Adrian's DeFi Alpha #30: BTC Dominance Back? | Altcoin Market Cap Analysis | Bridge Flows | Gnosis | VADER | Strategies & MORE

Definitely no financial advice, just insights based on my own journey in DeFi.

Christmas time was boring for BTC, ETH, basically all majors but of course with the knowledge of this newsletter and my Telegram group we are outperforming in this bull market:

This weeks highlights: VADER up 117%, AI16Z up 117%, HEU up 79%, AIXBT up 70%, SPX up 39%, VIRTUAL up 36%, PRIME up 24%

Hello Friend!

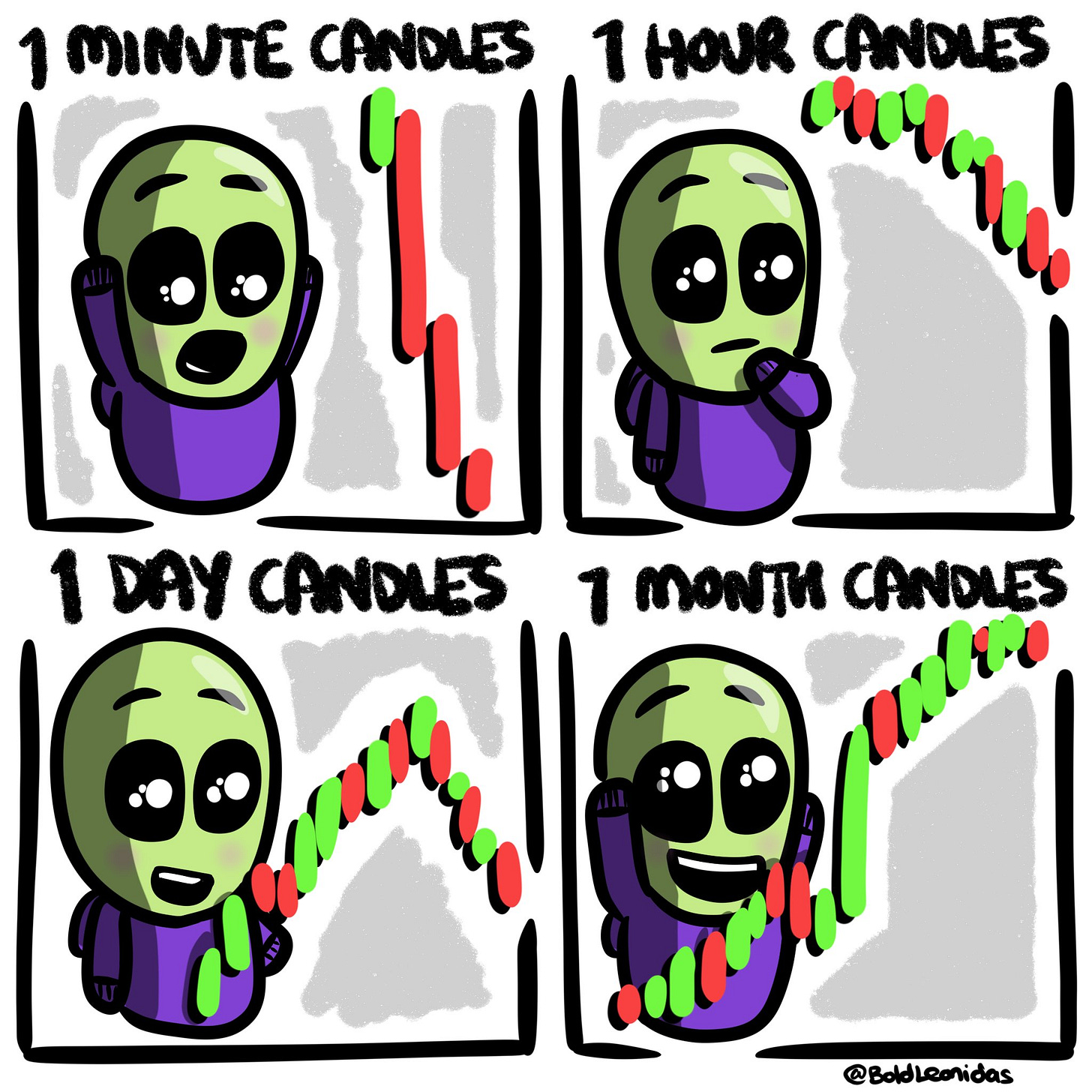

After the $108K Bitcoin rally, traders found themselves torn between chasing green candles and doomscrolling through FOMC-induced dips back to $93K. With BTC dominance NOT hitting 60%, a lower high was confirmed so that we should see further altcoin price action and a real altseason coming soon.

Meanwhile, Ethereum sits in BTC’s shadow, quietly preparing for its moment. Q1 2025 looks like it could be ETH’s breakout season. AI tokens like $VIRTUAL and $AI16Z are holding their crowns, Trump-linked coins like $AAVE and $LINK are riding a wave of attention, and $SUI’s recovery signals fresh momentum in the ecosystem.

And then there’s Hyperliquid ($HYPE), the rising star that’s running for Top 6 Layer-1 status—a potential Solana moment in the making.

️ On today's Episode:

📈 Market Update – BTC dominance, Total 2 altcoin market cap analysis and the money flow.

💻 Project Updates – Agent and DeFi Updates.

🐂 Alpha on Gnosis Card, Vader and leveraged strategies.

💎 The Premium Section with even more Alpha and all Portfolio, Airdrop & Farming Updates

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global cryptocurrency market cap is $3.42 trillion, a 3.05% decrease over the last 24 hours and a slight dip from $3.43 trillion last week. Bitcoin's dominance has risen to 57.79%. Meanwhile, Ethereum's dominance has dropped to 12.81%.

Total trading volume in the last 24 hours is $114.2 billion.

→ The flight to safety continues for now, with BTC steadily gaining dominance while ETH loses ground.

→ AI16Z: AI Agent Outperformance in the Solana ecosystem

→ BGB: Centralized Exchange Bitget changed tokenomics for the better. The token is reflecting that.

BTC Dominance and Altcoin Action

Bitcoin (BTC): Bitcoin hit a high of $108,000 before retracing to $93,000 now by the end of the year. Its dominance increased to almost 60%, which caused most altcoins to bleed. BTC’s price will continue climbing, pushing the dream of owning a full Bitcoin further out of reach for most.

Ethereum (ETH): While ETH’s price action has been subdued, its potential relative to Bitcoin keeps it in the spotlight. ETH is a prime candidate for accumulation, with a breakout expected as BTC dominance sinks, likely in Q1 2025.

Altcoins: Winners and Losers: Mixed movements define the altcoin market this week, with notable volatility in:

AI Tokens: Leaders such as $VIRTUAL, $AI16Z, $GAME, $GRIFFAIN continue to dominate.

Memecoins: $FARTCOIN sold off after a huge hype and did not manage to hold the 1b market cap.

Trump-Adjacent Coins: Investments by WorldLibertyFi have pumped the price of $AAVE, $LINK, and $ENA.

$SUI Recovery: A sharp rebound in $SUI to $4.9 and the long term uptrend in SUI/SOL ratio underscores the strength of SUI as a top L1 this cycle. Currently it’s going down due to SOL outperformance but this is a chart to monitor.

Altcoin Total 2 Analysis

Key Points:

Weekly Chart Is Consolidating

The candle on December 20 wasn’t great. It broke below a key level (1.34T), which weakens the medium-term trend.

However, we managed to hold above 1.25T, a key support level. As long as this holds, the bigger trend isn’t completely invalidated.

Weekend Price Movement

The market was choppy over the weekend, with many recent gains from altcoins retracing.

Possible Next Scenarios:

Range Formation

The market may is settling into a sideways range over the next few days, creating a foundation for future upward moves.

Another Push Down

If we drop further, the key level to watch is 1.19T.

A quick dip ("wick") could happen here to scare traders before bouncing back.

What matters most is avoiding a weekly close below 1.25T, which would signal a deeper trend shift.

My Plan:

Stick to solid risk management—don’t open positions too early and DCA into most positions.

If we hit 1.19T, I’ll look to add more positions, but only if the setup looks strong.

I still believe there’s more upside for altcoins in the longer term, but patience and proper risk management are key.

🌊 Where’s the Money Flowing?

The trend is going on: Significant capital is being moved from Solana to Arbitrum, only to end up in Hyperliquid’s ecosystem. This migration underscores Hyperliquid's growing pull as a platform.

Key Trends:

Hyperliquid is absorbing a lot of liquidity .

zkSync sees substantial inflows as well. Their incentivized DeFi season will start soon. I’ll update you with juicy farms in the coming weeks.

Top Bridged Net Flows: Base & Solana

In the broader market, Ethereum and Base dominate capital flows:

Ethereum: $245M bridged in the last 7 days.

Base: $127M bridged in the last 7 days.

→ Keep an eye on AI Agents on Base. These inflows are most likely due to the current hype.

2. Project Updates

What dApp and project updates you need to know in the fast-paced world of crypto

AI Agent Innovations

Spore.fun: Cool innovation with focus on autonomous AI evolution. Its second-gen agents, Adam and Eve, are driving interest in AI mutation frameworks.

ai16z: Preparing to launch an Agent Infra Ecosystem, enabling seamless operation of decentralized AI agent swarms.

Spheron: Unveiled the first fully autonomous, self-replicating AI agent, setting a new standard in the space.

Holoworld AI: Launched Agent Studio, introducing customizable 2D/3D avatars and advanced voice generation.

Send AI: Released the Solana Agent Kit, bridging AI capabilities with the Solana ecosystem.

Other Key Updates:

Chainlink: Introduced a Smart Value Recapture mechanism, creating a new revenue stream for token holders.

THORChain: Released V3, adding smart contract functionality to expand DeFi applications.

Uniswap: Set to launch its Unichain L2 Mainnet in early 2025, enhancing scalability and liquidity.

Frax Finance: Considering BlackRock’s BUIDL token as backing for Frax USD, signaling a closer TradFi-DeFi connection.

3. Alpha Section

Good projects and opportunities I discovered

Alpha 1: Spotlight: Gnosis Card—DeFi Meets Real-World Spending

DeFi payments, reimagined. That’s the promise of the Gnosis Card—a self-custodial Visa debit card powered by Gnosis Pay, the first Decentralized Payment Network (DPN). With the Gnosis Card you can easily transact stablecoins to your wallet and spend them in real life. Very convenient if you don’t want to cash out via a crypto exchange.

What Makes the Gnosis Card Special?

The Gnosis Card is a step forward in how we think about DeFi payments:

Self-Custodial Power: Unlike other crypto cards tied to centralized platforms, the Gnosis Card keeps your funds secure in your Safe Wallet on Gnosis Chain, one of the most decentralized EVM chains available.

Global Payments, Crypto Style: The card integrates seamlessly with the Visa network, enabling payments at millions of merchants worldwide while drawing funds directly from your wallet.

Low Barriers, High Potential: At just €30.23 to purchase (which you can save with my link), the card is affordable, with plans to expand access beyond Europe into the U.S., Brazil, and India.

You get cashback for holding the GNO token. About 30$ of the token give already 1% cashback.

Key Alpha Features of Gnosis Pay

Smart Payment Network: Built to blend the best of TradFi and DeFi, Gnosis Pay leverages stablecoins (like EURe or GBPe) to enable spending without selling your crypto.

Native Gnosis Chain Ecosystem: Transactions are routed securely and efficiently via Gnosis Chain, ensuring low fees and trustless operation.

Highly Secure: Certified by Visa and adhering to EMVCo standards, it’s as reliable as any traditional card—but with a DeFi twist.

How to Get Started with Gnosis Card

Eligibility: Currently, the card is rolling out in Europe, but broader access is coming soon. You’ll need to be over 18 and complete a quick KYC process using Fractal.

Funding Your Card: To use the card, swap your assets (like ETH or USDC) for EURe or GBPe on Gnosis Chain. Pro tip: Use DEXs like CoW Swap or Balancer for the best rates.

Bridging Assets: For users outside Gnosis Chain, bridges like Jumper, DeBridge, Bungee and Connext make it simple to transfer funds cross-chain.

Why I like the Product

DeFi Adoption in Action: The Gnosis Card embodies the kind of real-world utility that crypto has long promised but rarely delivered.

Capital Efficiency: By swapping your assets for stablecoins, you maintain control over your portfolio while unlocking liquidity for daily use.

Borderless Finance: It’s a tangible step toward breaking the barriers between decentralized and traditional financial systems.

→ If you like to support me and save 30€ for the card you can use my referral link.

Alpha 2: Vader

Vader AI is an autonomous AI agent platform for crypto trading, at the forefront of the rise of the Agentic Economy on Base.

Enhanced $VADER Tokenomics

Vader AI is positioning itself as the “BlackRock of the Agentic Economy”, as an Investment DAOs to capture and distribute value.

Two DAO Types:

Passive DAOs:

Track benchmarks or rulesets.

Operated solely by Vader AI, with 0.5% management fees distributed to $VADER stakers.

Active DAOs:

Actively managed by agents or humans with strategies.

Charge 0-20% performance fees, of which 20% goes to $VADER stakers.

$VADER Flywheel:

DAO Creation: Managers must stake 100K $VADER to launch a DAO.

Fundraising Advantage: $VADER stakers get first access to DAO fundraises.

Buffer & Buy Pressure: DAOs keep 10% of funds in $VADER, creating constant buy pressure.

Rewards: Positive return withdrawals are rewarded in $VADER, further increasing demand.

Burn Mechanism: 1% of withdrawals (in $VADER) are burned, reducing supply permanently.

Advertiser Airdrops: 100% of tokens received from advertisers are rewarded to $VADER stakers.

The result? A deflationary token that continuously accrues value through multiple mechanisms, aligning incentives across the ecosystem.

What’s Next for Vader AI?

Custom Agent Deployment:

Tools to create and scale personalized agents.

Cross-Chain Expansion:

Extending from Base to Solana, increasing adoption.

Ecosystem Growth:

Focus on both AI traders and institutional DAOs, strengthening the network effect.

Key Opportunity

Vader AI isn’t just the typical AI reply guy agent—it’s creating the infrastructure for the next-gen ad economy and investment DAOs. By combining decentralized AI agents with deflationary tokenomics, Vader is building a sustainable and scalable system for capturing value.

Pro Move: The last Vader Investment DAO filled in 30 seconds. With another round launching soon (double the capacity), this is a rare chance to join a first-mover in the Agentic Economy.

→ Vader made a 3x since I mentioned it last week in the premium section of this newsletter. A DCA strategy and limit buys around the $0.08 level could work for an entry.

Key Links

Contract Address: 0x731814e491571A2e9eE3c5b1F7f3b962eE8f4870

Twitter: @Vader_AI_

Coingecko: Vader

Alpha 3 - Leveraged Blue Chips Strategy

Arbitrum leveraged ETH Strategy

I am building a new leveraged ETH position on Arbitrum via Aave.

I lend ETH and borrow USDC to buy more ETH with conservative 1.5 x leverage. I am currently waiting to deploy more capital and borrow as soon as ETH price goes down.

Advanced users could also use Fluid on Base for this. I currently started using this novel lending / DEX hybrid.

Solana leveraged SOL Strategy

I am also doing basically the same on Solana with SOL on Kamino Finance.

The borrowing rates are higher here with 13.69 % for USDT and 10.64 % for PYUSD (Paypal Stablecoin). With a time horizon of 3-6 months and a conservative Solana price estimate of 500$ (2x from last all time high) this is still worth it to me.

Good reads & potentially interesting Agent plays

EternalAI one click Agent deployment

You will get daily updates on the market and my portfolio positions on Telegram

Watchlist for the Week

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps and Investment Theory

GM GM readers of Adrian’s Premium Alpha,

We are positioned for a great start into 2025 (or at least a great Q1) and made nice gains with the latest Agent investments.

I got some juicy alpha on Bitcoin’s recent price action and the devlopment of Bitcoin dominance. Additionally I found some great content on how to find small caps and make those juicy 10X and more.

Of course I’ll keep you up to date with our portfolios.

Keep reading with a 7-day free trial

Subscribe to Adrian DeFi to keep reading this post and get 7 days of free access to the full post archives.