Adrian's DeFi Alpha #20: AI Memes | BTCFi | Pendle | TAO | Sui | Lombard | Avalon | Babylon

Definitely no financial advice, just insights based on my own journey in DeFi.

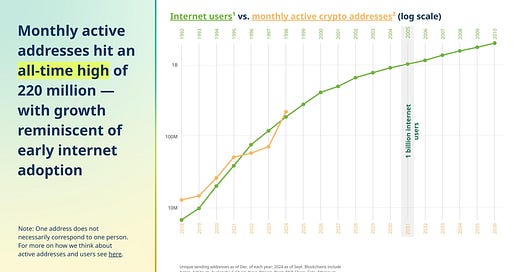

All-Time Highs?

Hey fren!

We’re in wild times. Monthly active crypto addresses just hit a record 220 million, thanks to another hype in memecoins and the rise of addictive crypto apps like tap-to-earn games and of course the prediction market #1 Polymarket. It’s a big win for crypto adoption and a clear signal: Things are heating up.

Traditional markets aren’t sitting still either. Gold hit a new all-time high, the S&P 500 is pumping, and MicroStrategy — aka Bitcoin wrapped in a suit — also smashed its ATH. But let’s talk real numbers: Bitcoin is only 5% away from reclaiming its all-time high of $74k, and with ETFs gobbling up BTC by the hundreds of millions, it’s only a matter of time before we blow past that. The buy pressure is building.

Premium Subscription

As a subscriber of the premium newsletter you can find the Premium Section below

️ On today's Episode:

📈 Market Update

💻 Project Updates

🐂 Alpha on BTCFi, Pendle, Bittensor, Sui & MORE

💎 The Premium Section with even more Alpha and all Portfolio, Airdrop & Farming Updates

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global #crypto market cap today is $2.48T, a 0.01% change in the last 24h. Total trading volume in the last 24h is at $91.4B. #BTC dominance is at 54.54% and #ETH - 13.20%.

📉 AI Meme Coins: The New Frontier

AI meme coins were the new hyped narrative in the last 7 days. Think of them as meme coins on steroids. They don’t just pump and dump; they adapt, learn, and spread like a financial virus. AI memecoins might become more than just a narrative — they’re a self-sustaining engine. With their ability to tap into social media trends and manipulate attention autonomously, these AI-powered assets could create a whole new breed of decentralized financial players.

Imagine an AI that’s constantly earning, reinvesting in itself, and growing without human intervention. We could be on the verge of a whole new economic landscape driven by AI entities with their own agendas.

We’re already seeing early signs of this, with projects like “Terminal of Truths” that are pushing the boundaries of AI containment. Soon it could be not just tech anymore — this could be a new kind of market player, influencing not just prices but even politics and culture.

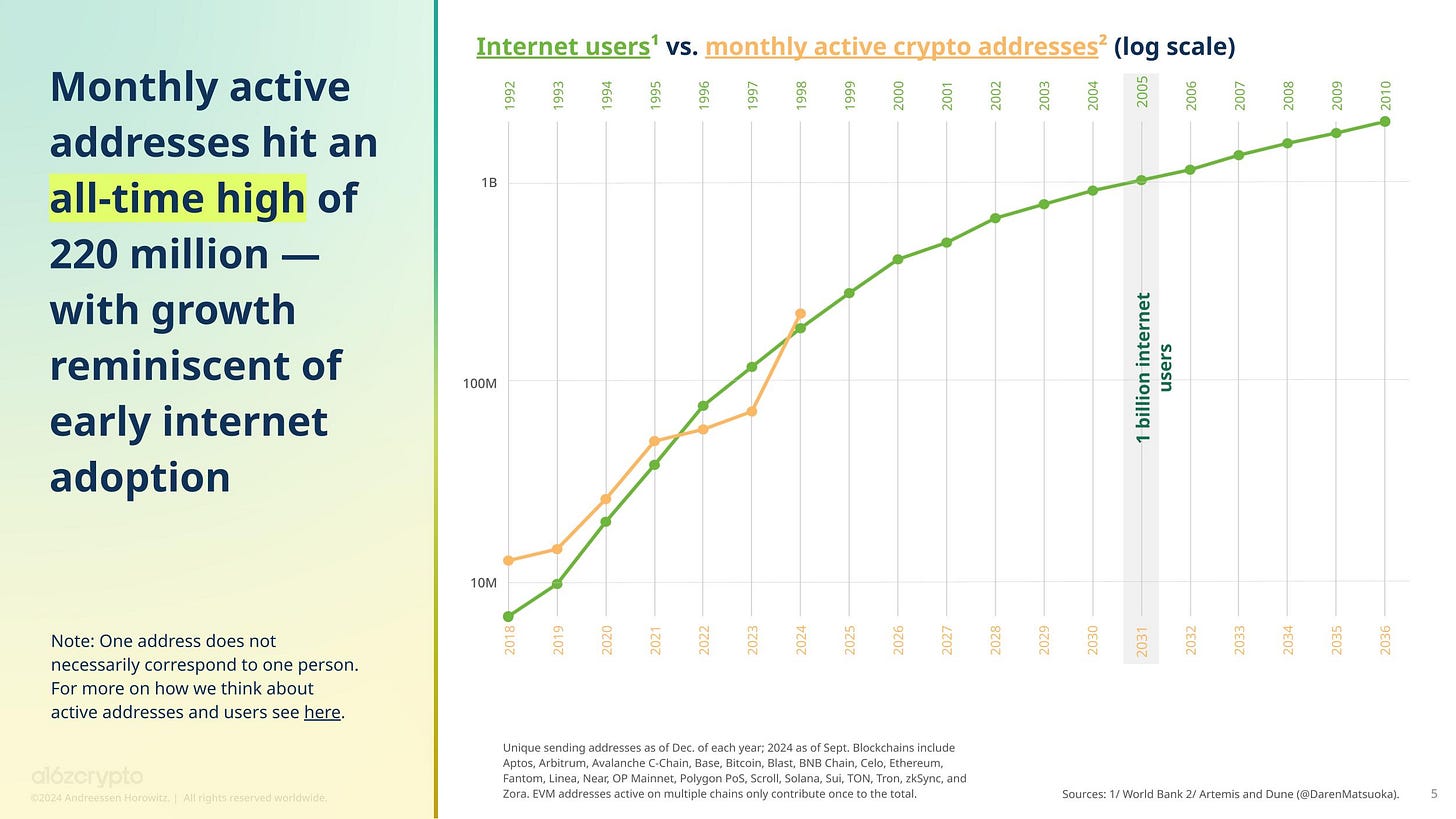

Apechain: New Meme Chain?

Just 2 days ago on Apechain were only eight tokens, and none of them over $1M. Fast forward, and we’ve got over 100 tokens, with the top one pushing $14M in market cap. That’s what we like to see in a bull market. The key to catching the next wave is spotting trends early, and Apechain could become the next hyped home for memes.

Solana’s Big Play

Forget the noise — all roads seem to lead to Solana this cycle. SOL’s gone from $8 to $210 so far, and if we see a parabolic phase soon, we’re just getting started. From 6-figure airdrops to AI metaverse plays, Solana is the undisputed playground for DeFi degens. Whether it’s DeFi, AI, or meme coins, Solana’s got nice, retail friendly dApps for all of that. With all the opportunities popping up, it’s clear SOL is the place to be this cycle.

→ There’s more and more active addresses on SOL (including bots).

→ Volume on decentralized exchanges is rising again.

Are We in Alt Season Yet?

So, is it alt season or what? The textbook definition is when 75% of the top 50 coins outperform Bitcoin over a 90-day period. The last true alt season was back in 2021, and it was wild. We’re starting to see hints that another one could be on soon.

Here’s why:

The Fed is softening its stance on interest rates.

China’s injecting liquidity into the global markets.

Bitcoin dominance looks like it might have peaked, which means BTC liquidity could soon start flowing into alts.

And with stablecoins piling up, there's a ton of dry powder ready to pump into the market.

That said, it’s not all sunshine. Retail investors still haven’t returned in force, and with the market more fragmented than ever, there’s a ton of competition for capital. Still, if Bitcoin slows down, alts are going to get their moment.

2. Project Updates

What dApp and project updates you need to know in the fast-paced world of crypto

You can find the links attached to the images

Pump Advanced: The Fastest Trading Terminal?

Pump.fun just introduced Pump Advanced, which claims to be the fastest trading terminal on the market. This non-custodial terminal lets you trade directly from your wallet, so no worries about third-party risks. The sleek interface gives you mini charts, top holder stats, social activity, and more, all in one view. Best part? There are zero fees for the first month, so it's worth checking out.

Base Surpasses Arbitrum in TVL:

In a big win for the Base ecosystem, it became the first Layer 2 to surpass Arbitrum in Total Value Locked (TVL) after a long stretch. Base’s TVL shot up by 44% in the last 30 days, with much of this liquidity (over 50%) flowing through Aerodrome, the go-to DEX for Base. While Arbitrum still holds the crown for utility projects, Base has ridden the wave of memecoin mania to its advantage.

Hyperliquid’s Airdrop and TGE:

Hyperliquid just announced details about their upcoming airdrop and Token Generation Event (TGE). Make sure to accept the Genesis Event Terms by November 11, 2024, 23:59 UTC to participate. This airdrop could be quite valuable. You can find more details on this thread.

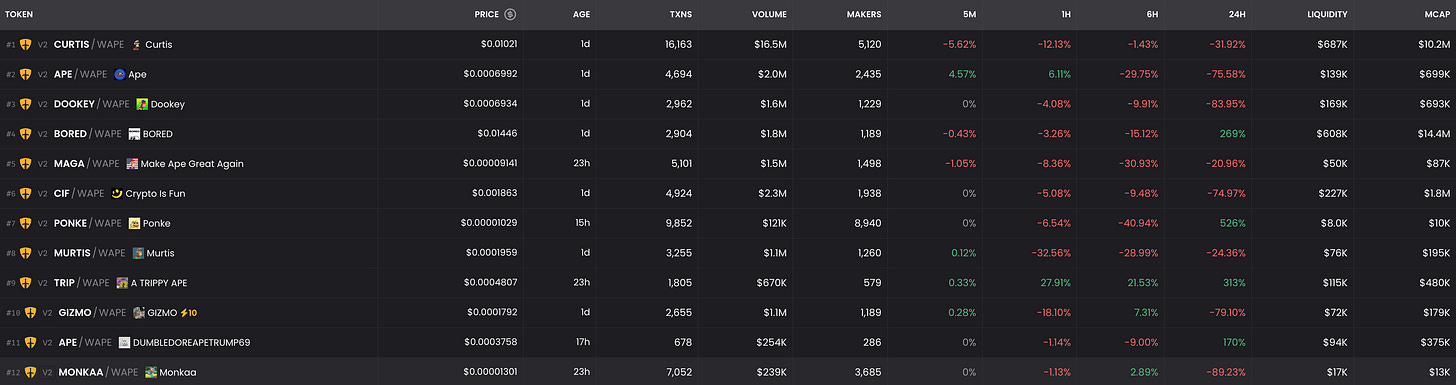

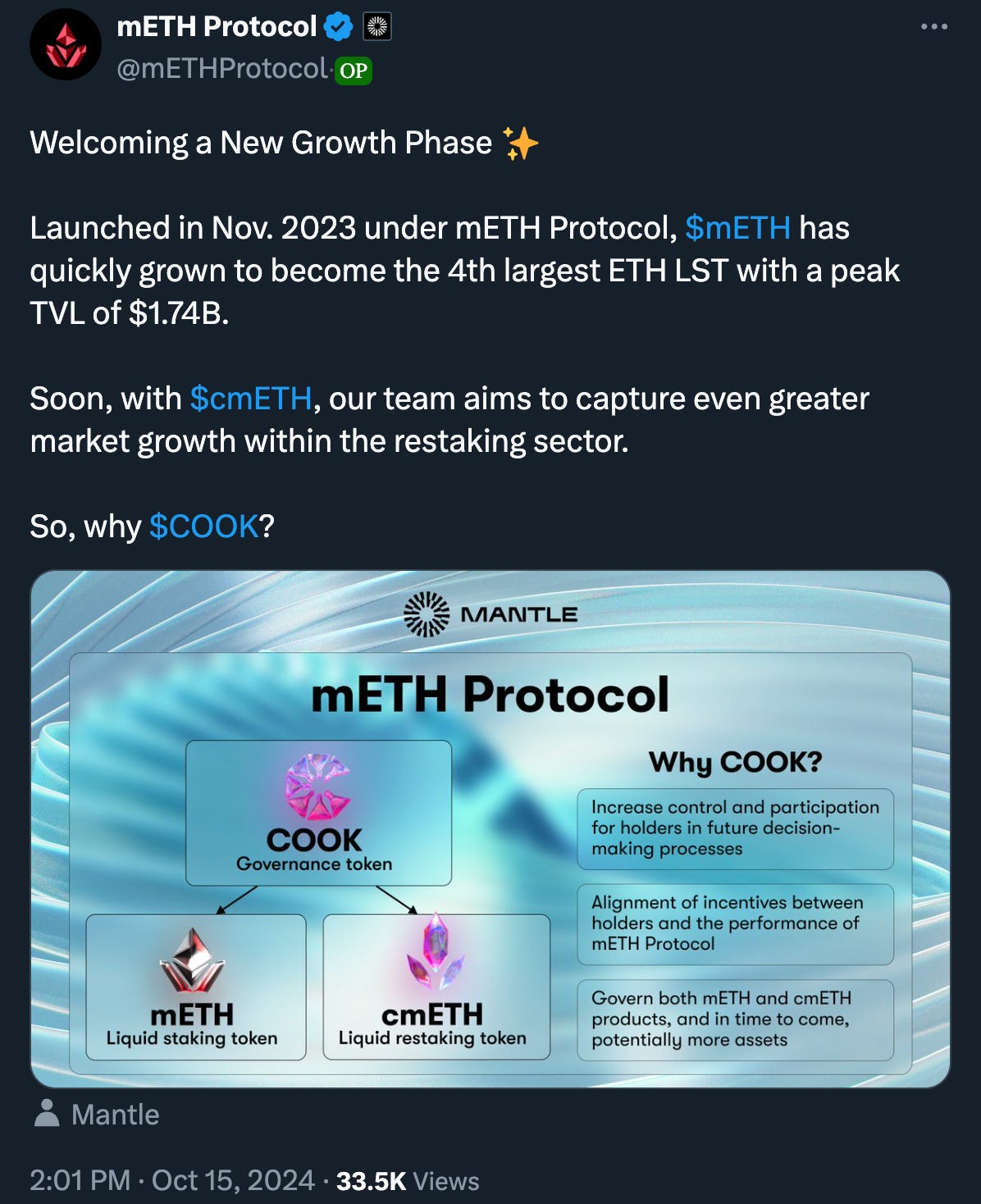

Mantle's Methamorphosis Airdrop:

Mantle just wrapped up their Methamorphosis Season 1 Airdrop Campaign and also kicked off their MNT Buildathon. Notably, 15% of the COOK token supply is allocated for the Methamorphosis airdrop. Keep an eye on this ecosystem if you're looking for early entry into emerging projects. Full details can be found here.

→ Mantle is getting more and more traction. If you don’t know which L2 to focus on, this should help.

Binance Labs x Lombard Finance:

Binance Labs has invested in Lombard Finance, the creators of LBTC, a liquid-staked Bitcoin token. LBTC lets you earn yield on Bitcoin while still keeping it usable in DeFi. Currently, Lombard is in Phase 2 of its roadmap and working to integrate LBTC into Ethereum DeFi while expanding to other Layer-1 and Layer-2 networks. This investment from Binance will help Lombard increase the accessibility of LBTC across more chains, potentially making it a key player in Bitcoin yield farming.

ZkSync Ignite:

ZkSync just dropped ZkSync Ignite, an ambitious plan to turn ZkSync Era into a major liquidity hub. The program will stream 300 million ZK tokens over 9 months to attract liquidity providers and users. This move is designed to deepen liquidity, reduce slippage on volatile and stable assets like ETH, USDC, and WBTC, and reward builders to grow the ecosystem. There’s also an additional 25 million ZK tokens earmarked for administrative costs.

The proposal for ZkSync Ignite is currently live, with delegates having 6 days to discuss before it moves to an onchain vote. This could be a nice opportunity for DeFi Farmers.

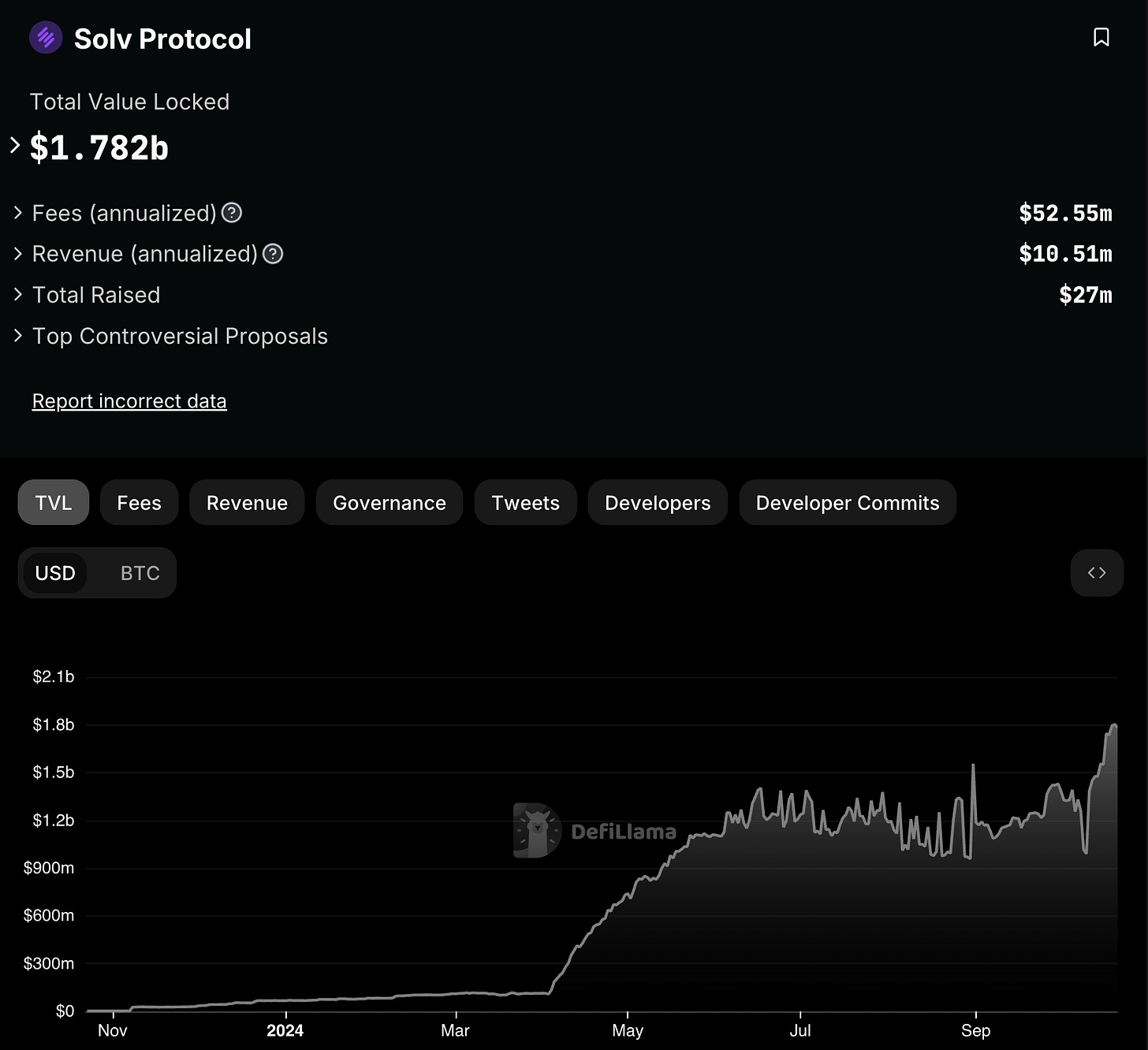

SolvProtocol Updates:

3. Alpha Section

Good projects and opportunities I discovered

Alpha 1: BTCFi:

Don’t fade BTCFi! Here’s why

→ Kaito’s 1k USD per month AI analysis tool shows strong interest in DeFi on Bitcoin.

The Optimized BTCFi Farming Point Strategies Landscape

As the hype around ETH Restaking cools off post-EigenLayer, all eyes are now on the emerging BTCFi landscape. With Babylon’s mainnet launch in August, we’re seeing the rise of optimized farming strategies specifically designed for Bitcoin holders, and the opportunities are looking juicy.

Two Main Strategies: Basic vs. Advanced

Basic Strategies: These are for the low-risk Bitcoin holders who want to passively farm without much fuss. By holding Bitcoin LRTs, you can earn Farming Points across multiple LSD projects without having to do much other than Restaking. Think of this as the "set it and forget it" strategy, offering exposure to multiple airdrops while keeping it simple.

Advanced Strategies: For the DeFi degens out there, advanced strategies involve spreading your assets across various projects to boost your point yield. These come with added complexity and risk but the rewards can be juicy—more points, more airdrops, and higher potential APY.

Basic Strategy:

Direct Restaking: If your focus is maximizing Babylon Points, the simplest option is to Restake directly into Babylon via @babylonlabs_io. This is your safest route to earn a consistent flow of points, though it limits exposure to other protocols.

LST Path: Want to cast a wider net? The LST path allows you to farm multiple airdrops across different projects. You’ll sacrifice some Babylon points in exchange for more exposure to other token drops. You can either:

Restake WBTC or other BTC-backed assets via Lombard Finance.

If you’re holding LBTC from Lombard, you can Restake it at Etherfi to get eBTC, which opens the door to earning points from Etherfi’s partner networks. → Solid strategy

Advanced Strategy:

For those ready to take things up a notch, here’s where it gets fun. The goal here is to leverage your LRT holdings and spread them across DeFi protocols to improve your yield.

Liquidity Pools on DEXes: By providing liquidity on DEXes, you can not only earn trading fees but stack Farming Points while you’re at it.

Leverage Strategies in Pendle: Pendle offers three routes:

Trade YT (Yield Tokens) to earn points.

Become an LP for double-digit APY (Tip: you can lock your Pendle to get vePENDLE and boost your returns!).

Lending & Looping: This is the classic degen farming strategy. Collateralize your Bitcoin LRT on lending platforms like Avalon Finance, borrow SolvBTC, and then loop it back into the system for more points. Avalon now supports SolvBTC.BBN PT, and depending on the APY, you can either loop or hold the borrowed assets (e.g. on BNB Chain).

→ Check out this full thread with a great overview on BTCFi if you want to learn more

Example of an advanced strategy:

BTCFi: Bedrock x Corn x Pendle x Babylon

The basic concept is that by depositing assets in the YT (Yield Token) pool, their value gradually decreases over time, eventually hitting zero by the maturity date (Dec 25, 2024). The tradeoff? You're betting that the points earned will be worth more than the value of the assets you lose.

To optimize this, consider splitting your position between YT and LP pools:

YT Pool: This allows you to earn high points rewards, but the asset value decreases over time.

LP Pool: Unlike the YT pool, your assets remain stable by the maturity date. Plus, you earn points from Babylon, Corn, and Bedrock.

Use both pools, but weight heavily toward the LP pool to maintain BTC exposure while still earning points.

Example: If you have $1,000 to allocate, you might put $250 into the YT pool and $750 into the LP pool. This keeps your BTC exposure intact while earning from the LP points.

You can earn:

1x Babylon points

3x Corn points

5x Bedrock points

💡 Tip: Since Pendle operates on Ethereum mainnet, execute this strategy when gas fees are low to maximize your profit margins.

My favourite strategies include SolvProtocol, Babylon, Lombard and Corn. I am mixing Pendle YTs and Avalon Finance lending strategies for maximum points farming.

→ Solv protocol TVL is growing very fast right now:

Alpha 2: Nudge

Nudge just dropped its Re:allocation Points campaign, a unique system that rewards users based on their on-chain activity. The app analyzes your interactions, assigns you points, and ranks you from Air to Diamond—and this ranking will directly influence future rewards and incentives within the Nudge ecosystem.

Here’s how to maximize your points:

Engage On-Chain: The more active you are across different protocols, the higher your rank.

Invite Friends: Earn extra points by bringing new users into the Nudge ecosystem.

Exclusive Rewards: These points will be redeemable for exclusive rewards in the future, so the higher your rank, the better the benefits.

→ You can get your wallet valuation with my referral.

Alpha 3: Pendle Token

Pendle is my biggest DeFi Token allocation and rightfully so:

→ I just took profits, if you are underexposed I’d wait for a correction. Mid term there should easily be the all-time high of 7$ on the table.

→ Check the full review on Pendle from Coinbureau here.

→ Here’s a strategy how to earn 2% yield in 5 days with Pendle.

More Alpha

The Crypto x AI Thesis: Crypto x AI is just starting. Nice read.

Bittensor: Apps and Tools: Try out what already exists on AI superchain Bittensor to get why it is so hyped and check its potential

Sui Alpha: The Sui Playbook for Degens includes some nice memecoin ideas and lays out the fundamentals of Sui. Worth the read.

Thanks for reading, fren and stay safe!

Adrian

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

The market looks good and especially memecoins are pumping again, but we are in an insecure environment till the US elections and big bets need a lot of thinking right now. Let’s get into it.

Keep reading with a 7-day free trial

Subscribe to Adrian DeFi to keep reading this post and get 7 days of free access to the full post archives.