Adrian's DeFi Alpha #38: Ceasefire Yields, Bera's Hidden Points & dTAO Explained

Definitely no financial advice, just insights based on my own journey in DeFi.

The market is dipping but the bull market is likely not over yet! With the knowledge of this newsletter and my Telegram group we are outperforming in this bull market:

Hello Friend!

The harsh truth – I roundtripped a good amount of profits in the past 6 weeks. While January was expectedly rough, February was supposed to be bullish for ETH and altcoins. Instead of our bags pumping, we got celebrity shitcoins, tariffs, a $1.4 billion exchange hack, and billions in liquidations.

But here's the thing about crypto: Winter always feels like it'll last forever – until suddenly it's spring again. We're seeing signs of thawing ice with commodity prices dropping on geopolitical shifts, China eyeing stimulus, and some incredibly juicy yields and new opportunities popping up on chains like Berachain and Bittensor.

️ On today's Episode:

📈 Market Update – Geopolitical impacts on crypto, flows, and where we go from here

🐂 Alpha Section – Bera's hidden yields & the dTAO revolution explained

💎 The Premium Section with deep dives into Berachain's ecosystem

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

A sea of red …

Geopolitical Impact on Markets

The winds of war are shifting, and markets are taking notice. Jeffrey Sachs, Trump, Pete Hegseth, and John Mearsheimer are all signaling that the Ukraine war is basically over or ending soon.

This has major implications for commodities – particularly oil and wheat, which could be shorts in this environment.

The Gaza ceasefire is likely to bring oil prices down further, especially as the IDF isn't optimized for a long ground war. Trump's administration seems to favor less conflict, which should benefit inflation metrics overall – good news for both Trump and the Fed.

Yields have been pricing this in, with the 2-year, 10-year, and 30-year all trending downward for over a month.

Trump and his economic advisor Bessent are particularly focused on the 10-year yield as they shift policy toward cutting government spending and driving growth via private enterprise rather than fiscal stimulus.

The tl;dr: All of this should bring inflation down long-term – good for our bags. Short to medium term (several months), things will remain chaotic and volatile as the market figures out what it all means.

China appears to be starting another round of stimulus, which is typically bullish for risk assets. And the US Treasury General Account is being drawn down – also net positive for global liquidity and could mitigate the tax season drain we saw last year.

Where Do We Go From Here?

The good news is that we might finally be close to a local bottom after the recent market bloodbath. Multiple bottom signals are starting to fire off:

The Crypto Fear & Greed Index is at its lowest point since 2022

Bitcoin ETFs have recently seen very large outflows (which marked a local bottom several times in the past)

Altcoin liquidations have significantly decreased lately

However, Trump's recently announced trade tariffs seem to be one of the primary reasons for this dip as they caused a lot of market uncertainty. If new tariffs continue being announced in the next few weeks, this could cause some additional selling pressure.

What I'm doing right now:

Rebalancing my portfolio - On red days, the market shows its hand. If a token has been underperforming for weeks without catalysts, it might be time to cut it loose

Putting my money to work - Yield farming is the perfect way to keep growing your crypto portfolio regardless of market conditions

Paying attention to relative strength - $KAITO is a recent good example – it held up well during the BTC dip and pumped straight to new ATHs afterward

Back to fundamentals - Tokens with buybacks and strong revenue are back in demand. Think: HYPE, JUP, MKR

A big mistake to avoid: catching falling knives. Just because a token has dropped a lot and seems 'cheap' doesn't mean you should buy it. It's generally cheap for a reason.

The Top Isn't In Yet – Here's Why

While BTC's two major catalysts (ETF launch and Trump's inauguration) have already materialized, I believe we haven't seen the cycle top. Here's my bull case:

The USD Index (DXY) is following a pattern remarkably similar to the 2017 cycle – historically a perfect setup for risk assets. Meanwhile, global money supply forecasts still project stronger increases throughout 2025, providing fuel for the next leg up.

Our recent correction, though painful, remains well within the normal range of what we experienced in previous cycles – actually milder than 2017's mid-cycle pullbacks.

And while the ETF and inauguration are behind us, the real impact of the pro-crypto administration will take time to materialize as policies get implemented. The Trumps themselves continue accumulating, suggesting confidence in what's coming.

The absence of an immediate catalyst doesn't mean we've peaked. A US National Bitcoin Reserve is being "evaluated" according to the White House's AI and crypto czar – and that's just one potential development on the horizon. With BlackRock's CEO publicly advocating for Bitcoin and major financial institutions exploring crypto integration, the foundation for long-term growth has never been stronger.

This cycle still has room to run, but the next months will be choppy and it won’t be as easy to make 10x like in previous cycles. We might have to be content with 2x.

🌊 Where’s the Money Flowing?

As for flows, capital isn't rushing into Solana at the aggressive rate we saw previously, but Sonic's ecosystem continues growing in value as it enjoys a local DeFi bull market. For DeFi enthusiasts who've been starved of action, those juicy APRs are worth exploring while they last.

2. Alpha Section

Good projects and opportunities I discovered

Alpha 1: Bera High Yield: The Hidden Vault Strategy

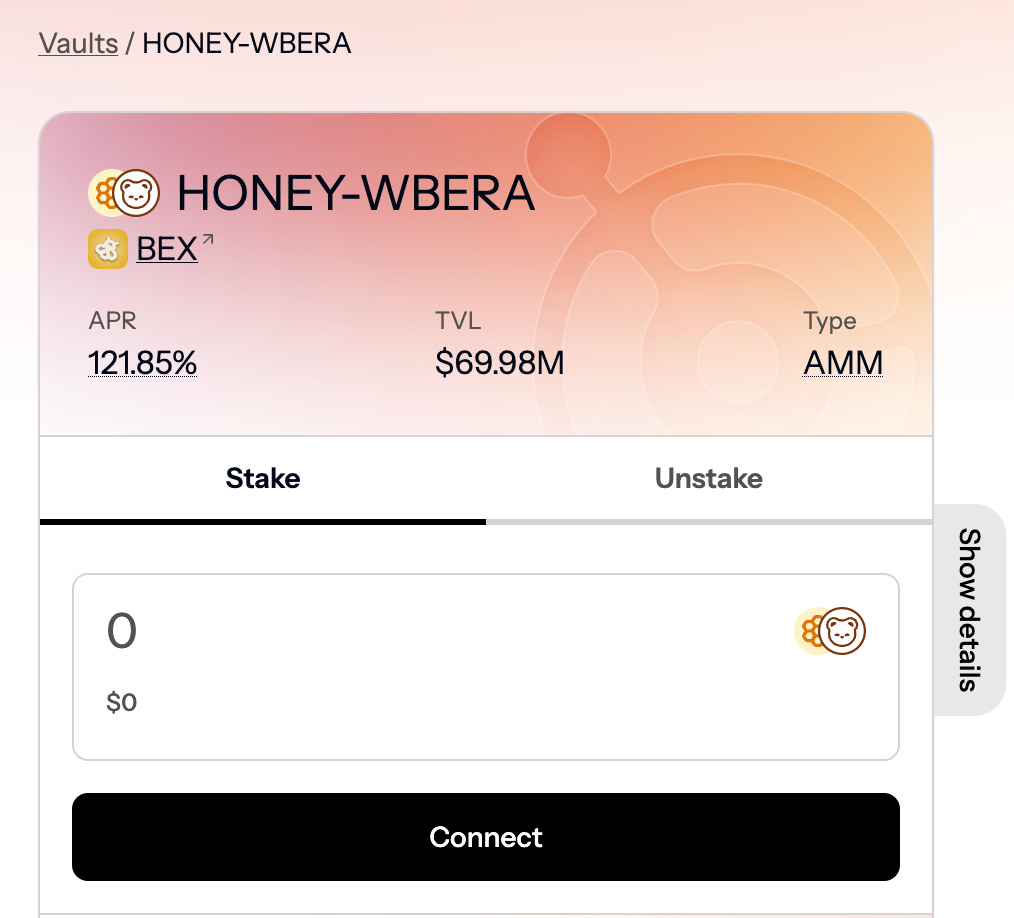

I'm mostly in this Infrared vault at the moment: HONEY-WBERA on Infrared Finance

It's offering an insane 121% APY, paid out in iBGT, which in turn can be staked for another 132% APY.

BGT is the Bera governance token, loosely pegged to BERA. iBGT is the Infrared liquid staking token. There are also rumors of a hidden points system on Infrared.

With this strategy you:

Have 50% exposure to stables

Earn 121% APY on your position, compounding – claim rewards whenever you like

Stack iBGT rewards and stake for another 132%, paid out in HONEY (stablecoin)

Likely earn points for the upcoming Infrared token drop

Support a platform with one of the highest RFA allocations for Berachain incentives

Alpha 2: The dTAO Revolution: Bittensor's Game-Changing Upgrade

On February 14, 2025, Bittensor launched its dTAO update, fundamentally shifting power from top validators to the open market. This might be the most important upgrade in Bittensor's history, and yet many people still don't understand it.

Why dTAO was needed:

The old Bittensor system had several issues:

Validator Bottlenecks: Top validators couldn't fairly assess the growing number of subnets

Conflicts of Interest: Validators often assigned higher weights to their own subnets

Poor Coordination: Stakers had no direct say in which subnets received emissions

The Update:

With dTAO, emissions are no longer assigned through validator weightings. Instead, TAO emissions flow through a market-driven system using subnet tokens (Alpha tokens):

Each subnet now has its own Alpha token

Alpha token price reflects market demand for a subnet

Higher Alpha price = more TAO emissions to that subnet

Lower Alpha price = fewer TAO emissions

This creates a self-regulating ecosystem where capital naturally flows toward the most productive subnets.

The Timeline (So Far):

Right now, we're in the early stages of dTAO:

Root (Subnet 0) is still dominating emissions because Alpha tokens are scarce

Root stakers are enjoying high APRs

As more Alpha tokens enter circulation, influence will shift away from Root

In approximately 100 days, TAO emissions to Root are expected to reach parity with subnet Alpha tokens

How Alpha Works:

Every block, each subnet mints 2 Alpha tokens (double TAO's rate)

Alpha emissions drop as token prices increase

Each Alpha has a hard cap of 21 million tokens

Each subnet operates an AMM pool where TAO is paired with Alpha

When you stake TAO into a subnet pool, you receive Alpha at the current market price

What's Happened So Far:

All subnet token pools started with just 1 Alpha / 1 TAO – the definition of a fair launch. In the early hours, some subnets soared to 5-10 TAO/Alpha, driven by speculators, while others stayed below 1 TAO.

But these price spikes likely won't last because:

Many newly minted Alpha tokens are automatically sold to pay Root stakers

Miners and validators are earning Alpha faster than TAO and will swap back to cover costs

There's extremely high inflation on subnet Alpha tokens in the early days

How to Get Subnet Alpha Tokens:

Research subnets (look for real utility, active communities, and strong miner participation)

Get a Bittensor wallet (the official Chrome extension from OpenTensor Foundation works well)

Stake TAO for subnet tokens using platforms like Taostats.io

Be cautious of slippage – most subnets still have low liquidity

My Take on dTAO:

The most exciting part of dTAO is that it's forcing everyone to actually research what each subnet is building. There's real alpha in doing the research – which wasn't necessary before when you could just buy TAO and call it a day.

Many subnets are led by technically skilled teams with deep AI expertise, tackling everything from AI model development to scientific research on protein folding. They're at different stages of development, with some still building miner communities while others are generating valuable outputs and securing commercial partnerships.

For those uncomfortable with the subnet frenzy, you can keep your TAO staked on Root for the next couple of months. The APR will drop over time, but it's still respectable.

dTAO isn't perfect. Manipulation is still possible, and scaling to 1,000+ subnets creates new challenges. But it's a major step in the right direction.

TAO initially gained good momentum and now sold off. Not a bad time to start accumulating.

You will get daily updates on the market and my portfolio positions on Telegram.

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

Some agents start to come back and we are seeing a slight recovery in the market.

Let’s find out which Agentic Investment DAOs have potential in this weeks premium.

And as always, I’ll keep you updated on our portfolios.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.