Adrian's DeFi Alpha #9: ETH ETF | AI Coins | New Airdrops

Definitely no financial advice, just insights based on my own journey in DeFi.

Hello there Friend,

busy with work and personal projects? Let me help. I’ve been navigating the DeFi space since 2020, and I love sharing what I learn.

These are the advantages you will get in each newsletter:

The key developments in Crypto.

Practical insights to act on.

All packaged in a 5-minute read. No sponsored content, no trading chaos. Just insights based on my own journey in DeFi.

Let’s make the most of your time!

FYI

I am linking the sources of the images in the newsletter, just click to follow the link.

Market Update

Highlighting the key developments and their implications.

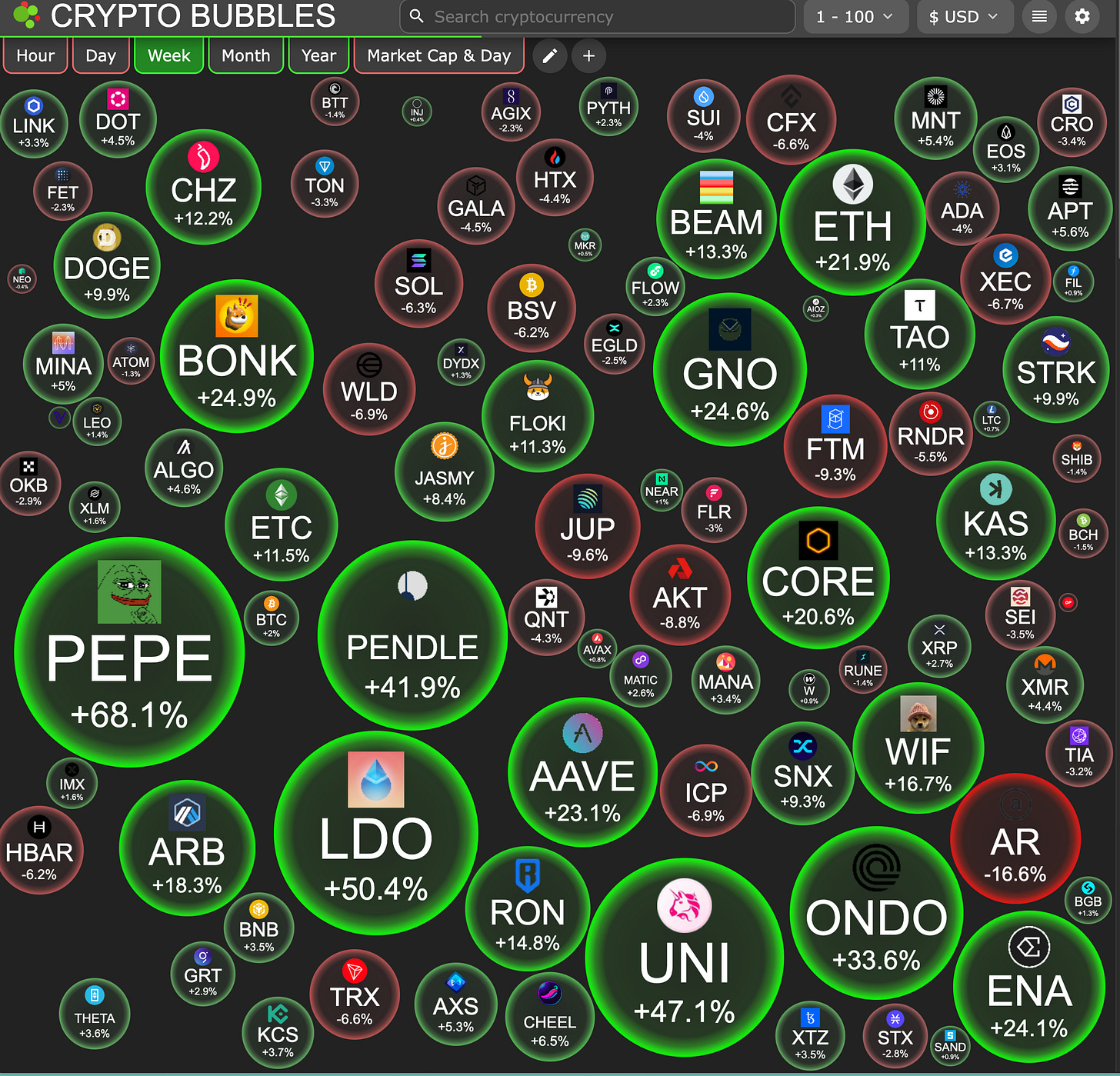

Weekly Crypto Bubbles

The global #crypto market cap is $2.70T, a 0.28% change in the last 24h. Total trading volume in the last 24h is at $58.1B. #BTC dominance is at 50.26% and #ETH - 16.87%.

A Seismic Shift - The Ethereum ETF

It could have played out anything like this:

The phone rings. Gary Gensler glances at the caller ID. Unknown number. He swallows hard and picks up, his hands trembling.

Gary Gensler: Uh, hello?

A sinister, gravelly voice: You're blowing it for us, Gary. Approve the spot Ethereum ETF immediately. We need to buy some time and win some good grace… or else.

Gary Gensler: Y-yes, of course. I’ll do exactly as you say.

Sinister voice: One more screw-up, and you're finished, Gensler. Understand?

Gary Gensler: Crystal clear.

Sinister voice: Good. Now get to it ….

The phone slams down.

We all have deserved this moment, after months / years of uncertainty and regulatory scrutiny in the US. Reaching this point has been a marathon through hell, and I truly believe the best is yet to come.

Just a day before the big Ethereum news broke, as I thought about selling some ETH to buy more SOL, I had never seen sentiment this bad during a bull market. Bad sentiment in a bull market is arguably harder to stomach than horrible sentiment in a bear market.

There's a lot to discuss, but let's start with the bigger picture. The Ethereum ETF news is fantastic, but its timing, alongside other developments, suggests that something significant is shifting in D.C., particularly among Democrats, the SEC, and the Biden administration.

Major political happenings this week: The Biden Administration vowed to veto H.J. Res 109. Donald Trump declared himself pro-crypto. Congress passed its first standalone crypto bill. 21 House Democrats and 12 Senate Democrats, including Senate Majority Leader Chuck Schumer, broke ranks. The FIT21 and Anti-CBDC Surveillance Act were introduced, the FDIC Chair was fired, and Klaus Schwab, an anti-crypto figure, departed. Recently, Trump accepted crypto donations.

What Does All Of This Mean?

An Ethereum ETF (Exchange-Traded Fund) provides a way for investors to gain exposure to Ethereum without needing to buy, store, or manage the actual cryptocurrency. This simplifies the process, making it more accessible to traditional investors and institutional players.

The Market Reacts

Since the announcement, although we've not seen a significant uptick in Ethereum's price, it’ll certainly reflect in the coming weeks. Investors are eager to capitalize on this new opportunity, and the influx of traditional capital is expected to bring stability and maturity to the market.

Looking at the Bitcoin ETF Approval announcement earlier this year, the price of $BTC dipped initially and later ran high.

A similar price action will likely replicate with Ethereum’s price. Though now may not the best time to buy ETH, as the price could dip further. As always a DCA (dollar-cost-average) strategy seems like the safest play if you are underexposed.

Why This Approval Matters

Legitimacy and Trust: The approval of an Ethereum ETF by the SEC is a strong signal of legitimacy. It suggests that Ethereum, and by extension other crypto assets, are being recognized as valuable assets in the financial world.

Increased Adoption: With an ETF, more investors can now easily add Ethereum to their portfolios, driving broader adoption and integration of crypto assets into mainstream finance.

Market Growth: The influx of new investors and capital can lead to a healthier, more robust market. As more people get involved, we can expect further innovations and developments within the Ethereum ecosystem.

What's the takeaway for your investment game plan? Track these patterns and stay informed. In my Telegram community, I lay out my market moves transparently, nailing the bottom for new buys. Check it out for yourself on Telegram

Other events moving the market

NVIDIA Earnings and AI

The AI & Crypto narrative could be enhanced by the good NVIDIAs quarterly results today:

Earnings Per Share: $6.12 adjusted vs. $5.59 adjusted expected

Revenue: $26.04 billion vs. $24.65 billion expected

Additionally they will issue a stock split which could be bullish as well.

This is extremely bullish for ETH beta plays and AI coins. I am betting big on them! I also show all my investments in the premium section below.

BTC ETF News

Millenium Management loves and Morgan Stanley likes the BTC ETF, which is a significant endorsement from a major financial institution. This development could pave the way for more traditional investors to enter the crypto space, driving further growth and adoption.

Alpha Insights - Airdrops

Your blueprint for finding alpha in Crypto.

Alpha 1: deBridge

@deBridgeFinance introduces $DBR, the governance token for its DeFi interoperability protocol

Community gets 20%: 2 billion $DBR for users, developers, and projects, with 1 billion DBR (10%) unlocked at TGE and the rest vesting over 3 years. Airdrop included although percentage allocated to users is still TBA

$DBR holders can stake their tokens to participate in DAO governance, voting on key protocol decisions like validator elections and chain integrations. Governance also manages the treasury and ecosystem reserves

Staked $DBR will serve as collateral for validators to ensure reliability. Locked tokens from strategic partners and core contributors can't be staked until vested

If you are missing funds on need more blockchains to bridge from / to, you can also use and farm Owlto Finance Bridge.

Alpha 2: zkSync

@TheBlock__ announced that ZkSync is planning on a token generation this week and airdrop in the middle of June

According to The Block’s sources, the token will have a total supply of 21b tokens and that the tentative airdrop date is June 13

It was also reported that the ZkSync team is looking to use $ZK as its ticker

Make your wallet stand out with tips from my Airdrop Guide!

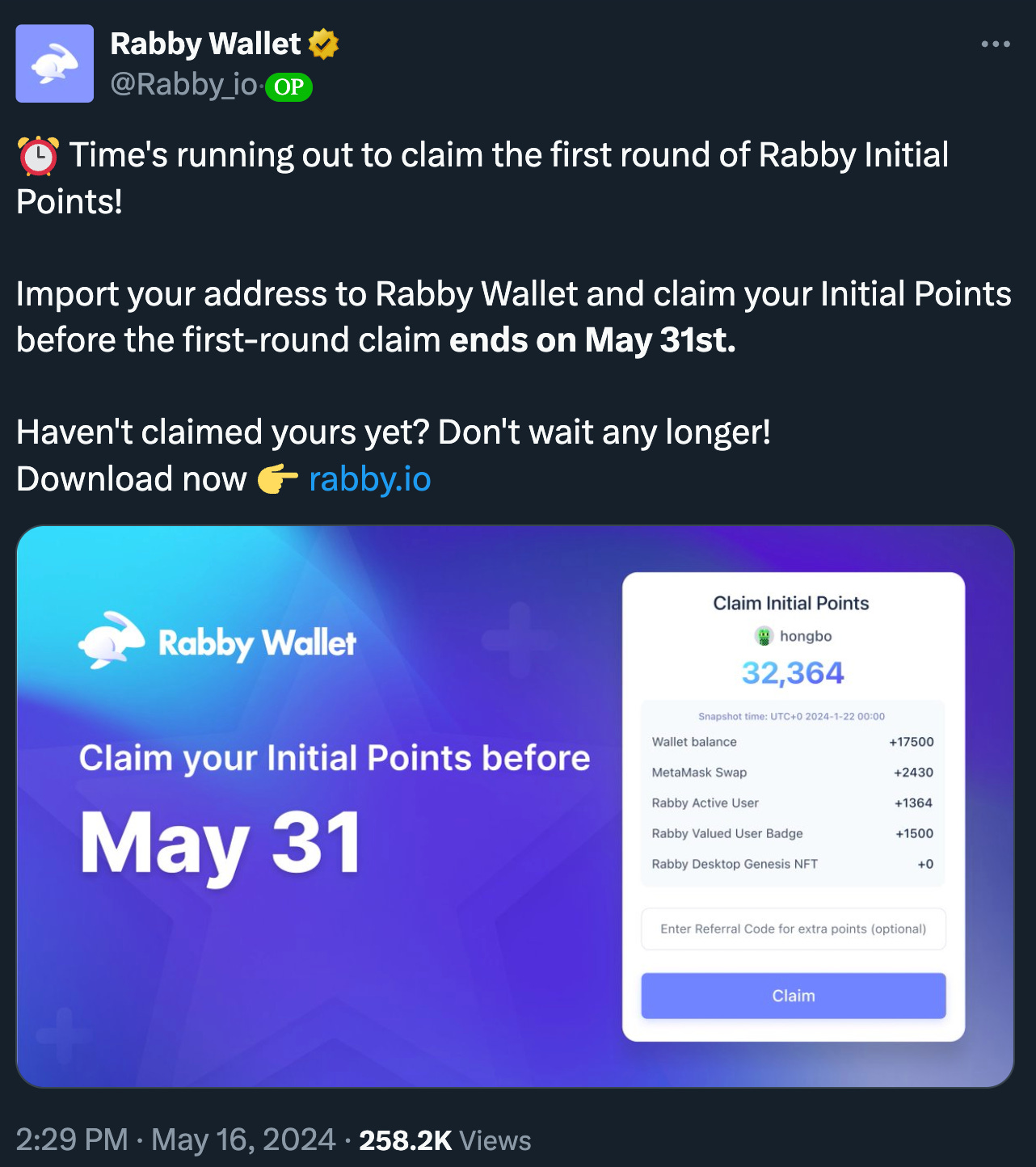

Alpha 3: Rabby Wallet

The first round of Rabby’s points program will end on May 31st.

Get a bonus and start with the Referral Code: RABBYREF

If you're still using MetaMask, you're missing out. The switch takes less than 2 minutes.

Alpha 4: Zora

Here’s a full Airdrop Guide on Zora. The NFT focused Eth L2 is an interesting airdrop target.

Project Updates

ETH L2s are hot. Don’t miss these opportunities. Of course I have a Scroll and Linea Airdrop guide for you.

Scroll

Linea

Start farming Linea here.

Kroma

As a clever farmer, keep farming undiluted and under-the-radar projects. Check out DeFillama and Dropstab for the latest opportunities.

Wrap Up

This week’s takeaways:

The Ethereum ETF approval marks a significant shift in the regulatory landscape and signals potential market growth.

NVIDIA’s strong earnings highlight the increasing demand for AI and its intersection with crypto.

The BTC ETF news points to growing institutional interest in crypto, which could drive further adoption and stability.

Airdrops from deBridge, zkSync, Linea, Rabby, Scroll, Zora, and Kroma present excellent opportunities for early adopters.

Till next time, stay safe!

Adrian

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

Holy Moly we really got an ETH ETF: With most altcoins down 40% and more from the highs, there are countless opportunities to buy some nice dips.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.