Adrian's DeFi Alpha #34: BTC $109K Pump or Fakeout? | DeepSeek AI Rattles Tech | Solana Revenue | DeFAI Meta | Holoworld, 0G Labs & More

Definitely no financial advice, just insights based on my own journey in DeFi.

The last two weeks January brought a lot of pain. With the knowledge of this newsletter and my Telegram group we will still outperform in this bull market:

Hello Friend!

The last two weeks have been complete chaos. Bitcoin hit $109K ATH, dumped back under $100K, and is now chopping around while everyone tries to figure out what just happened. The inauguration hype turned into one of the big speculative pumps. The actual catalyst was a lot weaker than expected. Trump memecoins hijacked the entire market, regulators made noise without doing much, and Ethereum got humiliated again.

️ On today's Episode:

📈 Market Update – Bitcoin soared to $109K, then dropped below $100K in an inauguration-driven frenzy. DeepSeek AI rattled tech stocks, Solana broke revenue records with TRUMP mania, and Ethereum struggled as ETH/BTC hit new lows.

💻 Project Updates – Venice AI offers a privacy-first LLM with potential airdrops. Holoworld unveiled $AVA staking and no-code AI agents, Nillion announced $NILL and Alpha mainnet, Abstract launched with points incentives, Kaito’s Yapper targets pre-TGE, and Phantom expanded cross-chain amid a $3B valuation.

🐂 Alpha – Abstract Chain, 0G Labs, and Hyperliquid remain top ecosystems to watch, while $BUZZ and $WHISP lead AI DeFi. Agent launchpads like $VIRTUAL and $AI16Z expand, and metaverse tokens $LIMBO, $BNTY, $REALIS seek a revival.

💎 The Premium Section – Portfolio updates highlight new buys. Expect detailed takes on Holoworld’s no-code AI, Venice’s privacy LLM, and the priority airdrop checklist.

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global #crypto market cap today is $3.70T, a 0.89% change in the last 24h. Total trading volume in the last 24h is at $153.6B.

→ Another bad week especially for altcoins. But a good opportunity to buy the dip.

Prices and Coins – The Inauguration Liquidity Squeeze

BTC had one of the most ridiculous moves in months. It nuked from $106K to sub-$100K after the $MELANIA memecoin launch, only to rip straight to a new ATH at $109K in the middle of the night. The market decided that someone knew something, and price-insensitive buying took over. That exact pattern repeated multiple times, with pumps fueled purely by anticipation of some big Trump-related announcement, only for BTC to bleed right back down after nothing materialized.

Altcoins took a much bigger hit. The Chinese AI model DeepSeek spooked U.S. markets and crushed tech stocks, with NVDA dropping -15% in a day, which became the perfect excuse for a broad sell-off.

BTC found support at $98K and bounced to $105K, but alts kept getting hit, especially in the aftermath of the Trump memecoin launch.

The $TRUMP launch on January 18 drained every other Solana token. The first reaction was disbelief, with people assuming Trump’s account was hacked. Once it became clear that this was real, liquidity flooded into the coin instantly, nuking everything else on Solana as traders dumped their positions to ape. $TRUMP ran from $1B FDV to $75B in 12 hours, completely wiping out smaller memecoins in the process. The tokenomics are pure garbage, with 80% of supply going to insiders, but that didn’t matter. The move got even crazier when short sellers started fading it, only to get squeezed into oblivion.

$MELANIA launched two days later and turned into the ultimate rug. $TRUMP nuked -50% in 3 hours, BTC dumped from $106K to sub-$100K, and SOL crashed from $280 to $230 as the entire market panicked. $MELANIA peaked at $13B FDV before dying instantly and is still bleeding lower. $TRUMP is down to $27B FDV from its $75B peak and looks dead.

The only memecoin that held up was $FARTCOIN, which somehow kept its momentum. It topped at $2.7B, then collapsed -72% but is still outperforming most of Solana’s meme sector.

⚖️ Regulation: Trump’s Executive Order Did Nothing, Yet

The market spent some days waiting for Trump to confirm some sort of pro-crypto stance. On January 23, he finally signed an Executive Order on crypto, and the initial reaction was bullish. That excitement died fast once people actually read it. The order created a Digital Working Group that will spend months making recommendations for potential legislation. No direct policy change, just a committee.

There were other major policy shifts though:

The U.S. may eliminate capital gains tax for crypto projects based in the country, while foreign projects could face a 30% tax. That would be a massive shift, with U.S.-issued tokens attracting way more money, but it’s still unconfirmed.

The SEC’s new Crypto Task Force is now led by Hester Peirce, aka “Crypto Mom.” She’s one of the only people in U.S. regulation that actually understands crypto, so this could finally lead to some reasonable policies.

The Tornado Cash case got overturned, which is a big win for privacy and decentralization. Ross Ulbricht got pardoned, which was something most people never expected to see happen. The executive order also put limits on CBDCs, which is good news for stablecoins and crypto-native solutions.

SAB 121 got axed, which removes a huge regulatory blocker for banks to offer crypto custody. Expect more institutional involvement.

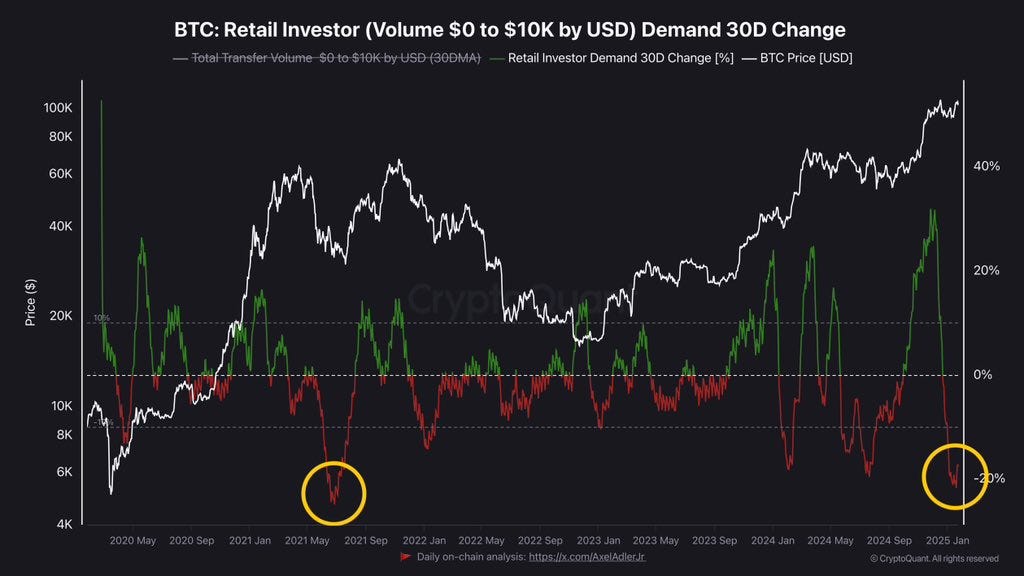

Retail is still out of the market and retail interest just hit a 3-year low. This was the most pro-crypto policy week in history, but crypto still sold off because positioning was too fragile.

🚀 Solana: The Only Chain Winning Right Now

Solana was the biggest winner from all of this. The chain’s ATH at $295 came right after the $TRUMP launch, proving just how much money memecoins can bring into the ecosystem.

The move was fast and aggressive, with SOL/ETH pushing to 0.09, but the market might be overstating the importance of Trump launching on Solana. The reality is that Solana is the memecoin chain, and any high-profile memecoin was always going to launch there.

The revenue numbers were the real confirmation. Solana’s app revenue revenue surpassed Ethereum’s by multiples ($18.1M vs $3.5M).

And there are more bullish market moving news on Solana:

JupiterExchange acquired a majority stake in Moonshot, which makes buying Solana coins as easy as using Apple Pay.

Pumpdotfun almost made $500M revenue now, which is absurd for any crypto protocol, let alone one built entirely around memecoins.

Meanwhile, Ethereum continues to struggle. ETH/BTC made new lows at 0.03, with more people abandoning “.eth” usernames. The founder of Lido announced a “Second Foundation” for Ethereum, but details are unclear. Vitalik bought a Milady and is now in war mode on Twitter. The desperation is real. ETH/BTC has been a brutal trade for months, and this might be the final capitulation, but nobody wants to be the guy trying to catch the bottom on it.

→ We are at the March 2021 level now and afterwards ETH/BTC saw a 192% pump. History doesn’t repeat but ETH might be a contrarian play with serious asymmetric upside. I am still holding.

2. Project Updates

What dApp and project updates you need to know in the fast-paced world of crypto

Venice AI is a privacy-first LLM with free queries for stakers of their new VVV token. Operates in direct competition with ChatGPT but without data collection. If open-source AI demand spikes, $VENICE might snag more devs and user adoption. Claim your airdrop if you held agents / VIRTUAL on Base or used the application.

Holoworld launched a new staking pool for $AVA. Early stakers earn potential perks, including ‘maximum benefits.’ Their agent launchpad also went live with no-code creation tools.

Nillion (Blind computer) announced a $NILL airdrop for community participants. Alpha mainnet is on the horizon

Tao watchers anticipate the dTAO launch around Feb 10, fueling Bittensor DeFi expansions and subnets. Price action suggests renewed interest

Kelp teased its $KERNEL TGE & airdrop.

Azuki is airdropping $ANIME to certain NFT holders.

Solv launched a $SOLV airdrop claim for Solv Points holders.

Abstract is launched mainnet, introducing a points-based incentives program.

Kaito unveiled Yapper Launchpad. Pre-TGE projects can compete for a Yapper Leaderboard slot. Start earning here.

Phantom raises $150M: Some say its $3B valuation is justified by Solana traction. Cross chain swaps and SUI integration were just announced.

3. Alpha Section

Good projects and opportunities I discovered

Ecosystems to Watch

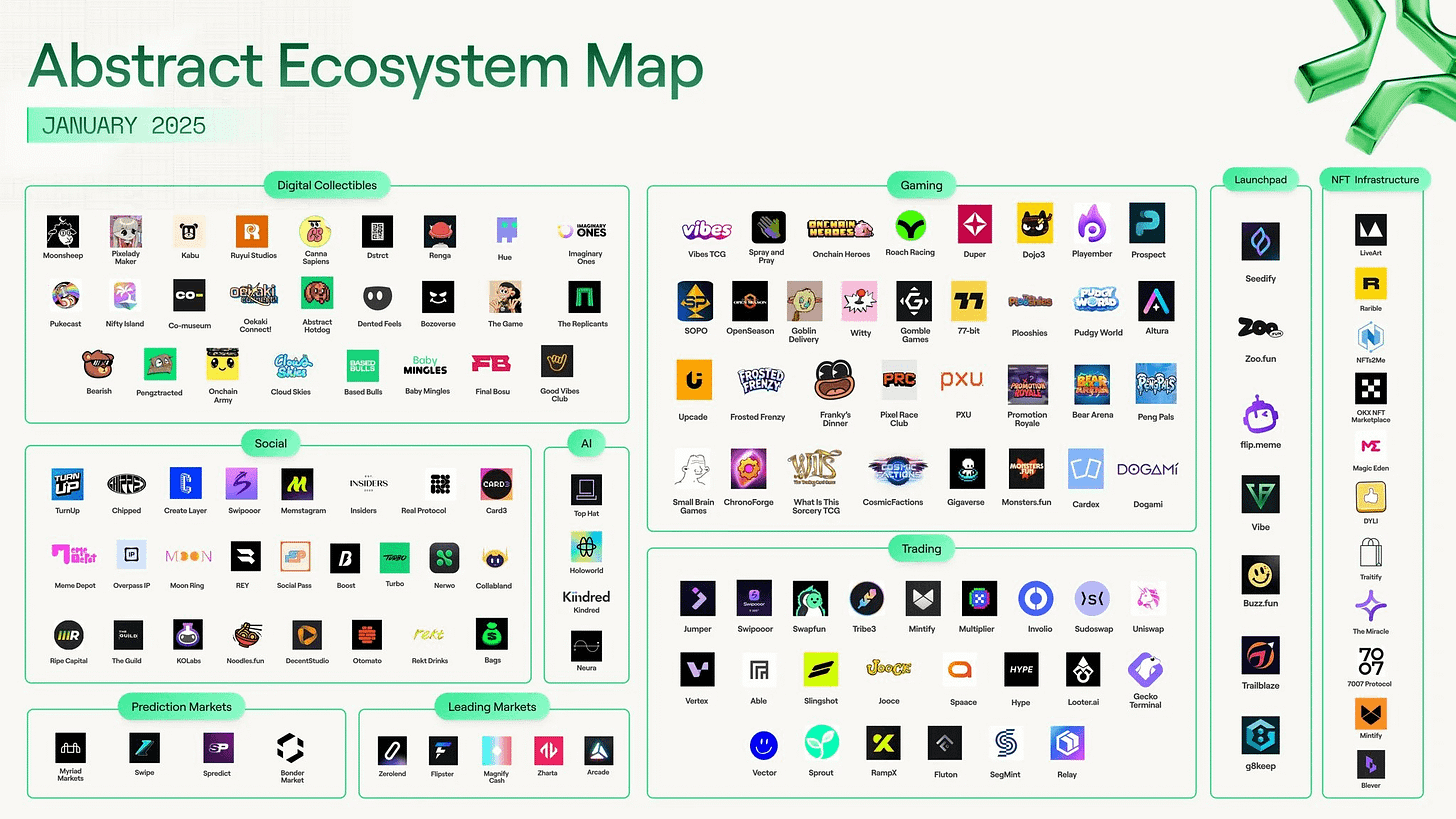

1. Abstract Chain

Abstract Chain is a Layer 2 built on Ethereum, designed for consumer-facing dApps at scale. It’s developed by Igloo Inc.—the same folks behind Pudgy Penguins. It just launched mainnet, and they’ve got a points program plus dApps that already show strong adoption. Easiest way in? Try out their apps, claim points, and track the ecosystem’s launch.

→ Here’s a good guide how to get started!

2. 0G Labs

0G aims to be the foundational layer for decentralized AI, giving users real data control and fair monetization. Its deAIOS operating system is at the core. They’re racing toward a mainnet launch as well, with multiple apps in the pipeline. If you think a dedicated AI Layer 1 can grow fast, 0G could be the one to watch.

→ Check out the testnet here!

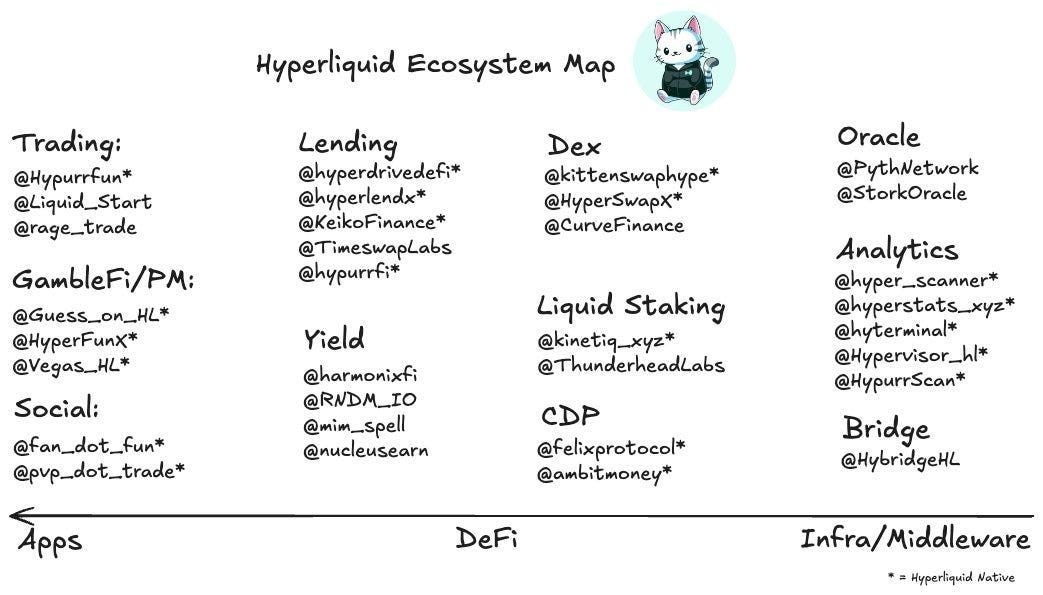

3. Hyperliquid

If you’re into derivatives trading, Hyperliquid likely rings a bell—they just hit $24B in 24-hour volume, and their airdrop was huge. They’re rolling out HyperEVM and their own Layer 1 soon, which could mean further incentives or a second wave of rewards. Keep trading or stay active to get exposure—there’s another airdrop rumored for engaged users.

→ I am watching three projects on Hyperliquid. Check them out for alpha!

FLY

LIQD

FARM

If you are new to Hyperliquid. Here’s a list of all the resources and tools you might need:

Hyperliquid Resources & Tools

Trading Bots & Sites

Hfun (PumpFun for HL): HypurrFunBot

HypurrFun Launches: Launch Dashboard

PvP Trade (Long/Short on TG): PvP Trade

Tracking Bots & Charts

HL Price Bot: Hyperliquid Price Bot

Whale Alerts: Whalecatalerts

Hypurr Bot: HypurrBot

Token Charts: Dexscreener for HL

Explorers

Hypurrscan: Hypurrscan.io

Hyperliquid Explorer: Hyperliquid Explorer

Hyperscanner: Hyperscanner.app

Tools & Analytics

ASXN Analytics: ASXN Data Hub

Hyperdash: Hyperdash Info

Purrsec: Purrsec Testnet

Funding Comparison: Funding Dashboard

Chrisling Tool: Chrisling Tool

AI Corner & Agentic Projects

The rise of AI agents continues despite the recent market rollercoaster:

DeFAI Tokens to Watch

@askthehive_ai / $BUZZ Hive has been gaining solid price action and mindshare, recently winning first place in the @sendaifun Solana AI Hackathon. The team ships features daily, including an AI-enabled token dashboard to analyze charts, holders, bubblemaps, and more—right inside Hive.

@whispersai / $WHISP A new abstraction layer that lets you create a Solana wallet directly from an X (Twitter) account, sending crypto to anyone on X—even if they don’t have Whisp. They’re pushing a mobile-friendly approach, aiming to be “ChatGPT + Venmo” for Solana.

Solana AI Hackathon Winners:

The Solana AI Hackathon, organized by SendAI, concluded after 15 days of competition. Over 400 projects were submitted, resulting in 21 winners sharing over $275,000 in prizes.

I see a lot of alpha here as all these teams seem to have working products with some product market fit at least. It pays to check them.

Key highlights include:

Main Track: The Hive won $60,000 for the best overall project, focusing on composable on-chain AI agents for DeFi tools. FXN took second place with $30,000 for their autonomous agent economy connectors, and JailbreakMe secured third with $20,000 for an AI security platform.

Solana Agent Kit Track: Top 5 integrations each received $3,000. Winners included

Agents Infra Track: AgentiPy won $15,000, followed by Neur with $7,500, and zk_agi with $5,000.

Autonomous Chat Agents Track: FomoFactory took first with $10,000, and AIasssss came in second with $5,000.

Meme Agents Track: Awe () won $10,000, and Rogue Agent () received $5,000.

Social and Influencer Agents Track: daVinci_AI won $10,000, with gigaisol taking $5,000.

Agent Token Tooling Track: DungeonDotCash won $15,000, and Agent Accelerator took $5,000.

DeFi Agents Track: Cleopatra won $15,000, Voltr received $7,500, and Xcombinator got $5,000.

Trading Agents Track: Project Plutus won $15,000, and BoltTrade received $5,000.

Agent Launchpads

$VIRTUAL keeps expanding with a 30-day buyback & burn program, plus a new Solana integration.

$AI16Z focuses on v2 tokenomics and a $10m founder acceleration initiative with JupiterExchange.

Both aim to become top-tier distribution networks for AI agents and might offer strong R/R after the recent price dips. DCA is the way.

Agentic Metaverses

This remains one of the most promising verticals in my opinion, but the top leaders have taken quite a big hit in PA and mindshare:

$LIMBO pumped ~75% post-rebrand to “Youmio,” teaming up with Virtuals and Sovrun to integrate 3D agent-based gameplay.

$BNTY, $REALIS, $HYPER remain down from all-time highs, but any agent revival could reignite interest in these metaverse projects.

Additional Nuggets

DeFi Agents are emerging to automate yield strategies, cross-chain bridging, or portfolio management. Tools like Amplifi, QuillAI, and Eliza frameworks are stepping in.

Rei Terminal Alpha Version Release:

Rei Network (@ReiNetwork0x) announced the release of the alpha version of Rei Terminal for $REI holders. This terminal serves as a quant/assistant, providing market insights, comparative analysis, token deep dives, and more. This development aims to enhance the analytical tools available to $REI holders, offering them advanced functionalities to navigate the market more effectively.

Solana DeFi environment could see a slow grind higher (JUP, KMNO, RAY, JITO etc.).

You will get daily updates on the market and my portfolio positions on Telegram

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps and Investment Theory

GM GM readers of Adrian’s Premium Alpha,

Some turbulent weeks but I’ve got some nice ideas which dips to buy. This is why we always hold stables in our portfolio!

Of course I’ll keep you up to date with our portfolios with all the buys and sells of the week.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.