Adrian's DeFi Alpha #18: Cycle on Point | Altcoin Outperformers | AI Buys | BTCFi | Best Airdrops

Definitely no financial advice, just insights based on my own journey in DeFi.

Never give up!

I’m bullish on crypto for Q4, and for good reasons. Here’s why I believe we’re at a key point in this crypto cycle, and why I remain optimistic about the near future.

Premium Subscription

As a subscriber of the premium newsletter you can find the Premium Section below

️ On today's Episode:

📈 Market Update

💻 Project Updates

🐂 Alpha on AI Coins I bought, BTCFi on Pendle, the best Airdrops right now

💎 The Premium Section with even more Alpha and all Portfolio, Airdrop & Farming Updates

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global #crypto market cap today is $2.27T, a -1.48% change in the last 24h. Total trading volume in the last 24h is at $97.5B. #BTC dominance is at 54.32% and #ETH - 12.88%.

📉 BTC Cycle ROI on Track

The current Bitcoin market cycle mirrors the 2016 and 2020 bull markets. Historically, two major trends have emerged:

BTC’s uptrend usually starts ~170-180 days after the halving.

Cycle tops have been hit ~480 days post-halving.

We’re only 160 days into the post-halving period, suggesting that BTC’s major rally may be just weeks away, if history is any guide. Human nature doesn’t change, and markets tend to repeat cycles.

Exchange Reserve Decline

Since January 2024, over 500,000 BTC has been withdrawn from exchanges. When whales withdraw from exchanges, it usually means they are holding long-term, signaling accumulation and a potential supply squeeze (which tends to happen about 160 days after the halving).

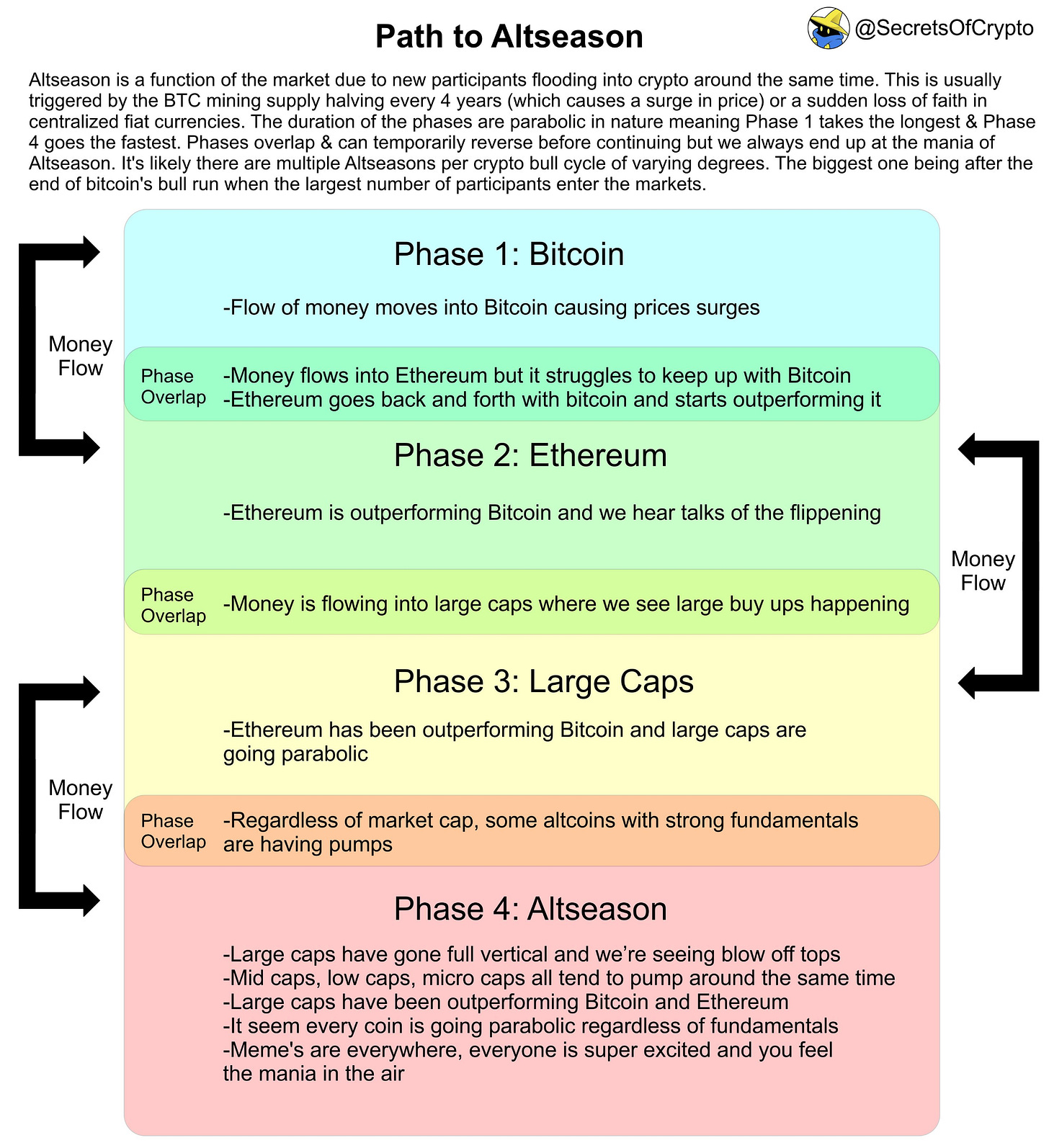

BTC Dominance Signals Early Cycle

BTC’s dominance recently hit multi-year highs. Historically, Bitcoin rallies first, followed by altcoins, with attention moving from large caps like ETH and SOL, then down the market cap ladder. If BTC dominance starts to decrease soon, altseason could be just around the corner.

While cycles like this have played out before, this time could actually be different. We've already hit a new all-time high, and speculative memecoins are dominating the narrative, which typically happened later in previous cycles.

To stay sharp, we need to keep a close eye on these trends and adjust our strategy.

September Recap: New Highs and VC Coin Outperformance

September exceeded market expectations, and there's a good reason to reflect on it. Recent outperformers are likely to keep leading the pack, making it worth tracking their progress for potential entry points or deeper exploration into their ecosystems. Key narratives to watch are:

Bitcoin’s Higher Low Before New High

BTC made a local low at $52.5k early in the month, only to pump toward $66k by month’s end. This established a higher high and sparked the first signs of life in altcoins. While memecoins have dominated since early 2024, September finally marked a shift in focus to VC-backed and fundamentally strong projects.

VC Coins Leading

The best performers of September were VC-backed Layer 1s, with $SUI (+123%), $SAGA (+114%), and $SEI (+63%). $SUI was the star, going from an $8 billion FDV to $18 billion, outperforming other S-tier (funded) coins like Aptos. The key question is whether this was a short-term pump or the start of a new “SOL-like” run for SUI.

Decentralized AI Narrative Gains Momentum $TAO doubled its market cap, becoming the leader in the decentralized AI narrative. Other AI-related tokens like $NEAR, $AR, and $AGI also saw notable gains as the sector caught a fresh bid.

Top Performers in September (Large Caps):

$SUI: +123%

$SAGA: +114%

$TAO: +106%

$FTM: +64%

$POPCAT: +68%

$WIF: +62%

$SEI: +63%

$PEPE: +38%

Potential Risks: Macro Uncertainty and Recession Fears

While I remain bullish on crypto for Q4, we can’t ignore macro uncertainty. War in the middle east and a global recession could affect crypto markets, but with the 2024 U.S. elections approaching, I doubt we’ll see a recession this year. The Democrats and Kamala Harris, will likely aim to keep economic conditions stable to improve their chances in the presidential race.

2. Project Updates

What dApp and project updates you need to know in the fast-paced world of crypto

Roam – Revolutionizing Global Connectivity with DePIN

Roam is a decentralized physical infrastructure network (DePIN) project that aims to redefine how we connect globally. With a decentralized global WiFi network, Roam provides seamless OpenRoaming while rewarding users for every connection they make worldwide. It’s an ambitious project, but they’ve already made some impressive moves.

They recently announced three major updates, and the most exciting one is the Roam eSIM. This eSIM grants access to over 400 networks across the globe, allowing users to stay connected wherever they are. What’s more, users can earn up to 50 MB of free data daily just by checking in through the Roam app. This blend of global accessibility and incentives is an interesting take on how how decentralized networks are utilized.

Sanctum – Unlocking Liquidity with Liquid Staking on Solana

Sanctum is a liquid staking protocol that enables users who stake SOL natively or with liquid staking tokens (LSTs) to tap into a unified liquidity layer, creating new opportunities for capital efficiency on Solana.

At Breakpoint2024, Sanctum made two announcements: Sanctum Creator Coins and the Cloud Card. While both are interesting, the Cloud Card really caught my attention. Created in partnership with Jupiter Exchange and BasedApp, this SOL debit card allows users to spend SOL and stablecoins in over 100 countries. It brings real-world utility to SOL, making it easy for users to transact globally.

3. Alpha Section

Good projects and opportunities I discovered

Alpha 1: Recent Buys:

I set some limit buy orders for alts to increase my exposure in case the market dumps after the recent pump. To make it as easy as possible I often set 1 order for a 10% decline and another one for 20%. That way I am not buying into pumps.

Whenever I have extreme FOMO I am just buying a very small allocation of a coin and set the limit orders as well.

These are the AI coins I want to hold with a time horizon of 3-6 months:

TAO: Bittensor is a decentralized blockchain network designed to create a marketplace for artificial intelligence, where developers can contribute and monetize their AI models while users can access these capabilities. It uses a native cryptocurrency (TAO) to incentivize participation, facilitate transactions, and govern the network, aiming to democratize AI development and create a collaborative ecosystem for machine learning advancements.

AIOZ: A Layer-1 blockchain designed to decentralize the streaming industry through a distributed content delivery network.

PAAL: Enhances real-time communication through an AI-driven Telegram and Discord bot, with active development and strategic partnerships increasing utility and engagement.

ANYONE: Former ATOR token is building the world's largest decentralized network for internet privacy, leveraging a globally distributed set of relays that earn ANYONE for contributing their bandwidth, computing power and services.

These are my high conviction plays that I am betting on with size:

Alpha 2: BTCFi Yield Farming

Eigenlayer farming is over, so we have to put our yield farming / airdrop allocation in other protocols. My bet in on BTCFi which gains traction quite fast right now.

These are the most promising projects:

Babylon Labs: Raised $70M in a round led by Paradigm, focusing on building innovative Bitcoin DeFi infrastructure.

Lombard Finance: Secured $16M in seed funding with Polychain as the lead investor, aiming to be a top player in BTCFi.

Corn: Raised $6.7M, backed by Binance, bringing unique yield farming opportunities with tokenized Bitcoin (BTCN) on Ethereum Layer 2.

Solv Protocol: Raised $6M with support from Binance. Solv Protocol is a platform that enables Bitcoin liquid staking, allowing users to stake their BTC, receive SolvBTC tokens in return, and participate in various DeFi activities across multiple blockchain networks.

→ These projects are well-funded and positioned for significant growth!

What’s Corn?

Corn is a new player on the scene, but it’s got my attention for a couple of reasons. First off, it’s an Ethereum Layer 2 solution that uses a tokenized Bitcoin (BTCN) as gas. The protocol recently launched a retroactive airdrop, rewarding early users with Kernels, which will convert into $CORN tokens.

Here’s what makes Corn different:

Users can deposit assets like WBTC, wETH, USDC, or DAI to earn yield, with no lockups or penalties for withdrawals.

Extra rewards are available through deposit multipliers on certain assets, making Corn one to watch if you’re yield farming on Layer 2.

What’s Lombard Finance?

Lombard Finance is quickly becoming one of the largest protocols in BTCFi, backed by Polychain. It’s focused on bringing liquidity and yield opportunities to Bitcoin, specifically through LBTC.

Here’s what makes Lombard interesting:

Experienced team: Leaders from Polychain, Coinbase, and Ripple.

Integrations: Works with protocols like Pendle and Etherfi, offering unique ways to farm Bitcoin-based assets.

Farming strategy: Earn Lux and other rewards by staking LBTC with no lockups, and maximize yield across different integrations.

BTCFi Strategies

Pendle is of course capitalizing on this narrative and offers several good opportunities.

→ A clever Quant Sheep has created a tool to calculate the fair value of Pendle Yield Tokens. Check it out on X!

Strategy 1:

A valid strategy is to farm Babylon, Corn and Solv Points all in one. I prefer to LP and mix it up with a little bit of YT (beware, YT price will be 0 at maturity, you are farming points only with it):

Another strategy is farming Lombard with Corn.

Some invite codes to start:

https://usecorn.com/app?code=3xtc-7ad7

https://usecorn.com/app?code=97yk-ffft

https://usecorn.com/app?code=c766-mdbm

https://usecorn.com/app?code=k9ek-b5d8

Strategy 2:

As a more conservative investor you can also bet on LBTC LP (Lombard) and get up to 33% variable APY.

→ More info on Lombard

Alpha 3: Airdrops - Top Picks to Watch

1. HyperLiquid

HyperLiquid is an on-chain derivatives protocol and Layer 1 network aiming to become the "On-chain Binance." With HyperBFT consensus, it processes up to 100,000 transactions per second, offering incredible speed. Unlike farming-heavy protocols, HyperLiquid has cultivated a real, sticky user base. While it may be too late to farm points, the upcoming airdrop (likely $HYPE) could be very lucrative for retail traders, as the project hasn’t been dominated by massive VC funding.

2. Berachain

Berachain is innovating with its Proof-of-Liquidity consensus and soulbound governance token, BGT. Built on Cosmos SDK and EVM-compatible, its ecosystem is gearing up for major launches. By interacting with the Berachain testnet and collecting NFTs, you might secure future rewards. This is a project with a lot of potential, so don’t miss your chance to get involved early.

→ Here is my Airdrop Guide how to start on Berachain.

3. Nillion Network

Nillion is all about data decentralization with its secure computation network, offering a unique way to decentralize data trust, akin to how blockchains decentralize transactions. Their Verifier Task Program could reward early interactions, making now a great time to participate. With its focus on DePIN applications and real-world data privacy, Nillion stands out as a top project. Emphasis has been placed on rewards for early interactions in the verifier program.

→ To get started, simply go to https://verifier.nillion.com/ and follow the instructions.

4. Monad

As an EVM-compatible Layer 1 with parallel execution, Monad is being hyped with its ambition to process 10,000 transactions per second. Its upcoming testnet launch is drawing attention. With a vibrant and meme-driven community, there’s speculation that early contributors could be rewarded. If you're looking for the next “Solana killer,” now’s the time to dive in and position yourself before the incentives begin.

→ You can get involved with Monad's vibrant community today. Here's how:

Join the official Discord. Be yourself, be respectful.

Share insights in #newbie-tech-and-trade.

Connect with the community in #newbie-chat.

Create VALUABLE content in #newbie-create.

5. Farcaster

Farcaster is a decentralized social network powering platforms like Warpcast, blending social media with on-chain capabilities. Staying active on Warpcast could position you for future rewards if Farcaster drops a token. The platform is still evolving, but it’s already offering a unique social experience, and now’s the time to get involved while the ecosystem is still maturing.

→ You can use my referral link to start on Warpcast.

Premium Section below with all Farming Positions, Important Updates and Portfolio Changes

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

The market recovered and especially altcoins are pumping again, but we are in an insecure environment till the US elections and big bets need a lot of thinking right now. Let’s get into it.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.