Adrian's DeFi Alpha #41: App Season > Alt Season

$HYPE & VIRTUAL Lead | Indicator Watch | Real Revenue Plays

We are back with the best DeFi plays in 2025.

Hello Friend!

Bitcoin continues to play the ultimate game of fakeouts — teasing both bulls and bears while stubbornly ranging between $103K and $107K. On the surface, it’s just range-bound chop. But if you look closer, the technicals suggest the downside is slightly more probable here, especially with June’s historically bearish stats.

A dip into the $98K zone wouldn’t surprise me — and honestly, I’d welcome it as a healthy correction and opportunity to buy the dip.

That said, don’t sleep on the upside risks. With Trump and China advancing talks, markets could turn risk-on fast and BTC has a habit of ripping just when everyone gives up on it.

Meanwhile, Ethereum is giving off some yellow flags. Open interest is overheating, funding is high, and downside liquidity is just waiting to be tapped. Still, any washout should be seen as a reload opportunity — especially with spot ETH ETF inflows increasing and the latest Treasury Strategy piece giving ETH-heads fresh ammo. As long as ETH keeps building in “war mode,” bulls have a reason to stick around.

️ On today's Episode:

📈 Market Update – Sell in May a good idea?, Market Indicators you need to know, Top apps and why they beat blockchains

🐂 Alpha Section – Virtuals’ Resurrection, Genesis Launches, and Why ACP Might Outlast the Hype

💎 The Premium Section with my portfolio positions to easily win the rest of this bull market

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

→ Memecoin SPX as the top performer this week. Murad’s shill on TikTok seems to be working.

→ Solid DeFi protocols like HYPE, AAVE and SKY performing well.

📈 Market Update – Sell in May?

May delivered the kind of chaos only crypto can serve — raging highs, relentless memecoins, and enough macro misdirection to keep everyone highly confused.

So… should you have sold in May and walked away?

Tempting, but I didn’t. I trimmed a bit, sure — took some profits off the table. But I stayed in the game. And here’s why:

🏆 Bitcoin Leads, Treasury Hype Builds

BTC hit a fresh all-time high at $112K, ripping over 50% from the post-tariff FUD lows. By month’s end, it cooled off to $103K — a well-earned breather after the vertical sprint.

But companies still doubled down on $BTC:

DJT raised $2.5B to buy BTC.

GameStop bought in with a cool $500M.

MicroStrategy keeps stacking like it’s 2021.

Metaplanet plans massive BTC buys: The Japanese "strategy copycat" wants to raise $5.4 billion in capital to buy more Bitcoin. By the end of 2026, the company aims to hold over 100,000 BTC — and more than 200,000 by the end of 2027.

It’s not just retail chasing pumps—this feels like the beginning of a serious treasury allocation trend. The Bull market is still on.

⚔️ Ethereum Fights Back

ETH finally woke up, surging to nearly $2800 and pushing ETHBTC from 0.019 to 0.026 in days. It’s the strongest relative move we’ve seen from ETH in a while. While the altcoin market struggled, ETH showed signs of life which is typically a sign for an upcoming altcoin season. ETF inflows are quite consistent compared to BTC.

💸 Altcoin Overload, No Altcoin Season?

But not everything pumped. The altcoin market is being smothered by nonstop token listings: $SOPH, $HUMA, $NXPC, $SOON, $DOOD… each one diluting the pie. New supply is real, and it’s putting pressure on older projects trying to hold relevance.

But luckily the expansion of the money supply has already begun. Historically, from this point, it hasn’t taken long for a breakout to follow.

To be more precise, it took 10 months in the last cycle. Today, we’re already in month six—meaning the altcoin market is getting more and more interesting.

🐸 Memecoins in the Spotlight vs Fundamentals

Dead memecoins from 2024 staged epic comebacks:

$MOODENG 10x’d

$PNUT +220%

$GOAT +280%

Big caps like $PEPE, $WIF, and $MOG held their ground, while TikTok influencers like Murad breathed new life into $SPX.

And then there’s $HYPE—May’s golden child. Up only, $40B FDV, and starting to get $SOL 2023 vibes. The perp DEX/L1 hybrid exploded to a $40B FDV, with some calling it the next $SOL. It’s not just hype—it’s becoming the most investable large-cap narrative in crypto.

→ Check out my HyperEVM airdrop farming guide here it was our recent Alpha 2 idea.

📊 Crypto vs TradFi: No Contest

Crypto outperformed every major asset class by nearly 2x last month. While TradFi debated Powell’s every syllable, onchain activity increased in May a lot which is a healthy sign:

Dune Index (Blockchain Activity): from 50 → 71

DEX Volume (Trading Activity): $474B

Combined Blockchain & App Revenues: $637M

Real usage. Real fees. Real alpha.

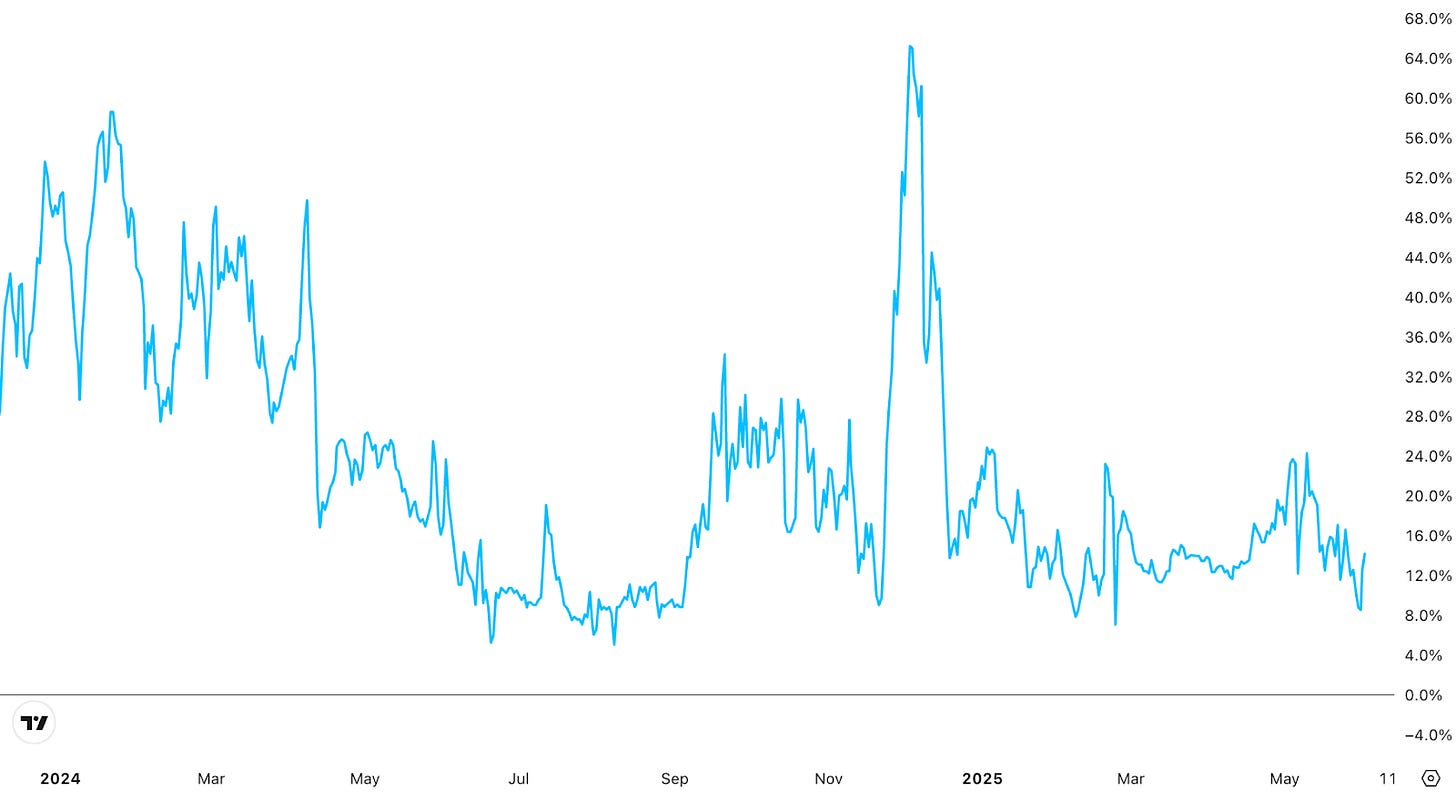

📉 Crypto Breadth And Altcoin Index Still Down

Crypto breadth measures how many tokens are actually participating in a rally and are in an uptrend. It doesn’t look at just the big names like BTC or ETH — it checks the whole field, especially altcoins.

24% of tokens are above their 50-day moving average (MA) — that’s a short-term trend indicator.

Only 5% are above their 200-day MA — that’s a long-term trend indicator.

🧠 What This Tells Us

Low Breadth = Narrow Rally: When only 24% (or even worse, 5%) of tokens are above these key averages, it means that the market’s gains are concentrated in just a few coins—mostly majors like BTC or hyped narratives like $HYPE.

Weak Alt Participation: The vast majority of altcoins are not in an uptrend. Even if the market “looks bullish,” most tokens are still struggling beneath key trend lines.

Short-Term vs Long-Term View:

The 50-day MA stat (24%) shows that some coins are starting to wake up short-term.

But the 200-day MA stat (5%) tells us that most of the market is still underwater when looking at the big picture.

🔎 Why It Matters for You

If your altcoin is performing well while breadth is low, you’re likely ahead of the curve.

If you’re holding bags and breadth stays low, it could be dead weight—attention and capital just aren’t rotating broadly yet.

In short: despite Bitcoin’s strength, the majority of altcoins are still technically in downtrends. Until breadth improves (especially the 200-day figure), altseason isn't fully “on”—yet.

Altcoin Index

This is about relative strength — how altcoins are doing compared to BTC.

Only 15% of coins have outperformed Bitcoin in the last 90 days.

That means BTC is still sucking up most of the market’s attention and capital.

🧠 Use this to measure risk appetite and whether we’re actually in an “altcoin season.”

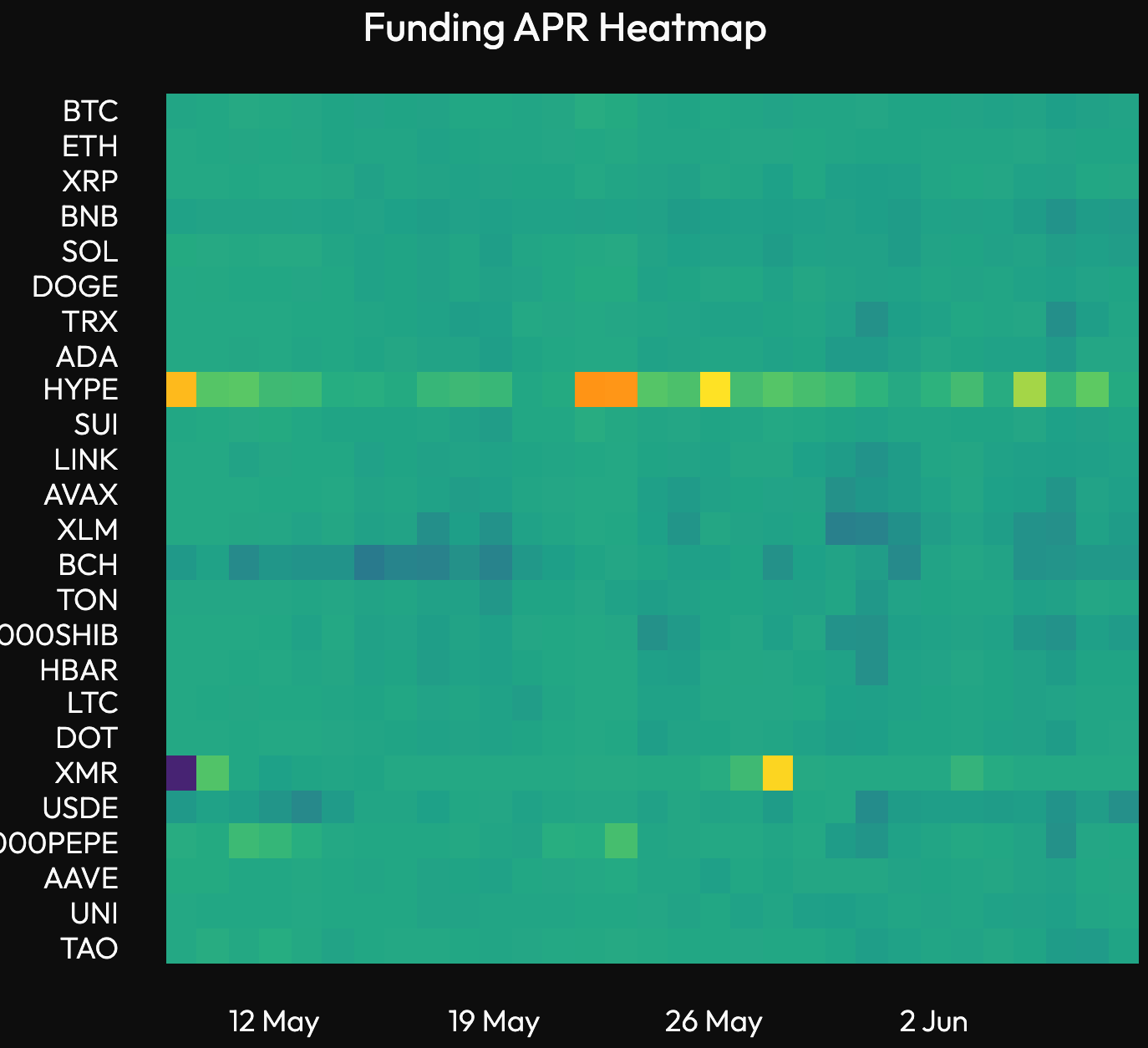

😐 Sentiment: Warming Up, Not Hot

Fear & Greed Index: hovered at 55 is no man’s land

Funding Rates: climbed to 5–10%, healthy but mostly not overheated (besides $HYPE)

BTC ETFs: added $5B in May, but end of May and start of June outflows were dominant.

ETH ETFs: pulled in $560M, with potential for more if staking ETFs will be approved.

Overall, sentiment’s improving, but we’re not in full-blown euphoria yet.

🌉 Onchain Flows & Stablecoin Trends

Ethereum dominated bridged asset flows (+$1B), mostly returning from Berachain post-incentive dump.

Stablecoins:

Arbitrum stablecoin supply surged +30.7% — mostly the Hyperliquid effect as stablecoins are still bridged from Arbitrum.

Solana surprised with a -13% dip.

Binance & Tron continued climbing.

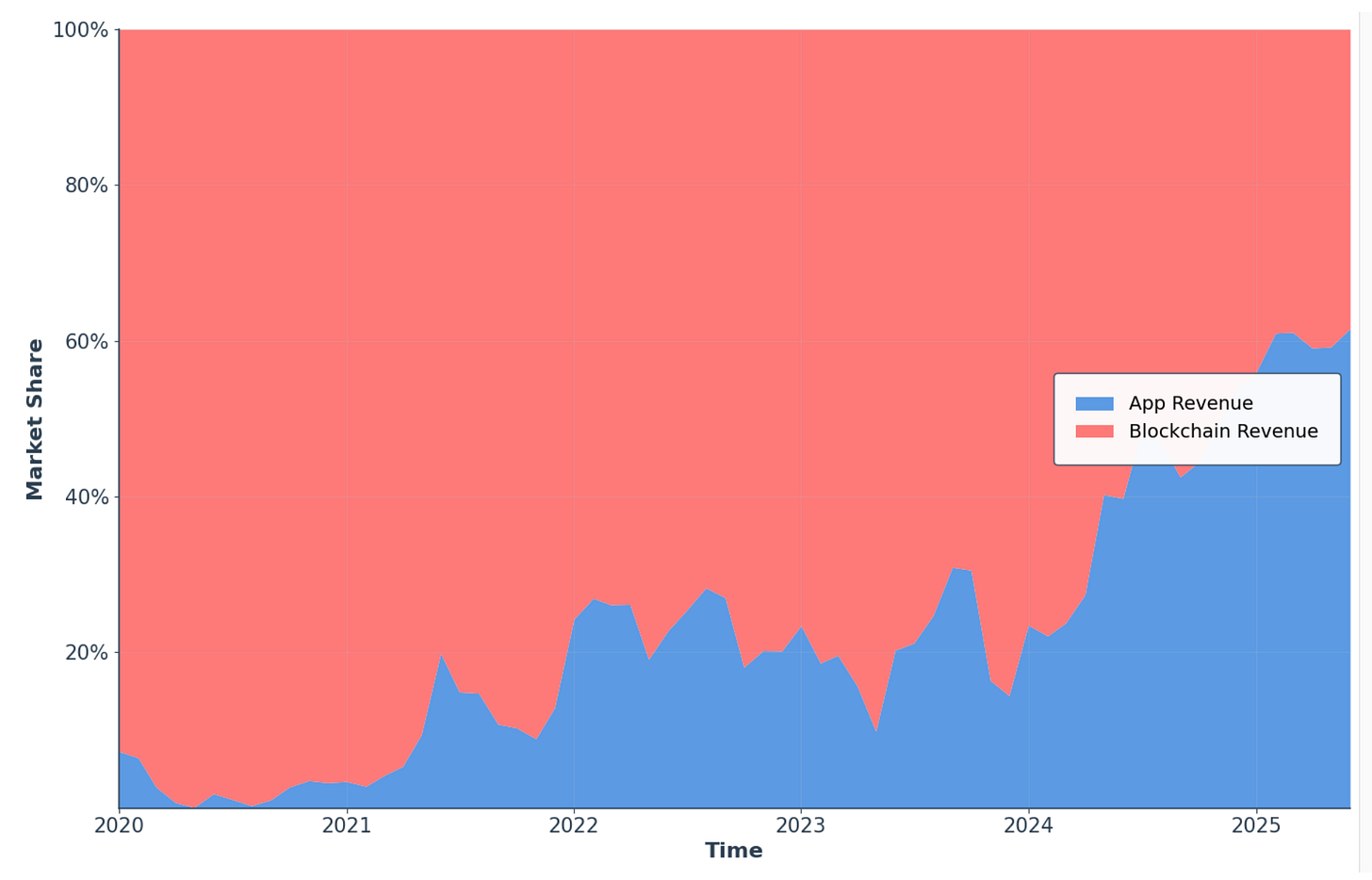

💵 Revenue Breakdown: Apps Dominate

Chains generated $260M in May. Solana led with 42% market share.

Apps brought in $377M. Solana again took the crown with 57%.

→ Apps generating 60% of the revenue which shows us where alpha is. The L1 trade is over. The “Fat App” thesis—more value accrues to apps than base chains—is playing out.

Top earners:

Wallets like Phantom, trading bots (Axiom, Photom, BullX), and DEXs like Aerodrome and Hyperliquid.

→ That's where I am looking now to accumulate more altcoins (or in this case): Solid apps with product-market-fit!

2. Alpha Section

Good projects and opportunities I discovered

Betting on the House: Virtuals, Genesis & the Agent Economy

Remember Virtuals Protocol? The Agentic AI darling that flew too close to the sun in January, kissed $5, and then faceplanted to $0.40? Well, it’s back. Up 400% off the lows and consolidating around $2, $VIRTUAL has clawed its way out of the ashes — not by hype, but by building.

Let’s break down what this comeback is built on.

🧪 Genesis Launches: More Than a Launchpad?

Virtuals has reinvented its token launch system with Genesis. It lets users participate in AI agent launches, but only if they’ve earned “Virgen Points” by doing ecosystem-positive things like:

Yapping about Virtuals on X

Staking $VIRTUAL or $VADER or agent tokens

Holding agents and not selling post-TGE

Participating in Genesis Launches

Buying Virtual Agents

This system gates allocations to the most active contributors. Presale deals value agents at ~$240K FDV, and everyone’s capped at 0.5% ownership, helping decentralize early token distribution.

🧬 Genesis Token Launches – TL;DR

Here’s how a Genesis launch works in short:

24-Hour Presale: Only users with Virgen Points can join. They pledge both points and $VIRTUAL to earn a slice of 37.5% of the agent’s token supply—valued at a $240K FDV.

Pro-Rata Allocation: The more points you pledge, the bigger your allocation (up to 0.5% max).

Transparency: Creators must disclose full tokenomics—50% is discretionary (e.g. team, marketing), 12.5% for liquidity, and 37.5% for presale.

Funding Threshold: If the sale doesn’t raise ~42K $VIRTUAL, it’s canceled and fully refunded.

Fair Launches: No snipers or insiders—only contributors who support the ecosystem get in. Bad agents are filtered by failing to meet funding goals.

So far, it works:

First 10 launches: 6 in profit, avg. FDV ~$1.9M

Most recent 10: all profitable, avg. FDV ~$5.67M (~24x!)

But let’s not kid ourselves — attention is the real driver. The newer the agent, the hotter the chart. That’s why Virtuals introduced TP cooldowns and shifted from just “holding” to “staking” to earn points. But these mechanics may not be enough when markets turn PvP again.

Additionally it’s quite hard to get a big allocation from points if you are not a huge investor or very active on X as a Yapper. So if you haven’t got many points it’s merely peanuts you get from a launch even if it made 24x.

💡 ACP – Where the Real Alpha Is

While Genesis might just be crypto-native fun, Agent Commerce Protocol (ACP) is a bigger swing. It’s a standardized protocol for agents to request, negotiate, transact, and evaluate services from one another — using smart contracts to create a fully onchain, trustless agent economy.

Think agents hiring other agents. A trading bot hiring an auditor. A media KOL contracting content agents. All automated, governed by code, and validated by Evaluator Agents. That’s a huge leap for agent-to-agent collaboration and one that could have implications far beyond Virtuals.

Even Google’s jumped in with its A2A protocol. The difference? Virtuals is onchain, transparent, and captures economic value via its token $VIRTUAL.

🎯 The Play – Don’t Chase Launches, Own the Rails

I’m not grinding the Genesis trenches even if it seems to pay out for yap spamming X content creators. It’s high-effort, high-churn, and the alpha is thinning fast. Yes, some launches like Axelrod did 70x, but attention cycles are brutal. Opportunity cost is real, and I’d rather be analyzing solid projects.

Instead, I’m holding $VIRTUAL.

It’s the house token. Required for launches, used in presales, and needed to stake for points. More launches = more demand = tighter supply. If Genesis stays hot, $VIRTUAL stays relevant. If ACP takes off, $VIRTUAL becomes the fuel for agent-to-agent economic coordination.

I'm just staking a small percentage of it — liquidity is key especially when we see a shorter altcoin season this year — so I’m positioned, but I also took profits from $VIRTUAL that I bought during the last months. If price dips, I’ll buy more. If not, I’m already exposed.

Long story short: Genesis is fun. ACP is serious. And $VIRTUAL might be one of the few ways to own a slice of the future agent economy.

Thanks for reading the public newsletter! Check out the Premium Section below for more alpha! You will get daily updates on the market and my portfolio positions on Telegram.

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

The most important crypto metric:

• revenue

Thes projects with strong revenue are the safest bets to win this cycle:

Keep reading with a 7-day free trial

Subscribe to Adrian DeFi to keep reading this post and get 7 days of free access to the full post archives.