Adrian's DeFi Alpha #33: Trump x Solana Special

Definitely no financial advice, just insights based on my own journey in DeFi.

This was the most insane weekend in crypto EVER!

As a European I did not get early into any of these launches that happened during nighttime but I managed to scoop up some AI Agents on a discount.

Find out which ones in my Telegram group where we outperform in this bull market!

Hello Friend!

It feels like we’ve crossed into a new era in crypto. The Trump administration is preparing to make digital assets a “national priority.” With proposals to use confiscated Bitcoin as a strategic reserve, support “homegrown” projects like Solana and Ripple, and end de-banking of crypto companies, this shift signals that U.S.-based blockchain innovation might finally get its due. Could we see America’s next Solana moment?

For all you alpha seekers out there, here’s a tip: Follow the money! Campaign contributions, strategic partnerships, and who’s backing these initiatives could reveal the projects set to thrive under this new narrative.

Let’s get into the week’s market madness.

️ On today's Episode:

📈 Market Update

Sentiment goes wild - what happened?

Solana THE platform for Memes

Will there be an altseason?

1. Market Update

Highlighting the key developments in Crypto and their implications.

Sentiment Rollercoaster

Last week was pure crypto chaos. On Monday, Bitcoin “cycle top” chatter dominated Twitter, only for a Tuesday pump to swing sentiment bullish again. By Friday/Saturday night, as bears took over again it happened …

On January 18, 2025, $TRUMP stormed the market in classic Trump fashion—loud, bold, and impossible to ignore. His memecoin pumped 9,500% within 12 hours, hitting $2.2 billion in trading volume and minting millionaires overnight. One trader flipped $50k into $1.1M, while another turned $800 into $300k+.

Initially, Crypto Twitter suspected Trump’s account was hacked (even Elon Musk wasn’t sure), but by midnight, the rally confirmed it: Trump is officially the first president to launch a coin.

Tokenomics in Focus

Only 20% of the 1B supply is in circulation at a $13B market cap. The rest will release gradually over three years, starting after Q1.

No new tokens will be released in the first three months.

Gradual monthly releases begin after Q1, ranging from 16.7M to 33.3M coins.

Google searches are at all-time highs, trading is going wild, and $TRUMP is the only thing anyone’s talking about. It’s official: 2025 is here, and the risk-on mania is just getting started.

Is Trump Good for Crypto?

🌟 The Positives: Why $TRUMP Could Be a Big Deal

Massive Visibility Boost

$TRUMP has done what no one else could: put blockchain in the limelight like a Super Bowl halftime show. From news headlines to late-night talk shows, crypto is the hot topic, and that attention spills over into the broader space. More exposure means more adoption.Regulatory Breakthrough?

A former U.S. president backing a token is a novum. While the coin itself might be a memetic whirlwind, its existence chips away at years of regulatory fear-mongering. Suddenly, blockchain isn’t just for techies and degens—it’s a tool for public figures, corporations, and governments alike.Tokenization Goes Mainstream

Trump’s move could inspire other institutions and leaders to tokenize. Imagine universities funding research through tokens or brands like Netflix offering loyalty rewards. $TRUMP might have started as a joke, but its impact could be serious.Ecosystem Boosters

Solana’s ecosystem went on a tear, hitting all-time highs as the $TRUMP mania drove unprecedented activity. While the blockchain struggled under the demand, the spike in users and transactions could accelerate development and scalability upgrades across the ecosystem.

⚠️ The Negatives: Risks and Red Flags

Hype Over Substance

Let’s face it: $TRUMP is a memecoin. It thrives on speculation, not fundamentals. With only 20% of its supply circulating and emissions set to ramp up post-Q1, there’s a real risk of inflationary pressure crashing the party.Regulatory Whiplash

While Trump’s involvement might seem like a stamp of approval, it’s a double-edged sword. Critics already allege that $TRUMP could pave the way for money laundering or other legal gray areas.Retail Sacrifices

As always with meme-mania, someone is left holding the bag. The coin’s volatility and intense trading volume mean retail investors could be burned when the hype fades. And when it does, funds may flow back to safer assets, leaving others at a big loss.Infrastructure Woes

The $TRUMP frenzy exposed the limitations of existing blockchain infrastructure. Solana, for all its recent upgrades, struggled to handle the load. Slippage went wild, transactions lagged, and users paid steep priority fees. Mass adoption is still a dream if the tech can’t scale.

Solana: The GOAT

Solana was the platform that made it all possible. In the first 24 hours of the $TRUMP launch, Solana processed $23B in DEX volume and it did it with zero downtime.

On Sunday volume is still incredibly high, more than every other chain combined.

Solana’s comeback story is officially complete. The chain that once struggled under load is now the gold standard for performance. No scaling issues. No bottlenecks. If this isn’t enough to rerate the network, I don’t know what is. $SOL price is certainly appreciating.

The Reality of Altseason

Everyone on Crypto Twitter is hyped about the “biggest altseason ever.” Sounds nice, right? But let’s get real for a second. Back in January 2021, CoinGecko listed around 4,000 coins. By January 2025, that number increased by 300% up to 16,000 coins. Liquidity is now so fragmented that expecting every token to 5-10x like in 2021 is unrealistic.

Sure, a new altseason is likely coming (late Q1/early Q2), but it won’t compare to 2017 or even 2021. Altseasons get smaller each cycle. Why? Too many coins, predatory tokenomics, and an overwhelming number of narratives competing for attention.

And for what it’s worth … more than 5 million memecoins were launched on #1 launchpad pump.fun on Solana.

Pick Narratives That Matter

You need focus. Hot narratives like AI, DeFi-AI (DeFAI), and RWA (Real-World Assets) will likely produce the best performing altcoins. But even here, historical data warns us:

Most AI coins from early 2024 have been wrecked against BTC:

$TAO/BTC: -58%

$RNDR/BTC: -63%

$AKT/BTC: -70%

$WLD/BTC: -88%

Many of today’s hyped tokens could easily be replaced by better ones within the year so don’t marry your bags.

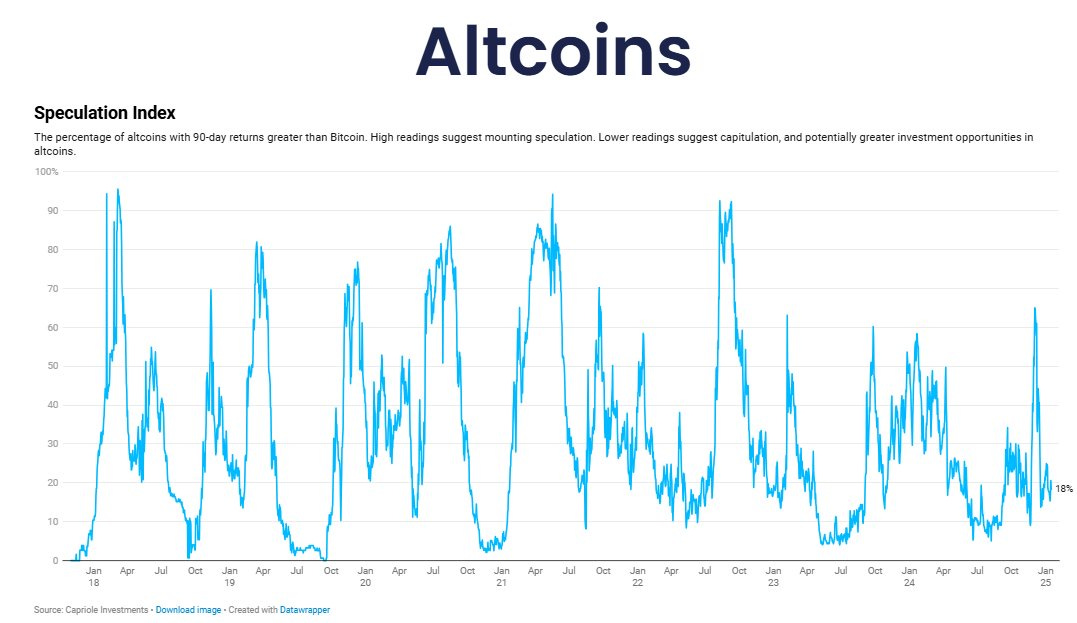

Opportunity Is Brewing

Here’s something positive for our bags and our ney buys: The Speculation Index is near historic lows. This is where fortunes are made for those who position wisely. But the key is to avoid anything with trash tokenomics and focus on quality projects with real momentum.

And if the fast-paced degen culture on Solana isn’t your vibe, take a look at Base. It’s crushing it with a thriving ecosystem and it dominates the L2 landscape.

~60% of all L2 transactions happen on Base.

3. Alpha Section

Good projects and opportunities I discovered

Delta Neutral $TRUMP Farming on Hyperliquid 🚀

If you’re looking to play the $TRUMP frenzy without getting caught in its meme-fueled rollercoaster, delta-neutral trading might be your golden ticket. Here’s the Adrian breakdown on how to earn that sweet 200% APY in funding rates while staying (mostly) sane.

The Setup: A Two-Step Tango

Buy Spot $TRUMP

Start by purchasing $TRUMP on the spot market. Whether it’s Solana or a centralized exchange like Coinbase, you’ll need the asset in hand to offset your short exposure.Short $TRUMP on Hyperliquid

Open an equal dollar-value short position on Hyperliquid. This hedges your exposure: any gain (or loss) in your spot holdings will be offset by the corresponding loss (or gain) in your short position.

Why This Works

Hyperliquid’s perpetual contracts have funding rates—fees paid between traders to balance long and short positions. Right now, $TRUMP’s funding rates are sky-high at 200% APY due to massive demand from longs. By staying delta-neutral, you’re essentially pocketing those fees without taking on directional risk.

The Math: APY Breakdown

You buy and short $10,000 of $TRUMP.

Funding rate = 0.022% per hour (~200% APY).

Earnings per hour: $10,000 x 0.022% = $2.20/hour.

Daily earnings: $2.20 x 24 hours = $52.80/day.

Annualized: ~$19,272 (minus fees).

⚠️ Warnings: Things to Watch

Funding Rates Flip

If the funding rates turn negative (more investors short than long), you’ll pay funding instead of earning it. Keep an eye on funding trends.Slippage on Spot Buys

$TRUMP’s liquidity can be volatile. Use limit orders and avoid chasing green candles, especially during high-volume moments.Liquidation Risk

While delta-neutral reduces market exposure, extreme price movements could still trigger liquidations if your margin isn’t managed properly. Maintain healthy collateral levels on Hyperliquid.

Why It’s Worth a Shot

Delta-neutral strategies let you profit from the $TRUMP hype and every other coin that is listed on Hyperliquid without needing to pick a direction. You’re effectively acting as a liquidity provider, earning income from the current imbalance between longs and shorts. It’s a low-risk way to take advantage of market inefficiencies.

Adrian’s Pro Tips 💡

Size Small: Start with a manageable amount (e.g., $1,000) to test the waters before scaling.

Set Alerts: Use tools like Hyperliquid’s notifications to monitor funding rates in real-time.

Ride the Narrative: $TRUMP mania could sustain funding for weeks, but stay nimble—if sentiment flips, so will the APY.

Delta-neutral farming isn’t glamorous, but it’s a reliable way to make the hype work for you without betting your bags on a memecoin moonshot. Stay sharp, stay hedged, and stay funded.

Links and helpful Tools

Hyperliquid: Hyperliquid Exchange

Hyperdash: Hyperdash Info

Funding Comparison: Funding Dashboard

Till next time, stay safe!

Adrian