Adrian's DeFi Alpha #2: ETH Rally | AI Coins | Starknet DeFi Opportunities

Definitely no financial advice, just insights based on my own journey in DeFi.

Hello there Friend,

busy with work and personal projects? Let me help. I’ve been navigating the DeFi space since 2020, and I love sharing what I learn.

These are the advantages you will get in each newsletter:

The key developments in Crypto.

3 practical insights to act on.

All packaged in a 5-minute read. No sponsored content, no trading chaos. Just insights based on my own journey in DeFi.

Let’s make the most of your time!

Key Developments

Shedding light on the recent significant developments within Crypto.

Short-Term Caution? Betting on short-term dips requires a gamble on BTC ETF flows decreasing. Especially when my long-term conviction is very high on the bull case, why would I bother too much with the short-term direction that I have way less conviction in?

$ETH's Rally: $ETH shines bright at $3000, with strength against $BTC. Unlike past patterns, $ETH's rise doesn't indicate a market downturn but signals robust bullish momentum for Ethereum, even outshining $SOL.

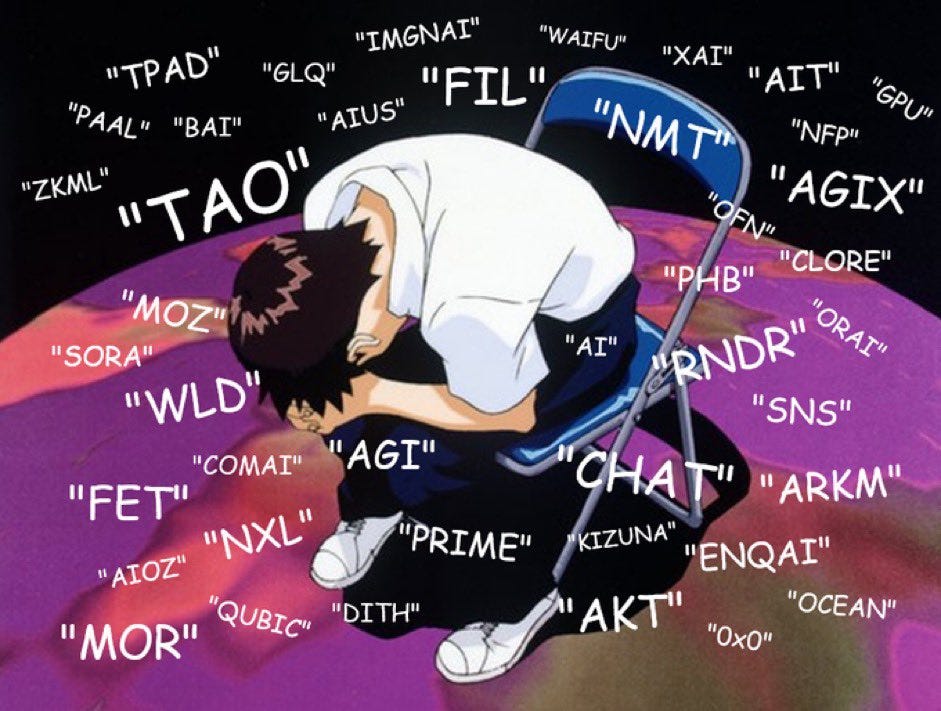

AI's Big Moment: OpenAI's latest innovation with Sora and Nvidia's earnings have kicked off a wave of excitement in AI. Tokens like $RNDR, $AGIX, and $FET are on fire. A demonstration of AI's growing role in crypto.

→ My favorite AI coins are : $RNDR, $OLAS, $PAAL and $TAO because I like to invest in the leaders, instead of having to pick the “best” coin.

Relevant News (click on the tweet for the original source)

What you should know about the Space this week.

Reddit holds BTC & ETH:

Ethena launch:

Ethena is a stablecoin (USDe) project, and the stablecoin is yield-bearing (its staked version*) because it is backed both by staked ETH and by an $ETH short on CEX… so delta-neutral with basis yield + staking yield. Many people seem worried about the protocol, because they think about everything that could go wrong and definitely still have Luna-PTSD. Here is a good recap by Jason Choi on the matter:

Ethena pays investors less than expected:

But still a lot of institutional investors in:

Base NFT

BASE released their anniversary edition NFT in Zora

You can collect it here in case they use it for their Airdrop (my referral link)

Actionable Insights

Some ideas where to find Alpha.

Launchpad Gold Rush: Ape Terminal's launches are hotter than a summer sale. Eyes on Fjord Foundry and Eclipsefi for the next big thing.

@apeterminal demand for the recent launches have been through the roof for @dechat_io, @Ordibank, @beoble_official, @ForgotPlayland, and @BefiLabs

@FjordFoundry’s recent launch @project_shutter (a project that prevents front-running and malicious MEV) has already raised $7m and the val is $10.6m MC & $257M FDV.

@MobyHQ launching @beoble_official, @StarHeroes_game, @Aark_Digital

@Eclipsefi launching @bonus_block, @demexchange, @stabbleorg, partnered with @NibiruChain to launch Nibiru ecosystem projects on Eclipse

WHAT DO? — Monitor Ape Terminal, register lottery for a chance to win allocations. Monitor Fjord for good projects, when investing in the LBP, make sure to buy dips rather than buy instantly once new projects launch.

GameFi's New Playground: WarpGate’s soft launch is interesting and the project has quite some traction due to good marketing.

@WarpGateX is a Decentralised Exchange on @Immutable zkEVM and has announced a Soft Launch with different campaigns.

→ Early Gamefi project with potential. I will invest a small sum.

DeFi Alpha - Starknet Guide

A step-by-step walkthrough on how to generate yield using Starknet, an Ethereum Layer 2.

StarkNet recently launched its $STRK token, causing irritation among its community. Initially, there was some frustration due to issues with the airdrop distribution and concerns about a large portion of the tokens being unlocked in just two months. However, StarkNet responded to the community's feedback by revising the token's vesting schedule to a more gradual release, easing those concerns.

So, why is farming on StarkNet attractive?

With the introduction of the DeFi Spring Daily Quests series, StarkNet is incentivizing participation with a reward pool of $40 million in $STRK tokens. This series will be running from February 22, 2024, to October 2024.

My Step-by-Step Guide to start with Starknet DeFi

1. Get funds from ETH or many L2s to Starknet via Bridge

2. Farm these protocols:

Swap 1/3 of your ETH into STRK

Go to Ekubo

Provide Liquidity for ETH and STRK

Use 0.3% fee and 0.6% precision tier

As a beginner use +/- 10% price range

As an advanced user use your preferred price range

Lend ETH

Borrow USDC

🚨 Account health should always be more than 1.5

Go to Pools

Provide Liquidity for all “Rewards” Pools

More infos on Nostra - DeFi Spring: https://mirror.xyz/0x845605C411132BAA06024a521a85B653F3C802dF/0CAY2mAh2qLeI8QxHcBCtkrpjhkj_TQLqbClPRR2H00

Find my whole Airdrop Guide here:

I added different difficulties, so beginners just start with green and advanced farmers with yellow.

I have free and cost intensive Airdrop farms in store, basically something for every type of farmer. Happy if it helps!

Wrap Up

Key takeaways for your DeFi strategy:

Bet on the future, not the fickle friend that is the present.

$ETH's power play against $BTC is a signal too loud to ignore.

AI's the word, and the word is profit.

Crypto ecosystems offer great opportunities after an Airdrop.

Whenever you’re ready, there are 2 ways I can help you:

Do you want to get the fastest DeFi and Airdrop Alpha then join my Community

Ready for an in-depth consulting session tailored to your needs, including market research and portfolio analysis? Secure your spot for a free 15 min introductory call here.

Meme of the week

(because a dash of humor always adds a fresh perspective!)

Until next time!

- Adrian