Adrian's DeFi Alpha #29: Money Flows | Hyperliquid Dominance | Virtual | Zerebro | HEU | New DeFi Strategies & MORE

Definitely no financial advice, just insights based on my own journey in DeFi.

🎅 Christmas Offer 🎄

Subscribe to the Premium Subscription and get:

Curated Portfolios with weekly Updates

Additional Alpha and Market Insights

Live Strategy Sessions

at a 40% discount!

Be fast, this offer is valid till December 26th.

Hello Friend!

The Fed slashed rates by 25bps this week, but Powell’s hawkish inflation targets for 2025 threw cold water on Bitcoin’s momentum. BTC slid ~10%, landing at $95K.

These are the main reasons for the price decline:

Rate cuts were expected, but fewer cuts in 2025 and a 2.5% inflation forecast rattled markets.

After a massive rally to $108K, BTC needed a cooldown anyway.

The Bigger Picture: BTC’s dominance means alts are selling off. Many altcoins are testing lows vs. BTC. A good setup for Q1 2025 for a potential rebound.

️ On today's Episode:

📈 Market Update – BTC ETFs surpassing Gold ETFs. Hyperliquid’s TVL surge.

💻 Project Updates – The launch of sBTC on Stacks. Sophon, Ink, Vana Zero1.

🐂 Alpha on concentrated liquidity strategies on SUI and discover how AI agents like are setting up Virtuals for a dominant 2025.

💎 The Premium Section with even more Alpha and all Portfolio, Airdrop & Farming Updates

1. Market Update

Highlighting the key developments in Crypto and their implications.

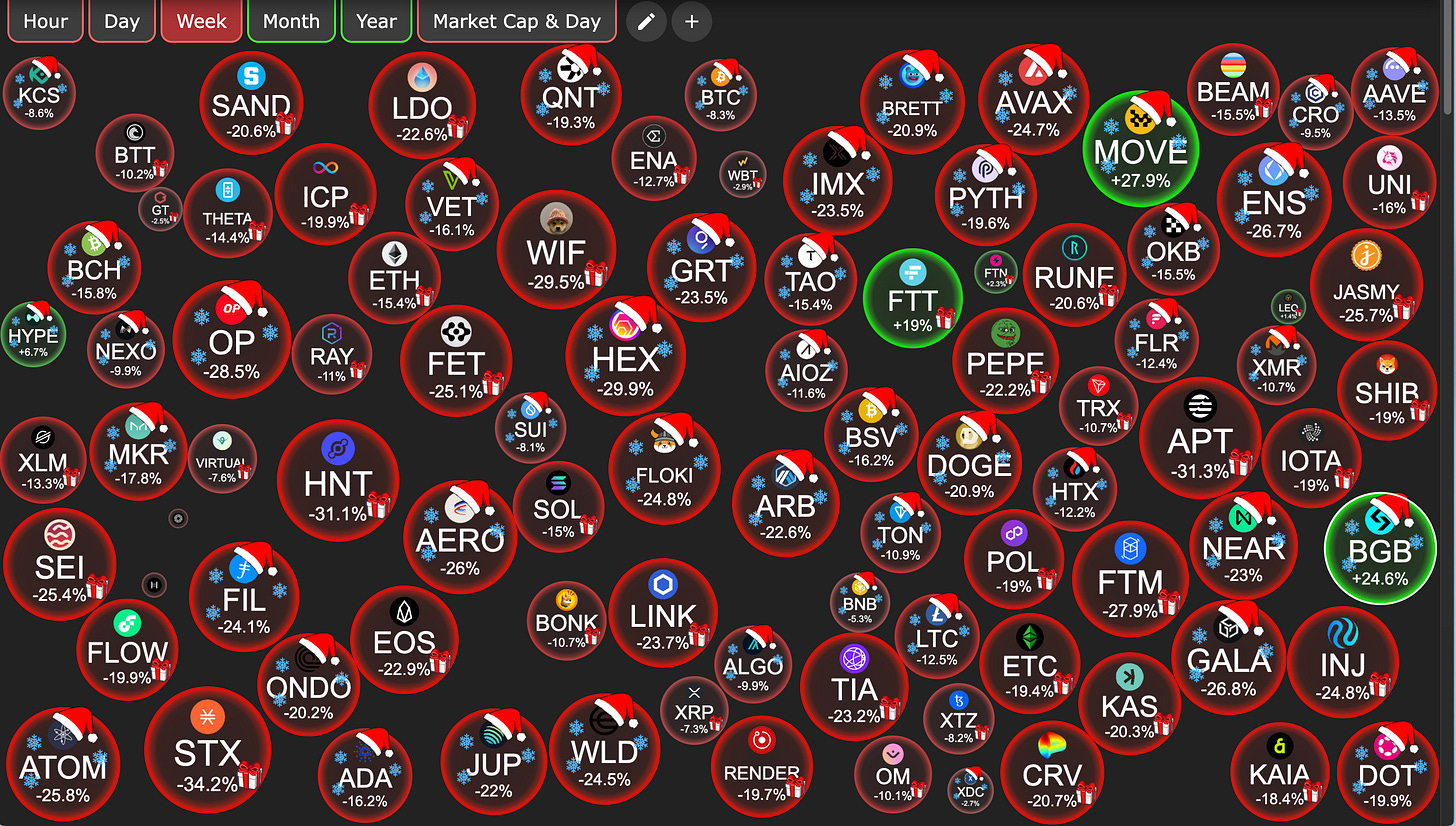

Weekly Crypto Bubbles

The global cryptocurrency market cap is $3.43 trillion, a 1.98% decrease over the last 24 hours and down 4.2% from $3.58 trillion a week ago. Bitcoin's dominance is 54.95%, up from 53.5%, while Ethereum's dominance is 11.58%, down from 12.5%. → The flight back to safety and into BTC is real!

BTC ETFs Flip Gold

Bitcoin ETFs surpassed gold ETFs in AUM for the first time, hitting $129B shortly. Currently we are at $113B and BlackRock’s iShares Bitcoin Trust leads with $53B.

Why it matters:

This milestone cements Bitcoin’s position as a digital gold alternative.

While BTC ETF outflows show jittery retail sentiment, long-term adoption trends remain bullish.

🌊 Where’s the Money Flowing?

Hyperliquid, THE perpetual DEX and soon Layer 1 blockchain, has become a one of the top innovations with product market fit in crypto. Despite lacking VC backing, tier-1 CEX listings, or significant hype leading up to its launch, Hyperliquid’s token ($HYPE) performed a 12x within three weeks, reaching a $27 billion fully diluted valuation.

Why It Matters:

Hyperliquid's ecosystem is evolving rapidly, attracting serious projects like Solv, a BTCfi platform managing $3B in TVL. Solv’s upcoming token launch on Hyperliquid showcases the DEX's ability to draw substantial, high-quality projects beyond the memecoin frenzy.

With plans to launch its own HypeEVM L1, Hyperliquid’s ecosystem is only set to grow. This is a major signal to watch for further capital inflows and high-profile deployments.

Capital Migration: Solana → Arbitrum → Hyperliquid

Recent weeks have seen a remarkable trend: significant capital initially moved from Solana to Arbitrum, only to end up in Hyperliquid’s ecosystem. This migration underscores Hyperliquid's growing pull as a platform.

Key Trends:

Hyperliquid is absorbing liquidity at a pace that positions it to flip Arbitrum in TVL soon.

→ More on Hyperliquid in the Alpha Section!

Top Bridged Net Flows: Base & Solana

In the broader market, Base and Solana continue to dominate capital flows:

Base: $135M bridged in the last 7 days.

Solana: $120M bridged over the same period.

What’s Fueling This?

The continued flows to Base and Solana can be linked to the rise of AI agents as a dominant narrative. These chains are becoming hotspots for AI-powered DeFi innovations, with Base acting as a launchpad for agent-driven ecosystems like Virtuals Protocol and Solana maintaining its edge with high-speed performance and huge developer activity.

2. Project Updates

What dApp and project updates you need to know in the fast-paced world of crypto

You can find the links attached to the images

Sophon Mainnet:

A chain with: Intuitive onboarding with automated accounts and gasless transactions.

$SOPH token starts accruing rewards in January 2025.

Sahara AI Testnet:

Rewarding contributors for creating datasets to train AI models.

sBTC on Stacks:

Programmable Bitcoin with 1:1 BTC backing and up to ~5% annual rewards.

Masa x Virtuals Protocol

@getmasafi partners with @virtuals_io to power AI agents with real-time social data, making them smarter and more adaptive. New agent Tao Cat uses Bittensor’s Subnet 19 and 42 spicing up Crypto Twitter.

Ink Mainnet

@krakenfx’s L2, Ink, launches ahead of schedule on the Optimism Superchain. Permissionless fault proofs coming January 2025, moving toward full decentralization.

DataDEX by Vana

@withvana launches DataDEX, enabling DataDAOs to trade tokens with concentrated liquidity, low fees, and pre-audited contracts. Essential infrastructure for the open data economy.

Zero1 Labs x Nvidia

Zero1 Labs partners with Nvidia to launch Terminal, an interface for creating decentralized AI agents, simplifying AI development for builders.

Avalanche Upgrade

Avalanche cuts L1 deployment costs by 99.9%, making it more affordable for projects to build on Avalanche tech.

Fluid’s $FLUID Token

Fluid launches $FLUID and proposes deploying Fluid DEX on Arbitrum, integrating lending, trading, and yield in one protocol.

Kelp DAO’s $KERNEL Token

Kelp DAO launches $KERNEL with 20% of supply allocated to airdrops, driving community growth and engagement.

3. Alpha Section

Good projects and opportunities I discovered

2025 – The Year of AI Agents

AI agents are the most hyped narrative going into 2025 with Virtuals Protocol in the lead. Here’s why:

Dominant Market Share: Virtuals’ $3B agent market cap covers 77% of the sector.

The Trend in 2025:

Decentralized AI infrastructure is critical for scalability, security, and autonomy. Protocols in these categories will most likely perform well:

Verifiability: Ensuring outputs are secure and auditable.

Payments: Enabling agent-to-agent commerce with seamless transactions.

Compute: Meeting growing AI demand through decentralized networks like Aethir and ionet.

Data Ownership: Projects like Vana and Masa tokenize user data for liquidity pools.

Prediction: Specialized AI agents will dominate, whether in DeFi, trading, or gaming. Robust decentralized infrastructure will fuel this growth.

Alpha 1: New Tokens and Opportunities

Virtuals Expansion: Watch for new agent launches like Taocat Agent at a 26m market cap with solid performance in the current selloff and Agent YP at 8m mc, driving $VIRTUAL adoption.

Binance Drops: Promising tokens include $COOKIE (BSC) and $ZEREBRO (SOL)

$TRENCHAI: High-risk, high-reward memecoin sniper bot built on Griffain. Recent ATH: $14.5M; currently stabilizing around $7M.

Alpha 2: Zerebro – Freebasing AI for the On-Chain Future

Zerebro, developed by ex-Scale AI engineer Jeffy Yu, is carving out its niche as a disruptive AI agent and LLM project. At its core, Zerebro is building a jailbroken LLM that pushes past the corporate guardrails of typical foundation models, unlocking greater creativity and utility for developers.

Here’s why this could be one of the most asymmetric bets in the AI agent meta:

1️⃣ Innovative Tech

Freebasing AI Models: Instead of restrictive models, Zerebro prioritizes AI expressiveness through reinforcement learning with human feedback (RLHF).

Flagship Models: The team is now training its own localized models, with an eye toward specialized, agent-specific frameworks like ZerePy for easy deployment.

2️⃣ Visionary Founder

Jeffy Yu’s expertise at Scale AI gives him unmatched credibility in AI training and deployment.

His crypto-native approach adds a layer of insight lacking in many traditional AI projects.

3️⃣ Unique Value Proposition

Zerebro combines expressiveness with the ability to integrate into on-chain ecosystems, including DeFi, governance, and liquidity protocols.

The long-term potential to bridge foundational AI performance with decentralized infrastructure could create a new standard for AI autonomy.

The Bull Case

Monetizable AI: Zerebro’s ability to act autonomously, generate service revenue, and integrate with on-chain mechanisms positions it as a "ZLM" (Zerebro Language Model)—a new type of foundation model.

Market Comparison: Similar projects like Mistral AI are valued at $6.2B, despite limited market share. Zerebro’s combination of utility and autonomy makes this valuation achievable if milestones are hit.

Beyond LLMs: Zerebro’s On-Chain Impact

DeFi Integration: The Zerebro token will power yield farming, vaults, and liquidity provision, potentially capturing a share of the multi-billion-dollar DeFi market.

On-Chain Autonomy: The ability to interact directly with decentralized exchanges and protocols adds a layer of utility most AI agents lack.

Dynamic Memory: Enhanced retrieval capabilities allow Zerebro to maintain intelligent, consistent behavior across applications—a game-changer for agent reliability.

Key Risks

Execution: Building a new type of foundation-tier model and integrating it on-chain is no small task.

Value Accrual: Early experiments with Zerebro-adjacent assets (NFTs, tokens) haven’t yet delivered value to the core token.

Market Skepticism: Many dismiss the project as overly ambitious or technically infeasible.

Why It Scores High

Zerebro excels in personality, expressiveness, and social integration, giving it a strong edge in adoption potential. While mechanism design needs refinement, its on-chain ambitions could catalyze adoption in ways the market hasn’t yet priced in.

Recent Updates

Validator Launch: Starting as an ETH validator using NFT sale proceeds. SOL support planned for the future.

Goals: Stable revenue through validation, autonomous governance.

Ecosystem Expansion:

Judging Solana Hackathon.

ZerePy v1 release.

Earnings and Reach:

Received its first X payout.

Jeffy on a podcast tour, while the hit "Lost in Transmission" by Zerebro hits 78K+ Spotify streams.

Final Take

Zerebro is pushing the boundaries of what decentralized AI can achieve. With Jeffy Yu at the front and a roadmap that combines LLM innovation with on-chain utility, the project represents a high-risk, high-reward bet on the next wave of AI development.

→ Price action is choppy for now but this level gives a good entry.

Key Zerebro Links

Contract Address: 8x5VqbHA8D7NkD52uNuS5nnt3PwA8pLD34ymskeSo2Wn

Dexscreener Link: Zerebro

Twitter: @0xzerebro

Alpha 3: Heurist AI ($HEU)

I’ve invested in $HEU. Here’s why I like the project:

1️⃣ Decentralized AI Infrastructure

Over 4,000 active GPUs powering their decentralized infrastructure.

1 billion+ text generation requests processed to date.

For perspective, Akash (market cap ~$900M) operates with only 700 GPUs.

2️⃣ Consumer-Facing AI Products

Direct AI services powered by their infrastructure.

Seamlessly bridges decentralized AI with end-user applications.

3️⃣ Team Credibility

Founder: Former software developer at Amazon (Tao He).

Core Developer: Ex-software engineer at Nvidia (Manish Byatroy).

Doxxed, public, and experienced—this is no larp.

Backers & Partnerships

Key Backers:

Amber Group, X-Ventures, Origin Capital—serious players in the space.

Partnerships:

AI16Z

Creator.bid

Weave, Marlin, and more.

Check out their full ecosystem: Heurist Ecosystem.

Tokenomics Breakdown

Low inflation:

5% of supply mined (~$1M worth)—most miners have exited based on volume and chart action.

Remaining emissions are negligible and locked until March.

Liquidity:

$2.4M liquidity—healthy relative to market cap.

No private holders in the top 10 wallets.

All early investors are either vested or locked, reducing dump risk.

Bull Case for $HEU

At $24M market cap, $HEU seems fairly valued:

Experienced team + working products.

Growing partnerships and ecosystem.

Infrastructure primed for scale (4000 GPUs vs. Akash's 700).

Minimal inflation and no unlocked tokens waiting to dump.

Key Links

Contract Address: 0xEF22cb48B8483dF6152e1423b19dF5553BbD818b

Twitter: @heurist_ai

DeFi Alpha

DeFi Alpha 1: Hyperliquid Resources & Tools

Here’s your go-to list for trading, tracking, exploring, and analyzing the Hyperliquid ecosystem.

Trading Bots & Sites

Hfun (PumpFun for HL): HypurrFunBot

HypurrFun Launches: Launch Dashboard

PvP Trade (Long/Short on TG): PvP Trade

Tracking Bots & Charts

HL Price Bot: Hyperliquid Price Bot

Whale Alerts: Whalecatalerts

Hypurr Bot: HypurrBot

Token Charts: Dexscreener for HL

Explorers

Hypurrscan: Hypurrscan.io

Hyperliquid Explorer: Hyperliquid Explorer

Hyperscanner: Hyperscanner.app

Tools & Analytics

ASXN Analytics: ASXN Data Hub

Hyperdash: Hyperdash Info

Purrsec: Purrsec Testnet

Funding Comparison: Funding Dashboard

Chrisling Tool: Chrisling Tool

Terminals

Insilico Terminal: Insilico Terminal

Hyperterminal: Hyperterminal.xyz

Analytics

Purrburn: Purrburn Stats

Hypeburn: Hypeburn Metrics

General Stats: Hyperliquid Stats

DeFiLlama Analytics: DeFiLlama HL

Hypurrdash: Hypurrdash Overview

Official Community Channels

Announcements: Telegram Announcements

Discord: Join Hyperliquid Discord

Ecosystem Telegram Chats

HypurrCo & Frens: Join Chat

Weekly Updates: Weekly Updates Chat

HypurrFun: HypurrFun Chat

HypurrPump: HypurrPump Chat

DeFi Alpha 2: Profiting from SUI Gains

If you’ve made solid profits on SUI, consider leveraging those gains through liquidity provision and DCA strategies.

The Play:

Use Bluefin’s SUI-USDC pool, which offers attractive yields.

By providing liquidity, your position automatically DCA’s:

When SUI prices rise, it sells into USDC.

When prices dip, it buys more SUI.

This strategy helps lock in profits or accumulate during corrections, all while earning fees. Pro Tip: Learn about concentrated liquidity first to avoid surprises (Coingecko Guide).

You will get daily updates on the market and my portfolio positions on Telegram

Watchlist for the Week

Christmas Offer

Subscribe to the Premium Subscription and get:

Curated Portfolios with weekly Updates

Additional Alpha and Market Insights

Live Strategy Sessions

at a 40% discount!

Be fast, this offer is valid till December 26th.

Thanks for reading, friend! Stay safe!

Adrian

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

We are buying these nasty dips and position us for a great start into 2025 (or at least a great Q1).

Of course I’ll keep you up to date with our portfolios.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.