Adrian's DeFi Alpha #40: BTC Dominance Peaking, Alts Awakening: Rotation Time

Definitely no financial advice, just insights based on my own journey in DeFi.

We are back with the best DeFi plays in 2025.

Hello Friend!

If someone told me a few years ago that in 2025 BTC would be at $110K and most alts would still be underwater… I would’ve said: “lol ok buddy.”

Yet here we are.

And honestly? What a wild ride. Big congrats if you positioned for this — you deserve your big win.

But this is what’s bothering me lately: People are FOMOing into BTC now, while rage quitting alts. That’s backwards.

Yes, Bitcoin probably still goes higher. But from a pure ROI perspective? It’s not where the real upside is anymore. A 2x from here (maybe) isn’t changing anyone’s life.

Meanwhile most altcoins are still miles away from their previous highs. Risk/reward looks juicy, especially with BTC dominance peaking and sentiment still low and no euphoria or big interest on the horizon.

When the crowd starts chanting “only BTC pumps” and “altseason is dead”… that’s usually your cue to rotate. We’re getting real close to that pivot point.

So if you’ve been holding altcoin bags through the pain — don’t exit now. This is when it finally starts to get interesting.

️ On today's Episode:

📈 Market Update – BTC Tops Quietly, Alts Warm Up, Smart Money Rotates

🐂 Alpha Section – InfoFi’s Rise, Hyperliquid Farming, Kamino Leveraged Yields

💎 The Premium Section with my deep dive on another InfoFi project

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles.

→ Some of our favorite positions are up a lot in the last 7 days. Glad to finally see outperformance compared to BTC again.

Bull or Bear - What indicators tell us

Bitcoin has slightly corrected from its ATH. Was that it? Is now the time to exit? I personally took some profits but remain invested. From my perspective, there's a lot speaking for further rising prices. Here are the facts:

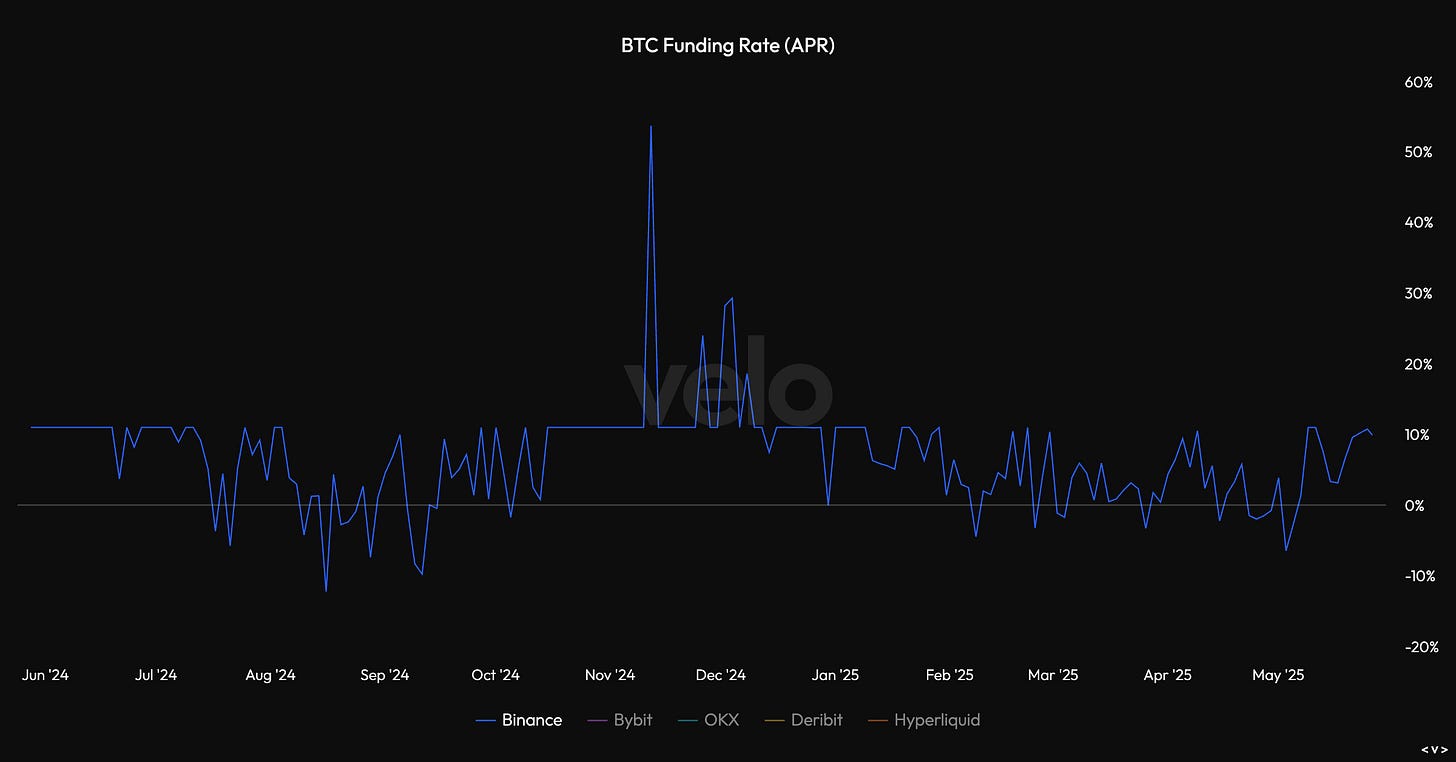

1 | Low Funding Rates

The fees for long trades remain low at around 9.8%. on Binance. This means the last rise was primarily spot-driven and not through leverage. This is healthy price action that suggests sustainability rather than overheated speculation.

2 | Low Social Risk

BTC reached the quietest ATH I've ever experienced. Social risk is literally at zero point. No sign of overheating.

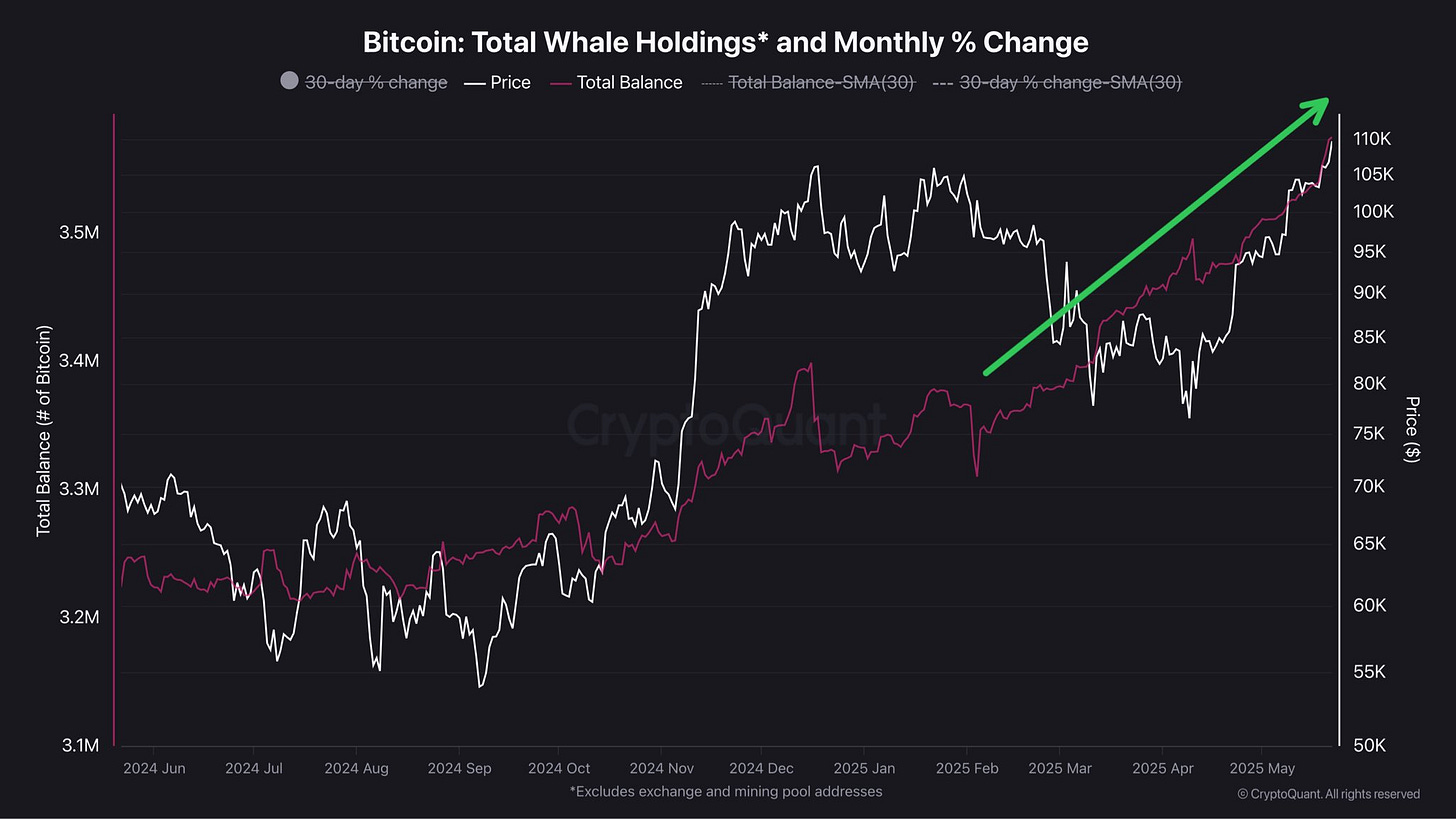

3 | Whales Accumulating

Bitcoin whales continue to aggressively accumulate. Historically, larger increases in BTC usually followed such phases. When the smart money is buying, it's usually wise to pay attention.

4 | Declining BTC Reserves

If many were selling currently, this would show up as rising supply of BTC on exchanges. Currently we see the opposite. BTC reserves on exchanges continue to fall. This is also partly due to BTC Spot ETFs continuously absorbing supply.

5 | Business Cycle

Arguably the most important correlation in crypto. The dynamics between the business cycle, global money supply, and Bitcoin price seem to be playing out again. Historically speaking, we should still be at the beginning of a parabolic phase where BTC rises strongly over several weeks.

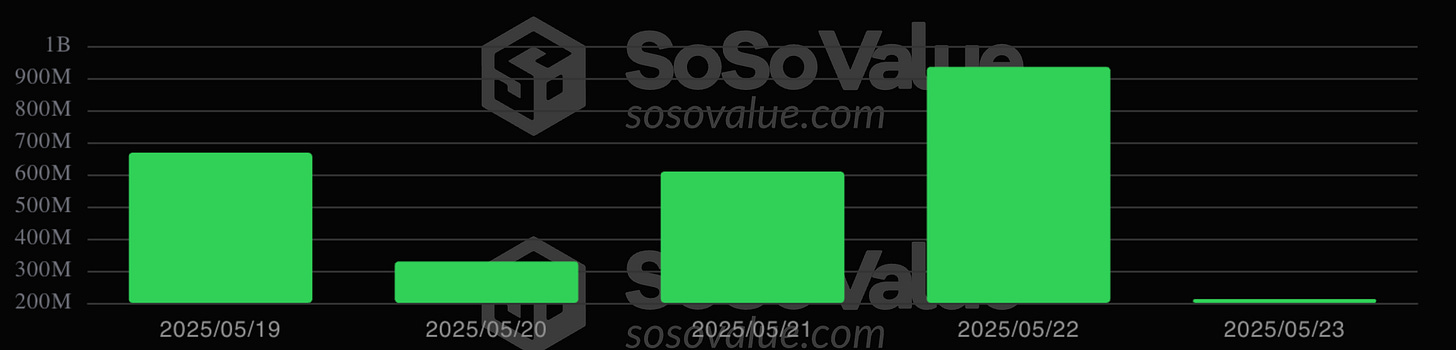

6 | Strong ETF Inflows

Last week alone, $2.75 billion flowed into Bitcoin via ETFs.

→ In summary: The foundation for further rising prices looks very stable. Honestly, what signals are we still waiting for?

... But what about Trump and the tariffs? Just last week Trump announced 50% tariffs for the EU and additional tariffs for Apple & Samsung. Yeah, that could really not please the stock market. But we're primarily talking about the crypto market here. And here applies: Bad for USD = Good for Crypto.

2. Alpha Section

Good projects and opportunities I discovered

Alpha 1: The Kaito Thesis - From Attention to Earnings

In an era defined by information overload and AI-driven noise, Kaito introduces a new market instrument where attention becomes a measurable, monetizable asset. Reason for me to outline the products, vision, market, and valuation framework that position Kaito as a leader in the Crypto attention economy.

The Rise of InfoFi: Monetizing Attention

Since the early days of the crypto economy, X has established itself as the primary hub for information flow within the industry. But the algorithm controls the flow of attention, resulting in poor distribution of information where high-quality insights are often buried beneath hundreds of low-value, engagement-driven posts.

In an era where AI has made content creation easier than ever, what truly holds value, and deserves fair compensation, is the attention that content generates. InfoFi represents a new paradigm where attention is allocated and rewarded by market forces - arguably the closest source of truth.

Kaito's Three-Pillar Approach:

Info as a Service - Kaito API & Kaito Pro transform unstructured information into structured data, powering third-party applications and research. Think Bloomberg Terminal for crypto.

Info as a Platform - Kaito Connect is a digital marketplace where brands, creators, and users meet, powered by AI and market-driven signals. The Yapper Leaderboard provides a fairer, more transparent go-to-market model.

Info as an Asset - Kaito Markets transforms information into tradable assets, unlocking an entirely new market primitive.

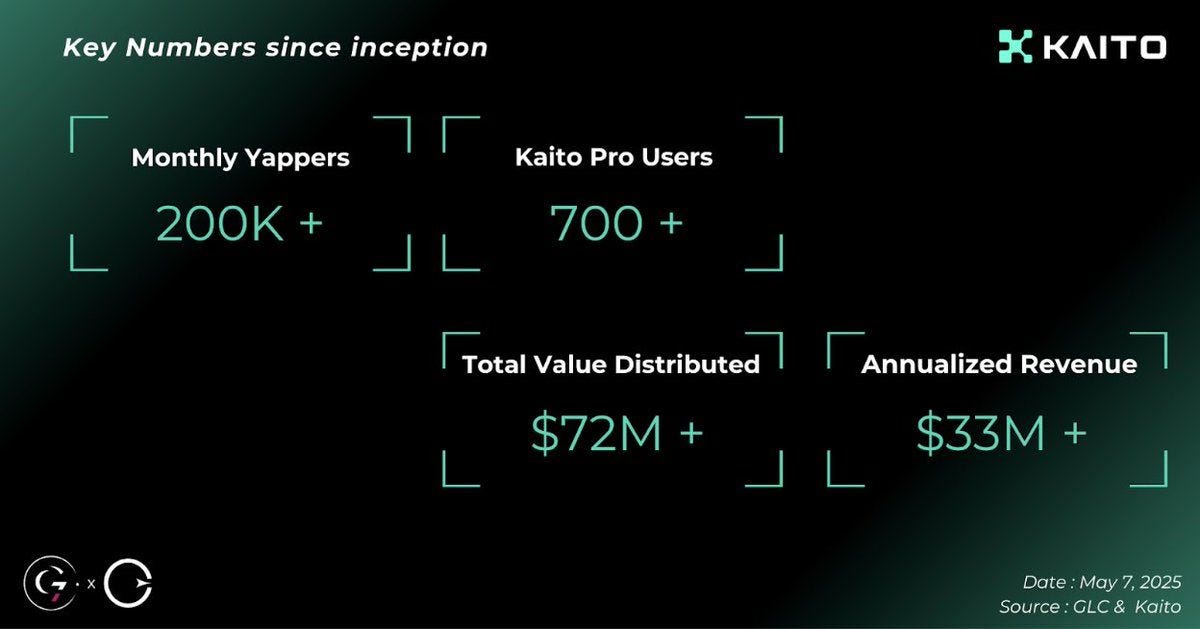

The Numbers Don't Lie

Kaito has achieved something few projects manage: actual product-market fit. Kaito Yaps launched just five months ago and now boasts over 200,000 monthly active yappers. Over 700 teams use Kaito Pro for daily operations.

In five months, more than $72 million in rewards from ecosystem projects have been distributed to yappers, stakers, and holders. Kaito generated an annualized revenue of over $33 million based on Q1 results - a 100x growth over the past 12 months.

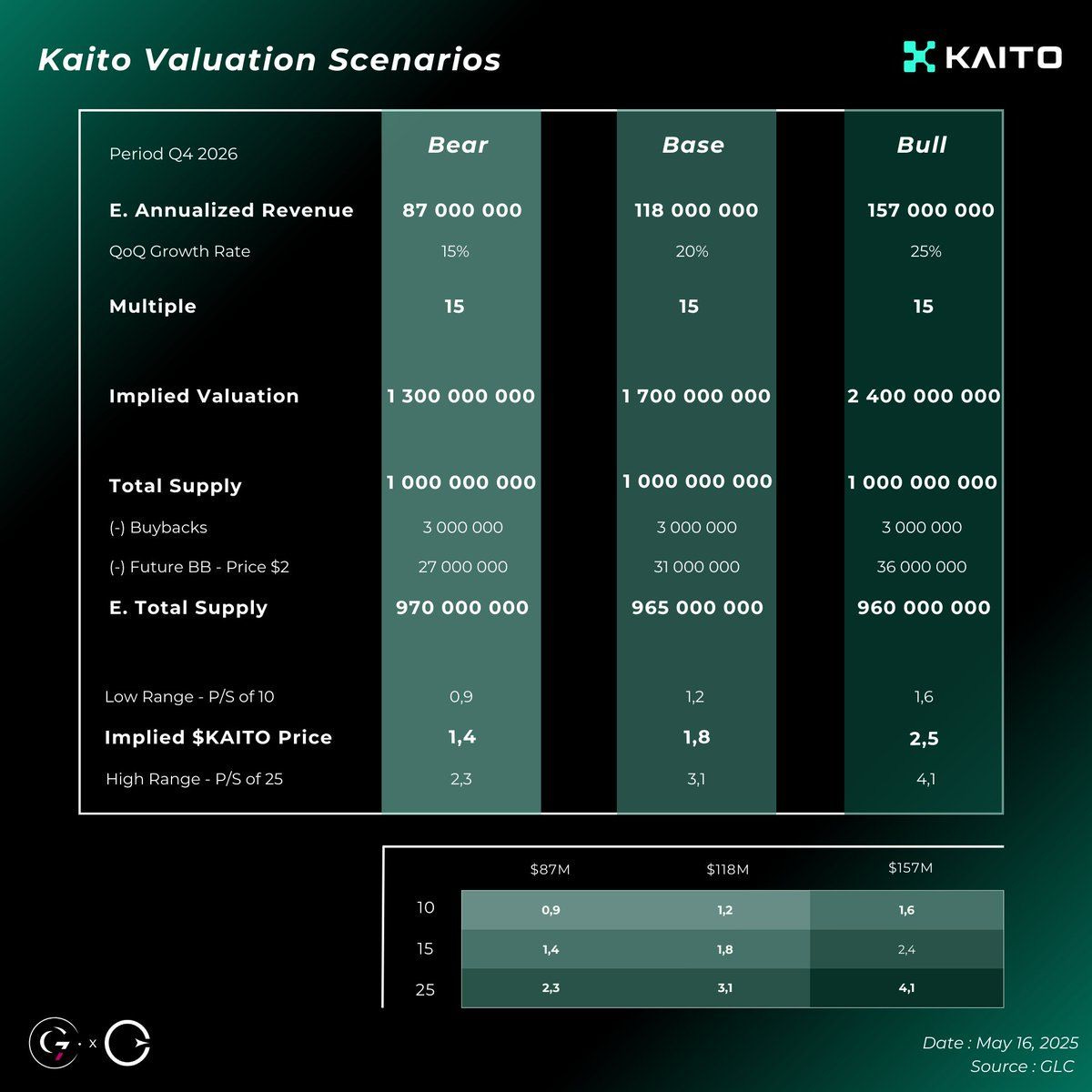

Valuation Reality Check

At ~$2B FDV, Kaito trades at a 58x P/S multiple. The analysis suggests the market is pricing in 15-25% quarter-over-quarter growth. Based on various scenarios, we could estimate a potential token price range of $1.70 to $2.50 by end of 2026.

The upside? sKAITO holders currently earn 39% APY (as seen on Pendle), with more project drops announced. This could create significant buying pressure as the yield opportunity remains compelling.

Risks to Consider

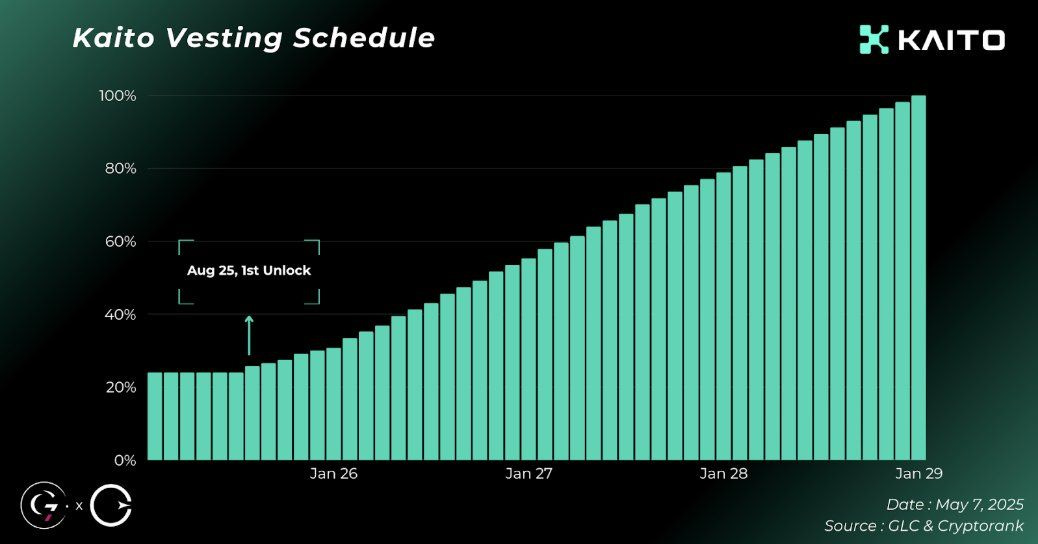

Competition is intensifying, with Cookie DAO emerging as a credible alternative at a much lower valuation ($228M FDV vs Kaito's $2.1B). Upcoming token unlocks starting August 2025 could create significant selling pressure.

Bottom Line

Kaito is building the infrastructure for web3's attention economy. If they continue executing at this level, the current valuation could prove conservative. In a noisy market, Kaito is building the signal.

→ Join Kaito with this referral link if you want to start creating content and earn Yaps on X.

Alpha 2: Hyperliquid Season 2 - The Airdrop That Keeps Giving

Hyperliquid isn't done. After distributing 31% of HYPE tokens in their massive Season 1 airdrop, they've launched Season 2 with even more opportunities. Here's how to position yourself efficiently:

Strategy A: The Safety Net

This is the go-to for steady yields with less risk:

Deposit 20% of stack on sentimentxyz – split half into leveraged position

Other half: borrow wHYPE against wstHYPE (swapped on @ValantisLabs)

Split borrowed wHYPE in two: lend on @hyperlendx and @hypurrfi for more HYPE

Take fresh HYPE and deposit on ValantisLabs

Strategy B: The Balanced Approach

Where most of the of capital goes – balancing decent yields with manageable risk:

Over half goes to @felixprotocol stable farm, minting feUSD with health factor > 2.5 (always monitor redemption rate)

Since vanilla market launch, also depositing HYPE for USDe

Other portion on @hyperlendx, borrowing HYPE to deposit on @0xHyperBeat

Recently increased allocation with USDT0 vault deposits

Strategy C: The Stablecoin Maximizer

Playing safer while earning solid yields:

LP farming during DEX season, currently USDE/feUSD on @CurveFinance

USDT0 vault deposits on 0xHyperBeat

HLP and harmonixfi for 15% APY on USDC

Bonus Farming:

Bridge BTC/ETH via hyperunit for additional farming

Quick Daily Rotation Framework:

Bridge USDC (Arbitrum → HyperCore)

Execute chosen strategy mix based on risk appetite

Daily: claim XP, make small swaps

Weekly: refresh LP ranges, rebalance positions

Delegate HYPE to third-party validators

This approach costs about $1/day in gas while stacking Season 2 points + dApp points + real yield. Mix and match based on market conditions and your personal risk tolerance.

Ongoing Strategy:

Don’t forget to take profits if you added HYPE with me last week, we are up 50% already.

Take the rest and farm responsibly. Don’t use risky LTV ratios on lending platforms and hold onto a part of your HYPE till the peak of this bull market. It seems to be one of the chosen coins this cycle.

Thanks for reading the public newsletter! Check out the Premium Section below for more alpha! You will get daily updates on the market and my portfolio positions on Telegram.

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

I uncovered another InfoFi opportunity that is already performing really well. I’ll walk you through why it’s different, where I’m sizing in.

Keep reading with a 7-day free trial

Subscribe to Adrian DeFi to keep reading this post and get 7 days of free access to the full post archives.