Adrian's DeFi Alpha #44: Macro Just Flipped Bullish on Altcoins & BTC 🔥 | Hyperliquid Airdrop Playbook | Profit Big From Solana ETFs

Why Whales Loading ETH and Altcoin ETFs Hint at a Hidden Bull Catalyst, why Hyperliquid Might Be the Best Airdrop Farm of the Cycle and the Best Bet on a Solana ETF

We are back with the best DeFi plays in 2025. If you followed the guidance from this alpha letter and my Telegram group you’ll have made great gains since the April lows. We just took profit on COIN after a solid 2x.

Hey Friend!

We're in an intriguing spot. While recent PCE data suggests July might be too soon for a Fed rate cut, September odds are already up at a confident 94%. Everyone's for now banking on a slow summer followed by a bullish Q4. But BTC just closed last week above $108k and can therefore expect bullish continuation.

Meanwhile, the GENIUS Act and whispers of extended "not QE-QE" suggest an extended liquidity cycle, positioning us nicely for a run well into 2026. Chill on the daily drama and think bigger — things are looking bullish into year-end.

Let’s position for that!

️ On today's Episode:

📈 Market Update – Global liquidity setup into 2026, what the Fed won’t say out loud, and why institutions are still behind the curve

💸 Altcoin Update – ETH whales strike again, Coinbase 50 Index ETF incoming, and public companies are now stacking alts too

🐂 Alpha Insights – Hyperliquid LP & aggregator plays, Felix x HypurrFi lending loop, and why JTO is a 3x SOL ETF proxy

💎 The Premium Section with my recent buys, sells and how to position for the coming months

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

→ A sea of green due to an end of war FUD.

→ ARB is profitting from the news about a Robinhood collaboration, tokenized stocks could be the outcome of this.

→ SEI surged due to its selection for Wyoming’s stablecoin pilot, booming Web3 gaming activity, and ETF speculation.

→ PENGU climbed driven by a meme coin short squeeze, Web3 gaming launches, and Solana ETF hype.

Macro Update

The Business Cycle Reality Check

We're at a macro turning point, and if you blink, you'll miss it. We see a stuck economy since early 2023 based on ISM Manufacturing PMI's long period of time spent below 50.

But deeper signals, like the Global Economy Index (GEI), say we hit a new business cycle in early 2025, with rising commodities, freight costs, and a sliding dollar indicating a fresh bullish chapter.

Liquidity Looking Juicy

Liquidity, our favorite market mover, is flashing positive across the board. A softer dollar is boosting global liquidity, typically signaling gains in risk assets (hello, Bitcoin).

The long-term dollar-denominated “Global M2 money supply” cycle is now also picking up due to the recent dollar weakness.

The Tariff Situation

Despite Trump's tariff truce ending July 9, markets have priced in the worst — another tariff drama seems unlikely. The market is already currently pricing in an “effective tariff rate” of between 10% and 15%.

Fed Games

Inflation is stubbornly high at 2.4%, suggesting two Fed rate cuts this year. This might be bullish for crypto, but bondholders won't be smiling if the Fed silently ditches the 2% target. Watch US 10-year yields — above 4.5% historically spells trouble for risk assets.

A Sentiment Check

Recession expectations have collapsed from elevated levels earlier this year. We’re now back to 2024 levels (recession very unlikely).

Institutional investors mostly missed the recent bounce. They're sitting on the sidelines with FOMO building. Retail bought the dip and made banks look foolish.

The AAII survey measures US investor sentiment weekly. Sentiment's improving but nowhere near overly bullish.

Translation: There’s plenty of room to run higher.

Animal Spirits Awakening

Retail investors are still buying dips while institutions missed the April bounce — plenty of room for markets to climb. Cathie Wood’s ARK ETF hitting highs means animal spirits are alive and well.

Expect summer volatility, but macro signals strongly support bullish momentum. Technical dips should get gobbled up as institutions play catch-up.

→ This part of the newsletter was created on the basis of Tomas research for Milk Road Macro. Give them a follow for more macro updates and insights.

The altcoin outlook is shifting faster than a new DeFi protocol's APY. KraneShares just filed for a Coinbase 50 Index ETF – tracking the 50 largest and most liquid digital assets. This could be massive for altcoin legitimacy.

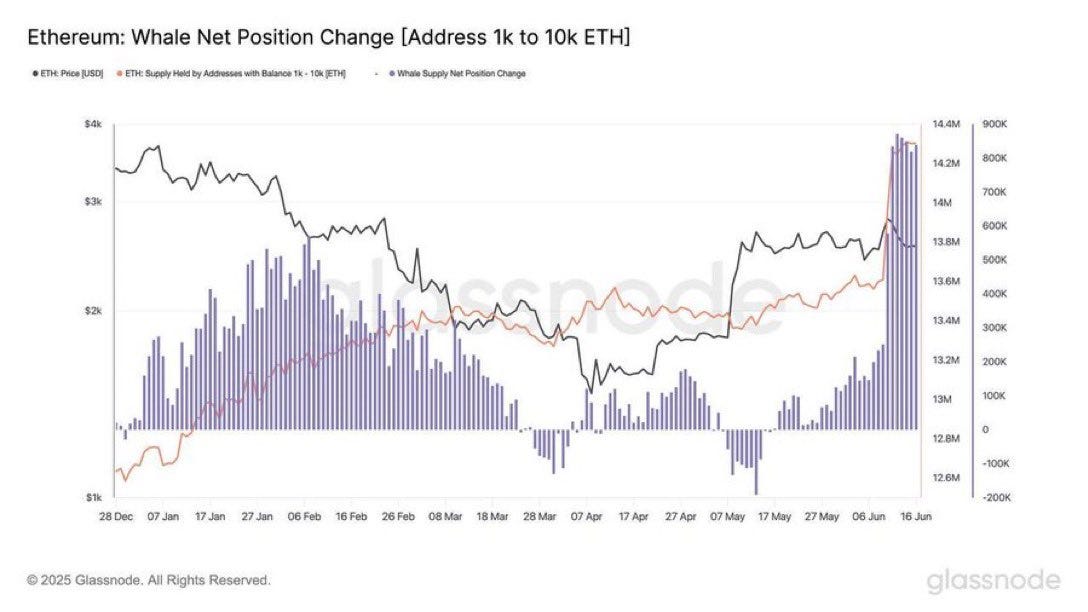

Even better, whales are loading up on ETH like it's Black Friday. Glassnode data shows nearly 1,000,000 ETH accumulated by whale addresses (10,000+ ETH holders) on June 26 – the largest single-day accumulation since 2018. When whales move like this, altseason whispers get louder.

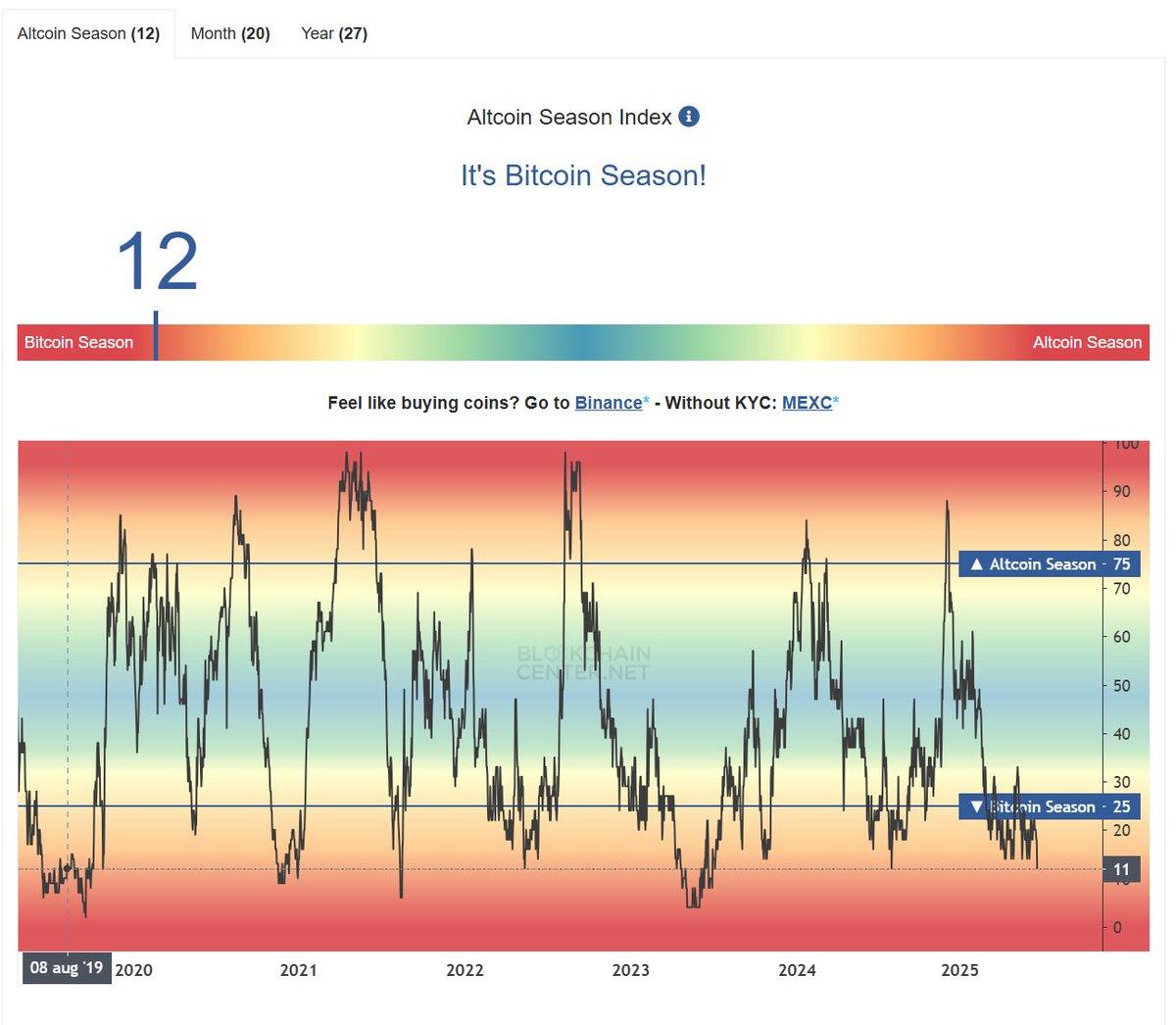

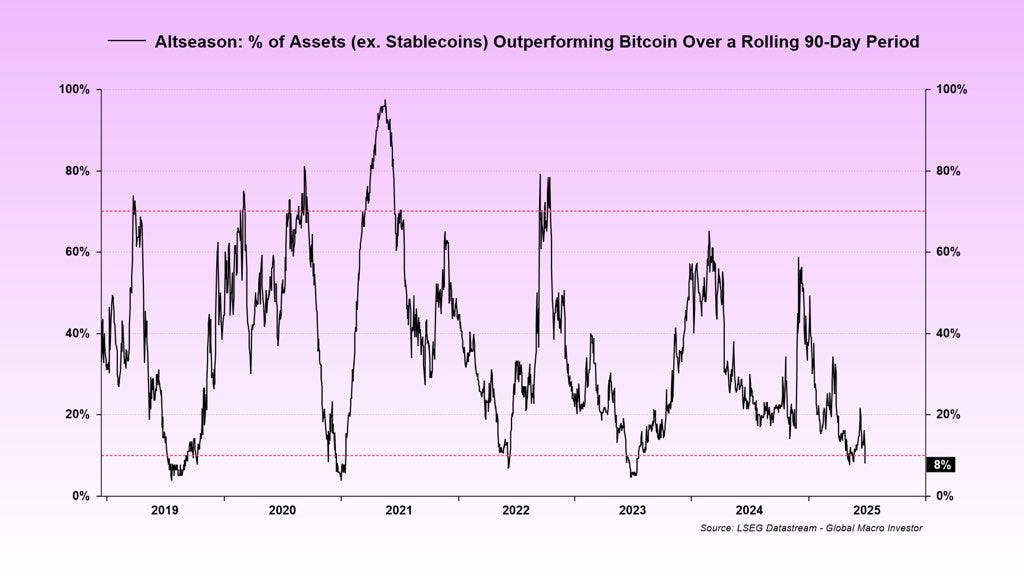

The altcoin season indicator just hit its lowest level in 2 years. Fun fact – this low has happened every June since 2019. There's a pattern here, and if history rhymes, we might be setting up for (selected) altcoin outperformance soon.

GMI's macro team isn't ruling out altseason either.

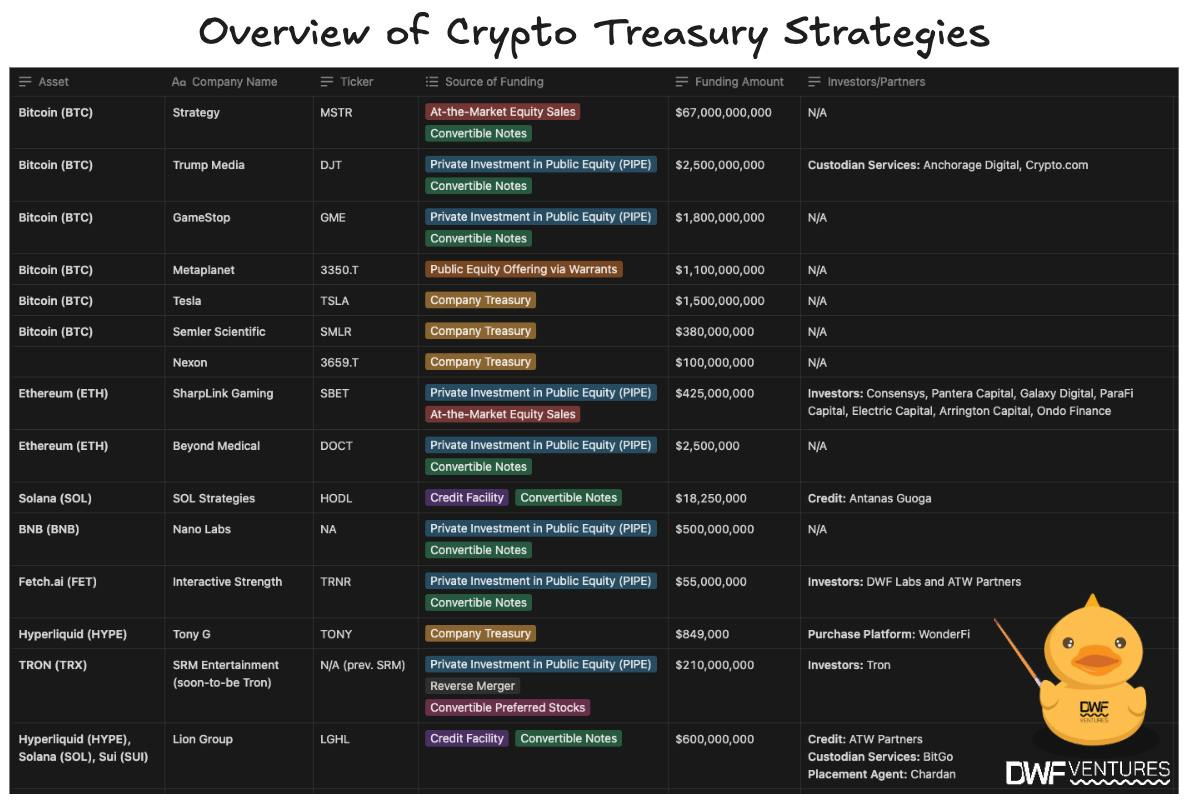

Plus, public companies have injected over $40 billion into digital assets in the past year, with combined crypto holdings now exceeding $76 billion. But this isn't just BTC and ETH anymore – companies are diversifying into altcoins.

Good projects and opportunities I discovered

Alpha 1: Hyperliquid LP and Aggregator Farming

Here's a pretty straightforward route to farm two airdrops while maintaining constant wallet activity on HyperEVM. Think of it as getting paid to prepare for the next HYPE stimmy check. Combine these strategies with Alpha 2 for maximum efficiency.

Hybra Finance is your starting point. Deploy into their new V3 pools where you currently get a 100% early adopter bonus. Since these are V3 pools, you'll need to actively manage positions and rebalance occasionally. Make sure you understand concentrated liquidity and impermanent loss – this isn't set-and-forget farming.

Next stop: HyperBloom aggregator. With only $350K TVL, you're still incredibly early. The aggregator provides a farming opportunity in pre-points phase, early users will get retroactive bonuses.

→ Provide LP on Hybra Finance, stack points, and use an aggregator like Hyperbloom that rewards early adoption – that's the trifecta right there.

Alpha 2: Hyperliquid Lending Strategies

Every serious DeFi ecosystem needs a robust money market. On Hyperliquid, we've got three main players: Hyperlend, Felix, and HypurrFi. Here's how to maximize your yield while farming multiple protocols.

The Felix + Hyperstable Strategy:

Start with Hyperstable – currently the best place for stablecoin yields in the ecosystem. Register first, then borrow USH against your collateral (WHYPE, UBTC, or UETH). Need BTC? Use Hyperunit (bonus: that's your third airdrop to farm on this route).

On Felix, deposit BTC into vanilla and borrow USDT0 at minimal rates. Then take that USDT0 and the USH from Hyperstable to the USH/USDT0 pool on Hyperstable's farm tab. Make sure to approve and deposit (click those buttons three times) – you'll be earning 27-30% yield on your stables.

Advanced Felix Farming:

Felix is the protocol everyone knows will print but nobody knows how to farm properly. The secret? Maximum points come from maximum skin in the game.

Bridge HyperCore BTC and HYPE to HyperEVM via Hyperunit

Borrow feUSD against WHYPE or BTC on CDP (BTC is more effective due to a higher LTV ratio)

Or if you have less collateral to farm: Borrow against UBTC/WSTHYPE on Vanilla (safer option)

Use your borrowed funds in:

Hyperswap V3 USDHL/feUSD pool

Hyperswap V3 WHYPE/USDHL pool (if borrowing USDHL)

USDHL/USDT0 pools on Hyperstable

Pro tip: Don't just borrow and lend back – actively LP to maximize TVL presence.

HypurrFi Strategy:

HypurrFi has evolved. Previously, depositing HYPE and borrowing stables/BTC/ETH was very effective. Now? Deposit USDT0 (get it from borrowing against HYPE/BTC on Felix), then borrow anything else. USDT0 gives a 5x boost currently. Points aren't technically live but launching in weeks.

Also check out Hyperlend – though borrow caps are always full. If you can get in, leverage HYPE positions by borrowing USDHL and buying more HYPE. Use the Hyperloop feature as well for a leveraged WSTHYPE position.

Alpha 3: JITO Solana ETF Bet

JTO is setting up as a natural 3x beta play on SOL. With Solana staking ETF flows potentially coming, this could surprise a lot of people to the upside. The institutional narrative around Solana is shifting, and JTO captures that momentum perfectly while offering leverage to SOL price movements.

Think about it – if SOL staking becomes accessible through ETFs, the demand for liquid staking solutions explodes. JTO is positioned right at the center of that ecosystem. This is a structural bet on Solana's institutional adoption.

→ In anticipation of this, JTO prices has already increased quite a bit. Might be worth checking for a better entry or get a bag now and some on a dip.

Thanks for reading the public newsletter! Check out the Premium Section below for more alpha! You will get daily updates on the market and my portfolio positions on Telegram.

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

Our performs well and we can start relaxed into the next leg up in the market.

Keep reading with a 7-day free trial

Subscribe to Adrian DeFi to keep reading this post and get 7 days of free access to the full post archives.