Adrian's DeFi Alpha #35: Berachain Special

Definitely no financial advice, just insights based on my own journey in DeFi.

Henlo and Ooga Booga Friend! The Beras Have Arrived 🐻🔥

Berachain officially launched today, February 6, 2025. After months of teasing “Q5” and locking in over $3.1 billion before a single transaction hit the mainnet, it’s finally here.

A Proof-of-Liquidity (PoL) L1 is no longer just a concept—it’s live. And the market (and I) wasted no time in testing it.

️ On today's Episode:

The Launch - A success?

Fundamentals of Berachain - A three token model

Projects to explore

Alpha on the chain

1. 🚀 What Happened on Launch Day?

Pre-market NFT trading had Berachain valued at a $3B FDV. But within hours, it spiked to $7B before settling at $3.8B.

Big players were ready: Binance, Coinbase, Upbit, and Bybit all listed $BERA immediately.

It wasn’t a flawless launch, though.

🛠️ Issues:

NFT bridge delays lead to Users having to refresh multiple times before seeing their holdings.

Trezor users couldn’t claim the airdrop due to oversized signature messages. The fix? Moving their NFTs to a hot wallet first.

Despite some hiccups, trading and liquidity incentives are already in motion. And this is where Berachain stands out.

Most chains treat liquidity as passive TVL—just money sitting in pools. Berachain flips the script: Liquidity = consensus. If validators want to earn, they need real, active liquidity.

This brings us to the three-token economy that forces users, apps, and validators to compete—or get left behind.

2. 🐻 Fundamentals – The Three-Token Model

Berachain’s economic system is built around liquidity, not just staking.

$BERA – The network token, used for gas fees, staking, and securing the chain.

$BGT – The governance & emissions token (non-transferable). Earned by staking or providing liquidity.

Boosts validator rewards, governs emissions, or can be burned 1:1 for $BERA (but NOT the other way around).

$HONEY – The chain’s fully collateralized stablecoin.

Most Proof of Stake chains like Ethereum reward passive stakers. Berachain prioritizes liquidity providers and dApps instead. $BGT emissions don’t just go to validators—they flow to active participants.

In theory, this creates a competitive market for liquidity instead of the usual “biggest validator wins” model.

🔥 How Proof-of-Liquidity (PoL) Works

Berachain’s economic flywheel looks like this:

1️⃣ Users stake $BERA or provide liquidity → They earn $BGT

2️⃣ Validators need $BGT to earn block rewards → They must attract liquidity providers to delegate $BGT to them

3️⃣ Liquidity providers get paid first → Rewards go through Berachain’s vaults, where dApps compete to attract liquidity

4️⃣ $BGT can be burned for $BERA (1:1 ratio) → If too much $BGT circulates, users can burn it for $BERA to balance emissions

This forces validators, users, and dApps to compete and collaborate. More liquidity = higher earnings. No more deadweight staking.

🚨 Risks to Watch

Inflation pressure – Since BGT can be burned 1:1 for $BERA, sell pressure is a real concern. If demand doesn’t keep up, $BERA’s price could struggle.

Validator centralization – Originally, PoL assigned block production randomly, but a last-minute change favored those with more staked $BERA. Insiders could gain disproportionate control.

Sustainability of PoL – If liquidity incentives dry up, will validators and users stay engaged? Many yield-driven ecosystems see capital inflows early, but retention is the real test.

Liquidity risks for new dApps – Many Berachain protocols rely on pre-launch deposits and grants. If incentives weaken or competitors offer better rewards, TVL could migrate elsewhere.

Supply overhang concerns – While most liquid supply is vested, unlock schedules should be monitored (1 year from now) to avoid sudden sell pressure.

🧐 My Take

Berachain is a high-risk, high-reward ecosystem. If PoL works, it could redefine staking incentives. If it doesn’t, it risks becoming just another liquidity mining farm that fades as rewards dry up.

Tokenomics – Who Gets What Amount?

Genesis Total Supply: 500M BERA

Initial Core Contributors - 84,000,000 (16.8%)

Investors - 171,500,000 (34.3%)

Airdrop - 79,000,000 (15.8%)

Future Community Initiatives - 65,500,000 (13.1%)

Ecosystem & R&D - 100,000,000 (20%)

Max Supply: Non-capped (10% annual inflation)

Marketing Reserve: 5M $BERA (to be distributed in batches 12 months post-spot listing)

Circulating Supply at launch: 107.48M BERA (21.5% of genesis supply)

Initial Unlock: After a one-year cliff, 1/6th of allocated tokens are unlocked

Linear Vesting: The remaining 5/6ths of tokens vest linearly over the subsequent 24 months

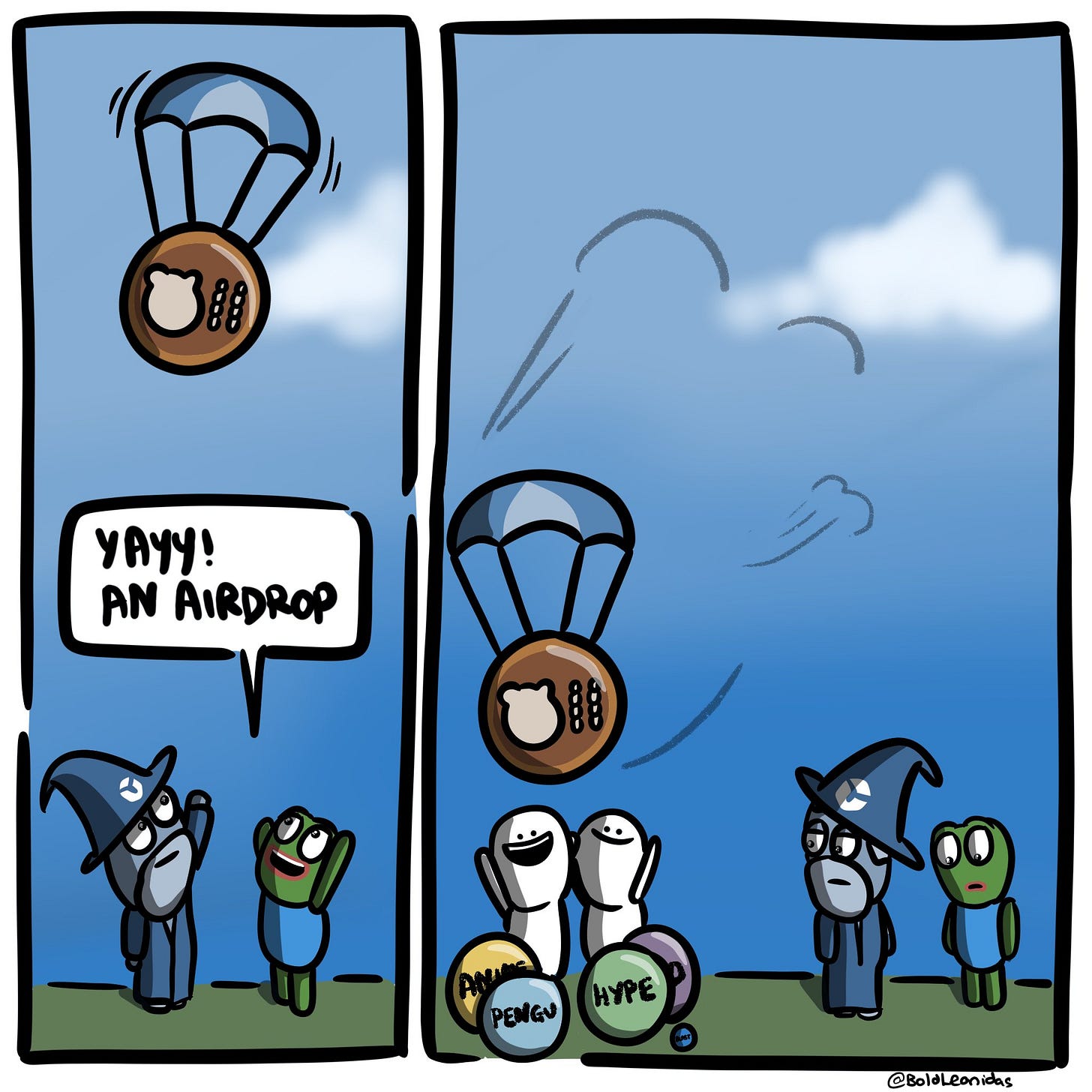

🪂 The Airdrop – Did You Get BERA?

Airdrop claims went live at checker.berachain.com. If you participated in:

Pre-launch vaults

Boyco liquidity bootstrapping

Or you created social media content / were active on Berachain Discord

You might have $BERA waiting for you. Boyco claims start at February 10th

For the wider ecosystem airdrops BeraLand created a nice airdrop checker:

3. Projects – What’s Actually Live on Berachain?

Unlike most L1 launches, Berachain already has an ecosystem fighting for liquidity.

🔥 Live dApps:

Oogabooga (DEX aggregator - like Jupiter on Solana)

Infrared (Liquid Staking Platform for BGT)

Kodiak (Berachain’s Native DEX)

Goldilocks (Novel DEX and Lending Platform)

Marginal (Permissionless Markets - With Leverage)

Beradrome (Restaking and liquidity marketplace)

Henlo (Meme coin)

Beraborrow (Instant Liquidity, Infinite Opportunities)

HoneyJar (Community NFT project)

And many more over at - https://www.berachain.com/#ecosystem

More projects will launch as incentives roll out.

4. Alpha and Investments

How to get onchain:

Bridge some ETH / USDC to Bera via the official bridge (use Arbitrum, it’s cheap)

Bridge some ETH into Bera (u need it for gas fees) directly via Symbiosis

Provide liquidity:

Only a few pools will have BGT emissions on day one:

These will be hosted on Berachain Hub (Berachain Native DEX)

💵 HONEY: The Stablecoin Flywheel

Berachain’s stablecoin, $HONEY, is fully collateralized with USDC and USDT, making it a safer alternative to algorithmic stablecoins.

Mint directly with a 0.5% fee (not recommended, could be cheaper on a DEX)

Borrow it on BEND using staked assets

$HONEY pools will earn BGT emissions, making them prime targets for stablecoin yield farming.

→ Link

💰 Liquid Staking for BERA: Passive Yield Opportunities

Infrared offers liquid staking products: iBERA, gBERA, and fatBERA allow auto-compounding $BERA rewards. Instead of manually restaking, these options reinvest yield automatically.

Converting $BERA into liquid-staked assets can maximize long-term gains.

→ Link

🛠️ Early Grants & Farming Incentives

Berachain’s Request for Broposal (RFB) grants reward early users of native dApps. Participating in Berachain projects now could lead to future airdrops.

Potential airdrop targets:

🌊 Leveraged Farming & High-Yield Plays

Later today or this week Dolomite will launch Leverage Farming

Deposit PoL-eligible assets → Stake them → Borrow against them for leverage

Looping borrowed liquidity into LPs could maximize BGT emissions

KodiakFi: Concentrated Liquidity & Memecoins

Berachain’s biggest DEX & memecoin launchpad

Pre-deposit vaults are full, meaning TVL will skyrocket on launch

Expect high APRs in early pools

🛠️ Token Launchpads: New Berachain Projects Incoming

Ramen Finance & Fjord Foundry will host IDO-style token sales for native projects.

Ramen is special. It’s a launchpad with fixed price sales and price discovery sales. Many hyped launches are lined up from day 1. Need to stake tokens to get lottery tickets to participate

Early project launches = Potentially one of the best entry points for new tokens

→ Some interesting token launches collected by my fren Lambro.

📊 Advanced DeFi Plays on Berachain

ivx_fi: Options Trading

Berachain’s first short-term options trading platform for high-frequency traders

Beradrome: LP Yield Farming

Earn token emissions by depositing LPs or staking receipt tokens

Origami_fi: Tokenized Automated Leverage

Early users are flooding vaults, signaling high demand for leveraged strategies

🤖 Trading Bots & High-Risk Plays

KodiakFi’s Panda Bot

Memecoins will be big on Berachain, and these bots help traders snipe new listings

High risk, high reward for those who trade aggressively

→ Link

📢 The Early Berachain Meta

Right now, the focus is on BGT accumulation and liquidity incentives.

What I am doing right now

Farm BGT early in BEX-approved pools

Stake BGT into liquid staking platforms (iBGT, LBGT)

Use HONEY for stablecoin yield farming

Farm KodiakFi

→ Some more ideas what to do on Day 1 from Waj, who is building on Berachain

🐻🔥 Berachain’s PoL model could redefine staking incentives. If it works, this might be one of the biggest L1s of the cycle. We needed some incentive in the current bad altcoin market. Berachain could exactly be the interesting new DeFi Play to survive till we see a better market sentiment.

📉 Final Thoughts: Hype vs. Reality

Berachain executed a strong launch. Exchange listings were smooth, liquidity incentives are active, and the network is already seeing real transactions.

But the long-term sustainability of PoL, inflation risks, and validator control remain open questions.

The real test starts now.

Either way—the beras are here. 🐻🔥

Till next time, stay safe!

Adrian