Adrian's DeFi Alpha #16: Global Liquidity Rising | Mantle | SolvBTC | Babylon | Berachain | Solayer

Definitely no financial advice, just insights based on my own journey in DeFi.

Are We Back?

Finally the market recovered after Federal Reserve Chair Jerome Powell hinted that U.S. inflation is on track to return to 2%, suggesting the long awaited interest rate cuts. BTC climbed by 5%, breaking the $64,000 barrier, while ETH climbed 3% to reach $2,700. Powell’s remarks sparked optimism for speculative assets, but the reality is that the timing and pace of these rate cuts remain dependent on upcoming economic data.

Premium Subscription

As a subscriber of the premium newsletter you can find the Premium Section below

️ On today's Episode:

📈 Market Update

💻 Project Updates

🐂 Alpha on Mantle, Solayer, Solv X Babylon, Aave, Berachain

💎 The Premium Section with even more Alpha and all Portfolio, Airdrop & Farming Updates

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global #crypto market cap today is $2.35T, a -1.10% change in the last 24h. Total trading volume in the last 24h is at $61.1B. #BTC dominance is at 53.84% and #ETH - 14.04%.

📉 The Importance of Liquidity

Global liquidity is creeping back into the markets, and that’s a big deal. When liquidity flows, it tends to lift everything in its path, from blue-chip crypto to even those long-forgotten tokens from previous cycles.

But don’t get too excited just yet.

Why the Alt Season Might Take Time

The widely expected alt season may not fully emerge until later in this cycle, potentially around Q1 2025 or beyond. While unforeseen events like a recession or market crash could disrupt this timeline, genuine growth might follow any significant downturn. The current boring market exhausts many investors, causing them to exit before the major upswing occurs.

Remember, this is a marathon, not a sprint. Patience is key in this market.

Telegram CEO Arrested - TON Price Is Down 💎

A shock went through Crypto Twitter as Pavel Durov, the founder of Telegram, was arrested at Bourget Airport in Paris. French authorities have charged him with terrorism, trafficking, and money laundering, citing Telegram’s lack of moderation as a gateway for organized crime. Durov’s arrest affected The Open Network (TON), whose native went down 22% from $6.80 to $5.30, though it has since recovered to $5.65.

In solidarity with Durov, several TON-based projects have updated their avatars and token logos.

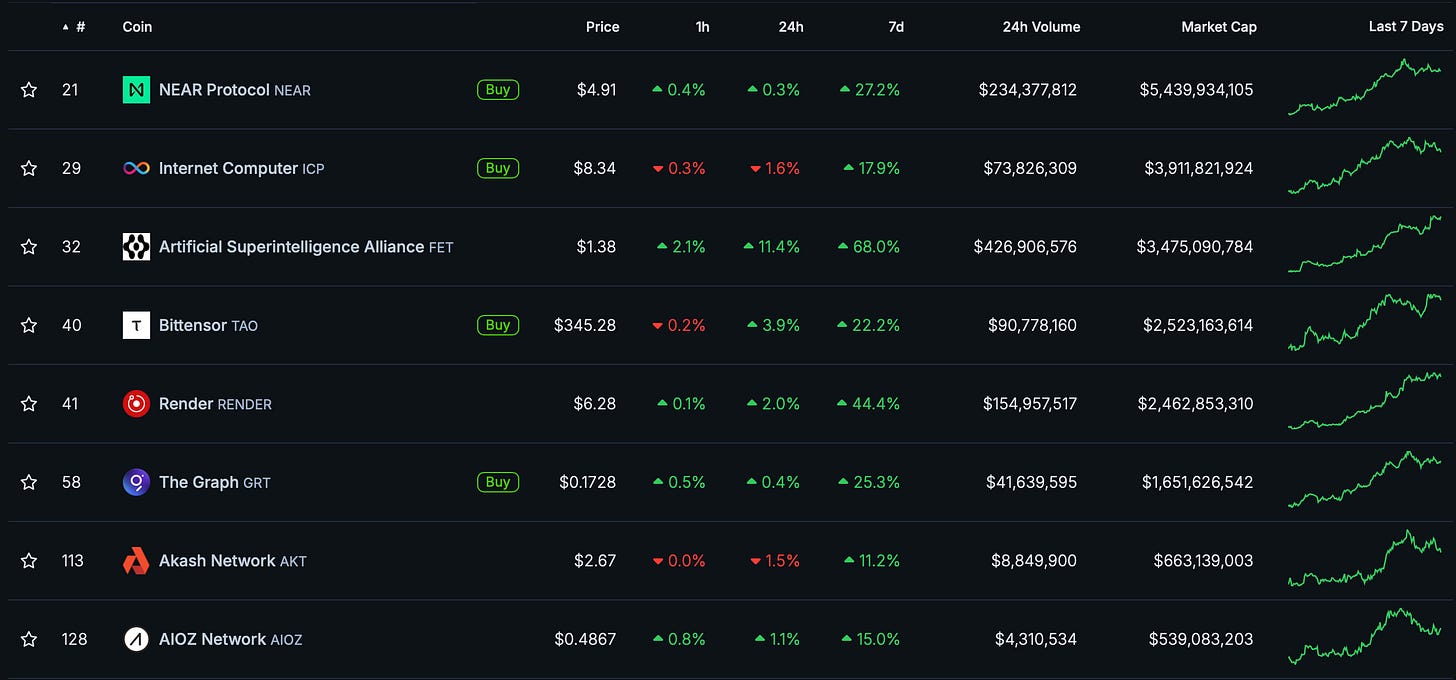

AI Outperforming 🤖

AI-related tokens are performing excellently ahead of Nvidia’s earnings report this Wednesday. The Artificial Superintelligence Alliance's token FET saw a 68.7% increase over the past week, while TAO rose by 22.7%. Other notable AI-linked assets like NEAR and RENDER also posted impressive gains, with 26.3% and 41.9% increases, respectively.

The surge in AI tokens comes as analysts predict Nvidia’s earnings per share to jump by 141% year-over-year.

New Money Is Here?! Stablecoin Market Hits All-Time High

Fresh capital is flowing into the crypto space, as the stablecoin market cap excluding algorithmic stables (we don’t want another Terra / Luna debacle) reaches an all-time high of $168B. This surge is seen as a potential sign of new money entering the ecosystem, which could signal further bullish momentum in the broader crypto market.

2. Project Updates

What dApp and project updates you need to know in the fast-paced world of crypto

Eigenpie Season 1 Ends

@Eigenpiexyz_io concluded Season 1 of its rewards program, where users earned Eigenpie Points by depositing ETH LSTs and minting LRTs. These points will convert to $EGP tokens, with 10% of $EGP allocated to participants—6% immediately and 4% after Season 2 ends. Season 2, starting Aug 15, will continue for six months, allowing users to accumulate points towards another airdrop.

Babylon Bitcoin Staking Launch

Babylon has launched its much-awaited Bitcoin staking service, allowing users to stake BTC for rewards. The launch generated massive hype, with 12,000 stakers jumping in and transaction fees surging by 500x as users rushed to participate. The staking cap of 1000 BTC was hit within five blocks, with Lombard and Solv Protocol securing top stakes of 250 BTC each. Keep in mind, Phase 1 of the mainnet doesn’t yet offer payouts to stakers, so the excitement is just beginning. More on Babylon and Solv in the alpha section!

MilkyWay Multi-Asset Restaking

MilkyWay Zone has introduced a flexible multi-asset restaking platform, allowing projects to use a variety of tokens—not just a single asset—to secure their networks. This chain-agnostic solution offers projects the ability to transition from relying on external security to full autonomy as their native tokens increase in value. A perfect option for projects with low-value tokens looking to bootstrap security.

I am farming with TIA the milkTIA airdrop.

NymVPN Beta

NymProject has released the beta version of its NymVPN, designed to protect users' privacy. Using zk proofs for registration, users can sign up without revealing their true identity. The VPN offers two modes: Fast Mode (speed-focused) and Anonymous Mode (enhanced privacy via network "noise").

Grayscale Avalanche Trust

Grayscale has introduced the Grayscale Avalanche Trust, providing institutional investors exposure to AVAX. With a focus on scalability, decentralization, and real-world asset tokenization, Avalanche positions itself as a key player in the institutional DeFi space. Their gaming ecosystem is also top notch with a lot of AAA games coming in the future.

Stacks Nakamoto Update:

The Stacks community is preparing for the Nakamoto Activation Sequence, set to begin August 28. This upgrade will introduce faster blocks, full Bitcoin finality, and sBTC to the Stacks ecosystem. Developers are readying new features and releases in anticipation of these changes. The introduction of sBTC is expected to enhance Bitcoin utility and expand DeFi capabilities on Stacks.

Rabby Wallet Chain Abstraction

Base gains a lot of traction

3. Alpha Section

Good projects and opportunities I discovered

Alpha 1: Mantle x Pendle

Multi-Income Strategy: Users can now hold mETH LP or Yield Tokens (YT) on Pendle, unlocking multiple reward streams. Specifically, mETH LP holders will benefit with low risk from:

Powder Rewards: 25x Powder per mETH daily, offering a substantial incentive for liquidity providers.

mETH Staking Rewards: Earn staking rewards for holding mETH, making it a dual-earning asset.

Swap Fees: Accumulate fees from liquidity swaps on Pendle.

PT-mETH Fixed Yield: Secure predictable income from fixed yields by holding PT-mETH.

$PENDLE Incentives: Further boosted rewards in Pendle’s native governance token.

Leverage on Pendle's Yield Tokenization: Pendle's yield tokenization allows users to zap mETH onto Pendle and split it into Principal Tokens (PT) and Yield Tokens (YT). By holding or trading YT, investors can bet on the future yields of mETH and potentially increase exposure to Powder rewards by up to 744x. This leverage play allows more aggressive investors to amplify returns if yields rise or stay stable, a strong incentive in a bullish DeFi environment.

TGE of $COOK Token: The mid-October Token Generation Event (TGE) for $COOK is a key upcoming milestone.

Start here.

For more powder farming strategies (up to 1000% APY) and a comparison of all opportunities read this.

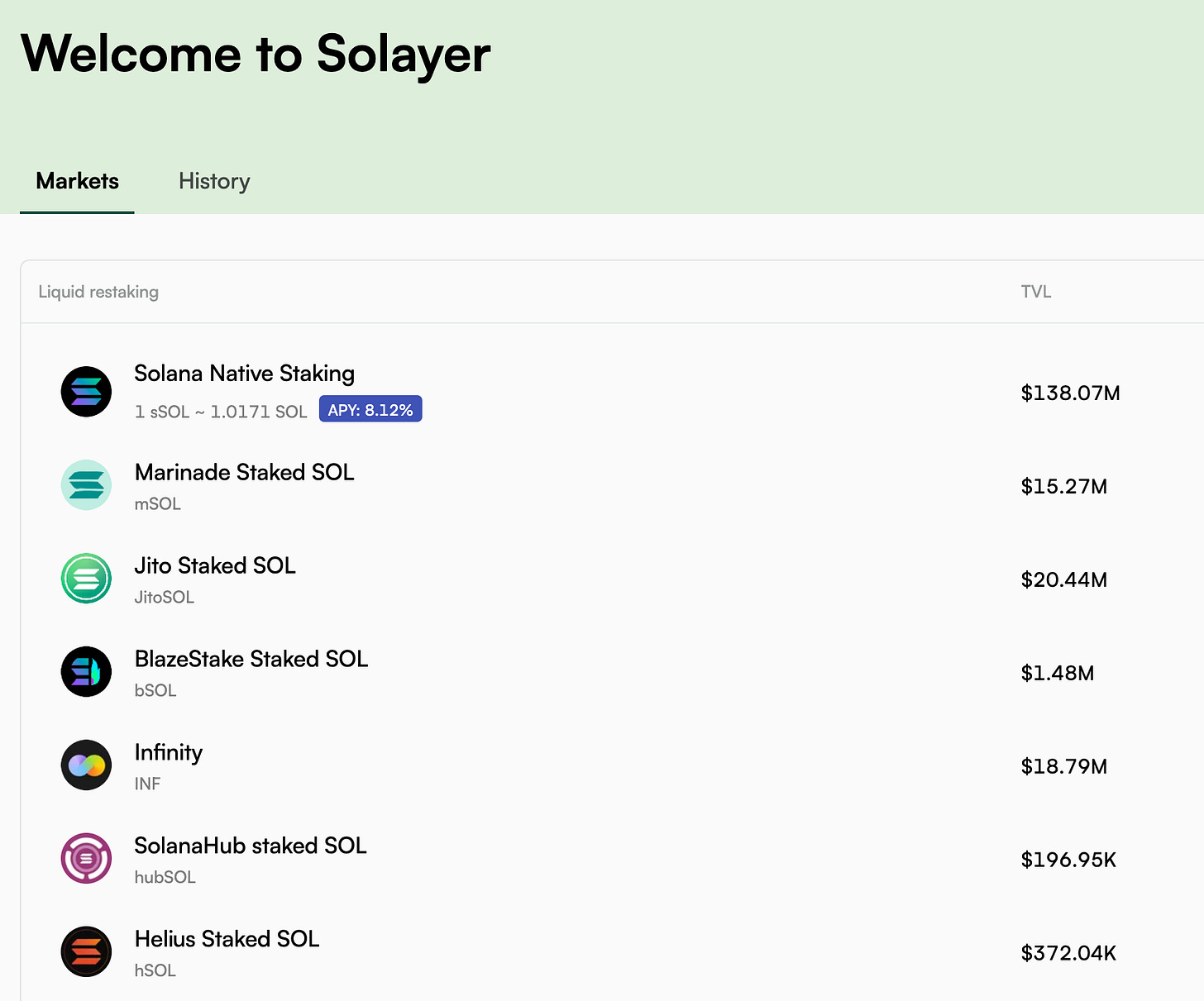

Alpha 2: Solayer - Solana Restaking

Solayer is gaining traction, with $194m in TVL, as a Solana-based restaking platform, similar to Eigenlayer on Ethereum.

Simply put, Solayer allows users to re-stake their existing $SOL and other LSTs for boosted rewards and Solayer points.

Learn more about their latest updates and how to get involved here.

Potential return with Airdrop: 15-30% APY

Alpha 3: SOLV & Babylon

In collaboration with Babylon, SOLV Protocol is pushing the BTC L2 and staking narrative. SOLV recently participated in Babylon’s Bitcoin staking launch.

Potential return with Airdrop: 40-60% APY

Maximize Your BTC Exposure with Babylon and Avoid BTC Gas Fees. SolvBTC.BBN allows users to stake their BTC and access Babylon strategies, all while earning nice yields and multiple point incentives across various chains.

Opportunities with SolvBTC.BBN

Earn 26% to 61% APR with SolvBTC.BBN LPs on Arbitrum.

Deposit BTC into Babylon without paying BTC gas fees or hitting staking caps by using Arbitrum. On top of that, you’ll earn Solv XP and Babylon points.

Here’s a quick step-by-step guide:

Head to Solv Protocol to start.

Select SolvBTC and choose your preferred EVM chain (I personally use Arbitrum for its low fees).

Go to BreederDodo here and head to the "Mining" section.

Figure out how much SolvBTC you need to create your LP pair. Currently 1 SolvBTC has to be pooled with approximately 2 SolvBTC.BBN.

Swap on DODO X tab your SolvBTC to SolvBTC.BBN and stake your assets.

💡 SolvBTC.BBN cannot be unstaked at the moment. Despite this, the APR and potential gains make it a risk worth considering—especially for those comfortable with long-term staking.

Advantages of Using Solv Protocol

SolvBTC offers nice benefits for those looking to get more out of their Bitcoin holdings:

Double Points: If you’re farming for Babylon points.

Earn Real Yield: The incentives from liquidity pools and lending dApps are quite attractive in the BTC L2 eco.

Cheap Gas Fees: With Solv, you avoid high BTC gas fees, allowing for cheaper staking and higher efficiency, especially across EVM chains like Arbitrum.

Key Risks to Consider

While the rewards are promising, there are a few risks to keep in mind:

48-Hour Withdrawal Window: Converting SolvBTC back to BTC takes about 48 hours.

One-Way Staking: Currently, SolvBTC.BBN is a one-way stake—once staked, they cannot be unstaked until specific dates.

This guide is inspired by my friend 2Lambro. Give him a like and follow on X for his excellent DeFi research!

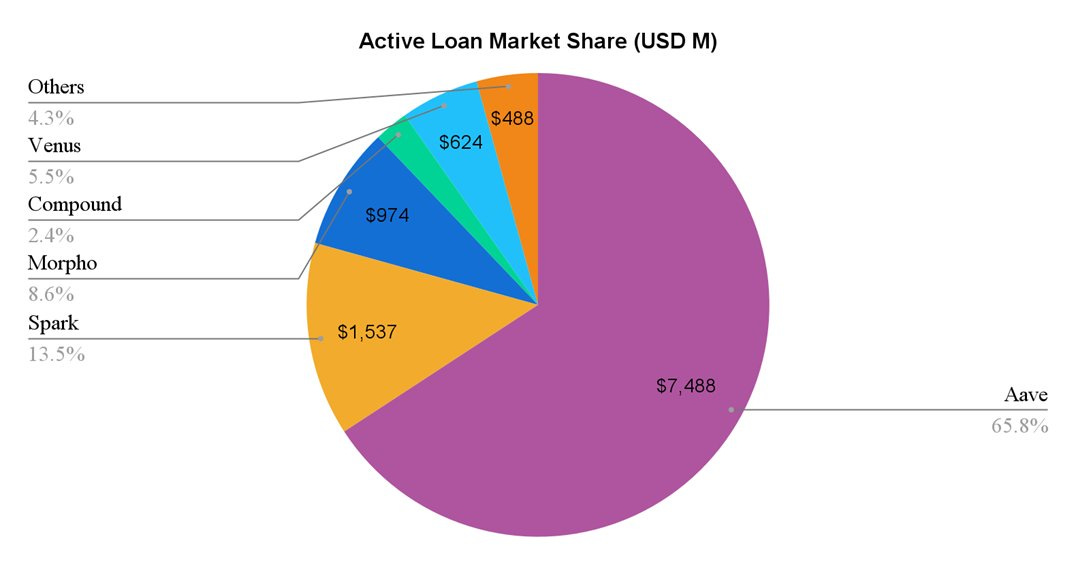

Alpha 4: Aave – The Undervalued DeFi Powerhouse

As the undisputed leader in the on-chain borrowing & lending space, Aave stands tall with a $7.5 billion active loan book, over 5x that of its closest competitor, Spark. Despite its massive market dominance and continued growth, Aave remains undervalued, presenting one of the most attractive opportunities in DeFi today.

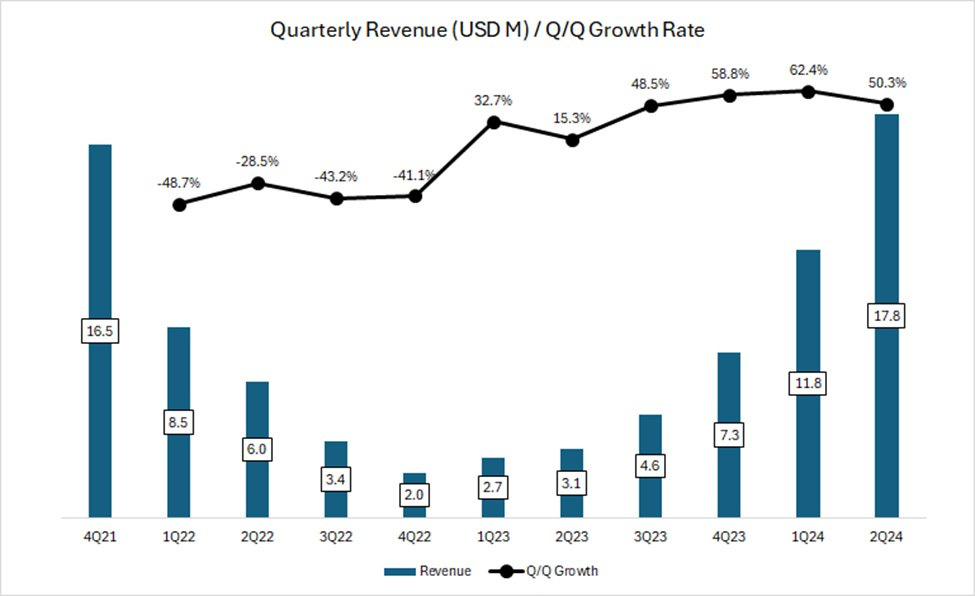

Aave’s Strong Fundamentals

Launched on Ethereum in January 2020, Aave is one of the most battle-tested protocols in DeFi. With TVL nearly doubling year-to-date, driven by both new deposits and the rising value of assets like ETH and WBTC, Aave has recovered to 51% of its 2021 cycle peak—a feat many other protocols have yet to achieve. Its revenue growth has outpaced that of the last bull market, increasing by 50-60% quarter-over-quarter through the first half of 2024.

What’s even more impressive? This growth has been organic, fueled by active loans and sustainable market demand, rather than by token incentives.

Why Aave’s Moat is Unbeatable

Aave’s sticky moat is built on four key pillars:

Unmatched Security Record: Aave has operated without a single major security incident where customers funds were lost, a critical factor for institutional and whale users seeking a safe platform for large capital. Even in case of the security incident in November 2023 they paused the protocol and were able to fix the respective bug.

Two-Sided Network Effects: Aave’s lending and borrowing marketplace benefits from deep liquidity, which in turn attracts more users, creating a self-reinforcing cycle of growth.

Multi-Chain Expansion: Aave’s presence across 13 chains (and soon zkSync and Aptos) cements its position as a multi-chain leader. The upcoming Aave V4 will link cross-chain liquidity, simplifying DeFi for users and providing seamless access to assets across networks.

Potential for Growth

Aave’s revamped tokenomics are expected to enhance value capture for the protocol. A new revenue-sharing mechanism will allow $AAVE stakers to earn directly from protocol revenues, while improvements in the Safety Module will reduce slashing risks, offering a more secure and sustainable way to stake AAVE.

With Bitcoin and Ethereum ETFs and a growing stablecoin market, Aave is well-positioned to benefit from the next phase of crypto adoption. As the DeFi space expands and institutional interest grows, Aave’s fundamentals suggest that it will continue to dominate and extend its lead in the decentralized lending market.

→ You can read an even more detailed report about Aave here.

Airdrop Alpha: Berachain

I just updated my step by step guide for the weekly Berachain tasks with all relevant links for your convenice.

Check it out here

Premium Section below with all Farming Positions, Important Updates and Portfolio Changes

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

The market finally recovered, but we are in an insecure environment and big bets need a lot of thinking right now. Let’s get into it.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.