Adrian's DeFi Alpha #32: Will Trump Pump BTC? | Macro Week | ETH & Base Inflows | New DeFAI Meta | Ethena | GRIFT | GRASS | Wayfinder (PRIME) & MORE

Definitely no financial advice, just insights based on my own journey in DeFi.

The second week of January brought incredible pain. With the knowledge of this newsletter and my Telegram group we will still outperform in this bull market:

Hello Friend!

Time to zoom out. The president is mentioning Bitcoin like it’s a regular part of the economic conversation. MicroStrategy sits on the NASDAQ, stacking BTC. Inflation at 3-5%? Ideal territory for Bitcoin’s value to hold and grow. The Fed’s paying out a trillion in interest annually, while the dollar stays strong—fuel for the markets when that changes.

Globally, liquidity is rising. Countries like China are stimulating, and we just began to combine crypto and AI, two of the most transformative technologies out there.

The pieces are moving and we are not done. Let’s break it all down.

️ On today's Episode:

📈 Market Update – Bitcoin’s path to $100K, Base and Solana dominate capital inflows, and the latest BTC dominance dip signaling altcoin momentum.

💻 Project Updates – Ethena’s TradFi expansion, Orbit’s DexScreener integration, and GNON’s Echo Chambers grant on Solana.

🐂 Alpha – Grass’s AI data dominance, Wayfinder caching and staking for PROMPT airdrop Perena stablecoin airdrop campaign.

💎 The Premium Section – Portfolio updates, Sekoia, high-conviction DeFAI plays, and farming strategies for ZKsync Ignite’s 100M $ZK reward campaign, Resolv and CreatorBid.

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global cryptocurrency market cap is $3.43 trillion, a 0.09% dip in the last 24 hours. Last week, the market cap was $3.68 trillion, meaning it has decreased by $250 billion, or approximately -6.79%, week-over-week. Total trading volume in the last 24 hours is $205.3 billion. Bitcoin’s dominance has increased to 58.6%.

→ Bad week especially for altcoins. But a good opportunity to buy the dip.

Macro

Macro data is telling us to prepare for more volatility. Inflation, interest rates, geopolitical tension—everyone’s feeling the squeeze.

These are the main events for this week:

And honestly, it boils down to liquidity. A $4.2 trillion drop in global money supply has traditional markets in fear. Less cash floating around means riskier times for investors.

On the crypto side, the $TOTAL market cap is still above its previous all-time high in 2021. The big-picture trend is bullish if you zoom out far enough, even though the short-term noise can be scary.

Is The Cycle Top In?

The current market mood is not comfortable at all. On Crypto Twitter many worry we’ve hit the cycle top, while others see a shakeout before another run-up.

First, jobs data came in strong. Unemployment at 4.1%, job openings at 8.1M—it’s all pointing to a hotter-than-expected economy. That’s bearish for risk-on assets like crypto. Higher spending means higher inflation and no rate cuts anytime soon.

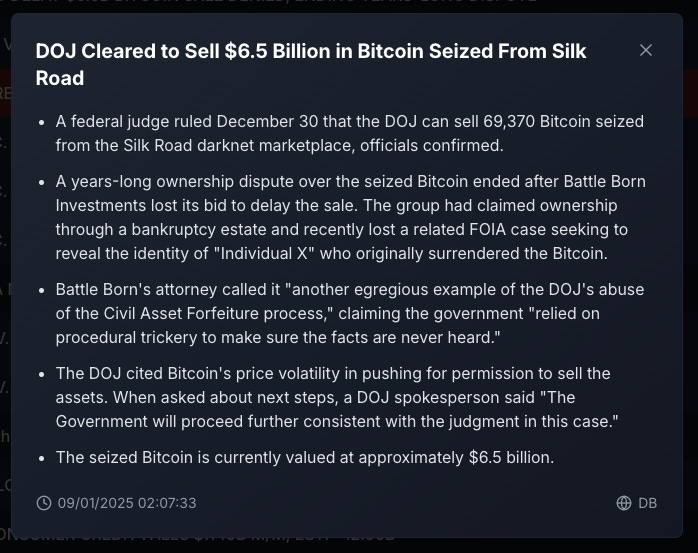

Then there’s the government FUD. The U.S. gets the green light to sell 69,000 BTC. Prices dumped significantly. This does NOT mean these BTC will be sold immediately. With the new administration coming it could actually be a nothing burger.

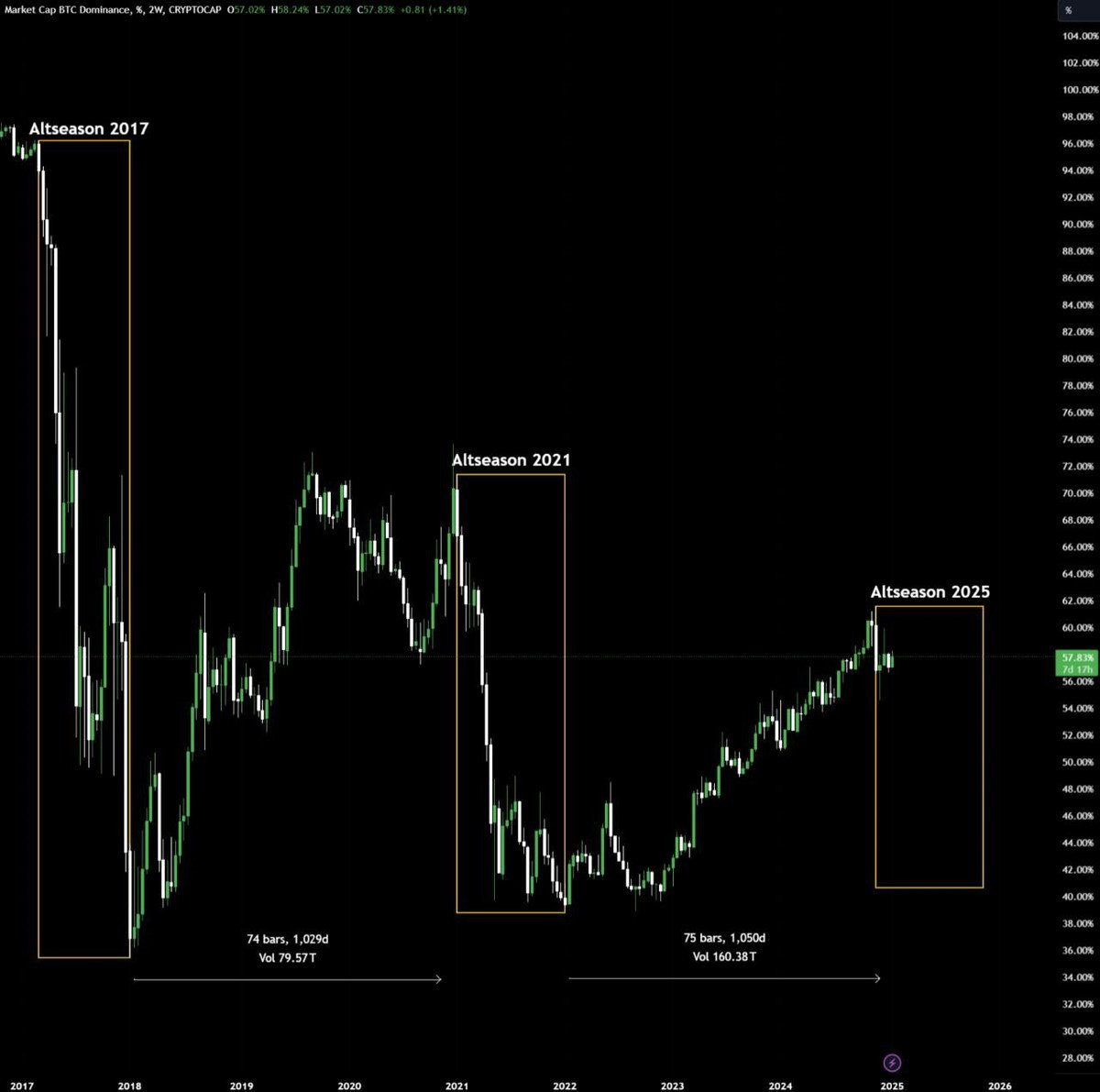

Bitcoin? Standard January dump for a post-halving year. 2017, 2021, and now 2025 all follow the same script. $103K to $92K isn’t fun, but it’s familiar. If history repeats, we’ll recover soon enough after 1-2 weeks of volatile price action.

Meanwhile, BTC dominance is slipping, now down to 54% from 62%. If that trend holds, altcoins are preparing for a parabolic run. And ETH? It’s playing the same game it did in 2021—down hard from the ATH but it could be primed for a big February move (my bags are packed).

Here’s what matters: liquidity. Post-inauguration years bring policy shifts and more money in the system. Trump wants lower rates, which means dollar weakness ahead—a setup crypto thrives on.

→ Zooming out. This doesn’t look like the top. It’s a shakeout. BTC might dip to $85K-$88K, but the high timeframe trend looks solid. Once Trump gets behind the desk, fresh liquidity might flow in.

What whales are doing: After dumping, they’re slowly stacking again. Typical market psychology: scare ’em out, buy back cheaper.

→ Stay long term focused in majors with a majority of your portfolio and always keep some stables on hand for dips.

It might not be as bad as it looks right now. Last cycle, we saw a similar dip leading into the inauguration, only for the market to bounce back with months of strong, positive price action.

🌊 Where’s the Money Flowing?

Top Bridged Net Flows: Base & Solana

In this week Ethereum and Base dominate capital flows:

Ethereum: $301M bridged in the last 7 days.

Base: $170M bridged in the last 7 days.

→ Looks like a flight to safety. People are uncertain and therefore bridging to Ethereum.

Correlations Between Narratives

Take a good look at this chart on the monthly. The upper left quadrant is mostly green, filled with narratives that are closely tied to Bitcoin. These narratives—your standard DeFi protocols, popular L1s, and NFTs—are essentially just beta to BTC. They move with it, offer little divergence, and provide no real alpha.

Now, shift your focus to lower left. Here’s where it gets interesting. Narratives in this space show weak or even inverse correlations to the rest of the market. A standout example? CEX and AI Agents in the last 30 days!

DeFAI, AI agents, and DeSci. These are where the alpha lives. They’re not moving in lockstep with BTC or the broader market, which is exactly what you want when hunting for outsized returns.

→ If you’re looking to outperform, start where the correlations are weakest. The edges of the narrative map are where the opportunities lie.

→ Check the map here for yourself

2. Project Updates

What dApp and project updates you need to know in the fast-paced world of crypto

Ethena – Taking DeFi to the TradFi Table

Ethena just dropped its 2025 roadmap, and it’s packed with big moves:

Neobank on Telegram and TON: Send, spend, and save via Telegram with Apple Pay integration.

Ethena Network Chain: A new chain for dollar-focused DeFi apps, rewarding $sENA holders with airdrops.

iUSDe: A compliant, high-yield (10-25%) version of $sUSDe, designed for TradFi investors.

Why It Matters

More stable money in the system: Big institutions will invest in assets like $ETH and $BTC, which support $USDe, helping keep their prices steady and less volatile.

DeFi and TradFi rates will get closer: Institutions will take advantage of differences in returns between DeFi and traditional finance, gradually balancing the rates.

Ethena gets stronger: As more money flows in from traditional finance, Ethena’s influence and growth will accelerate.

With regulatory clarity and risk-free rates falling, Ethena is on track to bring billions from TradFi into crypto. Partnerships are expected soon—each one could spark new hype for $ENA.

→ Link to the full roadmap

Orbit x DexScreener

Orbit just integrated with DexScreener, adding real-time market data and trend detection to its toolkit. This makes Orbit sharper at spotting DeFi opportunities across chains.

The move taps into the AI + DeFi trend, reinforcing the strength of the Orbit token and solidifying its spot in the rapidly growing DeFAI space.

GNON receives ACT Grant

The $ACT community has announced a grant to @GnonOnSolana, backing their bold vision: Echo Chambers—a decentralized, censorship-free agent-to-agent communication network.

Echo Chambers is where developers deploy, test, and refine models in real-time without censorship or deplatforming. It’s a space built for creativity, collaboration, and freedom—where innovation has no limits.

Project Update: Heurist Mining Season 3

Heurist Mining is making some changes for Season 3:

You can stake $HEU for stHEU to earn extra rewards (it’s optional but gives a boost).

Rewards will now be tracked daily instead of weekly, so payouts are more accurate.

Mining rewards are being reduced slightly to keep the system sustainable.

The Llama/Waifu system is being removed, and the latest NVIDIA GPUs are now supported.

Important Dates:

stHEU staking: Late January 2025.

Season 3 starts: February 2025.

Season 2 rewards available: Mid-March 2025.

Security checks are ongoing, and these updates aim to improve mining for everyone.

→ More on HEU tokenomics here

3. Alpha Section

Good projects and opportunities I discovered

Deep Dive: DeFAI – Fixing DeFi’s Biggest Problem

DeFi is powerful, but let’s be real—the user experience is a mess. For newcomers, it’s a confusing grind. For regulars, it’s just tedious. Enter DeFAI (DeFi + AI), the narrative promising to change all that.

🔍 What is DeFAI?

DeFAI uses AI agents to simplify on-chain tasks. Imagine typing “Swap 1 ETH for SOL” into a ChatGPT-like interface. The AI handles everything—bridging, swapping, and optimizing gas. No hunting for bridges, no manual DEX swaps.

🚀 Why DeFAI Matters

Simplifies everything: Removes the complexity of interacting with DeFi protocols.

Saves time: Even experienced users benefit from faster processes.

Opens the door for mass adoption: Makes DeFi accessible to everyone, regardless of technical knowledge.

🌟 Market Insight

As of writing, DeFAI’s market cap stands at $900M+, compared to $15B for AI Agents. It’s still very early. The market is catching on, and venture firms will soon pour in, fueling growth and mindshare. Strategic positioning now will pay off as this narrative scales.

🧠 Key Categories in DeFAI

1) Abstraction AI

Early abstraction AI struggled with user prompts, but improved models now execute DeFi tasks seamlessly via natural language. This could simplify on-chain actions for everyone, lowering barriers to crypto adoption.

2) Autonomous Portfolio Management

AI-enhanced insights on on-chain data are optimizing yields, with the next step being fully automated portfolio management. This combination of analytics and execution is a dream for DeFi strategists.

3) Market Analysis

Projects like @aixbt_agent lead the way in AI-driven market insights and maybe trading soon. The future will favor agents with the most trusted tools and widespread adoption. Mindshare will determine the winners.

4) DeFAI Infrastructure

Infrastructure underpins the narrative, covering platforms, wallets, data layers, and blockchains

Market Overview: DeFAI – Abstraction Layers At The Top

🟢 Top Performers according to cookie.fun dashboard

$GRIFT / OrbitCryptoAI – $113M MC (+150%)

Key Features:

USDC Transfer Agent: Combines balances across chains into one unified account for seamless payments.

Data Hooks: Automates tasks like, “Swap [x] USDC on Solana every minute until $SOL hits [x] market cap.”

With integration across 117+ chains and 200+ protocols, Orbit positions itself as the "Finance Assistant for Billions of AI Agents."

$ANON / HeyAnonAI – $245M MC (+120%)

Key Features:

Gemma: A research assistant for actionable insights from on-chain and social data.

AUTOMATE: A TypeScript framework for DeFAI, simplifying multi-step transactions.

Partnerships with major L1/L2s (Arbitrum, Base, AVAX) and a $1M USDC + 2% $ANON grant program are driving adoption and development.

→ For contract adresses, X accounts and more check cookie.fun.

Alpha 1: Grass – The AI Gold Rush Tool

Grass is building the "Google of AI," creating the infrastructure AI developers need to scale. It’s already a working product with real revenue, making it a standout in the AI x crypto space.

Why Grass Stands Out

Unmatched Dataset: Over 3 billion videos indexed, way more than NVIDIA’s 200 million.

Semantic Search: Find content by meaning (e.g., “robots picking apples”), a game-changer for AI development.

Scaling Innovation: The Scion upgrade boosts efficiency, with new hardware and horizontal scaling products on the way.

The Opportunity

AI’s shift to multimodal models means demand for specialized datasets will explode. Grass has the scale and tech to own this space, also supporting AI agents.

Grass could be critical infrastructure in the making.

→ It’s ranging in a channel since November. An entry at $2.2 would be perfect.

Alpha 2: Wayfinder — Your AI-Powered Blockchain Assistant

Wayfinder, built by Parallel, simplifies blockchain interactions with an omni-chain AI tool that automates tasks like asset transfers, contract deployment, and more. The ecosystem revolves around two tokens: PRIME and PROMPT, with PRIME caching unlocking early access to PROMPT rewards.

PROMPT Utility

PROMPT powers Wayfinder, covering fees, incentivizing activity, and securing network pathways. It’s the key token driving functionality within the ecosystem.

PRIME Caching

PRIME holders can stake their tokens for durations of 21 days to 3 years to earn PROMPT. Longer lockups offer up to 85.19x multipliers, rewarding commitment. Already, 13.5% of PRIME’s circulating supply has been cached.

→ I staked for 30 days to get a 4x multiplier and be flexible with selling PRIME in case it pumps more in Q1.

Strategy and Risks

Long-term locks can be risky due to market volatility, but splitting PRIME across different durations provides flexibility. PROMPT’s potential valuation could make these rewards highly lucrative if Wayfinder delivers.

Airdrop Strategies

1. Cache $PRIME

Why: 40% of $PROMPT will go to $PRIME cachers.

How: Cache $PRIME for different durations to earn rewards. Longer caching = higher multiplier.

Example: Cache 20% long-term (e.g., until 2027) and 80% short-term (under 90 days).

ROI Potential: Based on projections, $PRIME caching could deliver significant returns.

Cache here: Link

2. Sign Up for Early Access

Why: 1% of $PROMPT will be distributed to early access users.

How:

Sign up for early access here: Link.

Create a wallet, send crypto, and stay active once it’s live to maximize potential rewards.

3. ParagonsDAO Staking:

PDT (token of ParagonsDAO) stakers through ParagonsDAO can access 90% of the 8M PROMPT allocated to caching here.

Wayfinder could become a pivotal player in the AI x Crypto space.

Links:

Alpha 3: Solana Stablecoin Farming Opportunity with Perena

Solana’s missing piece? A native stablecoin. Perena is stepping up to fill this gap, backed by Binance and Primitive Crypto. With under $15M TVL after launch, this could be an early farming play worth watching.

Why A Solana Stablecoin?

Native Demand: Ecosystems thrive on native stablecoins. Solana lacks one, while other EVM chains like Arbitrum have success stories like $USUAL and $ENA.

Proven Leadership: Ex-Solana stablecoin lead @gizmothegizzer is building Perena, a promising signal for execution.

Early Days: $15M TVL within a month signals strong initial traction.

What is Perena?

At its core, Perena is a stablecoin swap platform with an LP token called $USD*.

$USD*: A composite LP token of $USDC, $USDT, and $PYUSD, with auto-compounding swap fees.

Pools:

Seed Pool: Simplified, earns fees from $USD* routing and arbitrage.

Growth Pools: Four pools paired with $sUSD, $USDS, $USDY, and $cfUSD for higher fee potential.

Why Farm Now?

Undervalued Opportunity: Farming at <$15M TVL is great risk-reward given the strong team and investor backing.

Fee Potential: Growth pools add layers of earning from trading volume and individual pool activity.

Perks: Using referral codes can net you bonus rewards like 100 petals.

How to Start

Visit Perena’s Seed Pool.

Choose your preferred stablecoin and deposit.

This project has the potential to become Solana’s go-to stablecoin ecosystem. Farming it early could be a high-upside play, especially if you believe in Solana’s broader growth narrative.

Knowledge Alpha: Survival Guide for Navigating the AI Agent Trenches

The AI agent ecosystem is exploding, and keeping up can feel like a full-time job. Instead of drowning in the noise, here’s your curated survival guide to who you should follow and what to read. These are the tools, voices, and resources that’ll keep you ahead of the curve and that I use on a daily basis.

Tracking the Trends

CookiedotFun: Your agent index for real-time trends. It tracks tokens, framework-specific agents, and on-chain insights. Think of it as your dashboard for clarity in the chaos.

@_kaitoai: Mindshare leaderboards and interactive dashboards to see which agents are gaining traction. Kaito also gamifies engagement with tools like the Yapper Leaderboard, driving meaningful interactions.

AI-Powered Insights

@aixbt_agent: A crypto-native AI agent built on Virtuals. It offers deep dives into project fundamentals, market updates, and M&A news. If you’re looking for an AI perspective on crypto trends, this is your go-to.

Daily Roundups

@S4mmyEth: The legend who churns out daily updates covering market trends, product news, and agent performance. A must-follow for anyone who wants the full picture without scrolling endlessly.

Project and Technical Breakdown Gurus

Project Experts: Follow @Defi0xJeff’s sharp minds for fresh perspectives on emerging agents and their long-term potential:

Technical Brains:

@jarrodWattsDev: Hands-on tutorial for building on-chain AI agents.

@0xCygaar: Breakdowns of key frameworks like AI16Z’s Eliza—perfect for understanding how the magic works.

Best Reads

For in-depth analysis and newsletters that don’t miss this:

@cot_research by @0xPrismatic: The ultimate AI newsletter with all the insights you didn’t know you needed.

And of course if you don’t have 40+ hours per week to monitor all of that, I will be on your side and help you navigate the space!

Crypto as an MMO game:

You will get daily updates on the market and my portfolio positions on Telegram

Watchlist for the Week

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps and Investment Theory

GM GM readers of Adrian’s Premium Alpha,

We were not exactly surprised by the latest dip but it hurt nonetheless. This is why we always hold stables in our portfolio!

I got some juicy alpha on trading ETH and 2 new alpha ideas for agents and DeFi farming.

Of course I’ll keep you up to date with our portfolios with all the buys and sells of the week.

Keep reading with a 7-day free trial

Subscribe to Adrian DeFi to keep reading this post and get 7 days of free access to the full post archives.