Adrian's DeFi Alpha #6: Airpuff | basedAI & Pepecoin | New Portfolio section

Definitely no financial advice, just insights based on my own journey in DeFi.

Hello there, Friend,

Feeling swamped between work and personal projects? No worries, I've got your back. Being in DeFi since the early days has armed me with insights I can't wait to share with you.

Here's the value you'll unwrap in this newsletter:

A spotlight on the most important market updates.

2 Alpha insights you can bank on.

In the premium section you will find:

2 portfolios, one for investors with low risk tolerance and one high risk portfolio

My crypto trades and the corresponding investment theses

All in a concise, 5-minute digest. No ads, no fluff. Pure insights from my firsthand DeFi exploration.

Let's dive in!

Market Pulse

Casting light on the dramatic swings and strategic plays in Crypto.

JPMorgan predicts SEC approval for Ethereum ETFs in the future

JPMorgan maintains a positive outlook on the eventual SEC nod for spot Ethereum ETFs, holding a 50% chance for May approval. Leading analysts, suggest a likely litigation phase if May doesn't see approval, comparing it to past legal battles where the SEC faced defeats. Despite the SEC's scrutiny of Ethereum, possibly eyeing to label ETH as a security, recent shifts like the decentralization trend might play in Ethereum's favor, hinting it could sidestep the security tag.

Solana struggles: Record 66% of user transactions are failing

Solana's network is having performance issues as on one day about 75% of its non-voting transactions are failing, primarily due to the high interest in memecoins and bot activity as well as a new mining dApp. Despite this high failure rate, which represents a record for the network, supporters argue that the interpretation of the data is flawed. They suggest most failed transactions are bot attempts at arbitrage, not affecting the typical user's experience significantly. Solana's leadership acknowledges the challenges and hints that upcoming network upgrades may not immediately solve the user experience problems, indicating that solutions to reduce spam and improve transaction processing are in the works. Amidst these technical struggles, Solana's SOL has seen a slight price decline, following a significant rally.

Alpha Insights

Your blueprint for finding alpha in Crypto.

Alpha 1: Airpuff - Leveraged Restaking Protocol

Airpuff is project designed for leverage points farming on platforms like EtherFi, KelpDAO, and RenzoProtocol. Users can amplify their restaking rewards up to 15x plus additional benefits from Eigenlayer points and the Airpuff airdrop. All that is possible on Arbitrum, Ethereum’s cheap Layer 2 which makes it interesting for even smaller retail investors.

The process involves selecting a restaking platform, choosing collateral, deciding on the asset to borrow, and the amount, then making a deposit. This strategy can be better than buying YT on Pendle due to the stability in farming points and the potential for triple incentives through restaking platform points, eigen points, and the Airpuff airdrop.

Additionally, Airpuff also offers a strategy for leveraging long on ETH by borrowing USDC, effectively acting as a leveraged long position on ETH with the benefit of earning leveraged points and airdrops. The project has notable backers, and with its rewards structure, it can present a cost-effective method to leverage long ETH.

Let’s talk security:

Airpuff plans to distribute 7% of its total supply to depositors in 2 Airdrop rounds.

Token Generation Event from April 8th

They will have a Token Generation Event in a Liquidity Bootstrapping Pool (LBP) model on Fjord Foundry. The LBP model is a good approach in the digital asset space, aimed at ensuring fair and transparent token launches. It operates on a unique high-to-low pricing mechanism, similar to a Dutch Auction.

15% of the total supply (150,000,000 APUFF.) will be made available in the TGE, and the community will have 3 days to contribute ETH to the pool in return for the APUFF token.

LBP Date: From April 8 @ 12PM UTC to April 11 @ 12PM UTC.

Duration: 3 days (72 hours)

Supplied tokens: 150,000,000 (15% of the supply)

Chain: ETH Mainnet

Minimum purchase amount: None

Contribution Currency: WETH, USDT, USDC

Vesting: Immediately liquid and claimable at the end of TGE

After TGE, the team will introduce $APUFF staking allowing holders to lock their $APUFF to earn airdrop rewards passively.

→ I invested 1 ETH in weETH and 1 ETH in rsETH both on Arbitrum with more conservative 7x leverage.

If you want to get started at Airpuff and support me, you can use one of these referral codes:

AR4FZS

N48ZDE

7FY8TQ

Alpha 2: BasedAi & Pepecoin

BasedAI is getting some traction as a privacy-centric L1 network with EVM compatibility, building on the concept of Bittensor but focusing on privacy and interfacing with large language models (LLMs) through smart contracts. Here’s some info:

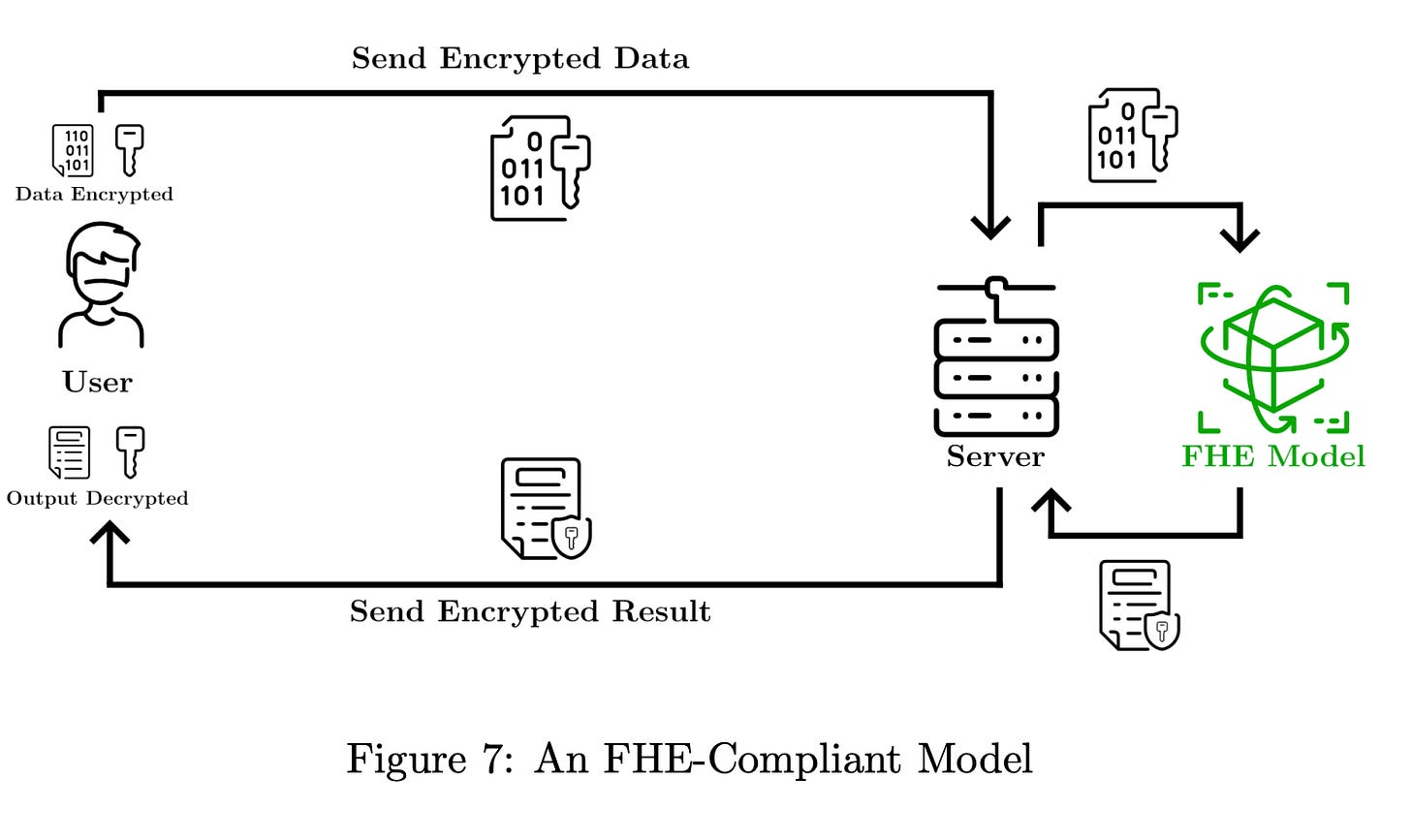

First of all we have to understand what Fully Homomorphic encryption (FHE) is:

Fully Homomorphic encryption is a cryptographic technique that allows computations to be performed on encrypted data, producing encrypted outputs that can only be decrypted by the data owner.

In BasedAI, FHE is integrated with LLMs to ensure that data remains encrypted during processing. This is achieved through Cerberus Squeezing: A technique to optimize energy-intensive computations like FHE. See in Figure 6 how an unencrypted model presents risks for users. These can be vulnerabilities from unencrypted data transfer, compromised servers, and the unauthorized

surveillance of model interactions and outputs.

Compared to this Figure 6 presents an FHE-Compliant Model: The capability of FHE to process encrypted inputs and return encrypted outputs ensures that data remains secure throughout the entirety of the computational process,

accessible only to users with the appropriate decryption keys.

Network Structure: The BasedAI network includes "Brains," which are computational units hosting LLMs. These Brains are powered by miners and validators.

Brains: Transform LLMs into zero-knowledge LLMs (zk-LLMs) to maintain data privacy during processing. Ownership of Brains is like holding a cloud service license, with incentives to attract computational resources.

Economic Model: $BASED tokens incentivize Brain operations. A limited number of Brains, Validators, and Miners creates a competitive, efficient network.

Brains in the BasedAI network can be acquired using Pepecoins from the open market

Miners and Validators: Miners provide GPU resources to process encrypted queries, while validators use CPUs to ensure the accuracy of computations. They earn rewards in $BASED tokens for their contributions.

→ Learn more about the utility of $BASED, real world applications and future developments in the premium section below.

When you're ready to dive deeper, here's how I can help:

Join my Community for the fastest DeFi and Airdrop Alpha.

Book a free 15 min intro call here for personalized consulting, market research, and portfolio analysis.

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

Holy Moly inflation is on the rise again but they can’t be raising those rates cause it’s an election year: CPI is this week, and you can expect the usual short-term de-risking into CPI which might dampen volatility. With most altcoins already down 20-30% from the highs, this puts us into a healthy consolidation as we go into the halving.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.