Adrian's DeFi Alpha #42: BTC Whales Accumulate | Infrastructure Bull Run | GENIUS & CLARITY Acts | Maple Finance, SYRUP & MORE

We'll check why whales are scooping up BTC, how the GENIUS & CLARITY Acts will unleash DeFi’s next growth phase, and why Maple Finance’s SYRUP buybacks make it one of the top performers.

We are back with the best DeFi plays in 2025. If you followed the guidance from this alpha letter and my Telegram group you’ll have made great gains since the April lows. We bought BTC at $75k (+40%) and MKR at $1.185 (+73%) and of course there’s more quality altcoins inside.

Hello Friend!

While the sentiment around crypto has been eerily quiet despite BTC hitting fresh all-time highs just weeks ago, something much bigger has been brewing beneath the surface. Sure, most altcoins have been lagging behind Bitcoin's institutional sprint, but the first half of 2025 has delivered some of the most significant infrastructure and fundamental wins in crypto history.

Think of it like this: While everyone's been watching the price charts, the foundation for the next major bull run has been quietly cementing itself through regulation, legitimacy, and real-world adoption. Today, we're diving into why these developments matter more than any short-term price action and why they're setting us up for what could be crypto's most explosive period yet.

Let's break down the building blocks that are positioning us for a monster 2025-2026 bull run.

️ On today's Episode:

📈 Market Update – Sell in May a good idea?, Market Indicators you need to know, Top apps and why they beat blockchains

🐂 Alpha Section – Virtuals’ Resurrection, Genesis Launches, and Why ACP Might Outlast the Hype

💎 The Premium Section with my portfolio positions to easily win the rest of this bull market

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

→ Memecoin SPX still a top performer this week. Fartcoin sees solid gains.

→ It’s DeFi season, Baby. HYPE, AAVE, JTI, UNI and SKY performing well.

→ WBT is an exchange token and AB looks like scam. These are new to me.

→ KAIA, the Telegram TON chain of Asia seeing a bid.

The Calm Before the Storm

Here's something that'll make you do a double-take: Bitcoin sentiment is absolutely brutal right now—while BTC sits comfortably above $100k. That disconnect makes me more bullish than I've been in months.

Google search volume for "Bitcoin" and "crypto" just hit the lowest point in 12 months. We're talking about search interest levels that we normally only see at the deepest, darkest moments of a bear market. Except Bitcoin is trading above six figures. Wild.

Macro Noise Creating Micro Opportunities

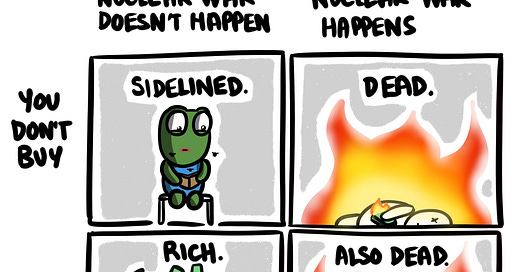

Part of this stems from Israel's recent strikes on Iran, which sent traditional safe-haven assets like gold, oil, and bonds rallying while stocks and crypto got hammered. No official war declaration yet, but markets hate uncertainty.

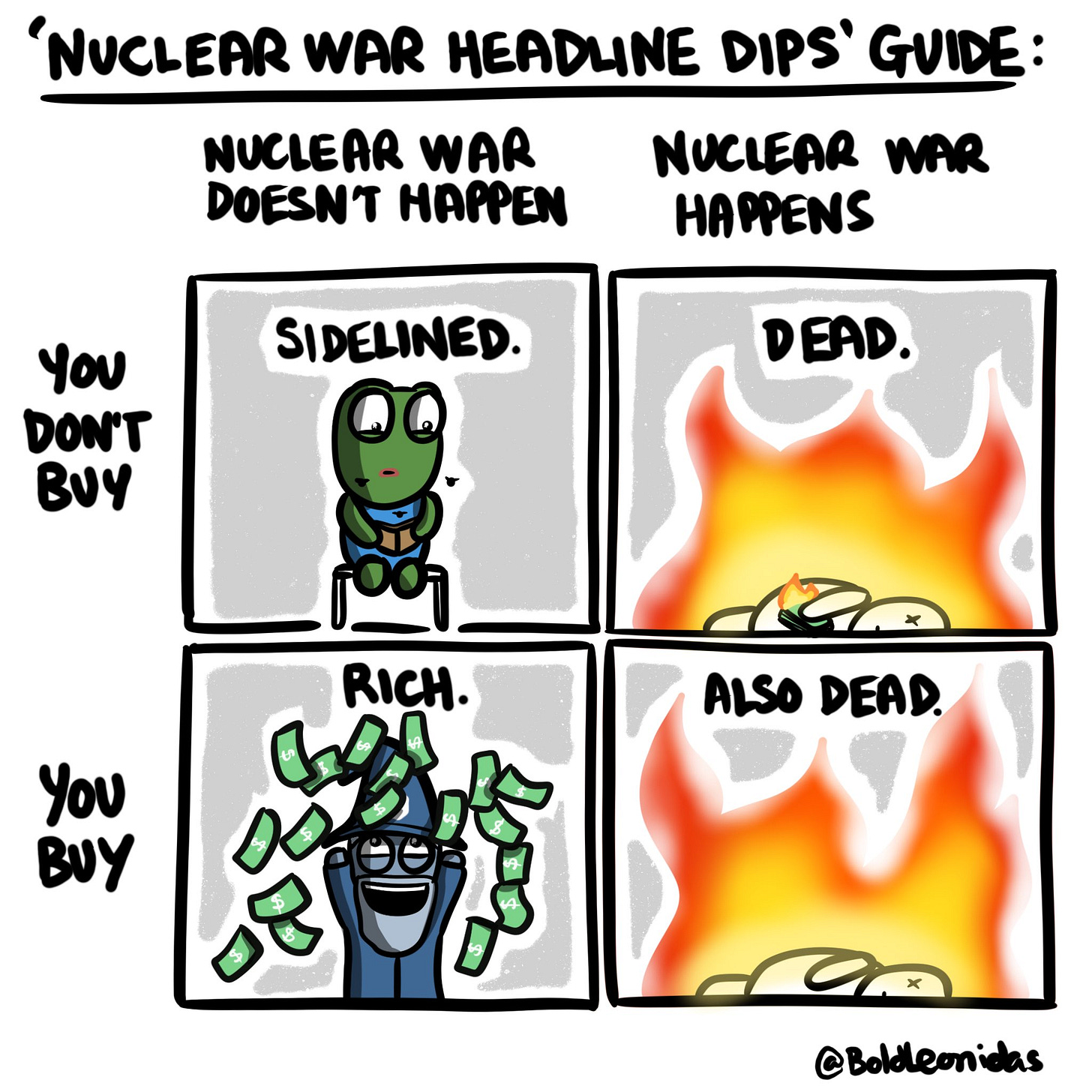

Here's the thing about geopolitical events: As tragic as conflicts are for humanity, they've historically created some of the best buying opportunities for investors who can think past the headlines. Raoul Pal nailed it when he called this "just noise"—BTC moves 89% in correlation with global liquidity anyway.

The macro picture hasn't fundamentally changed. If anything, the fundamentals (regulatory clarity, ETF approvals, institutional adoption) make this cycle different from previous geopolitical selloffs.

But here's where it gets really interesting when you dig into what Bitcoin whales are actually doing beneath all this noise...

Bitcoin: The Data Tells a Different Story

While sentiment is in the gutter, the on-chain data is painting a completely different picture. Long-term holders are aggressively accumulating again—those green zones on the charts that historically precede major Bitcoin rallies in this cycle.

BTC whales are also playing their cards close to their chest. On-chain data shows they're sending relatively few coins to exchanges right now, preferring to hodl rather than distribute. This is a stark contrast to the mid-2024 top and January 2025 peak, when we saw massive whale inflows to exchanges before major corrections.

The combination of retail fear (low search volume), institutional bids (ETF flows, IPOs and regulation), and whale accumulation creates the perfect setup for what typically comes next.

And speaking of what comes next, the infrastructure and fundamentals being built right now make this cycle completely different from anything we've seen before...

📈 The Infrastructure Bull Market

Smart money is paying attention to something far more valuable than daily candles: the systematic legitimization of our entire industry. These recent developments are laying the groundwork for the next leg up in this bull cycle.

1/ Pro-Crypto Legislation: The Game Changer

Remember when Gary Gensler's SEC felt like crypto's final boss? Those days are behind us. The new crypto-friendly Congress isn't just talking about change — they're actively building it.

Two major bills are making their way through the system:

The GENIUS Act represents the most comprehensive stablecoin regulation we've ever seen, written in collaboration with actual crypto natives (not bureaucrats guessing how DeFi works). This gives us regulatory clarity as the government essentially admitting that stablecoins are here to stay and deserve proper framework.

The CLARITY Act will finally end the "is it a security or commodity?" game that's been holding back innovation for years. Clear rules mean institutional money can finally flow without compliance nightmares.

Both bills have massive bipartisan support, which in today's political climate is basically a miracle. When Washington agrees on crypto, you know we've hit an inflection point.

2/ Stablecoins Hit $250 Billion: The Irony of Success

The stablecoin market cap has increased past $250 billion, up $89B in the last year. It’s a sign that people see more value in digital dollars than on traditional banking rails — and that value is translating into trust and an upward spiral.

With stablecoin-friendly regulation incoming via the GENIUS Act, this sector could hit $1 trillion in the next 2-3 years.

This matters for DeFi because stablecoins are the rails that make everything work. More stablecoins = more DeFi liquidity = higher yields and better opportunities across the ecosystem.

3/ Circle's IPO: Wall Street Validates Crypto

Circle's public offering on the NYSE was a statement. CRCL shares tripled on the first day, sending a clear message to institutional investors who've been sitting on the sidelines.

When a crypto company successfully goes public and performs this well, it legitimizes the entire industry for the traditional finance crowd. Suddenly, crypto becomes an investable sector with real companies generating real revenue.

This legitimacy opens doors for institutional capital that was previously locked out due to compliance concerns.

4/ Ethereum Gets New Leadership: Finally, Some Direction

For years, the Ethereum Foundation felt disconnected from the actual ETH community. The March leadership change brought two new co-executive directors who immediately made moves that showed they actually understand how this space works:

EF started using its ETH holdings in DeFi to generate yield (practicing what they preach)

Quarterly transparency reports on expenses (accountability, finally)

L1 scaling became priority #1 with Vitalik expecting 10x scalability improvements in the next year

The market noticed—ETH's May performance likely reflected confidence in this new direction. When the foundation behind the world's second-largest crypto starts acting like it understands DeFi, the entire ecosystem benefits.

What's Next: The Catalysts That Could Ignite 2025-2026

The foundation is set, but the real fireworks are still coming. Q3-Q4 could bring us two of the most anticipated developments in crypto history:

Staked Ethereum ETFs: The SEC confirmed in May that staking doesn't involve securities, clearing the path for the first yield-generating crypto ETF. Institutional demand for passive ETH income could be massive.

Spot Solana ETFs: Bloomberg's Eric Balchunas and James Seyffart (the same analysts who called the Bitcoin ETF approval) are giving SOL ETFs a 90% chance in 2025. Blockworks is even more aggressive, predicting approval in 3-5 weeks.

These ETFs matter because they're the final bridge between traditional finance and crypto. When pension funds and endowments can buy crypto exposure through their existing brokers, we're talking about billions of dollars of potential inflows.

Bottom Line: While everyone is fixated on short-term price movements, crypto’s foundational pieces are rapidly coming together in the background. Regulatory clarity, growing institutional involvement, and anticipated ETF approvals set the stage for a massive run-up into 2025-2026.

But before we get carried away with the bullish long-term view, let's quickly check the current market conditions and whether it’s time to accumulate altcoins or not.

Altcoin Season Index: We’re not getting closer - for now!

The current altcoin season index sits at 20, indicating we're still in Bitcoin season territory. For context, if 75% of the top 100 coins outperform Bitcoin over the last 90 days, it's officially altcoin season. We're nowhere near that threshold yet, but the recent movement mid May 2025 showed again how fast momentum can be built (and how aggressively we have to take profits).

Bitcoin dominance remains strong at 64.81%, but here's what I'm watching closely: after hitting a peak of 65.39% in May, dominance formed a lower high in June. This indicates potential weakening bullish momentum in BTC dominance, though the broader uptrend from early-year lows around 57% remains intact.

The recent movement in mid-May 2025 showed again how fast altcoin momentum can build—and how aggressively we need to take profits when it does. The infrastructure is being built, the foundations are solid, but patience is still required for the altcoin rotation we're all waiting for.

So for now I continue to focus on revenue generating protocols. These are the top 10 this month:

(Source: Defillama API)

→ I started farming Axiom for the airdrop. If you are trading on Solana, I can recommend to test it (here’s my ref).

2. Project Updates

What dApp and project updates you need to know in this week in the world of crypto

Bittensor is one of my favorite AI altcoins right now—not just because of the token performance, but because of the solid projects actually building real utility on the network. The ecosystem development has been impressive, and now we're seeing institutional validation.

Public Companies Go All-In on Bittensor

The institutional Bittensor adoption story just got a lot more interesting. Synaptogenix (SNPX) made headlines by pulling a full MicroStrategy playbook, announcing a $10 million TAO purchase that's more than twice their own market cap. The market loved it — shares jumped 40% immediately.

But they're not stopping there. James Altucher has plans to scale that position to $100 million, betting on TAO as the backbone of decentralized intelligence. He's putting his money where his mouth is too, dropping $5.5 million personally through preferred stock and TAO-linked warrants. A complete rebrand and ticker change are already in motion.

Oblong (OBLG), a network software company, is following by raising $7.5 million specifically to stack TAO and back Subnet 0.

Their thesis is straightforward: TAO is the native asset for decentralized intelligence—scarce, programmable, and productive. I expect more public companies to follow this playbook as the first volley in a public market race to corner crypto AI infrastructure.

That’s not all in the Bittensor ecosystem:

Crucible Labs launched Smart Allocator, an auto-staking tool that allocates TAO into top-performing subnets by price. This is perfect for passive holders who want Bittensor yield without the complexity of managing subnet allocations manually.

TaoFi just went live with the first Solana-to-Bittensor USDC bridge, powered by Hyperlane. This unlocks Bittensor DeFi access from Solana, Base, and Ethereum—a massive development for cross-chain liquidity. The bridge is live now at taofi.com/bridge.

Phala Network: The Privacy-First AWS Alternative

Phala Network is building the infrastructure layer that could power the next generation of private AI applications. They're now processing over 30,000 secure compute requests daily through Trusted Execution Environments (TEEs).

The big development is Phala Cloud, launched in early 2025 as a privacy-first alternative to AWS. Developers can deploy Dockerized apps directly into TEEs, completely sidestepping the surveillance capitalism of centralized clouds.

The setup process has been streamlined through Dstack, a toolkit that wraps Docker containers in secure virtual machines. It handles encryption, attestation, and portability without requiring complex DevOps work—a major breakthrough for mainstream adoption.

For developers building private agents or zero-knowledge oracles, Phat Contracts provide off-chain logic that securely interfaces with blockchains. With gasless execution, AI compatibility, and privacy guarantees, they're ideal for the next wave of intelligent agent applications.

The underlying DePIN architecture connects a global fleet of worker nodes that provide compute power and earn PHA tokens. That same PHA token governs staking and DAO coordination, creating a complete ecosystem around censorship-resistant compute.

The big advantage of decentralized infrastructure:

And finally quick update from one of our recent alpha ideas:

Arbus Terminal is now live, giving stakers of 100,000+ $ARBUS early access to AI-powered research tools and real-time Web3 insights.

3. Alpha Section

Good projects and opportunities I discovered

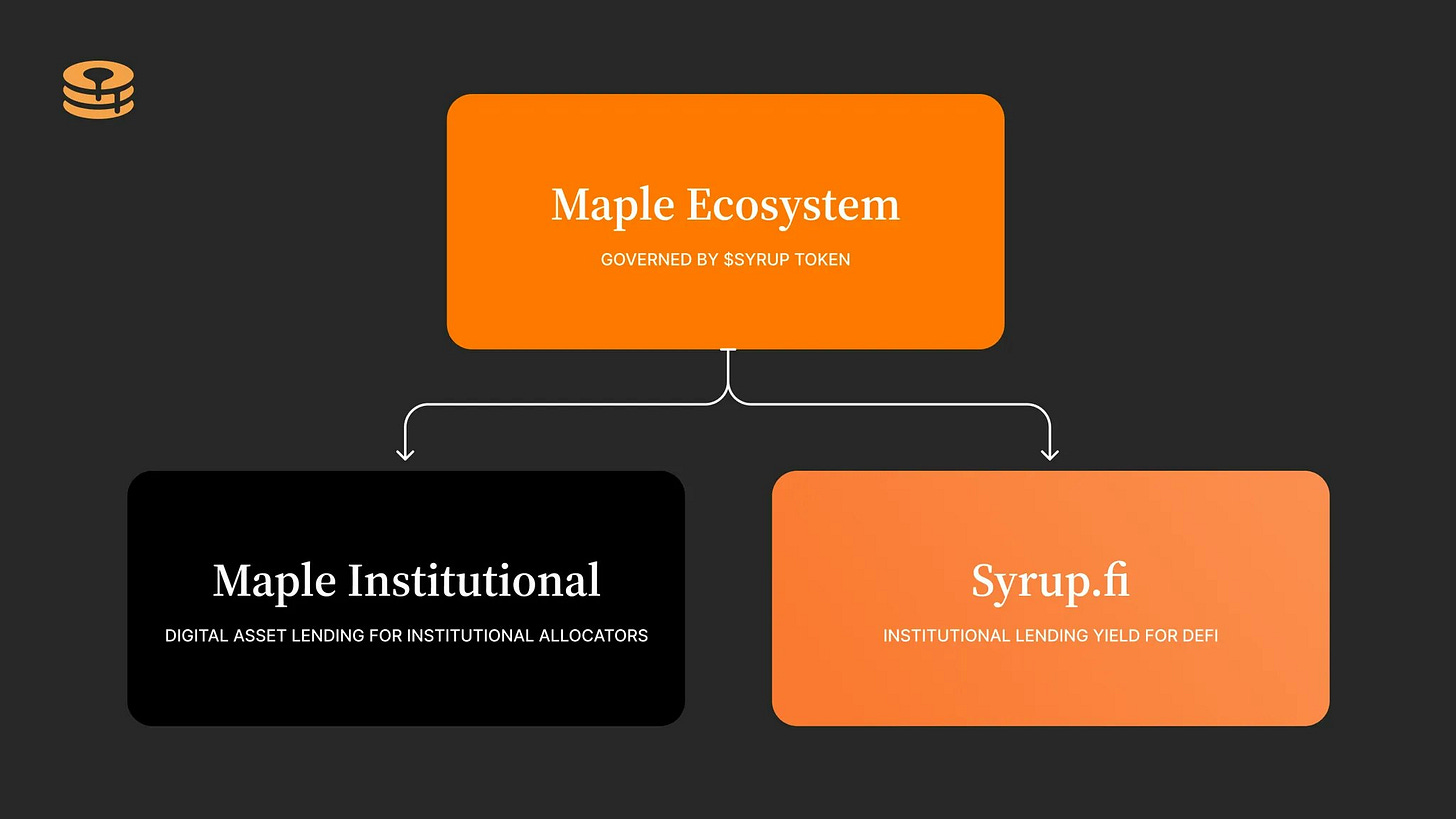

🧠 Maple Finance – DeFi’s Credit Powerhouse

Sometimes the best-performing protocols aren’t the loudest and most innovative. Maple Finance is one of those rare DeFi platforms that’s been scaling steadily and, most importantly, sustainably.

🏦 What is Maple Finance?

At its core, Maple Finance is a decentralized credit protocol. But unlike most DeFi platforms where loans are always over-collateralized (think Aave or Compound), Maple dared to go where few are: Lending for institutions, sometimes even under.collateralized.

It was a bold bet—and it paid off.

Over 2024, they doubled down by launching Syrup Protocol, which does offer over-collateralized loans in a permissionless way.

💰 The Mechanics: Lending Pools, Trust, and Track Records

Here’s how it works:

Lenders (institutional or accredited) deposit USDC into lending pools.

Pool Delegates manage these pools, vet borrowers, and set terms.

Borrowers (mostly crypto-native companies) get fixed-rate, short-term loans.

Maple’s underwriting model has worked. No defaults on $600M+ in loans (as of end 2024). That’s rare air for DeFi.

📈 Key Growth Numbers

$2.2B+ AUM across all Maple products

28 active institutional borrowers (up from just 4 last year)

15x growth in lenders

$1.1B+ locked in syrupUSDC

📊 The Investment Thesis

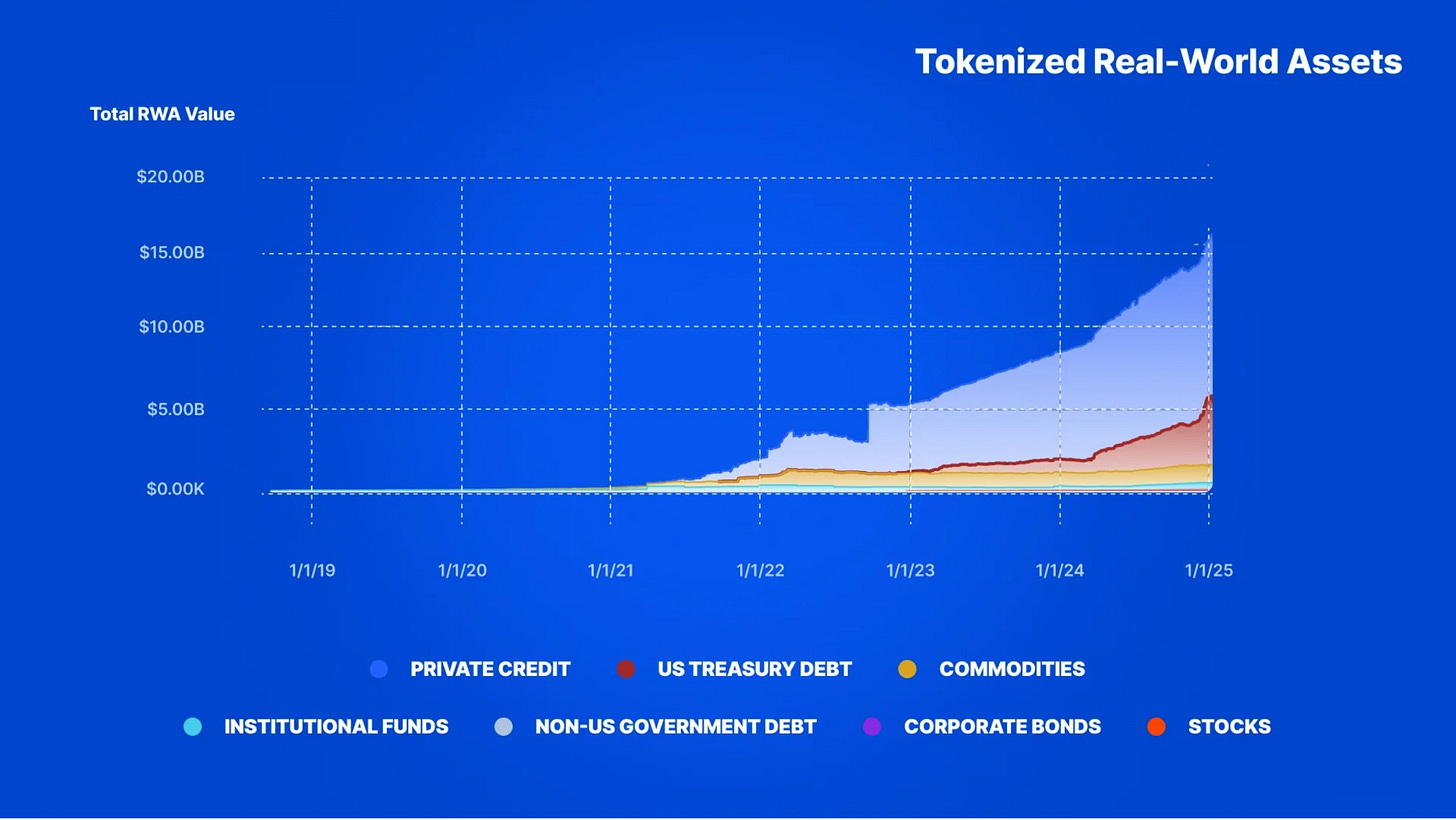

1/ RWA Power Play

Maple’s eye is on the real-world asset (RWA) megatrend. With the RWA sector hitting $217B (including stablecoins), Maple’s offering of tokenized U.S. Treasury yield pools (like AQRU’s 14% APY tax credit pools) is exactly what institutions want. It’s fixed income — on-chain.

2/ Bounce-Back Resilience

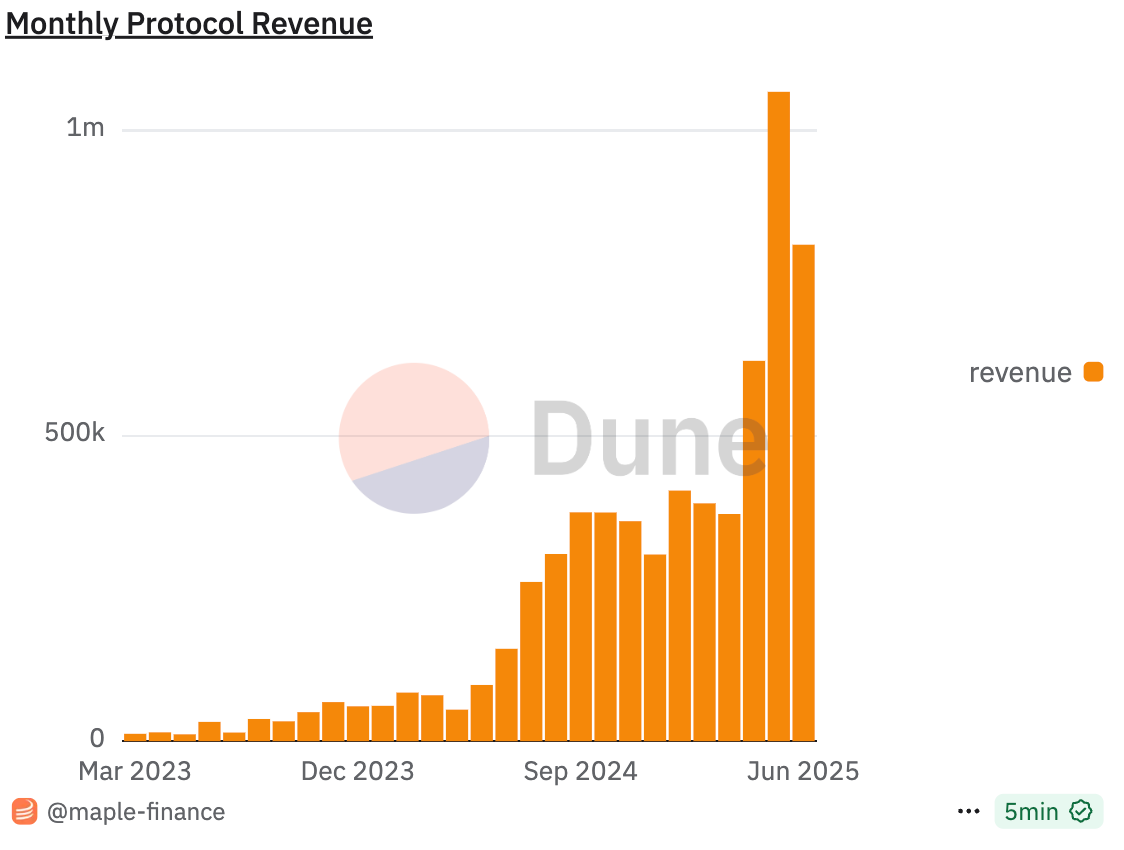

After surviving a $36M default post-FTX, Maple launched version 2.0 with smarter credit risk controls. That’s where Syrup was born, and its buyback mechanic (20% of protocol revenue goes to $SYRUP buybacks) adds fuel to the flywheel. The protocol is rising steadily which is our primary metric we consider for a token investment. In May it went over $1M for the first time and June looks like it’s beating that number by a lot.

3/ syrupUSDC on Solana = Yield Engine

Maple just launched syrupUSDC on Solana with $500K in incentives. Users are already stacking up 6.44-9.53% APYs with Kamino vaults and other protocols.

📉 Risks to Keep in Mind

Credit Risk: Under-collateralized lending isn’t risk-free.

Regulatory: New rules could complicate Maple’s growth path.

Centralization: Pool Delegates still play a gatekeeping role.

🔥 What’s Next?

Targeting $4B AUM by end of 2025

Potential $35M in protocol revenue

$7M in $SYRUP buybacks projected (if policy holds)

Deeper TradFi integration: Maple was tapped by Cantor Fitzgerald, one of TradFi’s heaviest hitters

♦️ The Token

$SYRUP has seen a huge run-up over the last 3 months, so it's certainly not a buy right now.

SYRUP holders can stake tokens to earn rewards, participate in governance decisions, and share in protocol revenue through buybacks. The token posted a 355% rally from April 2025 lows, driven by exchange listings (Binance, Bitget, dYdX) and growth in TVL.

At a market cap of $570M it’s not small anymore, so further growth is limited as long as we are not in an altcoin season.

Technical Analysis:

Uptrend: Strong bullish trend since April 2025, breaking key resistance at $0.1930 and flipping it into support

RSI: At 75, indicating overbought conditions with bearish divergence (price rising while RSI trends down)

Support/Resistance: Key support at $0.3184 and $0.20; resistance at $0.53 (ATH)

Outlook: While the long-term trend remains bullish, short-term overbought signals suggest a potential correction to $0.3184 before resuming upward momentum. Wait for the pullback.

Thanks for reading the public newsletter! Check out the Premium Section below for more alpha! You will get daily updates on the market and my portfolio positions on Telegram.

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

Our portfolio performed excellently and I am finally able to sleep with a substantial altcoin bag. The downside (like we saw it due to war FUD) is very limited and the upside quite big.

Additionally I have a deep dive on my favorite DeFi protocol for you, enjoy!

Keep reading with a 7-day free trial

Subscribe to Adrian DeFi to keep reading this post and get 7 days of free access to the full post archives.