Adrian's DeFi Alpha #17: Altcoin Rallye | Sui | Corn | Squid | Plume | Trump Project

Definitely no financial advice, just insights based on my own journey in DeFi.

We are Back!

Last week $BTC was sitting pretty at $58K, but the vibes were off—apathy, fear, and all-around hesitation. Fast forward to today, and $BTC pumped to $64K. The market's mood has flipped; bulls are coming out of hibernation, and it feels like we’re gearing up for something big.

Premium Subscription

As a subscriber of the premium newsletter you can find the Premium Section below

️ On today's Episode:

📈 Market Update

💻 Project Updates

🐂 Alpha on Sui, Corn, Squid and Plume

💎 The Premium Section with even more Alpha and all Portfolio, Airdrop & Farming Updates

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global #crypto market cap today is $2.33T, a -4.29% change in the last 24h. Total trading volume in the last 24h is at $84.9B. #BTC dominance is at 53.84% and #ETH - 13.65%.

→ Time to take some profits on our PENDLE / TAO trades, if you bought with me on August 5th.

📉 Key Catalyst: FOMC Rate Cut

The most important factor right now moving the markets? The FOMC meeting on September 18. The market was torn between a 25 bps or 50 bps cut, and we got the more bullish 50 bps rate cut. What does this mean? More liquidity—always a good thing for risk assets like $BTC. The S&P 500 hit a new ATH right after, and $BTC reacted with a quick +4% pump. Liquidity’s flowing, and that’s usually a green light for crypto.

The Macro Angle

The US economy doesn’t look too bad, rates are dropping, and liquidity is coming back—bullish for $BTC, plain and simple.

Altcoins Showing Signs of Strength

Another trend reversal is brewing in the altcoin market. Altcoins, which have been bleeding, are now consolidating with higher lows. This shift suggests we may be on the cusp of a broader rally if $BTC maintains its momentum.

🔍 Chart Watch: Altcoins are beginning to move in sync with $BTC, as highlighted by a higher-low formation in recent price action, breaking out of a 6 month downward spiral.

Michael Saylor Keeps Buying

Big moves from Saylor again, with another $400M of $BTC added to his stash this week. His buying saw a $1.1B accumulation, which helped mark a local bottom. The fact that we aren’t dumping on this news? Bullish.

$ETH Still Weak

Meanwhile, $ETH continues to struggle, with ETHBTC recently dipping to 0.0385 (it’s rebounded to 0.041). The absence of ETF inflows for ETH is concerning, and it’s a key reason for the bad price action.

$SUI is the Market Leader

Among all major coins, $SUI stands out as the fastest-moving asset, nearly doubling in price over the past two weeks. $SUI's FDV (Fully Diluted Valuation) now stands at $15 billion, far outpacing similar projects like $APT.

SUI’s rise has been echoed across its ecosystem, with $CETUS and $SCA also doubling in value, and $BLUB pumping from a $3M market cap to $30M. However, despite its strength, SUI’s FDV has traditionally hit a ceiling around $20-25 billion, suggesting short-term growth might be capped unless it convincingly breaks through this range.

VC Coins Lead the Rally

Interestingly, the strongest coins in recent days have been VC-backed projects, particularly $SUI, $SAGA (+84% in a week), $TIA (+48%), $DYM (+48%), and $ALT (+44%). These projects are now showing a return of capital, signaling a shift in market leadership away from memecoins.

AI Coins Pumping

Who would’ve thought? Both TAO (leader in AI with biggest market cap) and the smaller altcoins are finally waking up. The past few days have seen some wild repricing, with $DEAI, $AIT, $COMAI, and $SPECTRE all making serious moves. But the real standout? $TAO, leading the charge like a champ (+88%). The AI narrative is taking over, and these coins are showing they’ve got serious legs.

Solana Mid Caps Shine

On the Solana front, $SOL has lagged until recently, but mid-cap Solana tokens like $CLOUD (+137%), $DRIFT (+68%), $KMNO (+90%) and $ZEUS (+73%) have outperformed in September.

2. Project Updates

What dApp and project updates you need to know in the fast-paced world of crypto

Trump Launches WLFI Token

Donald Trump has launched World Liberty Financial, a money market protocol for lending and borrowing, along with a governance token named WLFI. Key details:

63% of WLFI tokens will be sold to accredited U.S. investors under SEC Regulation D.

17% will be allocated to community rewards, while 20% goes to the team and advisors.

World Liberty Financial aims to offer access to DeFi tools focusing on high-yield crypto investments for Donald’s rich friends.

Celestia raises $100M

→ This comes at a crucial point in time as on October 30th 175M token or 82% of the current supply worth about $940M will be unlocked and maybe sold by early investors.

Story protocol raises $140M

3. Alpha Section

Good projects and opportunities I discovered

Alpha 1: $SUI’s Market Dominance

Let’s start with the big one: $SUI. Over the last 10 days, $SUI has been hell of a fast horse, doubling in price and flexing a $15B FDV. If you’ve been riding this one, congrats—you’re sitting on a 2x in just two weeks. The key? It broke out of the pack of similar VC-backed Layer 1s like $APT and $SEI.

But here's a word of caution: while $SUI is leading the pack now, its FDV is inching toward the $20-25B range—a ceiling that’s historically been tough to break. If $SUI can smash through, it could be in a new league, but for now, I’m skeptical about how much room it has left to run in the short term.

The SUI ecosystem has also been popping off:

$CETUS and $SCA are both up 2x in two weeks.

$BLUB went from a $3M to a $30M market cap—classic memecoin pump.

SUI Eco TVL increase:

SUI DeFi: NAVI - Get Paid to Borrow

Now, if you’re looking for yield, you’ll want to check out NAVI. It’s Sui’s leading lending protocol with a liquid staking solution, and its TVL just crossed $500M. What’s cool about NAVI? They’re running a borrow-to-earn incentive program where you can actually get paid to borrow.

How It Works:

You deposit assets and borrow against them, while NAVI rewards you, offsetting the cost of borrowing. So, you're earning even while you’re borrowing.

Risks: This won’t last forever. The incentives are temporary, and you’ll need to keep a close eye on your position’s health factor. Over-leveraging could mean liquidation, and we’ve all seen how that plays out.

→ My strategy: I am lending SUI and borrowing stables. Then I buy SUI again and lend it to get leveraged exposure to SUI. Do this at your own risk always keeping the health factor and liquidation price in mind.

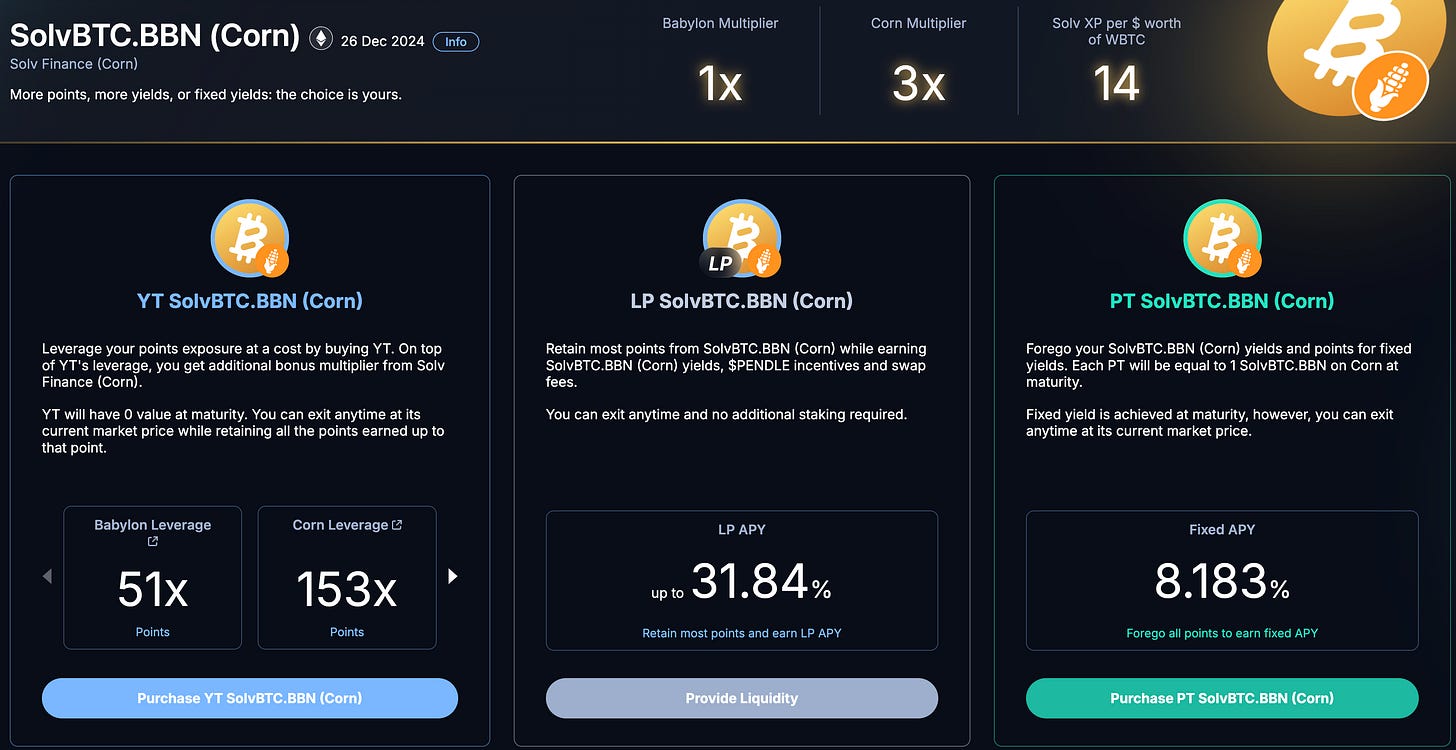

Alpha 2: Corn - Yield Farming on ETH L2

Corn is a new player on the scene, but it’s got my attention for a couple of reasons. First off, it’s an Ethereum Layer 2 solution that uses a tokenized Bitcoin (BTCN) as gas. The protocol recently launched a retroactive airdrop, rewarding early users with Kernels, which will convert into $CORN tokens.

Here’s what makes Corn different:

Users can deposit assets like WBTC, wETH, USDC, or DAI to earn yield, with no lockups or penalties for withdrawals.

Extra rewards are available through deposit multipliers on certain assets, making Corn one to watch if you’re yield farming on Layer 2.

Bonus Alpha: Pendle, another DeFi protocol, has partnered with Corn and Lombard to offer pools with variable yields of up to 30% on a Bitcoin-backed token. It’s not every day you see yields like this, so it's worth checking out.

Some valid strategies on Pendle to farm Babylon, Corn and Solv Points all in one. I prefer to LP and mix it up with a little bit of YT (beware, YT price will be 0 at maturity, you are farming points only with it):

Don’t know about SolvBTC and Babylon? Check out the alpha section of the last edition of this newsletter.

Some invite codes to start:

https://usecorn.com/app?code=3xtc-7ad7

https://usecorn.com/app?code=97yk-ffft

https://usecorn.com/app?code=c766-mdbm

https://usecorn.com/app?code=k9ek-b5d8

Alpha 3: Airdrop Farming with Squid 2.0

Airdrop hunters, here’s a gem. Squid has rolled out Squid 2.0, a cross-chain liquidity routing protocol powered by Axelar. It’s modular, 10x faster, and allows same-chain swaps. That’s a interesting for cross-chain DeFi, especially if you want to bridge into the Cosmos ecosystem.

What’s New in Squid 2.0?

Optimized routing: Better liquidity, less slippage, and improved pricing.

New interface: You can now pin your favorite tokens, track routes, and swap faster from 5 seconds down to 500 milliseconds.

This opens up a whole new level of cross-chain DeFi functionality, so if you’re looking for airdrop opportunities, Squid 2.0 should be on your radar.

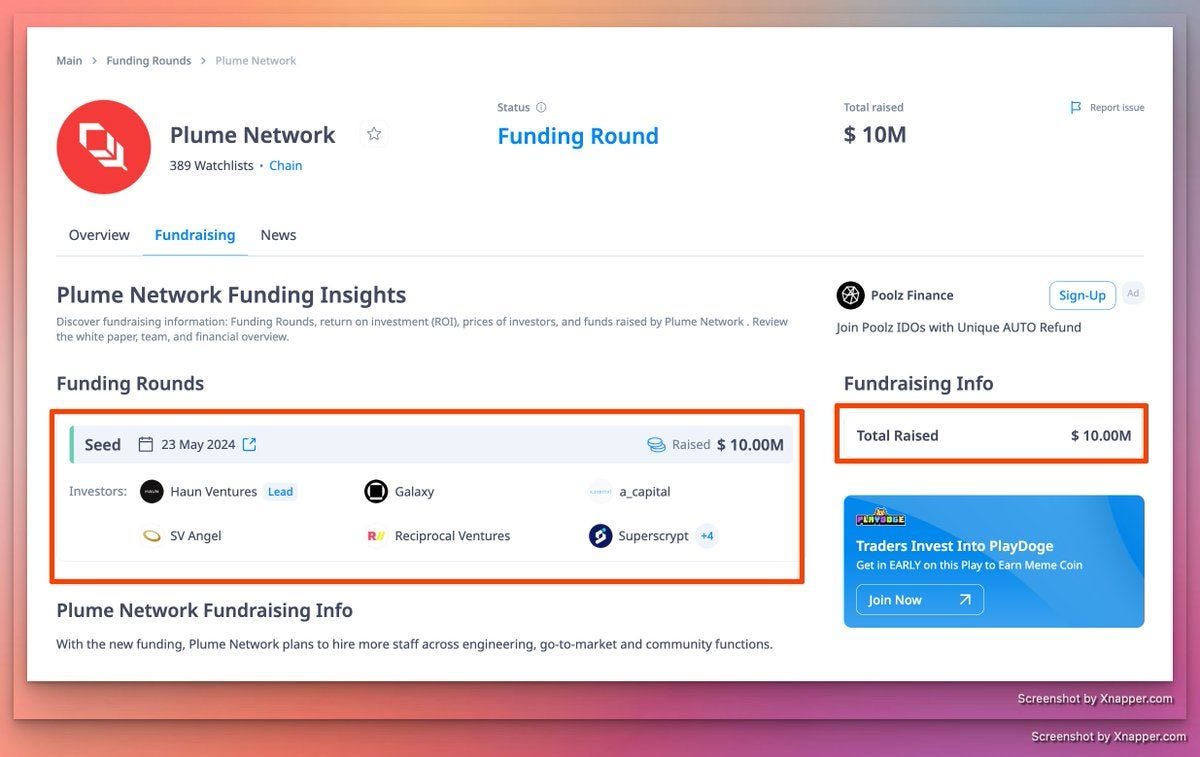

Alpha 4: Airdrop Farm - Free Testnet with Plume Network

If you’re looking for a free airdrop opportunity, Plume Network is worth checking out. Plume is still in testnet, but with $10M in funding from top names like Huan Ventures and Galaxy Digital, it’s one to watch in the Real World Assets (RWA) space.

Why it’s hot:

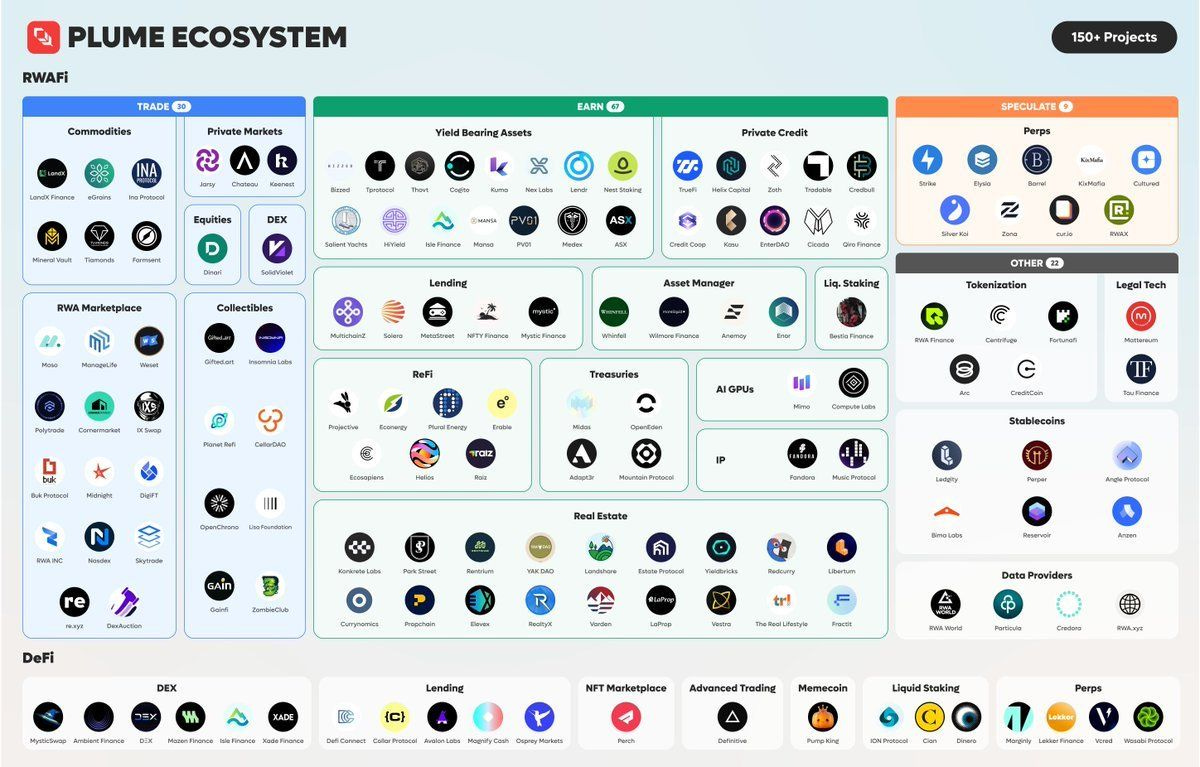

The RWA market is expected to hit $10T in the next few years, and Plume is positioning itself as a leader in tokenizing RWAs and bringing them on-chain. It’s an entire ecosystem, with 150+ projects in RWA, DeFi, and commodities.

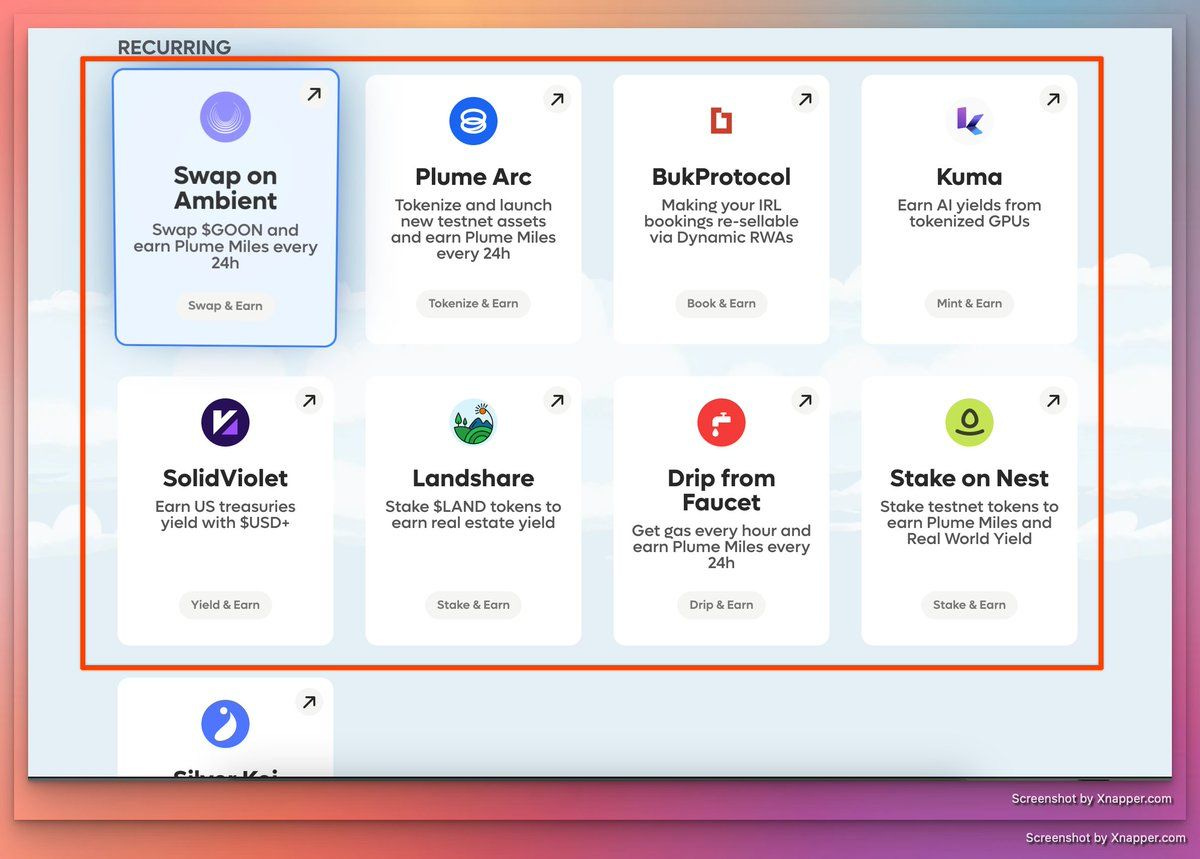

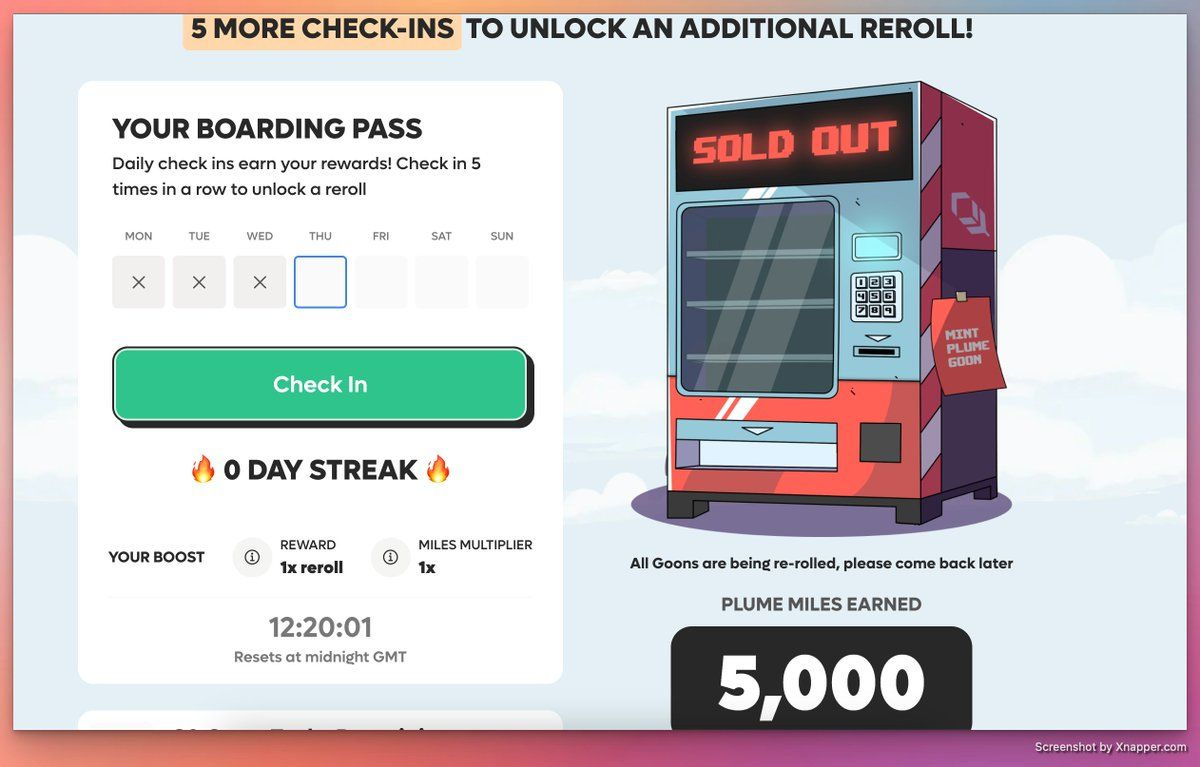

How to Farm Plume Airdrop:

Start by visiting: miles.plumenetwork.xyz (my referral link)

Connect your wallet, and you’ll get 5,000 miles right away.

Complete daily tasks and check-ins to accumulate more miles.

Tip: You can vote daily in Plume’s ecosystem for even more rewards. The project is still in testnet, so getting involved early could yield significant airdrop rewards.

Ecosystem Insight: Plume’s ecosystem includes projects like PlumeArc, Cultured_RWA, Landshare, and more. The network is aiming to simplify on-chain RWA deployment and build a composable ecosystem across multiple DeFi applications.

Premium Section below with all Farming Positions, Important Updates and Portfolio Changes

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

The market recovered and especially altcoins are pumping again, but we are in an insecure environment till the US elections and big bets need a lot of thinking right now. Let’s get into it.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.