Adrian's DeFi Alpha #19: Memecoin Supercycle? | Scroll Airdrop | New AI Projects | Wormhole & MORE

Definitely no financial advice, just insights based on my own journey in DeFi.

Up or Down?

It was a rollercoaster week for Bitcoin as it briefly dipped to $58k last Thursday, sending panic across the market. But buyers swooped in, pushing the price back above $60k within hours. While we’ve seen a steady upward trend since, the $64k resistance is proving to be a significant hurdle.

To flip into full bull mode, we need to see a breakout above $64k. The market’s failed attempts at this level have kept traders cautious, and another rejection could send us into bearish territory. My advice? Stay patient, don’t chase big trades in this range, and let the market guide you. The altcoin scene is where the action’s at in the meantime.

Premium Subscription

As a subscriber of the premium newsletter you can find the Premium Section below

️ On today's Episode:

📈 Market Update

💻 Project Updates

🐂 Alpha on Memecoins, New AI Projects, Wormhole, BTCFi & MORE

💎 The Premium Section with even more Alpha and all Portfolio, Airdrop & Farming Updates

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global #crypto market cap today is $2.29T, a -1.67% change in the last 24h. Total trading volume in the last 24h is at $60.3B. #BTC dominance is at 54.09% and #ETH - 12.89%.

📉 Altcoins: A Bottom is Forming?

Altcoins bottomed on October 3, and so far, we’ve only seen higher lows, encouraging signs that we’re breaking out of the frustrating March-August downward spiral. The market could be positioning itself for a rally, especially with narratives like the Trump election trade driving activity.

I’ve got my altcoin bags packed, but truth be told, the market’s direction on lower timeframes is tricky. Keep an eye on how things unfold as the U.S. elections approach.

Altcoins & Key Catalysts: SUI, APT , WLD, and EIGEN

$SUI has reclaimed its previous ATH and continues to perform exceptional. $APT is running closely behind it.

$WLD is gearing up for a potential pump ahead of an October 17 event featuring Alex Blania and Sam Altman.

$EIGEN, from EigenLayer, launched and seems to be stabilizing after its initial airdrop sell-off.

Murads Memecoin Mania – $SPX, $POPCAT, and $GIGA

The memecoin supercycle narrative has gained steam, thanks to the so-called Murad effect. Murad’s aggressive bullposting around memecoins like $SPX, $POPCAT, and $GIGA has ignited a reflexive loop where hype drives price, and price fuels more hype.

Most notably, $SPX pumped from $10M to over $800M in market cap this week alone. Likewise, $GIGA more than doubled from $200M to $500M. $POPCAT, jumped 45% to hit its previous ATH, followed by a slight correction.

Check out Murads talk on Token2049, it’s an interesting take on how this cycle could turn out.

→ I would not buy most of these as they pumped incredibly hard the last week. If you want to get a top performing Memecoin Portfolio, check out the Premium Section below.

Politifi Coins: Betting on the Trump Trade

Memecoins with political angles—like $TRUMP, $MAGA, and $TREMP—are also seeing strong gains. As the U.S. elections loom, $TRUMP is up +180%, $MAGA has pumped +250%, and $TREMP is up 3x. It’s all linked to increasing Polymarket odds favoring Trump, now standing at 55%. If you’re betting on the political meme narrative, these coins are worth watching closely.

2. Project Updates

What dApp and project updates you need to know in the fast-paced world of crypto

Scroll vs. Centralization Debate

The recent Binance listing of Scroll stirred debate over centralization concerns. With 5.5% of the token supply allocated to Binance’s Launchpool, the community is questioning whether Scroll has capitulated to the biggest CEX. It’s worth noting that Scroll is now trading at a lower valuation than its Series B round from March.

→ I farmed the Airdrop heavily but have no big hopes for it.

WorldLibertyFi Public Sale

WorldLibertyFi, backed by the Trump family, is set to conduct its $WLFI public sale on October 15. With a hefty $1.5B valuation, the project aims to raise $300M. Stay tuned for further developments.

Gaming Goes Web3: “Off The Grid” Gets Serious Hype

A new AAA game called “Off The Grid” has taken the gaming world by storm. Why should you care? The game runs on the GUNZ blockchain, a custom Avalanche subnet, signaling a huge step forward for Web3 gaming. It’s available on PS5 and the Epic Games Store, with top streamers like Ninja already playing it.

Phantom Expands to Base

In a big move for the Solana ecosystem, Phantom has completed its integration with Base. This could drive a massive influx of users into the Base ecosystem, sparking another potential memecoin season.

Jupiter goes mobile

Big news from Jupiter, the decentralized trading platform in the Solana ecosystem: They’ve just launched their mobile application, offering a seamless, on-chain experience with zero platform fees. The app stands out by supporting multiple payment methods, including Apple Pay and credit cards, making it easier than ever for users to onboard and trade crypto directly from their phones. Currently available on iOS, with an Android version coming soon.

3. Alpha Section

Good projects and opportunities I discovered

Alpha 1: New Risky Trading Ideas On Ethereum:

1. Brume

Brume Wallet is an Ethereum wallet with a unique focus on privacy. Its standout feature? A built-in Tor protocol that hides your IP address when making network requests, preventing third parties from tracking your activities.

Unlike traditional wallets, Brume ensures your IP isn’t shared, protecting your transactions from censorship and surveillance. The project launched at the privacy-first EthBrno hackathon in 2022 and took first place. Developed by cypherpunks with strong security backgrounds, it aims to address the privacy issues inherent in many existing wallets.

Brume has a clear mission: make privacy accessible to everyone.

TaoBank is building on the Bittensor ecosystem with the first TaoFi project on EVM chains.

Initially launched on Arbitrum and now on Ethereum, TBANK focuses on lending and staking for AI-related assets like wTAO and stTAO. Their staking platform already holds over 3,500 TAO. TBANK is going to launch Delegate-As-A-Service in late October, allowing users to stake dTAO for rewards.

With smart contracts coming soon on Bittensor, TBANK could be positioned for long-term growth.

→ These are risky small caps, time the entry and adjust size accordingly.

Alpha 2: Vana

The goal of Vana is to revolutionize data ownership with its EVM-compatible Layer 1 network designed for private, user-owned data. Instead of handing over your personal data to corporations like Google or Amazon, Vana empowers users to own, govern, and monetize their data through a Data Liquidity Layer and Data Liquidity Pools.

Here’s the actionable: Vana is currently running a Telegram mini-app game where you can earn Vana points by:

Identifying deepfake data.

Connecting your wallet.

These points could provide early exposure to their growing ecosystem as they expand partnerships (like their plan to acquire 23andMe’s genetic data) and scale their decentralized data marketplace.

👉 Start earning: Join the game here

With $25M in funding from heavyweights like Polychain and Paradigm, Vana could become a promising player in the emerging decentralized data economy.

Alpha 3: Gradient Mining

Missed out on the $GRASS free mining rewards? Gradient is here with another exciting mining opportunity, and it’s still early. This is your chance to get in during the Alpha stage and position yourself for a future airdrop. Here's how to get started:

Sign up on Gradient using my referral link and verify with your email.

Follow their X (formerly Twitter) account for extra XP.

Download their browser extension to track your mining position, similar to the $GRASS setup.

To earn rewards, simply keep your node running for 72 hours to prove you're not a bot and secure your spot in the upcoming airdrop. The earlier you start, the better your position when rewards drop.

Gradient received funding from: Pantera Capital, Multicoin Capital and Sequoia Capital

Alpha 4: Wormhole Airdrop #2

With Wormhole Airdrop 2 potentially dropping at any moment, it’s surprising how many people have stopped farming for it. According to their tokenomics document, 6% of the $W supply was unlocked in June and could be distributed at any time. But since no official announcement has been made yet, this gives us a unique opportunity to keep farming.

Here’s the strategy to position yourself for a piece of that airdrop:

Bridge across chains using both Jumper (Mayan Finance) and the official Portal Bridge. This way, you maximize your chances of qualifying for multiple airdrops:

Wormhole

Jumper/Lifi

Mayan Finance

Route between different chains e.g. Solana, Base, Sui, Aptos and use various crypto assets (stablecoins, ETH, SOL) to cover as many unique bridging weeks/months as possible. Volume is likely a key metric, so aim for consistency in your activity leading up to a potential snapshot.

Few are farming this airdrop, so this could be a significant edge in securing a bag when the next round hits.

Alpha 5: Core - The Nr. 1 BTC Sidechain:

CoreDAO Bitcoin L2: A layer 2 (L2) solution built on top of the Bitcoin network, aimed at enhancing the scalability, efficiency, and functionality of Bitcoin.

Best BTC Strategy: Provide SolvBTC.CORE/COREBTC for a 5X spark multiplier. Start here.

I put in a small amount in the SolvBTC.CORE/COREBTC pool in the 0.05% fee tier for the start as I consider this a more risky investment.

→ Right now you can earn a 5x Sparks Multiplier on Core Ignition Drop for SolvBTC.CORE

The more secure and 3 in 1 airdrop farm is Pell network, another restaking platform gaining traction with 288m in TVL.

I am restaking coreBTC and SolvBTC on Pell and consider this less risky than liquidity provision on a DEX or lending.

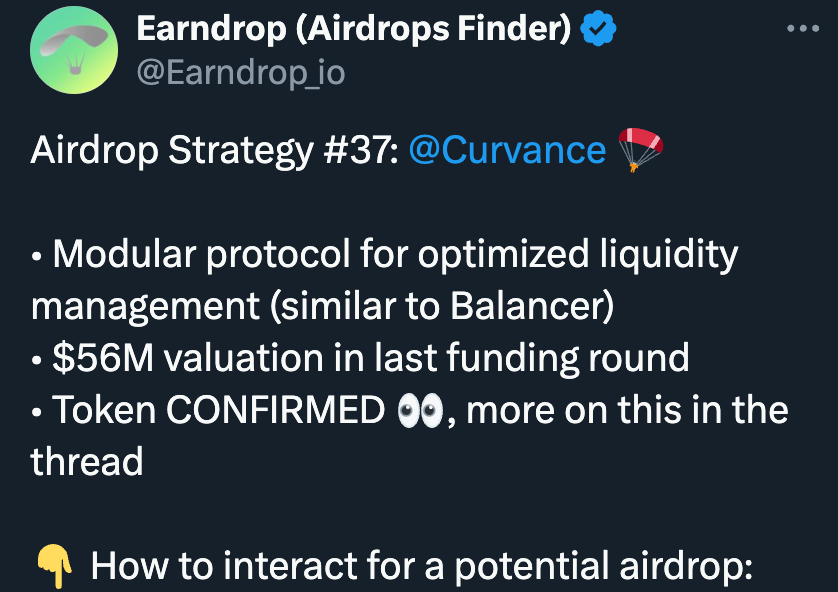

Alpha 6: Curvance Airdrop

Thanks for reading, fren and stay safe!

Adrian

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

The market looks good and especially memecoins are pumping again, but we are in an insecure environment till the US elections and big bets need a lot of thinking right now. Let’s get into it.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.