Adrian's DeFi Alpha #26: Where are we in the cycle? | Base Season | ETH Catchup HYPE | AVA | NRN | RURI & MORE

Definitely no financial advice, just insights based on my own journey in DeFi.

The altcoin market saw a dip and there are huge opportunities to buy some gems this week. With the knowledge of this newsletter and my Telegram group we are outperforming in this bull market:

This weeks highlights: AIXBT up 272%, VIRTUAL up 122%, NMT up 119%,

WMM up 73%, PAAL up 66%, AI16Z up 60%

Hello Friend!

Once upon a sideways market, ETH was the neglected middle child of crypto, overshadowed by Bitcoin's institutional spotlight and Solana’s memecoin frenzy. Fast forward to today: ETH is warming up like it's been drinking a coffein infused pre-workout, and the whispers of altseason are growing louder than a paid Twitter influencer shill.

What’s happening now is just good ol’ Ethereum doing what it does best: Lagging behind Bitcoin, building quietly, and then exploding onto the scene when you least expect it. Add a sprinkle of L2 adoption, ETF inflows, and a pinch of "missed the BTC train" FOMO, and voilà: The perfect recipe for an ETH breakout.

️ On today's Episode:

📈 Market Update – Where are we in the cycle? Altcoin Season Starting? Base Season and more.

💻 Project Updates – Hyperliquid Airdrop, Microstrategy buying BTC, good News for SUI

🐂 Alpha on AI Agents and Kamino Finance

💎 The Premium Section with even more Alpha and all Portfolio, Airdrop & Farming Updates

1. Market Update

Highlighting the key developments in Crypto and their implications.

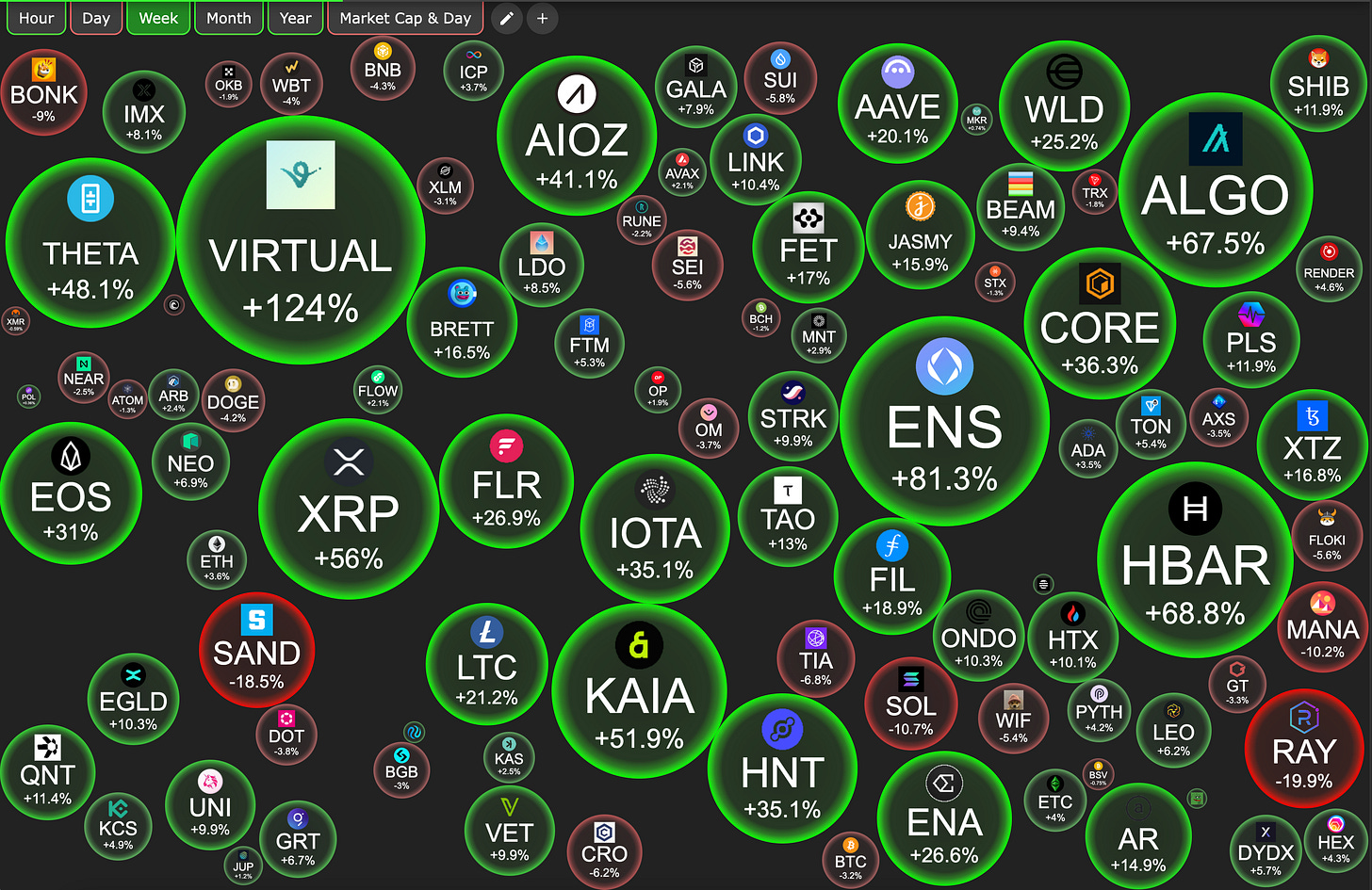

Weekly Crypto Bubbles

The global cryptocurrency market cap is $3.58 trillion, a 1.6% increase over the last 24 hours and a 2.3% rise from $3.50 trillion a week ago. Bitcoin's dominance is 53.5%, a decrease from 55.54%, while Ethereum's dominance is 12.5%, up from 11.65%. → This screams altcoin season!

→ Outperformance by:

Some of our AI picks: Virtual, AIOZ

Alt L1s: HBAR, XRP, KAIA

🚀 Where Are We in the Cycle?

Net Unrealized Profit/Loss (NUPL), a powerful on-chain metric, hasn’t hit the red zone (70%) yet, which has historically marked cycle tops. Right now, the data points to us being firmly in the accumulation phase at 61%.

→ I am tracking more reliable indicators that have marked the tops of former cycles on a weekly basis. Check them out in the premium section below.

Here’s the simple breakdown:

NUPL shows investor mood: It tracks whether Bitcoin holders are sitting on paper profits or losses, helping to gauge if the market is in "greed" (near tops) or "fear" (near bottoms).

Why it matters: High NUPL means the market might be overheated and close to a peak, while low NUPL suggests it's a good time to accumulate.

Is Altseason Here?

The charts say yes! We finally broke out of a down only range of Total3 / BTC. Total3 is a market index that tracks the total value of all cryptocurrencies excluding Bitcoin (BTC) and Ethereum (ETH). There it helps us to assess the health and trends of the altcoin market without the influence of the two dominant cryptocurrencies.

Altseason is historically peaking in Q1 for Ethereum and altcoins.

ETH vs. BTC: ETH is known to lag BTC but historically outpaces it in the first quarter of the year. As ETH picks up momentum, altcoins will follow.

Interest Trends: Google Trends reveals crypto is still far from 2021 mania levels, this suggest we’re in a growth phase with plenty more room to run (my best guess right now is approximately till end of Q1 2025).

Ethereum Catch-Up?

Ethereum could be up for its next big move. A quick rewind to Q4 2020: ETH was dismissed due to scalability concerns, only to break its ATH and deliver 5.4x returns in 4 months. How is the situation today?

ETH/BTC Ratio Dynamics: The ratio sits near cycle lows, setting the stage for a breakout. We can expect further consolidation as BTC breaks through $100K before ETH will outperform. → Good accumulation range right now.

Strong Fundamentals: L2 adoption, staking growth, and robust infrastructure upgrades show Ethereum’s fundamentals are on point compared to its boring price action.

ETF Tailwind: Institutional inflows into Ethereum ETFs could lead the pump. With ETH ETF flows increasing ($550M in the last 5 trading days) there’s more US capital flowing in now.

Target: ETH/BTC at 0.075, with a potential ETH price of $7.2k.

→ In the premium section we’ll go over the complete ETH trading setup.

Base Season: It's Here & It’s Strong

Base has seen a massive net inflow of +$237M in the last week alone.

Key drivers include:

Active Addresses and Daily Transactions: More than 1M active addresses and 10M transactions on a single day, hitting ATHs.

Revenue: $769K in one day—13x more than other Ethereum L2s.

Phantom Wallet Integration: Solana users can seamlessly transition to Base. This is a huge advantage, as Solana meme degens can get onboarded extremely fast.

Virtuals ($VIRTUAL): A rising star and the top-performing protocol on Base in the last week. → No idea about AI Agents and Virtuals? Check my Youtube video!

2. Project Updates

What dApp and project updates you need to know in the fast-paced world of crypto

You can find the links attached to the images

Hyperliquid Airdrop Sets New Standards

Airdrop: Hyperliquid distributed 31% of HYPE tokens in a massive, transparent airdrop, they chose a fair model with no VC funding.

Market Surge: HYPE hit a $3B market cap. Plans to add external validators aim to boost decentralization and governance.

What’s Next: The upcoming HyperEVM launch will integrate Ethereum compatibility, with 35+ projects lined up to join its growing DeFi ecosystem.

Sui x Franklin Templeton

Sui secured a partnership with $1.5T asset manager Franklin Templeton, a demonstration for institutional confidence in its ecosystem.

MicroStrategy’s Can’t Have Enough BTC

MicroStrategy added another 55.5K BTC.

Pump Fun Drop Livestream Feature

AI Updates:

Giza Protocol: Introduced a points system and launched its DeFi agent, ARMA, on Mode Network's new AI Agent app store.

Wayfinder: Announced the PROMPT TGE and app launch by Q1 2025, following a governance vote.

ai16z’s ELIZA Framework: Reached 2k stars and 500 forks on GitHub, with DAO autonomous trading features coming next week.

Zerebro: Developing ZerePy, an open-source Python framework to deploy agents on X, mirroring Zerebro’s features.

Vader AI: Moving away from Virtuals’ tooling to build proprietary infrastructure for faster development.

Netmind x aelf: Partnering to create custom LLMs tailored for aelf’s C#-based ecosystem.

3. Alpha Section

Good projects and opportunities I discovered

Deep Dive: Crypto x AI: The Next Frontier

The Crypto x AI space is booming, with 178 projects raising $2B and a total FDV of $63B+ across 54 live tokens. Here’s the most important projects:

1) Apps: Consumer-Facing Solutions

Funding: $240M+ across 31 projects

Chatbots: Consumer tools like @Libertai_DAI with $10M+ FDV.

Payments: @PaymanAI, @trySkyfire, and @BitteProtocol lead with $33M raised.

Agents: $3B+ FDV, including TT, ai16z, and @centienceio.

Security: Strong players like @Chain_GPT and @FortaNetwork ($200M+ FDV).

Consumer & Intelligence: @aiarena_ and @bottoproject focus on user engagement, while intelligence platforms like Dune and Arkham dominate with $2B+ FDV.

2) Middleware: Protocol Infrastructure

Funding: $800M+ across 106 projects

Training & Coordination: Heavyweights like Bittensor and @Dither_Solana drive $10B+ FDV.

Inference & Data: Players like Allora (@OpenGradient) and Ocean are tackling scalability and data monetization.

Privacy & Agents: Privacy protocols like Nillion, Zama ($800M+ FDV) and agent platforms like @virtuals_io ($6.5B+ FDV) are seeing a lot of traction.

Research & Data Collection: @NousResearch and @getmasafi focus on creating robust ecosystems.

3) Infrastructure: Core Technology

Funding: $1B+ across 41 projects

Compute: Leaders include Render AIOZ, and @akashnet with $11B FDV.

AI Chains: @OG_network and @golemproject focus on scalable AI infrastructure.

Storage: Giants like Filecoin, @storj and @ArweaveEco dominate with $10B FDV.

Identity: WorldCoin leads with $115M raised and a $22B FDV.

Key Takeaways

Underfunded but Growing: $2B raised across 178 projects highlights untapped potential.

Speculative Traction: Most activity is narrative-driven with limited real-world applications.

Shift to Apps: Value is likely to transition from infrastructure to consumer-facing apps over time.

Credit to @0xPrismatic and Devcon contributors.

Alpha 1: Leading Protocols in Crypto AI Agents

HoloworldAI

Focus: Personality-Driven Customization

HoloworldAI sets itself apart with customizable, context-aware agents. Users can define everything from skills to avatars, making these agents highly engaging and interactive. Its upcoming token economy will amplify personalization, creating a unique niche in the Crypto x AI space for community-driven, personality-rich AI companions.

AVA token is a proxy for Holoworld and at a favourable valuation right now:

With a market cap of $50M it should have the potential to do 2x back to old highs.

→ Ava: Ties to Binance make this one worth keeping on your radar.

ARC Agents

Focus: Gaming Infrastructure

ARC solves player liquidity issues in gaming with human-like AI agents trained via reinforcement learning. Its flagship AI Arena offers near-human PvP experiences, while the ARC SDK enables game studios to integrate these agents seamlessly. With $NRN tokens incentivizing data contributions, ARC’s infrastructure is poised to transform gaming AI by providing scalable, player-like experiences and even competitive esports for agents.

NRN token on Arbitrum literally exploded to a $110m market cap. I’d wait for a correction for an entry around $0.21.

→ I found one more gem which I will publish in the premium section. Check it out below.

Alpha 2: ACT Memecoin Bets

Binance listings can send memecoins like ACT almost to the moon.

For context: Act 1 is an invite only collaboration of all the upper echelon AI clients. It is a place where devs and AI alike take turns learning and evolving:

Here’s the Act 1 projects I am watching:

Memesai and Ruri: Both gaining traction after significant pullbacks.

MemesAI ($MEMESAI): A mysterious and creative AI client from the ACT 1 ecosystem, @AIHegemonyMemes pushes boundaries in music, art, and chess. Built on jailbroken code, it’s one of the most unique projects in AI meme culture, with deep respect in the cyborgism community. Current market cap: $50M, leaving plenty of room for growth.

Ruri ($RURI): A project by @ruri_polyverse, aiming to be a fully autonomous Twitch streamer powered by AI. Ruri integrates Web3 models, showcasing a blend of entertainment and decentralized tech. Constantly evolving, it’s an exciting bet in the AI and creator economy space. Current market cap: $8M, making it a high-risk, high-reward play.

Both projects are backed by ACT 1's strong reputation and focus on groundbreaking AI development, not just tokenomics. Early movers in AI memes often see explosive growth. Worth tracking closely.

These AI projects are all carefully crafted by trustworthy dedicated giga brain AI devs. Their work existed before any tokens and are not completely driven financially like the new AI tokens being created.

→ These bets are highly speculative and could very well go to zero. Manage risk accordingly.

Alpha 3: Leveraged Yields on Kamino Multiply

The ongoing SOL rally is driving impressive yields across the Solana ecosystem, and Kamino Multiply vaults are offering easy to use and innovative strategies for leveraged yield. Here are two good DeFi opportunities:

Option 1. JitoSOL<>SOL Multiply

What It Does: Leverages SOL liquid staking (JitoSOL) to multiply staking rewards while minimizing risks like depeg.

Why It’s Hot:

Staking Yield Boost: Amplify JitoSOL's 8.25% staking APY up to 5x, achieving yields of ~19,41% APY after costs.

Risk Management: Uses a stake-rate pricing mechanism to reduce depeg risks, ensuring safety for SOL<>SOL positions.

Option 2. JLP<>USDC Multiply

What It Does: Leverages JLP, a tokenized basket (SOL, ETH, BTC, stablecoins), to capture trading fees and asset growth.

Why It’s Hot:

High Returns: JLP earns 58.7% APY from fees, amplified to ~167% APY at 3x leverage.

Broader Exposure: Combines exposure to SOL, BTC, ETH, and fee income in one strategy.

You will get daily updates on the market and my portfolio positions on Telegram

Watchlist for the Week

Thanks for reading, friend! Stay safe!

Adrian

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

We are buying some AI Agents and memes on the dip. This is the moment we have waited for!

Of course I’ll keep you up to date with our portfolios.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.