/SOL?

Stable/yield coins, I guess also are also held constantly-SKY, SYRUP, PENDLE, ENA?

Thanks