Adrian's DeFi Alpha #11: Crash or Opportunity? | TON Airdrops | Mantle LRT | Best Scroll Farms

Definitely no financial advice, just insights based on my own journey in DeFi.

Hello there Friend,

busy with work and personal projects? Let me help. I’ve been navigating the DeFi space since 2020, and I love sharing what I learn.

These are the advantages you will get in each newsletter:

The key developments in Crypto.

Practical insights to act on.

All packaged in a 5-minute read. No sponsored content, no trading chaos. Just insights based on my own journey in DeFi.

Let’s make the most of your time!

FYI

I am linking the sources of the images in the newsletter, just click to follow the link.

Market Update

Highlighting the key developments and their implications.

Weekly Crypto Bubbles

The global #crypto market cap today is $2.23T, a -4.76% change in the last 24h. Total trading volume in the last 24h is at $111.3B. #BTC dominance is at 51.24% and #ETH - 16.75%.

What’s moving the market?

This week marks the start of a new quarter. Does this fresh start call for renewed optimism? Let’s break it down layer by layer.

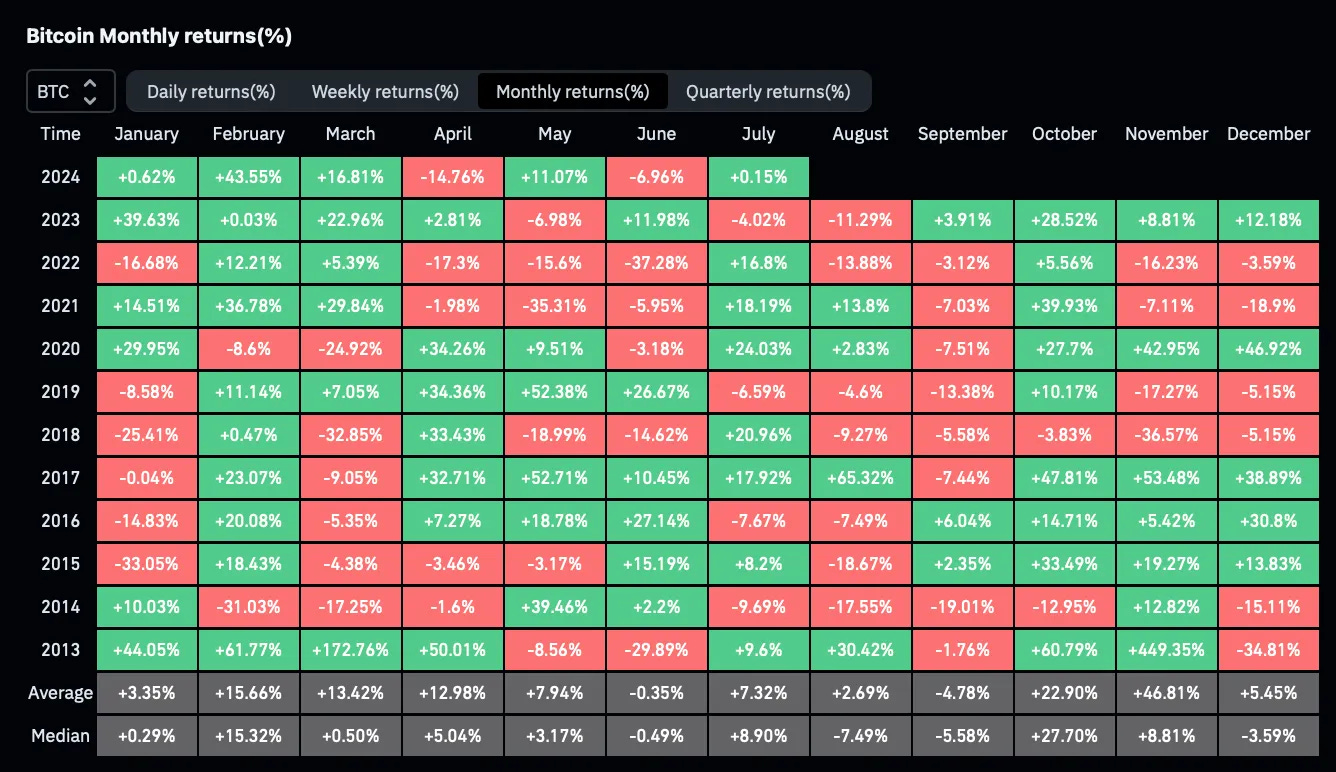

Historically, the third quarter has not been the best for Bitcoin and other cryptocurrencies. However, drawdowns during this period have typically been less severe. August and September are usually associated with mass selling, while July often sees more buying activity. In fact, the average returns for July stand at 7.32%, compared to 2.69% for August and -4.78% for September. If history rhymes in 2024, we might see another green July.

Since the last Bitcoin halving, miners have been selling aggressively, but recently, they've started taking it easy. The number of miner withdrawal transactions has nearly bottomed out, which could signal another price leg up soon.

Bearish News on Bitcoin

Before we get too excited, we have to remember the bearish news surrounding Bitcoin:

Mt. Gox Creditors are expected to receive their coins in July, collectively worth around $9bn BTC.

The German Government has started selling some of the BTC it seized years ago. They still hold more than 43K BTC, worth around $2.6bn at current prices.

The US Government also sold some seized BTC, though the amount was not substantial.

Ethereum ETF But No Strength

Despite the upcoming Ethereum ETF, ETHBTC is not moving significantly and still trades around 0.055. This is surprising considering the headwinds facing Bitcoin that Ethereum is not concerned about, such as selling pressure. The $ETH ETF might not be correctly priced in yet, presenting a potential opportunity. I am just dollar cost averaging into ETH. This proved to be the best strategy for me.

ETH Related Coins: Mixed Performance

Besides memecoins, the strongest ETH beta coin recently has been $ENS. It broke out of its $28 resistance and went as high as $34 but gave back much of the move in the last two days. Keep an eye on $ENS if you’re looking to bid on ETH beta coins, they have an update coming on July 8th.

$LDO, which was strong since mid-May, suffered due to the SEC filing a lawsuit against Consensys over Metamask swaps and staking services, claiming that Lido and Rocket Pool are unregistered securities.

Other ETH-related coins have also faced difficulties:

$PENDLE: -17% in one day, and -40% in TVL in one week due to reduced “restaking speculation”. A good buy zone for me and I am also DCAing into $PENDLE.

$ETHFI: -25% in a week due to upcoming unlocks.

$DEGEN: -40% in two weeks, one of the leading Base coins.

On the other hand, DeFi 1.0 coins like $AAVE, $MKR, $LINK, are holding up well. $AAVE and $MKR, in particular, are revenue-generating with low valuations, making them potential bids if the market pivots to fundamentals and less regulatory fear.

Among ETH memecoins, $PEPE has been weak over the last seven days, retesting its 0.00001 support level. Conversely, $MOG has been strong, reaching a new ATH near $700M market cap and remaining up 1.5 x from June 18 despite recent sell-offs.

AI x Crypto will come back this summer and I am still buying. If you want to know what exactly, get a limited free premium subscription by sharing this newsletter:

Solana ETF Soon?

This year, we’ve seen approvals for Bitcoin and Ethereum ETFs, seemingly impossible feats given the SEC’s resistance. Now, Solana is next in line. VanEck recently filed for the first Solana exchange-traded fund (ETF), asserting that Solana functions similarly to BTC and ETH with several utilities, making it suitable for an ETF.

Interestingly, 21 Shares filed for a Solana ETF just hours after VanEck submitted their application. With these filings, it's likely other competitors will follow suit. GSR, an investment firm, stated in a recent report that the Solana ETF has a high likelihood of approval based on its decentralization and demand scores.

These scores evaluate how decentralized the blockchain is and the potential demand of the token based on its utilities, which Solana easily meets. Hence, the approval of a Solana ETF could be a possibility (maybe next year).

Besides that there are many reasons to be bullish on SOL:

Altcoin Market Movements

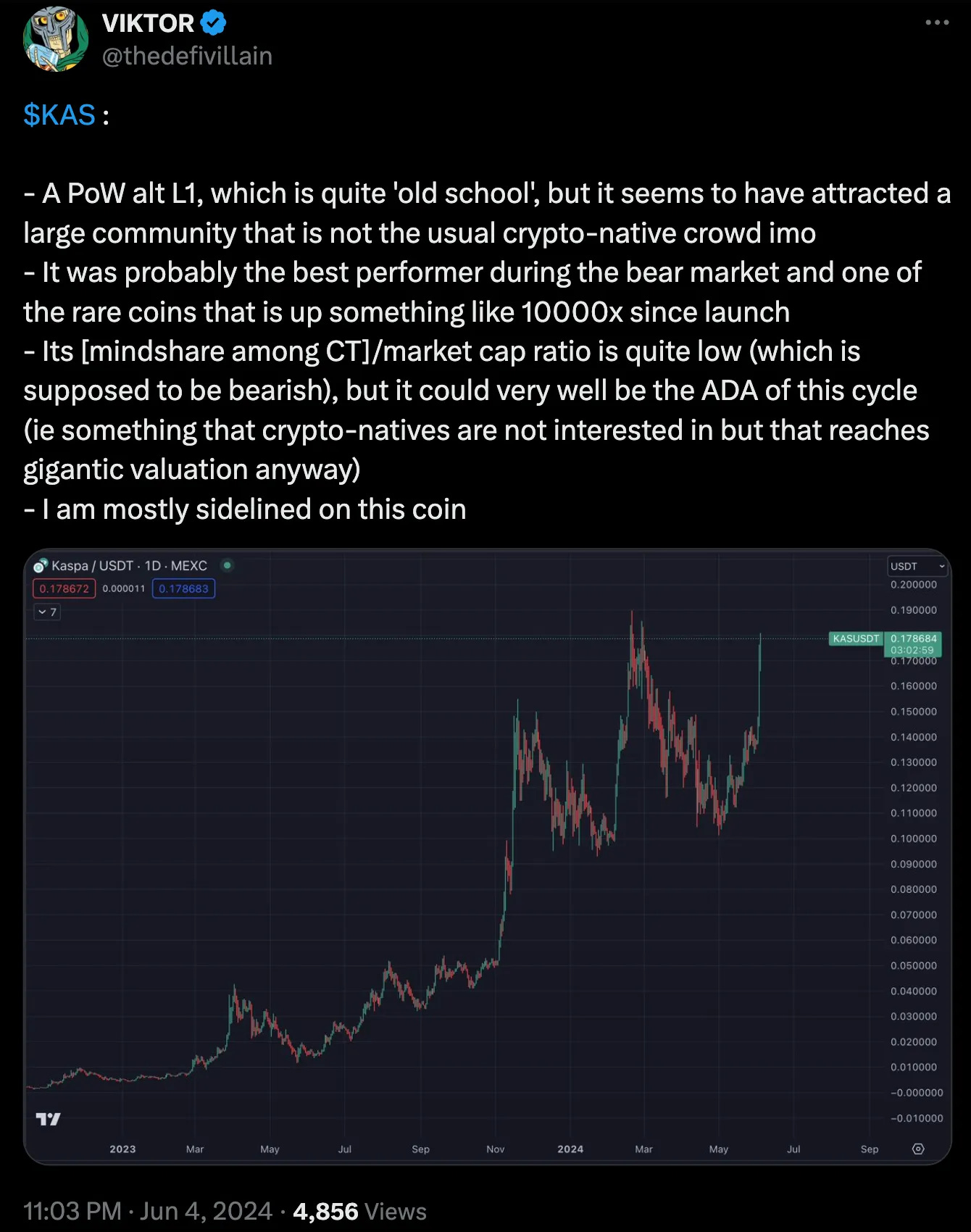

$KAS is among the strongest coins in the top 100, reaching a new ATH a few days ago but being rejected again below $0.2.

Grayscale’s Top 20

Grayscale published a list of 20 high-potential assets for Q3 2024, focusing on trending catalysts, adoption trends, and tokens with low or moderate supply. These tokens are a must-watch for those looking for “safer” altcoin bets (which are still risky compared to BTC, ETH, SOL of course).

Polymarket finds Product-Market-Fit

Alpha Section

Alpha 1: DeFi Protocols on TON with Airdrop Opportunities

TON is booming like no other L1 (besides SOL maybe?) I started farming these protocols actively. Beware of the high transaction fees (2-3 USD).

I can recommend to use a smartphone for most of these activities. It’s fun and works quite well. DeFi on the go!

Ton Stakers: Ton Stakers

Function: Offers liquid staking of TON tokens.

Yield: Approximately 3%.

TVL: Notably larger than its counterpart, Bemo.

Airdrop Opportunity: Potential future airdrops for stakers. I staked 1/4th of my TON there.

Bemo: Bemo

Function: Another platform for liquid staking of TON tokens.

Yield: Around 3%.

TVL: Over $70 million.

Airdrop Opportunity: Onchain points program offering staking token holders 15% of the total supply once TVL hits 30 million TON. I staked 1/4th of my TON there.

Evaa: Evaa

Function: Leading lending market on TON.

Use: Deposit liquid staked TON from Ton Stakers or Bimo and earn APY.

Airdrop Opportunity: Participants earn Evaa XP points and potentially qualify for airdrops through lending and borrowing activities.

Ref: Evaa Bot

Storm Trade:

Function: Leading perp trading DEX on TON for leveraged crypto trading.

Airdrop Opportunities: Ongoing points program where reward points convert to Storm Trade tokens. Earn points by opening your first position, trading positions over $100, and depositing liquidity.

Strategy: I am providing liquidity with 1/4th of my TON and trade with the rest on 2 accounts. One on the telegram smartphone app and one on my browser.

I am going long on one account and short on the other to farm delta neutral.

DeDust and Stonefi:

Function: Decentralized exchanges for swapping tokens and liquidity provision.

Yield Opportunities: 82% APY for TON/USDT pairs in DeDust and 79% APY.

Airdrop Opportunities: Token rewards for liquidity pool participants.

More info on TON DeFi

Alpha 2: Mantle - Methamorphosis Season 1

Mantle announced that Season 1 of Methamorphosis is now live. They launched cmETH. a new restaking token. Starting from July 1 and for 100 days, users will accrue Powder daily across their mETH positions. The accrued Powder will then be convertible to $COOK, Mantle's future governance token.

Participants: mETH, cmETH holders, and Season 1 Partner dApps.

Rewards: 200M $COOK tokens allocated to Mantle Rewards Station, where users can lock $MNT for $COOK rewards starting July 10.

A solid restaking target, the Mantle DAO has a huge treasury.

It is recommended to do all activities on the Mantle L2.

Start here and get an overview

Alpha 3: Scroll Airdrop

Scroll is rapidly growing with over $400 million in TVL across various DeFi protocols, offering scalable and low-cost transactions.

Key Protocols on Scroll

Pencil's Protocol

Description: Third-largest DeFi protocol on Scroll, categorized as a farming protocol.

Features: Multiple vaults for different assets, including single-sided staking options.

Rewards: Earn additional tokens and potential airdrops.

User-Friendly Interface: Easy-to-navigate with transparent reward structures.

Vaults: ETH Pool, BTC Pool, Stablecoin Pool.

My Strategy: Farm more Liquid Restaking Airdrops for KelpDAO and Puffer. Just use Jumper to get the tokens you need.

Description: Decentralized exchange and liquidity layer on Scroll.

Features: High APRs, security through auditing, liquidity provision.

Pools: ETH-USDC Pool (51% APR), Wrapped Staked ETH Pool (38% APR).

I have one more 5 in 1 airdrop strategy on Scroll which I will publish first for the premium subscribers. Check it out by scrolling down to the premium section.

Important Dates

The success for this cycle hinges on US monetary policy and a strong ETH and DeFi season. Lets pray for it!

Till next time, stay safe!

Adrian

If you want to get the best DeFi strategies even faster, get a limited free premium subscription by sharing this newsletter:

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

The market got rekt and Altcoins are down big time. Of course there are countless opportunities to still win! Let’s get into it.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.