Adrian's DeFi Alpha #15: When Recession? | Jupiter Tokenomics | Elixir Airdrop | DeFi 1.0 return

Definitely no financial advice, just insights based on my own journey in DeFi.

Hello there Friend,

busy with work and personal projects? Let me help. I’ve been navigating the DeFi space since 2020, and I love sharing what I learn.

These are the advantages you will get in each newsletter:

The key developments in Crypto.

Actionable alpha insights to act on.

All packaged in a 5-minute read. No sponsored content, no trading chaos. Just insights based on my own journey in DeFi.

Let’s make the most of your time!

Premium Subscription

As a subscriber of the premium newsletter you can find the Premium Section below

️ On today's Episode:

📈 Market Update

💥 When Recession?

🐂 Alpha on JUP, AAVE and ELIXIR

💎 The Premium Section with even more Alpha and all Portfolio, Airdrop & Farming Updates

Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global #crypto market cap today is $2.16T, a -0.82% change in the last 24h. Total trading volume in the last 24h is at $89.7B. #BTC dominance is at 53.46% and #ETH - 14.57%.

📉 Chaos Hits Markets:

Wow, what a couple of weeks in August! Panic spread across both the stock and crypto markets like wildfire. If you’ve been glued to the charts like me, you’ve probably felt the heat. Stock market volatility hit levels we haven’t seen since the COVID-19 crash, and crypto didn’t get away unscathed either. So, what sparked this? Let’s dive in.

What Happened?

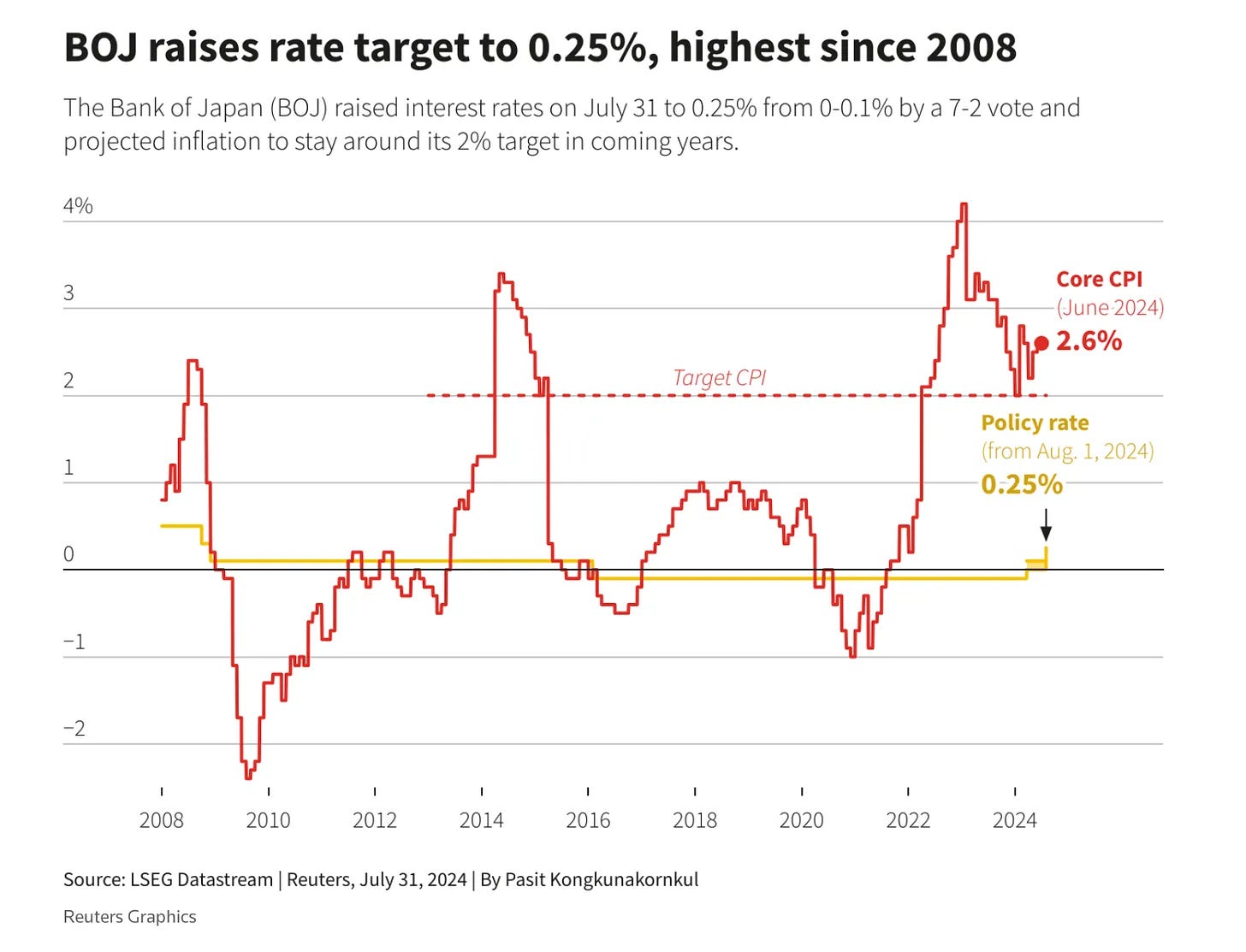

It all boils down to The Bank of Japan’s surprise interest rate hike. For years, borrowing Yen was basically free—wealthy investors loved it, as they could borrow at nearly 0% and reinvest in higher-yielding assets. But the BOJ just flipped the script, raising interest rates for the first time in years, forcing those investors to sell off assets to repay their loans. The result? A cascade of asset sales that sent markets crashing.

What’s Next?

After markets freaked out, the BOJ did some damage control by announcing there won’t be more hikes anytime soon. This helped things bounce back, but uncertainty is far from over.

Here’s what we’re looking at:

• Iran-Israel tensions: Potential war escalation could rock markets further.

• Kamala Harris odds rising: Prediction markets show her chances of becoming the next U.S. president are increasing, and guess what? She hasn’t even mentioned her opinion on crypto. I just got a feeling she is not exactly a friend of ours.

• Recession fears

🚨 When’s the Recession?

Recession fears are growing, with multiple economic indicators flashing red:

1. Yield Curve Inversion: The 10-year and 2-year U.S. Treasury bond yields have been inverted since 2022, a key historical recession indicator. As the yield curve begins to “uninvert,” a recession could follow within the next 1-6 months.

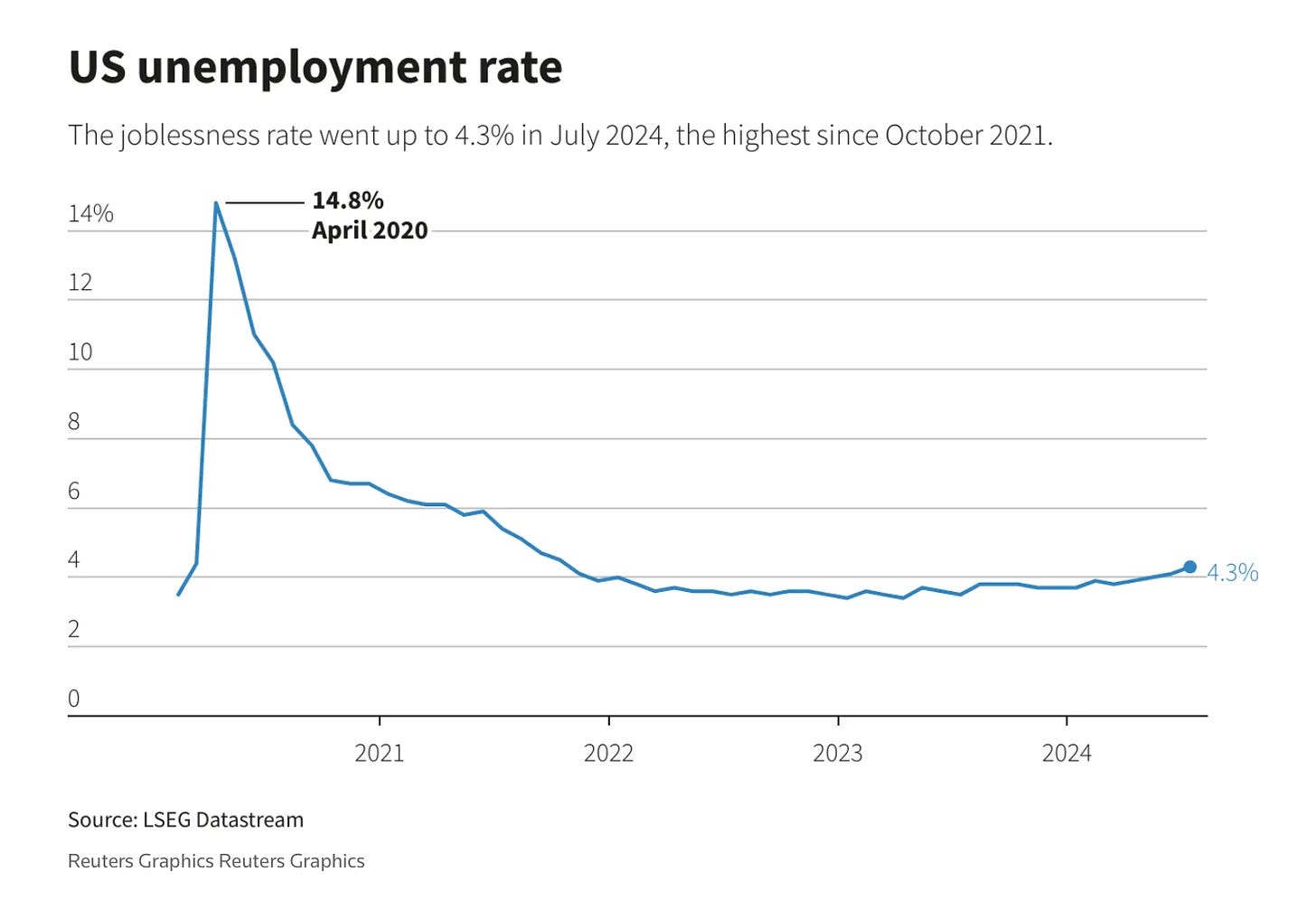

2. Unemployment Trends: Rising unemployment often precedes recessions.

3. Federal Funds Rate: The Fed’s aggressive rate hikes in 2024 have plateaued, and a rate cut is expected on September 18, 2024 — a rate hike is normally a sign that the economy is weakening.

Given the alignment of these factors, we could see a recession hit between late 2024 and mid-2025. Historically, when these indicators flash, markets (including the S&P 500) tend to decline by 50% or more.

Crypto Strategy: Take Profits Aggressively

We as crypto investors should consider locking in profits during any Q4 rallies. Recessions are typically brutal for speculative assets—Bitcoin could drop 60%, Ethereum by 70%, and altcoins may lose up to 99% of their value. The key strategy for now? I am going to build a strong cash position to capitalize on potential buying opportunities during a downturn.

Alpha Section

Good projects and opportunities I discovered

Alpha 1: AAVE - the DeFi 1.0 Powerhouse

Introduction

The lending protocol AAVE could yield significant "Old School DeFi" returns based on recent chart analysis and developments.

Setting the Scene: The Buyback Mechanism

AAVE’s new "AAVEnomics" proposal introduces a revenue-sharing mechanism to create sustainable value. In simple terms, AAVE will buy back its tokens from secondary markets using protocol revenue and distribute them to the ecosystem reserve and stakers (stkAAVE). This introduces a new, sustainable source of buy-side demand for AAVE.

Risk Mitigation

Another new aspect of the proposal is the revamped Aave Safety Module, called "Umbrella." Under this system, stkAAVE will no longer be at risk of being slashed in case of protocol bad debt. Instead, market participants can stake aTokens (e.g., aUSDC, aUSDT), which can be slashed first, offering higher yields but with increased risk. This significantly lowers the risk for stkAAVE holders, making staking more attractive with only the liquidity risk of a 20-day unbonding period.

The Investment Thesis

Currently, AAVE/ETH is forming a potential bottom. The current price levels create an attractive risk/reward setup. With AAVE’s valuation at $1.6B and a path to sustainable value accrual, now might be the ideal time to consider an entry.

Catalysts

Sustainable Value: The new buyback mechanism provides a consistent source of buy-side demand for AAVE, potentially driving up its price over time.

Enhanced Staking: The "Umbrella" module reduces risk for stkAAVE holders, making staking more attractive.

Market Position: AAVE remains a leading DeFi protocol, continuously innovating and adapting to market needs.

Risks and Hedging Strategies

Market Volatility: As with all cryptocurrencies, AAVE is subject to market fluctuations.

Hedging: Diversify your portfolio to mitigate risk and consider setting stop-loss orders to manage potential downsides.

Regulatory Risks: DeFi protocols face regulatory scrutiny, which could impact AAVE's operations.

Execution/Entry Strategy

The current buy levels offer a favorable risk/reward ratio. Consider gradually building a position to average the entry price.

Entry Points:

Current Price: Start to DCA (dollar-cost-average) into AAVE. Current prices under 150$ are great for an entry.

Why AAVE could outperform ETH

AAVE’s innovative approach with the "AAVEnomics" proposal and the "Umbrella" safety module positions it to capture significant value. Given the projected growth in DeFi applications and AAVE's continuous improvements, AAVE has the potential to outperform major cryptocurrencies like ETH within the this market cycle.

Alpha 2: Jupiter’s Major Tokenomics Shift

Jupiter has been a beast on Solana as its premier DeFi aggregator and one of the top perpetuals exchanges. But here’s what’s changed now: last week, a huge vote passed with 95% approval, and it’s set to burn 3 billion JUP tokens, or 30% of the total supply.

Why is this a big deal?

Jupiter launched with only 13% of its supply in circulation, leaving it with a $900 million market cap and an FDV of around $7 billion. This low float and high FDV model has been a recurring problem in crypto, with price charts often trending down post-token generation events (TGEs). Jupiter wants to change the narrative.

The Proposal:

• 3 billion tokens will be burned, split equally between team and community allocations. This reduces supply and boosts long-term value.

• The burn will take place gradually in the lead-up to Jupuary, the airdrop event for the ecosystem.

Team Tokens: Before

Team Tokens: After

Community Tokens: Before

Community Tokens: After

Why it’s a win:

This burn addresses one of the biggest critiques of token launches—massive FDVs. By slashing supply, Jupiter creates a more sustainable value system. Other projects should take notes here, especially those with a large gap between market cap and FDV.

Next Steps: This burn is just the beginning, with two more votes expected to further shape Jupiter’s tokenomics. I’m excited to see how this plays out because, honestly, it’s the kind of move that could spark a further price increase for JUP, my biggest altcoin position on Solana.

🌊 Alpha 3: Elixir’s deUSD Stablecoin – Season 2 Point Farming

The Elixir blockchain protocol is designed to enhance liquidity on decentralized orderbook exchanges. It operates as a decentralized, modular network powered by a Delegated Proof of Stake (DPoS) consensus mechanism. Elixir's key goal is to provide infrastructure that allows decentralized exchanges (DEXs) to bootstrap and maintain liquidity, particularly for orderbook models.

The team has just launched their own stablecoin, deUSD, and is building an entire ecosystem around it. For those who love a good farming strategy, this one’s for you.

Season 1 Recap:

• ETH could be deposited for elxETH and locked until 28 August 2024.

But Season 2? Oh boy, this is where it gets fun.

What’s New in Season 2?

elxETH deposits can be converted into deUSD, locking liquidity until December 2024 and starting Season 2 farming with a 2X multiplier on points earned.

30 million points will be distributed, compared to just 20 million in Season 1.

If you hold deUSD during Season 2, you get a 5X points multiplier. Yes, you read that right—5X!

Why this is an insane farming opportunity:

If you missed out on Season 1, don’t sweat it. Season 2 is where more points can be gained. Holding deUSD for that 5X multiplier and farming in liquidity pools is going to be extremely profitable. If you haven’t started farming Elixir yet, now’s the time.

How to get in on the action:

1. Buy deUSD on Curve.

2. Stake it on the Elixir platform.

3. Start farming and stack those points.

Premium Section below with all Farming Positions, Important Updates and Portfolio Changes

If you want to get the best DeFi strategies even faster, get a limited free premium subscription by sharing this newsletter:

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

The market kind of recovered, but we are in an insecure environment and big bets need a lot of thinking right now. Let’s get into it.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.