Adrian's DeFi Alpha #13: TradFi inc | Sei Lending | SolvBTC x CoreDAO | Timeswap

Definitely no financial advice, just insights based on my own journey in DeFi.

Hello there Friend,

busy with work and personal projects? Let me help. I’ve been navigating the DeFi space since 2020, and I love sharing what I learn.

These are the advantages you will get in each newsletter:

The key developments in Crypto.

Actionable alpha insights to act on.

All packaged in a 5-minute read. No sponsored content, no trading chaos. Just insights based on my own journey in DeFi.

Let’s make the most of your time!

Premium Subscription

As a subscriber of the premium newsletter you can find the Premium Section down below

Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global #crypto market cap today is $2.43T, a -3.25% change in the last 24h. Total trading volume in the last 24h is at $99.9B. #BTC dominance is at 52.20% and #ETH - 15.75%.

📊 Mt. Gox Repayments Begin on Kraken

Repayments Begin: Kraken has kicked off the long-awaited distribution of Bitcoin (BTC) and Bitcoin Cash (BCH) to Mt. Gox creditors, concluding a decade-long story. Kraken received 92,000 BTC (worth $5.8 billion) from Mt. Gox. The goal is to repay $3 billion worth of BTC to creditors over the next 7-14 days. BTC's price remained stable, but BCH saw a 7% drop. Trustee Nobuaki Kobayashi confirmed repayments began on July 5, 2024. The influx of BTC into the market might affect its price, so keep an eye on this development.

ETH ETF: A Game-Changer for Ethereum?

Spot Ethereum ETFs Generate $951 Million in Volume on Second Day

Ethereum ETFs are in demand, with over $1 billion in volume during their first two days. These ETFs reached 23% of the Bitcoin ETFs' trading volume on their launch day—an impressive feat! Despite the large volumes, ETH's price has not mooned yet.

Market Shift: Significant outflows from Grayscale's Ethereum Trust (-$484.9M) were hardly balanced by inflows into the new Ethereum ETFs. These outflows might put pressure on ETH's price in the coming weeks.

Performance: All Ethereum ETFs performed well without major issues or pricing discrepancies. The Grayscale Ethereum Trust led with $492 million, followed by BlackRock's iShare Ethereum Trust ($256 million) and Fidelity Ethereum Fund ($113 million).

Grayscale launches new fund for decentralized artificial intelligence

Decentralized AI projects already included in the fund's basket as of today's launch are Bittensor (TAO), Filecoin (FIL), Livepeer (LPT), Near (NEAR), and Render (RNDR). Near, Filecoin and Render are, respectively, the top-weighted assets in the fund. The assets included are solid in my opinion, so if you are bullish AI, this might be an interesting venture bet on this market segment. My latest Crypto x AI investments can be found in the premium section of this newsletter.

Alpha Section

Alpha 1. Lending Protocol YeiFinance on alt L1 Sei

Sei, a fast alternative L1 in the Cosmos ecosystem, has been very rewarding to its community with random phase 2 airdrops. YeiFinance, the top lending protocol on Sei with over $58M TVL, is currently offering 16% APR on USDC and USDT, plus Yei points. This provides good yield and potential airdrops. The former airdrop was given to Sei stakers and users of their liquid staking protocols.

Strategy:

Farm Stable APY, future SEI airdrops and Yei points for YeiFinance airdrop

I put in 1.000 USDT

Guide to Farming on YeiFinance:

Set Up a Wallet: Use Compass Wallet for Sei.

Bridge Assets: Decentralized with Squid Router or via CEX (easier, bridging on Cosmos is a pain).

Deposit on YeiFinance: Supply assets and start earning.

Top Yields:

USDC: 16% APR

USDT: 17% APR

SEI: 4% APR

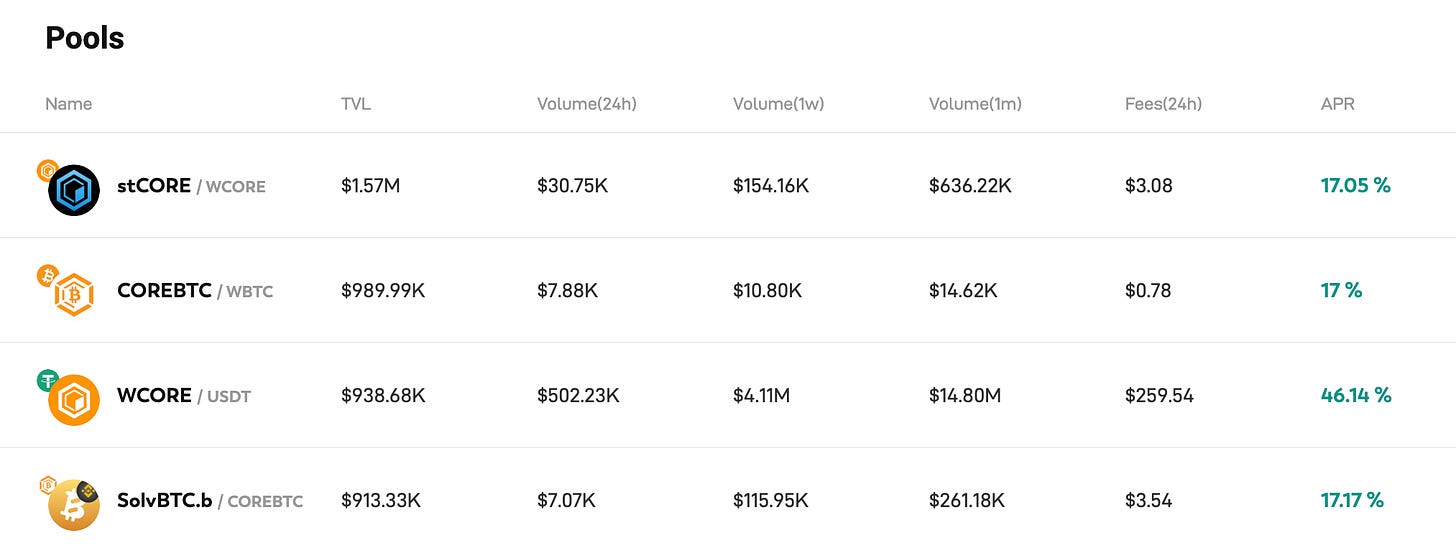

Alpha 2: Bitcoin L2: SolvProtocol & CoreDAO

CoreDAO Bitcoin L2: A layer 2 (L2) solution built on top of the Bitcoin network, aimed at enhancing the scalability, efficiency, and functionality of Bitcoin.

Solv Protocol aims to unify Bitcoin’s fragmented liquidity, bridging Bitcoin's trillion-dollar economy to DeFi. This offers Bitcoin holders the ability to earn yields while maintaining liquidity across multiple chains.

Strategy:

Farm yield with SolvBTC.b/COREBTC for 17% APR on CoreDAO. Their Core Ignition program offers incentives and airdrops.

Best BTC Strategy: Provide SolvBTC.b/COREBTC for 17% APR + 1.2x spark multiplier. Start here.

I put in $1.000 in the SolvBTC.b/COREBTC pool in the 0.05% fee tier for the start as I consider this a more risky investment. I will add more later.

Alpha 3: Timeswap - High Yields and Non-Liquidatable Leverage

Earn ARB, OP, and TIME rewards in the ARB and OP pools. Lend your USDC or OP to earn fixed yields and TIME, ARB rewards. Borrowers can use ARB or OP as collateral to borrow USDC without the risk of liquidation.

Incentives:

USDC/ARB Pool: Fixed yields + ARB, TIME rewards → 52 % at the time of writing

USDC/OP Pool: Fixed yields + OP, TIME rewards → 20 % at the time of writing

Important Updates

What else you need to know in the fast-paced world of crypto

Layer3 $L3 Airdrop

Layer3 is launching an airdrop eligibility and allocation checker on July 25th.

Mantle Cook Tokenomics

Mantle's $COOK tokenomics details are out, with 15% of the total supply allocated to various initiatives, including the Season 1 campaign rewards.

General Overview

Initial Distribution: 15% of the total $COOK token supply will be allocated among four key ecosystem initiatives

Token Purpose: $COOK is the new token for Mantle LSP, enabling stakeholder participation in governance and economic decisions related to the project, including $mETH and $cmETH.

Token Distribution Breakdown

Season 1: Methamorphosis: 5% of the total $COOK token supply.

Mantle Rewards Station: 4% of the total $COOK token supply.

Puff: 5% of the total $COOK token supply.

Puff NFT: 1% of the total $COOK token supply.

Token Generation Event (TGE)

Timing: Scheduled for the end of Season 1: Methamorphosis, anticipated in mid-October.

Token Unlocks

Galxe: 586.67K $GAL (~$1.9M) on JUL 24

Yield Guild Games: 14.08M $YGG (~$6.7M) on JUL 27

SingularityNET: 8.45M $AGIX (~$5M) on JUL 28

Ethena: 14.89M $ENA (~$6.8M) on JUL 28

Premium Section down below

If you want to get the best DeFi strategies even faster, get a limited free premium subscription by sharing this newsletter:

Till next time, stay safe!

Adrian

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

The market was back shortly with the anticipation of the ETH ETF, but now we are getting rekt again and Altcoins are selling off. Of course there are awesome opportunities to leverage our position and win still! Let’s get into it.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.