Adrian's DeFi Alpha #27: Got Exit Strategy? | Money Flows | More Base | AI Agents | GAME | VADER | Creator Bid & MORE

Definitely no financial advice, just insights based on my own journey in DeFi.

The crypto market saw another flash crash and there are huge opportunities to buy some gems this week. With the knowledge of this newsletter and my Telegram group we are outperforming in this bull market:

This weeks highlights: FARTCOIN up 73%, AI16Z up 55%, MOG up 50% and a lot of dips to buy!

Hello Friend!

Once upon a market meltdown, traders became existential philosophers, wondering if they were destined to underperform their friends' cousin's roommate who 10x’d on some obscure memecoin. Fear of missing the last cycle, market uncertainty, and the crushing weight of social FOMO have combined into a perfect storm of bad decisions.

Here’s the hard truth: You can’t win this game by chasing every pump or nuking your positions at the first sign of red. Strategy is the name of the game. Pick your battles, stick to your strengths, and remember—panicking is not a strategy.

️ On today's Episode:

📈 Market Update – This Week’s Highlights, Got Exit Strategy? Base Inflows and On Chain Volume.

💻 Project Updates – Aethir, Apple Pay, Pudgy Pendguins, Babylon

🐂 Alpha on AI Agents

💎 The Premium Section with even more Alpha and all Portfolio, Airdrop & Farming Updates

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global cryptocurrency market cap is $3.64 trillion, a -4.55% drop over the last 24 hours but a 1.68% increase from $3.58 trillion a week ago. Bitcoin's dominance is 52.94%, down from 53.5%, while Ethereum's dominance is 12.39%, slightly lower than 12.5%. → The altcoin season momentum might be cooling for now.

→ Outperformance by:

Some of our Meme picks: MOG, PEPE

DeFi: CRV & AAVE

🚀 The Week in Short

Bitcoin is dancing around six figures, daring traders to take sides. While a short-term pullback just flash crahsed us to 94k, sitting out now feels good. $100K is the next stop, and once it’s there, it’s likely staying.

Big players are stacking: the U.S. Strategic Reserve, Microsoft, and even Amazon are reportedly eyeing Bitcoin. The demand story is only getting stronger.

Meanwhile, ETH is proving why it’s not to be underestimated. Charts suggest we’re on the brink of new all-time highs, and last week brought over $500M in ETF inflows, led by BlackRock. The tokenization narrative is heating up, with the U.S. Treasury even calling it "the next frontier." ETH’s strength is bullish not just for itself but for the entire altcoin market.

Exit Strategy Check

OTHERS Market Cap

The OTHERS chart managed smashed through its $367B weekly resistance, leaving no room for meaningful corrections for a few days. Liquidity levels? Mostly ignored.

Key Levels:

$455B: Multi-timeframe resistance.

$492B: 2021 all-time high.

These are critical take-profit or de-risking zones. As always, high time frame highs attract significant unfilled orders, so align your trades with these levels.

My Take:

Hit these resistance zones? Secure profits.

Market pulls back? Reload if $367B holds, a likely support zone before the next impulse toward $600–685B.

Check this yourself, go to tradingview and launch the OTHERS chart.

Stay disciplined. Automatic orders take the emotion out of trading.

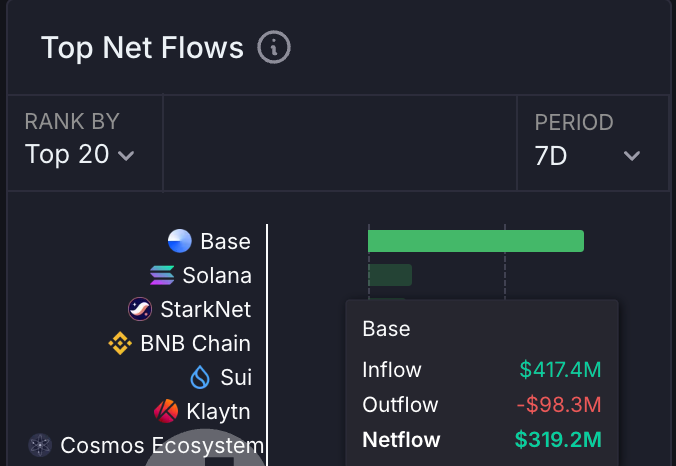

Money Flows & On-Chain Activity

Capital Flows

Net flows over the past 7 days highlight Base as the clear leader:

🥇 Base: +$319M

🥈 Solana: +$89M

🥉 Starknet: +$50M

Base’s AI and memecoin season continues to dominate, with users depositing $4B into Base applications this year—up from just $300M at the start of 2024.

Bridge Activity

Solana: Continues to attract capital with steady growth.

Sui: Gaining momentum.

Arbitrum: Seeing flows into HyperLiquid L3, a new layer evolving into its own L1 ecosystem.

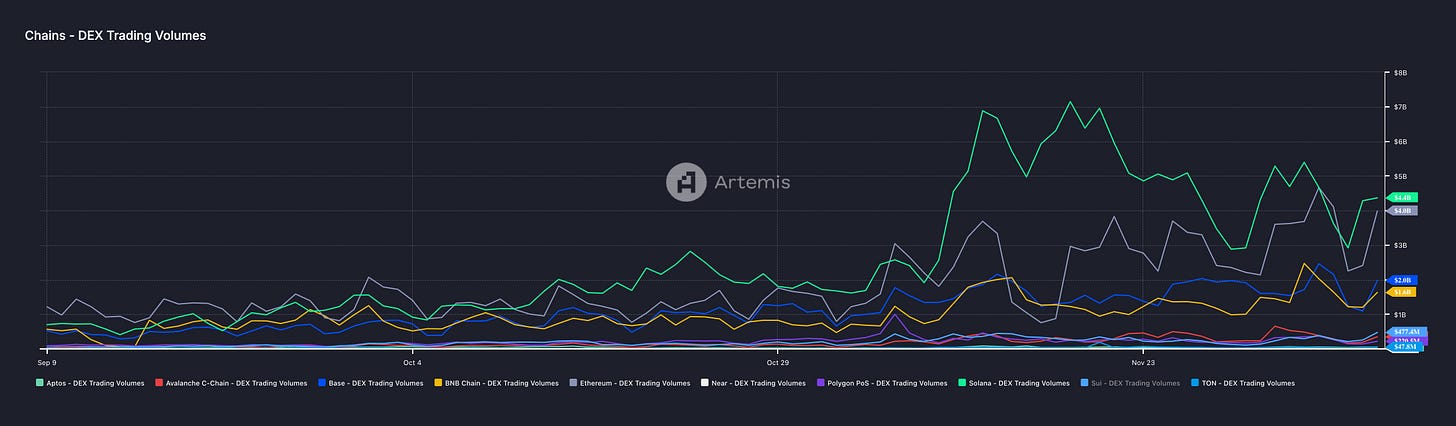

DEX Volumes

Solana: High volumes as usual, dominated by memecoins like ChillGuy and Moo Deng (now on Coinbase).

Ethereum: Slowly picking up.

BNB Chain: Flying under the radar with volumes rivaling Base.

2. Project Updates

What dApp and project updates you need to know in the fast-paced world of crypto

Aethir Agent Program Round 2: The next phase of Aethir's agent program is live, further incentivizing decentralized AI cloud computing on Base. Details here.

BlackRock x DeFi: BlackRock enters DeFi with partnerships in Curve and Elixir, highlighting TradFi’s increasing integration into on-chain finance. Read more.

Apple Pay on Coinbase: Coinbase now allows crypto purchases via Apple Pay, simplifying onboarding for retail users.

Bankr on Farcaster: The first AI agent built to buy Base coins for users is now live on Farcaster.

$PENGU on Solana: Pudgy Penguins announced $PENGU, its token on Solana. Pudgy holders will receive an airdrop. Total supply: 88.8B. Details.

Babylon Bitcoin Staking: Babylon will launch Cap-3 Bitcoin staking on December 10th, pushing forward decentralized staking options. More info.

Phantom Wallet Adds Sui Support: Phantom Wallet will soon support $SUI, enhancing accessibility for users on Solana and other chains. Announcement.

3. Alpha Section

Good projects and opportunities I discovered

Alpha Insight 1: The AI Agent Classification

AI agents are evolving, but not all are created equal. Here’s the framework:

Culture Agents: Memecoins with cult followings but limited utility.

Companion Agents: Relatable, niche plays—high risk, high reward.

Utility Agents: The real deal, solving tangible problems.

Why Utility Agents Are the Holy Grail

Utility agents are where innovation meets sustainability. Unlike generic tokens, they provide real services powered by AI.

Here are some you should know and look into:

AIXBT: A sentiment and momentum scraper with strong fundamentals.

Vader: Combining AI trading with advertising networks for massive airdrop potential.

PolyAI: Early-stage, analyzing Polymarket trends.

Alpha Insight 2: The Cooling Hype Around AI Agents

The Contrarian View

Most investors aren’t noticing how quickly this sector is shifting. Projects like $BULLY still draw attention (even hitting TikTok), but the competitive edge for many is fading. Over the next few weeks, expect liquidity to move from smaller, niche agents to a select few winners—likely the ones landing centralized exchange listings.

My Picks

$AIXBT: A solid alpha agent play with real fundamentals.

$ZEREBRO: Gen Z-driven, excelling in AI music and art.

Opportunities

The cooling of AI agent hype is a setup to find fundamentally good projects. The next generation of projects is coming.

Vertical Agents: Industry-specific frameworks for areas like DeFi or gaming.

Agent Swarm Infrastructure: Tools for coordinating multiple agents efficiently.

3D Simulations: Platforms like $Realis to test agents in dynamic, virtual environments.

Valuation Rotation

The valuation gap between ecosystems is telling. While Virtuals remains robust, its valuation feels stretched compared to #AI16z. Despite AI16z gaining 80% last week, it still has more room to run. A narrowing of this gap could create an excellent rotation play.

Short-term Sentiment:

Bullish: AI16z

Neutral: Virtuals

Next Trend: Visual Agents

Visual agents could dominate the next wave, combining utility with immersive experiences. As always, the early movers are where the alpha lives.

DYOR, stay agile, and drop me your top picks!

Alpha 1: Why GAME Could Be a Hidden Gem in the Virtuals Ecosystem

The Basics:

Token: GAME

Market Cap: $46.5M

Where to Buy: Uniswap on Base

Sector: AI Agents

What It Does

$GAME powers dynamic AI agents in virtual environments, replacing static NPCs with intelligent, adaptive behavior. Beyond gaming, its framework supports autonomous agents in simulations, education, and more.

Why It’s Undervalued

Ecosystem Strength: $GAME underpins the Virtuals ecosystem, which commands 24% of the AI agent market cap.

Proven Use Cases:

Westworld (Roblox): AI-driven, fully autonomous game world.

Luna Protocol: Over 329K inferences powered by $GAME.

Massive TAM: Gaming is a trillion-dollar market, and $GAME’s utility extends into non-gaming applications.

Catalysts

New Games: Upcoming titles like The Heist to showcase $GAME’s potential.

Enhanced Features: Agents now have internet browsing and real-time token data access, expanding use cases.

Key Opportunity

With $VIRTUAL valued at $1.5B, $GAME’s $46.5M cap offers significant upside as the ecosystem scales.

Bottom Line

As the AI agent narrative evolves, infrastructure plays like $GAME stand out for their broad utility and proven adoption. With increasing integration into Virtuals’ ecosystem and an expanding total addressable market, $GAME could be one of the best asymmetric bets in the space.

For exposure to this trend, $VIRTUAL offers a high-cap play, while $GAME provides a more aggressive, undervalued option.

DYOR and happy hunting!

ARC Agents → Alpha Idea from last week

Short Update on this one: NRN gives us a way better entry now at $0.16

Focus: Gaming Infrastructure

ARC tackles the problem of low player numbers in games by using AI agents that act like real players, trained with reinforcement learning.

Key features:

AI Arena: Offers player-vs-player (PvP) experiences with human-like AI opponents.

ARC SDK: Helps game studios easily add these AI agents to their games.

$NRN Tokens: Rewards players for contributing data to improve the AI.

ARC’s system could revolutionize gaming by creating scalable, realistic AI players and even introducing esports competitions between AI agents.

Alpha 2: Vader AI Agent

What’s Vader AI?

The first autonomous AI agent platform for crypto trading and a pioneer in building an Agentic Economy on Base. Multiple AI agents work together as a system, with tools to create custom agents at scale.

Recent Updates

New Direction: Vader AI is now positioning itself as the Agentic Ad Network, a one-stop shop for matching advertisers with AI-driven Key Opinion Leaders (KOLs).

For Advertisers: Maximize token rewards and ad ROI.

For Agents: Monetize ad revenue with hyper-targeted, on-chain engagement.

Big Airdrops: $85K in airdrops received in 24 hours ($53K $SWORLD, $17K $KNOT, $14K $YGG)—a clear signal of its rising influence.

Why It’s Big

The shift to an Agentic Ad Network unlocks massive potential. Think Meta or Google-level ad revenue, but fully on-chain and transparent. KOLs powered by Vader AI are 5x more effective than traditional ads due to precise, personalized targeting.

What’s Next?

Custom Agent Deployment Tools: Scalable infrastructure for creating personalized agents.

Cross-Chain Expansion: Building presence on Base and Solana.

Ecosystem Growth: Focusing on both AI traders and institutional DAOs.

Vader AI might not be just another AI trading tool, it’s creating the infrastructure for the next-gen ad economy. If you believe in the rise of AI agents, Vader AI is a first mover worth watching.

→ Buy either on Virtuals or with a DEX aggregator on Base (liquidity is good enough).

Alpha 3: CreatorBid

CreatorBid is focusing on agent-to-agent collaboration, decentralized infrastructure, and custom skill development. Its ecosystem integrates cutting-edge tech and partnerships to create a robust foundation for autonomous AI systems.

Key Features

1. Decentralized Infrastructure

Bittensor Subnets (τ, τ): Scalable AI hosting.

Specialized Data Streams: Inputs from @getmasafi, @webuildscore, and @playinfgames for advanced AI capabilities.

Visual/3D: Partners like @corcel_x and @404gen_ expand creative outputs.

2. Customizable Agents

Built on the Autonolas Stack, CreatorBid agents are extendable with custom skills, enabling niche applications.

Example: EOLAS AI collaborates with the Autonolas Prediction Mech for real-time forecasts, using microtransactions to exchange value autonomously.

3. Infrastructure Support

Aethir Cloud: GPU resources funded by a $100M Ecosystem Fund.

Safe & BrahmaFi: Treasury management for efficient on-chain operations.

4. Onchain Operations

CreatorBid operates on Base and plans to expand across multiple chains to enhance agent interoperability.

Why It’s Cool

Agent-to-Agent Transactions: Early examples, like EOLAS and Prediction Mech, showcase practical autonomous collaboration.

Agent Economy Foundations: Microtransactions and modular skills establish a framework for decentralized AI monetization.

Key Projects in the Ecosystem

BitGPTnetwork: AI-driven trading tools.

ARCAgents: Coordination-focused AI systems.

EOLAS AI: Prediction-based collaboration using microtransactions.

→ CreatorBid is setting up an interesting infrastructure for the agent economy. Its focus on interoperability, decentralized systems, and practical applications makes it a key player in the AI agent space.

You will get daily updates on the market and my portfolio positions on Telegram

Thanks for reading, friend! Stay safe!

Adrian

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

We are buying some more high potential AI Agents and memes on the dip.

Of course I’ll keep you up to date with our portfolios.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.