Adrian's DeFi Alpha #12: ETH - Now or Never | Mitosis | SolvBTC | Plume

Definitely no financial advice, just insights based on my own journey in DeFi.

Hello there Friend,

busy with work and personal projects? Let me help. I’ve been navigating the DeFi space since 2020, and I love sharing what I learn.

These are the advantages you will get in each newsletter:

The key developments in Crypto.

Practical insights to act on.

All packaged in a 5-minute read. No sponsored content, no trading chaos. Just insights based on my own journey in DeFi.

Let’s make the most of your time!

FYI

I am linking the sources of the images in the newsletter, just click to follow the link.

Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global crypto market cap today is $2.53T, a 1.25% change in the last 24h.

Total trading volume in the last 24h is at $120.0B.

$BTC dominance is at 51.40% and $ETH - 16.59%.

Ethereum ETFs: A New Chapter Begins (hopefully)

The Big Players

So, who’s in the game? BlackRock, Franklin Templeton, and VanEck have all gotten the nod from the SEC. According to Reuters, these firms now need to finalize their paperwork and submit it by the end of the week. The word on the street is that all eight spot ETH ETFs will launch at the same time, just like we saw with the Bitcoin ETFs earlier this year.

Key Dates to Remember

Mark your calendars! Eric Balchunas, a senior ETF analyst at Bloomberg, has noted that the final S-1 filings and fees are due by July 16th. If everything goes smoothly, the official approval could come as early as next Monday, with trading kicking off on July 23rd. This synchronized launch is designed to level the playing field, so no single fund gets a head start.

What will be the impact of the ETH ETF?

Timing and Impact

Bitwise (Bitwise Asset Management is a cryptocurrency-focused investment firm) highlights that while the launch date might be a bit fluid due to regulatory steps, the excitement is real. Detailed analysis from Bitwise predicts that these ETFs could attract significant investments—think $3-5 billion by the end of 2024 and $15 billion by the end of 2025. This mirrors the historic success we saw with Bitcoin ETFs, which drew massive inflows.

Lessons from Bitcoin ETFs

The Bitcoin ETFs gathered around $15 billion in just six months! That kind of demand indicates a strong appetite for crypto ETFs, and we can expect a similar trend for Ethereum. ETFs usually gain more traction over time, so we’re looking at a robust growth trajectory here.

Institutional and Retail Appeal

The beauty of ETFs is that they’re appealing to both institutional and retail investors. For retail investors, they offer a simple and secure way to get in on the action, without the hassle of managing actual crypto assets. This dual appeal could drive significant inflows and help stabilize and mature the market.

The Ripple Effect

Legitimacy and Trust

The SEC's nod to these Ethereum ETFs is a stamp of legitimacy. It signals that Ethereum, like Bitcoin, is being recognized as a valuable asset in the financial world. This will pave the way for even broader adoption and integration into mainstream finance.

Market Growth

With these ETFs, we can expect more investors to easily add Ethereum to their portfolios, driving wider adoption. The influx of traditional capital could lead to a healthier, more robust market.

Bullish Thesis for ETH

Since the beginning of this bull market, ETH has been quite disappointing price-wise. While Bitcoin managed to break its past all-time high, ETH has lagged. But is it finally time for ETH to shine now?

The Current State of the Network

Total Value Locked (TVL)

After a significant decrease in TVL during the bear market, activity has gained momentum on the Ethereum blockchain. TVL is up approximately 200% over the past year. While there’s still room to reach its ATH, the upward trend is clear.

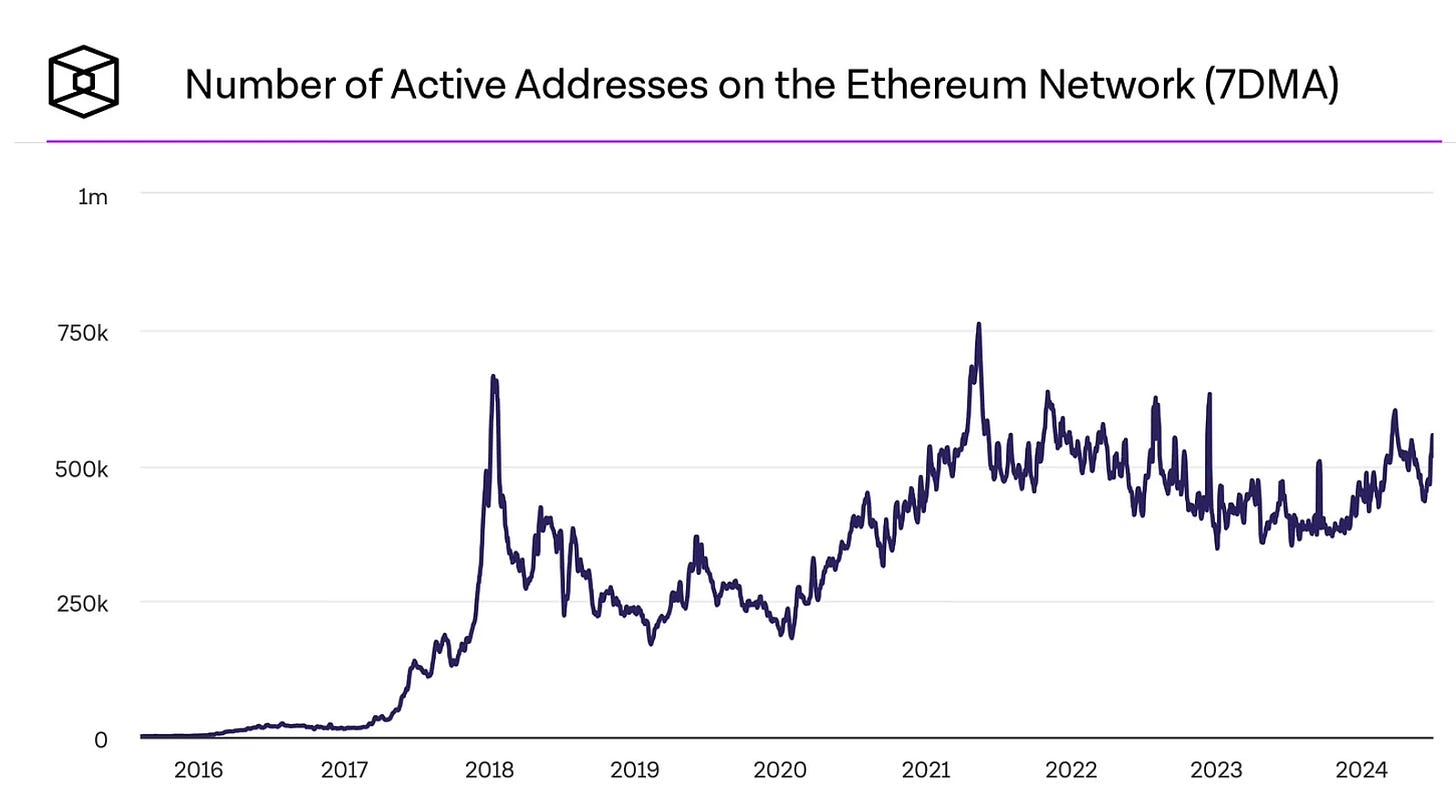

Active Addresses

Active addresses have shown resilience, never dropping below 300k even at the depth of the bear market. This demonstrates Ethereum’s stability and maturity as a blockchain.

Core Developers

With over 440 full-time developers, Ethereum is one of the most active blockchains in terms of development. This number continues to grow on a yearly basis, showing that Ethereum remains attractive to developers.

Further Catalysts for ETH

The Dencun Upgrade

This upgrade brought several technical improvements, including reduced transaction fees for layer-2 networks. This solidifies Ethereum as a scalable settlement layer.

US Presidential Election

Crypto is a significant topic in the upcoming election. Donald Trump, the current favorite, has established himself as pro-crypto. If elected, this could be a positive catalyst for crypto adoption, benefiting ETH.

ETH Supply Being Constrained

ETH supply is mostly deflationary since the Merge. With a high percentage of ETH staked, less is available for trading, implying more potential for explosive price action.

Price Action

ETH has been forming a consolidation pattern near its past ATH, which could provide interesting buying opportunities. The ETH/BTC chart has rebounded from a multi-year low with strength. If this momentum holds, ETH could attract a lot more market attention. The timing might be right for the beginning of an alt season, with investors shifting focus from Bitcoin to altcoins.

Alpha Section

Alpha 1: Scroll 5 in 1 Airdrop Strategy with Mitosis

Mitosis is an innovative Layer 1 (L1) blockchain that focuses on Ecosystem-Owned Liquidity (EOL) to improve the DeFi liquidity provider (LP) experience.

Jump over to Mitosis

Deposit weETH on Scroll (from ETH, ARB or many other L2s)

Farm these Airdrops: Scroll, Eigenlayer, Etherfi, Mitosis, Hyperlane

Here are the key aspects of Mitosis:

1. Crypto-Economic Security

Mitosis uses Ethos Automated Verification System (AVS) to provide crypto-economic security. This system ensures that the protocol remains secure as the TVL grows, effectively scaling the security measures in line with the assets under management. Ethos AVS continuously monitors and verifies the transactions and states within the Mitosis network to prevent fraudulent activities and ensure integrity.

2. Cross-Chain Deposit Module (CCDM)

Mitosis employs the CCDM to manage deposits and asset minting across multiple chains. This module facilitates the seamless transfer and minting of assets, ensuring secure handling of funds across different blockchains. It involves several key steps:

Deposit and Minting: Users deposit their assets, which are then wrapped and minted into Mitosis assets (miAssets) on the target chain.

Redeem Process: Users can redeem their miAssets back into the original assets after an optional unstaking period, ensuring they can reclaim their assets securely.

Bridge Flow: The CCDM handles asset bridging asynchronously to save on fees and gas costs, batching transactions and leveraging canonical bridges of each L2 (Layer 2) network for efficient asset transfers.

3. Interoperability via Hyperlane

Hyperlane's permissionless interoperability stack is utilized to allow Mitosis applications to access liquidity across multiple chains from the onset. This interoperability ensures that Mitosis can provide a secure and efficient way to manage liquidity across different blockchain environments, minimizing the risks associated with cross-chain operations.

4. Governance and Incentives

Mitosis employs a point reward system to bootstrap initial liquidity and incentivize liquidity providers. This system ensures that liquidity is maintained and rewarded in a secure and predictable manner without overcommitting token allocations. The governance model allows LPs to have a say in protocol decisions, enhancing the security and stability of the ecosystem by ensuring community involvement in key decisions.

My take: Mitosis has support for Linea, and Scroll, which will allow LPs to stack even more points. Vault caps have recently been removed, resulting in TVL ballooning to $84M.

Alpha 2: SolvBTC

Solv Protocol aims to unify Bitcoin’s fragmented liquidity, bridging Bitcoin's trillion-dollar economy to DeFi. This offers Bitcoin holders the ability to earn yields while maintaining liquidity across multiple chains.

Introducing SolvBTC.BBN: The Liquid Staking Token for Bitcoin

SolvBTC.BBN, in cooperation with Babylon, is Solv's Liquid Staking Token (LST) for Bitcoin, designed to enable Bitcoin holders to earn staking yields while keeping their assets liquid. This allows users to leverage their staked Bitcoin across a range of DeFi applications, enhancing the flexibility and profitability of their holdings.

Babylon just completed a 70m raise led by Paradigm, which makes me quite bullish on the project. Babylon Chain is Layer 2 scaling solution designed to enhance Bitcoin's utility and scalability.

The initial staking cap of 500 BTC has been reached, which shows the big interest and trust in SolvBTC.

Solv x Ethena: SolvBTC Yield Vault

You can maximize your returns with the SolvBTC Yield Vault, a partnership between Solv and Ethena that allows you to:

Triple Dip in Rewards: Maintain Bitcoin exposure while earning multiple rewards.

Solv Points: Earn 2.5x multiplier on Solv Points.

sUSDE Yield: Estimated 10-15% yield.

10x SATs: Additional rewards in Bitcoin.

Alpha 3: Plume

Plume Network is an infrastructure RWA Layer 2 that have raised 10M$ from builders of big projects like @eigenlayer @wormhole_labs @SeiNetwork @InjectiveLabs @Azuki @sedaprotocol @rwa_xyz @centrifuge @LayerZero_Labs

Plume Network is designed specifically for real-world assets (RWAs). Plume recently announced the launch of its testnet and a points campaign. Here's what you need to. know.

Testnet Launch and Points Campaign

The Plume testnet was launched in partnership with notable protocols such as Celestia, Bitget Wallet, and Supra.

Earn Miles and Explore the Testnet

To incentivize participation, Plume has introduced a points campaign where users can earn "Miles."

Interact with Protocols: Engage with different protocols on the Plume testnet to earn Miles. This hands-on interaction helps you understand the network's capabilities while earning rewards.

Daily Check-Ins: Consistency is key. By checking in daily, you can accumulate additional Miles, boosting your total points.

Referral Program: Spread the word! Refer other users to the Plume testnet and earn Miles for each successful referral.

How to Get Started

Participating in the Plume testnet is straightforward:

Sign Up: Join the Plume testnet by signing up on their platform.

Engage: Start interacting with the testnet protocols, check in daily, and refer friends to maximize your Miles.

Earn Rewards: Accumulate Miles through your activities and watch your points grow.

Important Dates

What else you need to know in the fast-paced world of crypto

The success for this cycle hinges on US monetary policy and a strong ETH and DeFi season. Lets pray for it!

Till next time, stay safe!

Adrian

If you want to get the best DeFi strategies even faster, get a limited free premium subscription by sharing this newsletter:

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

The market is back rekt and Altcoins are pumping finally. Of course there are awesome opportunities to leverage our position and win even more! Let’s get into it.

Keep reading with a 7-day free trial

Subscribe to Adrian DeFi to keep reading this post and get 7 days of free access to the full post archives.