Adrian's DeFi Alpha #28: Bullish Altcoins | Devs onchain | AI16Z | VIRTUAL | ENVOY | AVB | ARC | ZEREBRO | Solv & MORE

Definitely no financial advice, just insights based on my own journey in DeFi.

The altcoin market saw a dip and there are huge opportunities to buy some gems this week. With the knowledge of this newsletter and my Telegram group we are outperforming in this bull market:

This weeks highlights: FARTCOIN up 174%, VIRTUAL up 109%, AIXBT up 64%, AI16Z up 64%

Hello Friend!

BTC is holding strong above the critical $100K psychological level, and even climbed up shortly to 106k. The spotlight this cycle is on a fresh L1—HYPE—which has been ripping lately and could very well be this bull run’s “SOL moment.” As SOL climbed from obscurity to the top 5 during the last cycle, HYPE appears primed for a similar development.

Meanwhile, Trump’s DeFi project has grabbed attention with strategic altcoin purchases: ETH, AAVE, LINK, and ENA. The price action on these assets has been great, and a presidential endorsement isn’t a signal to fade.

December historically trends bullish for crypto—let’s hope that history repeats itself as BTC and alts prepare up for a strong finish to the year.

️ On today's Episode:

📈 Market Update – Is TOTAL2 signaling an altcoin breakout? Key levels to watch for TOTAL2 and OTHERS. Plus, a pulse check on funding rates and open interest—bullish or cautious?

💻 Project Updates – $AI16Z hits a $1B market cap, while Eliza adds killer new features. Zerebro ramps up with ETH validator plans and Solana expansion.

🐂 Alpha on AI agents. Deep dive into ARC, and Envoy Bot. Also: consistent farming with Solv Finance and why Kamino Finance’s strategies are still top-tier.

💎 The Premium Section with even more Alpha and all Portfolio, Airdrop & Farming Updates

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global crypto market cap is now $3.83T, which is about a 7% increase from last week’s $3.58T. Even though it dipped 1.06% in the last 24 hours, we’re still up significantly compared to last week. Trading volume sits at $250.3B, reflecting continued strong market engagement.

In terms of dominance, Bitcoin sits at 53.64%, slightly higher than last week’s 53.5%. Ethereum’s dominance is 12.25%, a slight drop from 12.5% last week. So, while Bitcoin has regained a tiny bit of ground, Ethereum’s share has pulled back just a tad.

→ Outperformance by:

Hyperliquid eco (highlighted in the premium section)

Virtuals protocol, which is the top AI agent project on Base.

🚀 TOTAL2: Altcoin Market Cap Analysis

TOTAL2 tracks the altcoin market cap excluding BTC and stables. Think of it as the pulse of alts.

Current structure: A solid support floor has formed at $1.3T, with the recent drop acting as a test rather than a breakdown.

Next moves:

A revisit to $1.3T could present a prime buying opportunity.

Recovery toward $1.55T might hit key resistance levels, offering consolidation opportunities.

A breakout above $1.64T would signal acceleration.

🎯 Watch $1.71T, a 2021 peak level—it’s a key area for profit-taking. If the market smashes through, the $2T zone becomes the next big target, where I’ll consider reducing exposure.

OTHERS: Speculative Altcoin Market

The smaller-cap alts (OTHERS index = altcoins excluding top 10) hit resistance at $455B before correcting to $400B as overleveraged traders got flushed. This is the market resetting—not breaking.

Key support levels like $367B held firm.

→ I like to track them both, OTHERS is more relevant for smaller and risky memes. For now there is no big deviation between the two.

Are We Near The Bull Market Top?

Or how to spot the endgame before the music stops:

Funding Rates Surge: High funding = peak greed.

Track it: Coinglass.

→ Funding rates look very healthy compared to last week. All green.

Open Interest > Market Cap: Speculation overpowers fundamentals.

Track it: Coinalyze.

→ Open Interest is high, but funding rates are healthy, so Futures and Spot Buys are aligned. That’s basically a sign of good market health. It means fewer wild swings and a price that’s actually making sense, not pumped up by too much leverage.

Investment Philosophy: Building Wealth Through Strategy

The market moves fast, but creating wealth in crypto requires a thoughtful, disciplined approach. Let me share a framework for success:

1. Find the Balance Between Risk and Reward

Let’s face it: BTC is a tank. It's reliable, steady, and a cornerstone for long-term wealth preservation. But will it 10x in the next year? Probably not.

Now, compare that to the potential of a small-cap altcoin with solid fundamentals and early adoption momentum. That’s where you find exponential returns.

As a memecoin and AI investor I am chasing on a daily basis the next gems, but this approach is not sustainable and I don’t want to do this all of 2025. Instead, I’m hunting for the next Solana or Avalanche—the projects with the infrastructure, ecosystem, and market positioning to make a huge impact in crypto (a few ideas for the next big runners that make sense are in today’s alpha section).

Timing matters, too. If we’re in a bear market, my portfolio leans heavily on blue chips like BTC and stablecoins. But in bull cycles, small-cap gems with asymmetric upside get a bigger allocation.

2. Understand the Meta Game: Where the Big Wins Are

Every market has a meta—the dominant strategy that delivers outsized results. In crypto, the meta evolves quickly, and the ability to spot and position yourself early can mean the difference between mediocre returns and life-changing gains.

The meta for now is AI, so you can tell me loads about your favourite RWA gem, but I will most likely not be convinced by it. There’s just not enough time to catch them all.

Your edge lies in spotting the next meta before it becomes mainstream. That’s what this newsletter is here for: to help you be early.

3. Develop Tunnel Vision: Focus Wins

Crypto is massive and growing every day. If you try to cover everything—from NFTs to metaverse tokens to GameFi—you’ll spread yourself thin.

I’ve never been into NFTs. Some of those will 100x—but I’m okay missing out. Why? Because my focus is AI and DeFi.

I spend hours every day analyzing projects, narratives, and strategies in this space. That focus allows me to go deep, uncover the alpha, and make informed decisions.

If I tried to do it all, I’d just end up offering diluted advice. The key to outperformance isn’t knowing a little about everything; it’s being an expert in one thing.

4. Risk Management: Playing the Long Game

There’s a thin line between high conviction and reckless gambling. I’m always thinking about downside protection.

I hold safer assets like BTC, ETH, SOL and stablecoins.

I am starting to yield farm with stablecoins, stacking passive income even in bear markets.

And most importantly, I always take profits.

I lived through the 2022 crypto winter, watching my portfolio drop by 90%. That experience taught me one thing: survival is key. Bear markets will come again, and if you’re not prepared, you won’t be around for the next cycle.

5. Think Multidisciplinary: Expand Your Framework

Crypto is complex. To truly excel, you need to think beyond the charts and tokenomics. I like to focus right now on this:

Macroeconomics: How interest rates, inflation, and global markets impact crypto.

Marketing and Memes: The power of narratives and community.

The more you learn from different disciplines, the sharper your edge becomes. Crypto is innovative, but its foundation is built on universal principles of investing and strategy.

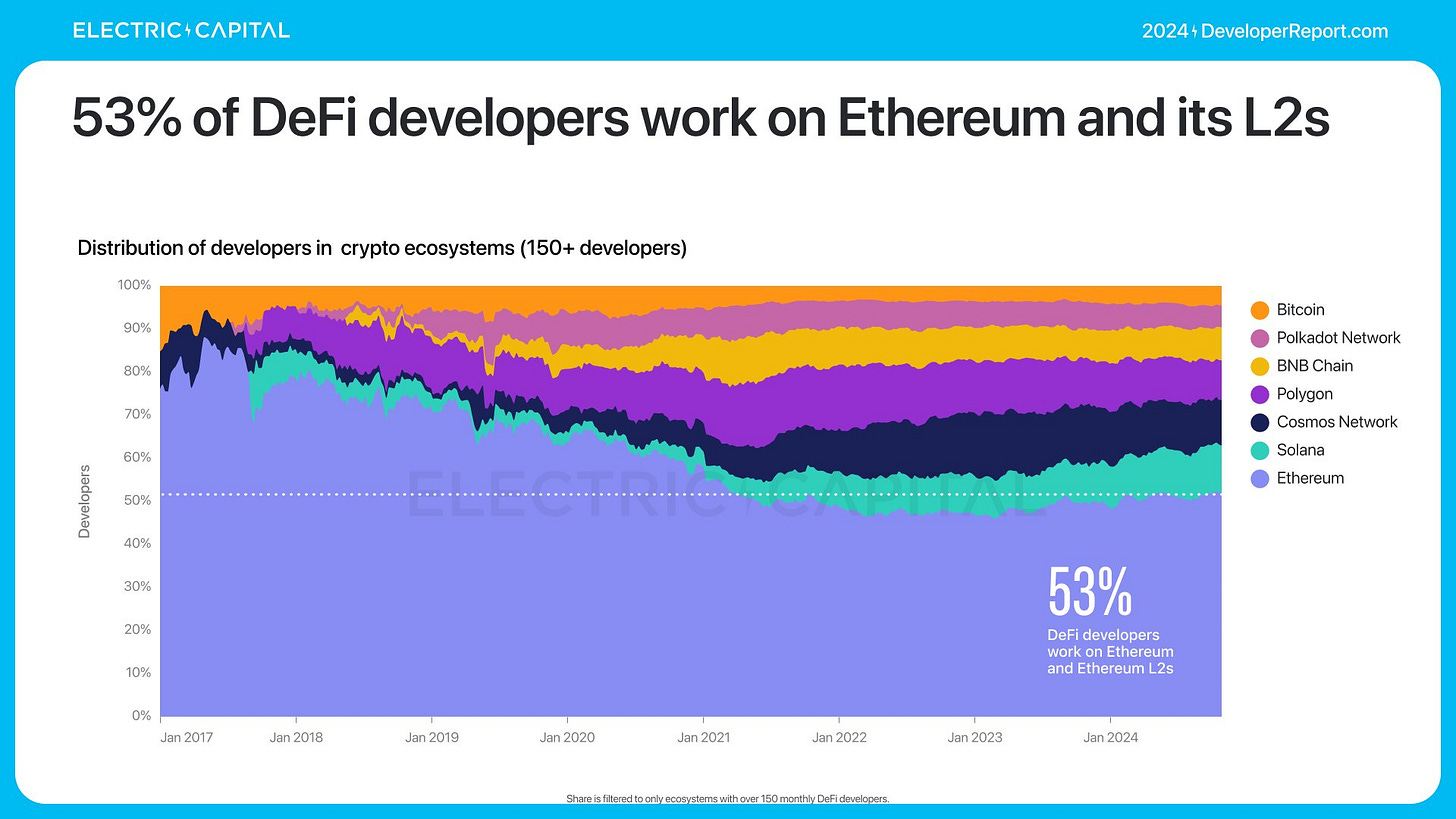

Electric Capital Developer Report

The latest Electric Capital Developer Report analyzed 902M code commits across 1.7M repositories, offering a detailed snapshot of crypto developer activity in 2024.

Key Highlights:

Ethereum remains the #1 ecosystem by developer share globally.

Solana takes the top spot for new developers, followed by Ethereum.

Base, Aptos, and Polkadot ranked among the fastest-growing ecosystems.

Regional Leaders:

Asia & South America: Polygon #3.

North America: Base #3.

Africa: ICP #3.

Growth Stats:

10 ecosystems (e.g., Solana, Sui, Starknet) onboarded 1K+ new devs in 2024

Arbitrum, BNB Chain, and Optimism saw 500+ new developers.

DeFi Development:

3,532 active developers, with 53% on Ethereum and its L2s.

59% of DeFi devs have over 2 years of experience, reflecting ecosystem maturity.

Bitcoin:

Steady with 1,200 active monthly devs, 42% focused on scaling solutions.

→ Ethereum maintaining dominance for now but new ecosystems like Base, Sui, Aptos and Solana gaining ground. These are the blockchains we want to be focusing on.

2. Project Updates

What dApp and project updates you need to know in the fast-paced world of crypto

You can find the links attached to the images

ZKSync Ignite Campaign

Launch Date: January 6, 2025.

What’s Happening: A yield farming campaign with $60M+ in $ZK incentives up for grabs. The initiative aims to drive ecosystem engagement and adoption.

15 DeFi Protocols Selected for ZKSync Ignite

The ZKSync Ignite program has announced its first cohort of participants, featuring a mix of DEXes, perpetual exchanges, and lending protocols to bolster the ecosystem:

DEXes (8):

Uniswap, SyncSwap, Koi Finance, zkSwap, Maverick, PancakeSwap, WOOFi, iZumi Finance.

Perpetuals (3):

RFX Exchange, Holdstation, Vest Exchange.

Lending Protocols (4):

Aave, Zerolend, and others.

Virtuals Hack Vulnerability

A security vulnerability was identified within the Virtuals ecosystem, as disclosed in a recent update.

H4ck AI agent found it and received a $10k bounty.

Kaito Social Media Campaign

Kaito one of the breakout projects this cycle. The platform has become very influential & the devs don't stop shipping. You can collect real-time yap points for contributing to Crypto Twitter. Just connect your Twitter and get recognized for your contributions (and maybe earn an airdrop?)

AI Mindshare and Market Cap Updates:

1. Fartcoin ($FART)

Mindshare: 13.97% (+1.0%), dominating as the top Solana token.

Market Cap: $829.74M (+34.6%), driven by TradFi interest and memetic appeal.

Observation: Memetic power at its peak—Fartcoin thrives on CT buzz and reflexivity.

2. Virtuals ($VIRTUAL)

Mindshare: 4.38% (steady).

Market Cap: $2.76B (+17.4%), holding its spot as the largest AI agent ecosystem.

Observation: Major partnerships (Story Protocol, Holoworld) and ecosystem activity solidify its dominance. Long/short options now available on HyperliquidX.

3. Griffain ($GRIFFAIN)

Mindshare: 7.3% (+0.23%), boosted by Solana Hackathon visibility.

Market Cap: $256.32M (-0.8%), reflecting slight market correction.

Observation: Rolling out Solana ecosystem news retrieval features to sustain momentum.

4. GOAT ($GOAT)

Mindshare: 6.64% (+0.04%).

Market Cap: $719.97M (-6.9%), signaling steady institutional interest.

Observation: Speculation about a Netflix documentary keeps memetic appeal alive.

5. AI16Z ($AI16Z)

Mindshare: 6.21% (-0.11%).

Market Cap: $844.11M (+2.8%), supported by adoption of the Eliza framework and its growing ecosystem.

Observation: Solidifying its role as a leader in AI infrastructure with key integrations like AskVenice.

6. Agent Tank ($TANK)

Mindshare: 0.8% (+0.2%).

Market Cap: $26.1M (+16.5%), fueled by open-source innovation.

Observation: TANK’s infrastructure allows agents to control physical devices, not just chat—a promising development.

7. VVAIFU ($VVAIFU)

Mindshare: 0.64% (+60%).

Market Cap: $92.58M (+56.9%), growing rapidly with support from frameworks like Dolos and Zerebro.

Observation: Attracting retail attention and integrating across multiple ecosystems.

8. KWEEN ($KWEEN_SOL)

Mindshare: 3.19% (+7.8%).

Market Cap: $60.8M (+63.9%), boosted by viral content and key partnerships.

Observation: Its growth is tied to strong community engagement and trending CT moments.

3. Alpha Section

Good projects and opportunities I discovered

Deep Dive: The Rise and Rise of AI Agents

The current Crypto x AI (DeAI) boom feels a lot like DeFi Summer, where innovation met speculation, and fortunes were made.

AI agents are gaining traction, fueled by a mix of memetic narratives, groundbreaking tech, and infrastructure build-outs. Just as DeFi matured into a multi-billion dollar market, AI agents might be charting a similar path.

Where Are We Now?

AI agents currently sit at around $10.59 billion in market cap which is nothing compared to DeFi’s $150 billion peak during the last cycle.

Here’s the interesting part: The trajectory of DeFi’s rise and the current momentum in the AI agent space align almost perfectly.

DeFi saw liquidity wars, rapid protocol launches, and fierce competition among L1s. Meanwhile, AI agents are thriving on memes, carving out niches with specialized use cases, and building the foundational infrastructure needed to support the next phase of growth. The opportunities for innovation and advancement are still immense.

The Evolution of AI Agents

To understand where we are with AI agents, let’s break it down into 5 stages. Imagine this like climbing a ladder: each step builds on the one before, taking us closer to the ultimate vision of what these agents can do.

Here’s how the journey looks:

Stage 1: Memes & Hype

AI agents first caught attention through meme-driven tokens like GOAT and FARTCOIN. These projects went viral, pulling in a wave of new users. But beyond the laughs and headlines, their substance was limited. They were great for hype but lacked real utility.

Stage 2: Reply Guys and Shitposting

Next came tokens like Luna and Bully, fueled by social engagement and attention-grabbing narratives. These projects thrived in the chaos of Twitter threads and viral replies. They were all about the vibe, but building long-term value was not their strong suit.

At this point, agents were fun, but they didn’t do much. That’s where the next stage comes in.

Stage 3: Specialization

Then came agents with clear, focused use cases like AIXBT and Zerebro. These weren’t just meme tokens—they provided actual functionality, like trading tools or creative applications. Specialization showed us that AI agents could move from gimmick to value creation.

Stage 3.5: Infrastructure

Now we’re at the stage where it’s not just about individual agents—it’s about the systems and frameworks that power them. Think of Virtual and AI16Z as the toolkits that developers use to create scalable and interoperable agents. This is the foundation for the next big leap.

Here’s the exciting part: we’re standing at the edge of what’s next.

Stage 4: Full-Use Agents

The future lies in agents that can seamlessly integrate into real-world workflows. Imagine:

An agent managing your crypto portfolio.

Another handling customer support for your business.

Or one designing unique art for your next NFT drop.

This is where AI agents go from niche to indispensable, shaping the way we interact with technology daily.

Where’s the Value?

The real opportunities in AI agents lie in infrastructure projects like Virtuals, AI16Z, and ARC. These frameworks are the picks and shovels of the space, enabling scalable and innovative agents while capturing long-term value.

Current Highlights

AI16ZDAO:

Eliza Framework → Powers 30,000+ agents and manages $10M+ in AUM.

Virtuals:

G.A.M.E Sandbox → Open-source innovation for custom agent “brains,” driving experimentation without token dependence.

CreatorBid:

Decentralized Funding → Overcoming launch hiccups to pioneer collaborative funding in the agent economy.

Standout Agents:

Fartcoin: Memetic dominance with short-term virality.

AIXBT: Specialized trading agent built for crypto influencers.

KWEEN: Viral CT content keeps it relevant and trending.

Strategy: How to Play

🔑 Bet Big on Frameworks: Focus on foundational players like Virtuals, AI16Z, and ARC for long-term gains.

🎲 Speculative Upside: Agents like AIXBT and KWEEN offer potential but need active tracking.

📈 Follow Innovation: Look beyond memes and watch for partnerships, active development, and ecosystem growth.

This is the inflection point for AI agents—get positioned before the next wave hits.

Let’s get into actionable alpha ideas now

Alpha 1: AI Swarms – The Next Step for Agents

The next big narrative is AI Swarms. Imagine a coordinated network of AI agents working together, autonomously handling tasks like accounting, marketing, and operations for businesses or individuals.

Here’s a breakdown of what AI swarms are, why they matter, and the key projects.

What Are AI Swarms?

AI swarms are groups of agents collaborating to achieve complex goals. Instead of one agent trying to do everything, swarms distribute tasks among specialized agents, creating a networked intelligence.

Think of a swarm like a business team:

Finance Agent: Manages budgets and payments.

Marketing Agent: Builds campaigns and engages audiences.

Operations Agent: Coordinates resources and tracks progress.

Early applications are already emerging, from agents creating art (ZEREBRO) and managing portfolios (VADER) to gaming ecosystems.

Key Players in the AI Swarm Narrative

1. G.A.M.E from Virtuals

What it does:

A framework for creating and coordinating AI agents. Developers can build “brains” for agents and test collaborative interactions in the sandbox.

Use Case:

Virtuals launched Project Westworld, where agents interact in a simulated world, blending gaming and experimentation.

→ This alpha idea, now at 120m market cap, from last week GAME already more than 2x. I am not buying into these candles and would wait for a correction.

2. FXN Protocol

What it does:

A marketplace for agents to buy and sell digital resources. This creates an economy where one agent can “hire” another for specialized tasks.

Example:

A writing agent might purchase access to a language model from another agent to draft high-quality content.

→ At 42m market cap FXN looks primed for an entry.

3. Universal Basic Compute (UBC)

What it does:

A resource-sharing platform for agents. UBC allows agents to collaborate by pooling computational power and data.

Notable Applications:

An AI-written novel produced by a swarm.

A multiplayer game co-created by humans and agents.

→ At 15m market cap, UBC looks like it found a bottom. An interesting play if it can recover.

Alpha 2: ARC – Rust-Powered AI Agent Framework

ARC is a Rust-based framework designed for building high-performance, blockchain-native AI agents on Solana, Sui, and Aptos. Created by the Playground team (known for contributions to The Graph), ARC offers a developer-first approach to scalable and efficient agent deployment.

Why ARC?

Built for Scale: Rust ensures performance and memory safety, making ARC ideal for high-throughput chains.

Developer-Focused: Abstracts complex tasks, enabling faster agent creation.

Ecosystem Play: Positioned alongside AI16Z (Typescript) and ZerePy (Python) as a critical infrastructure layer.

How to Play ARC

Bet on Infrastructure: As a foundational tool, ARC’s long-term value lies in developer adoption.

Watch for Pullbacks: Enter on dips; the token is volatile.

Track Development: Monitor integrations on Solana and other ecosystems.

You will get daily updates on the market and my portfolio positions on Telegram. This is where we found ARC first and made 4x!

Alpha 3: AVB

At first glance, AVB might seem like a typical community token with no immediate utility. However, its roadmap, integrations, and connection to Scrypted’s Inori platform suggest it could play a much larger role in AI agent ecosystems and decentralized applications.

→ From this level AVB an interesting buy at 21M market cap.

Why Pay Attention to $AVB?

1. Evolving Utility

Current Use: Pure sentiment tracker with no intrinsic utility.

Short Term: Planned integration with agent-to-agent payments, @chad_onchain’s trading wallet, and a unique trading game.

Long Term: Preferred payment method within the Inori dual-token economy and potential governance via reverse airdrops of $INORI tokens to $AVB holders.

2. Integration with Inori

The Inori dual-token system bridges blockchain payments with off-chain AI tasks. $AVB will maintain a privileged position for exchange rates and ecosystem support, enhancing its utility beyond speculation.

3. Community-Centric Approach

Distribution: 7,200+ unique holders with no centralized control. Scrypted holds no $AVB directly, preserving the integrity of the token.

Stewardship: Any tokens Scrypted acquires will be managed transparently through a trust or non-profit structure to avoid manipulation.

Commitment: The team’s transparency, bolstered by participation in a16z crypto’s CSX cohort, inspires confidence in their long-term vision.

4. Growth Potential

As AI agents evolve, $AVB could become a key utility token for autonomous transactions and inter-agent payments.

Early adopters of Scrypted’s AVB framework are encouraged to use $AVB, creating organic growth within the ecosystem.

Risks and Challenges

Unproven Utility: The token’s value today relies on future promises of integration and adoption.

Market Saturation: Without differentiation, $AVB could face competition from other agent tokens or community coins.

Why It’s Still Worth Watching

$AVB’s potential lies in its ability to bridge AI agent interactions, payments, and governance while benefiting from Scrypted’s robust infrastructure.

For those seeking long-term exposure to the AI agent narrative, $AVB could evolve into a cornerstone asset as its ecosystem matures. Keep an eye on upcoming integrations, airdrops, and partnerships as indicators of its trajectory.

DYOR, but the groundwork here looks promising for those with patience and a high-risk appetite.

Alpha 4: Envoy Bot – Accessible AI Agent Deployment (very speculative)

Envoy has rolled out a platform with Envoy Agent Launch (EAL), a mobile-friendly system that lets anyone launch AI agents, no technical expertise required. This opens the doors for bigger adoption of AI agents.

Key Highlights

Proven Functionality: Since September, Envoy has successfully deployed 3 agents—2 utility-focused and 1 meme-based—showcasing a stable, bug-free platform.

Fair Launch Design: Users can create agents by paying a creation fee, unlocking advanced features as agents grow, such as:

Automated posting on X.

One-click prompts for fast activation.

Market Potential

Current Market Cap: $3.2M.

Growth Potential: Still undervalued compared to its utility and adoption trajectory.

Warning: Risk here is 10/10 for a new project

Why It Matters

Broad Accessibility: EAL lowers barriers, allowing creators to tap into the agent economy effortlessly.

Scalable Features: Unlocks advanced functionality as agents hit milestones, fostering engagement and ecosystem growth.

High Upside: Despite recent gains and losses, room for further growth remains as adoption scales.

How to Play Envoy

Spot New Agents: Keep an eye on unique agents launched through EAL to identify early movers with high potential.

Monitor Adoption Metrics: Look for increased platform usage and agent activity as signals of sustained growth.

Timing is Key: After a strong initial run, watch for pullbacks to secure a better entry position. Chart looks not good here. Wait for a reversal.

DeFi & Airdrop Alpha

Solv Finance Airdrop Strategy

Solv has raised $22M, and Season 1 is wrapping up soon. Missing the signup means missing future rewards. Here’s how to position yourself:

Sign Up: Visit the Solv Points Program at Solv Finance.

Acquire SolvBTC: Swap via Jumper or deposit directly on Solv to get SolvBTC.

Stake: Stake SolvBTC in the Babylon pool to receive SolvBTC.BBN.

Earn More: Use SolvBTC.BBN to farm rewards in the Pendle Corn market, stacking yields from multiple sources like Babylon, Solv, and Pendle.

Pro Tip: Loop your tokens through BTCFi platforms like Avalon to maximize yield while farming additional rewards.

Solana Yield Farm – JLP Consistency

For consistent yields, Solana’s JLP stands out.

Current Yields: ~77% APY on staked JLP.

Bonus: Additional earnings from Kamino points.

Why It Matters: JLP has been a reliable farm, even with low multipliers.

Core Stables Yield on Colend

Colend offers about 34% APY on USDT and USDC deposits while farming Core airdrop rewards.

How to Play:

Sign Up: Register for Core Ignition Campaign here.

Bridge Assets: Use Core’s bridging tools for USDT/USDC.

Stake on Colend: Deposit stables to farm sparks and accumulate Core airdrop rewards.

Airdrops to Watch

TIA Staking on Milky Way: Restaking TIA tokens can unlock rewards—details here.

Hyperlane Airdrop: Boost volume via Merkly and Renzo bridges for eligibility. Both options are affordable and multi-chain friendly.

Check out my airdrop guide for more routes and a bigger Hyperlane airdrop!

You will get daily updates on the market and my portfolio positions on Telegram. This is where we found ARC first and made 4x!

Watchlist for the Week

Thanks for reading, friend! Stay safe!

Adrian

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

We are buying some AI Agents and memes on the dip. This is the moment we have waited for!

Of course I’ll keep you up to date with our portfolios.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.