BTC Breakdown: Bottom Signal or Bear Market Start?

Macro Tailwinds Into 2026. Pump.fun’s Distribution Flywheel and What Comes Next.

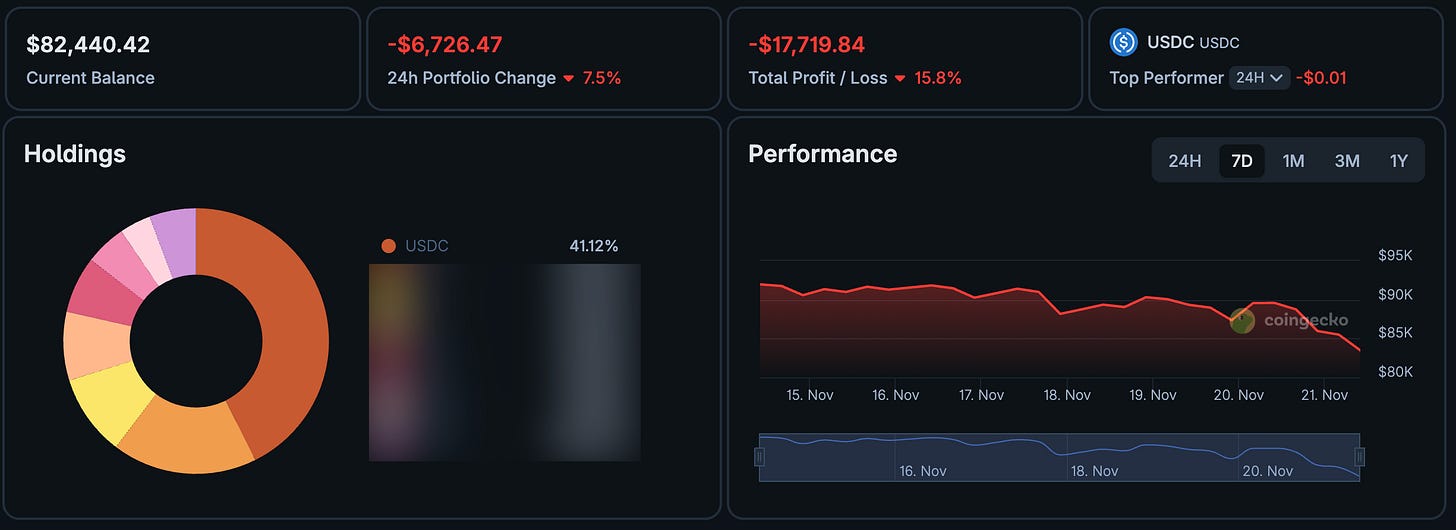

The last few weeks, and especially the last 24 hours, hurt. No way around it. Our premium portfolio took a hit, but this is exactly why we always keep a stablecoin stack. Moments like this aren’t the end of the story, they’re the entries we wait for. Sharp drops almost always get a relief bounce, and we’re positioned to buy where it actually matters.

The goal to 2x this portfolio in this bull run still stands. If anything, every step down only widens the opportunity, especially with 2026 lining up real macro tailwinds.

Don’t give up. Reduce risk. Stay liquid. Stay cool.

We play the long game and it’s far from over!

Using the calls from this newsletter and the Telegram group, we’re going to win this cycle.

Hey Friend!

Let’s zoom out and look at the broader picture and how to set up for the week ahead.

️ ⚡ On today's Episode:

📈 Market Update – BTC is now 34% off the top, mirroring past mid-cycle pullbacks — but a second weekly close under the 50W MA (~100k) puts us dangerously close to early-bear territory. Short-term holder capitulation is spiking as BTC trades below the 109.2k STH cost basis. The next two weeks decide whether this is a flush or a full trend reversal.

🔊 Project Updates – Aave previews its consumer-ready savings app (up to 9% yield, insurance-backed, instant compounding, biometric recovery, 12k+ cards). MegaETH opens its USDm pre-deposit window Nov 25 with a 250M cap, KYC, and 1:1 mainnet issuance.

🐂 Alpha Insights – Pump.fun’s evolution accelerates: Terminal acquisition completes the launch → trade loop, Ascend drives creator monetization, MoonPay removes onboarding friction, and Spotlight targets a $10T private equity market. Aggressive buybacks continue — but major unlocks remain the risk.

💎 Portfolio Section – This week’s premium breakdown focuses on one DeFi project with exceptionally strong fundamentals, real revenue, and a structural catalyst the market hasn’t priced in.

The current state of the market.

Weekly Crypto Bubbles

Market Overview

Bitcoin has already corrected about 34 percent from the recent top. The move lines up almost perfectly with the last two mid-cycle pullbacks.

January 2025 came in at 32 percent.

March 2024 came in at 33 percent.

If the bulls are right and this is just another mid-cycle cooldown, we might be very close to the spot where bottoms usually form.

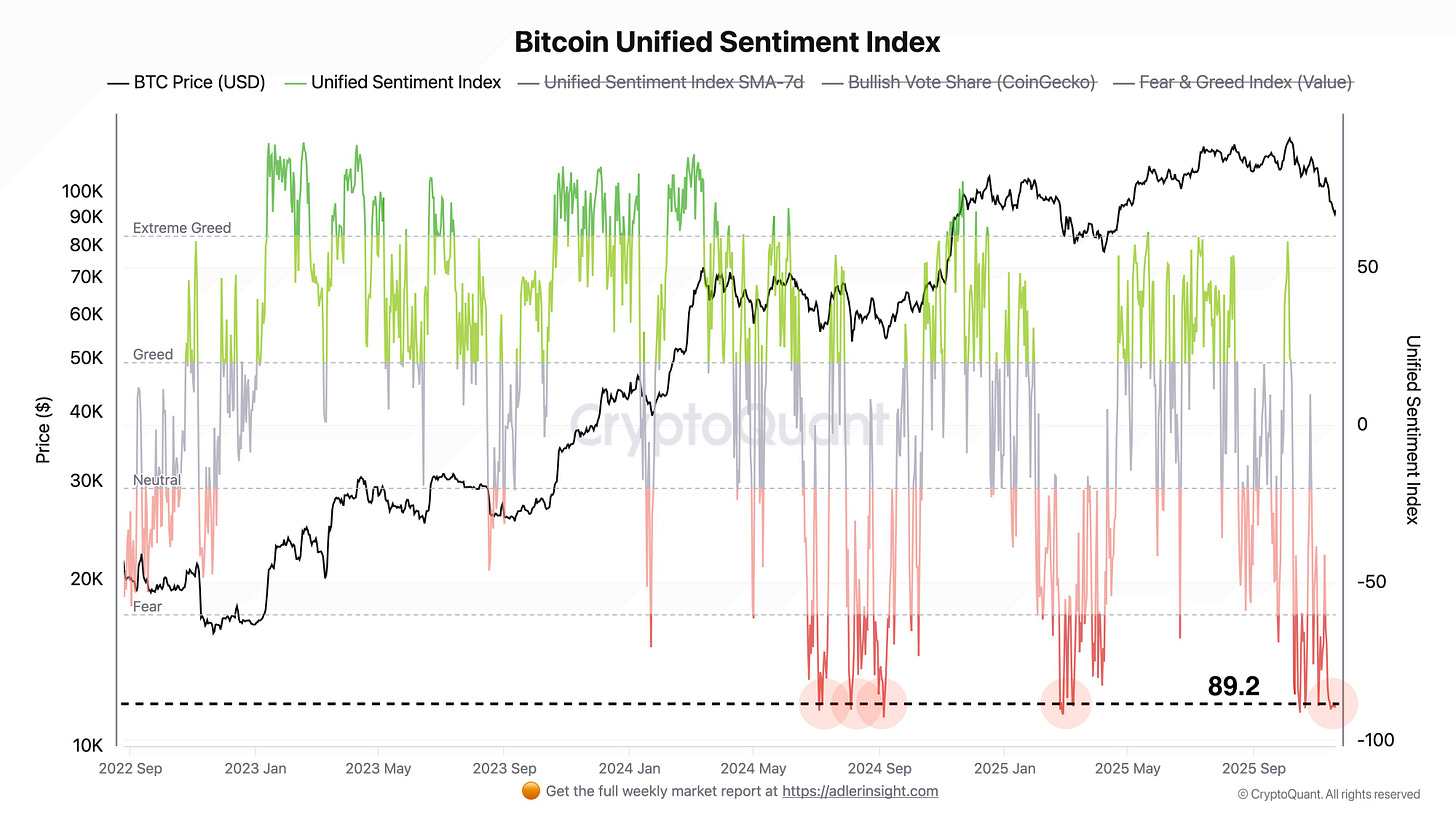

The Unified Sentiment Index (cumulative difference between market buy volumes and market sell volumes over a 3-month period) is landing in the same area as during those previous corrections. And everyone in the market is asking one question: Is this the end of the bull market?

Twitter is circulating the Fear and Greed Index again, but I am cautious with it.

Sentiment loses reliability at the start of a bear market because extreme fear can appear long before price truly bottoms. We have also seen multiple waves of extreme fear without any meaningful bounce. That is classic early bear behavior. On top of that, the structure of this cycle is different. Retail is not the dominant force anymore, and many sentiment indicators were built for a retail-driven market.

A more concrete sign: BTC looks on track to close a second week under the 50 Week Moving Average at roughly 100k. Historically, that meant one thing. Bear market.

If this really is the beginning of a bear market, then this correction is only the first chapter of what could unfold over the coming months.

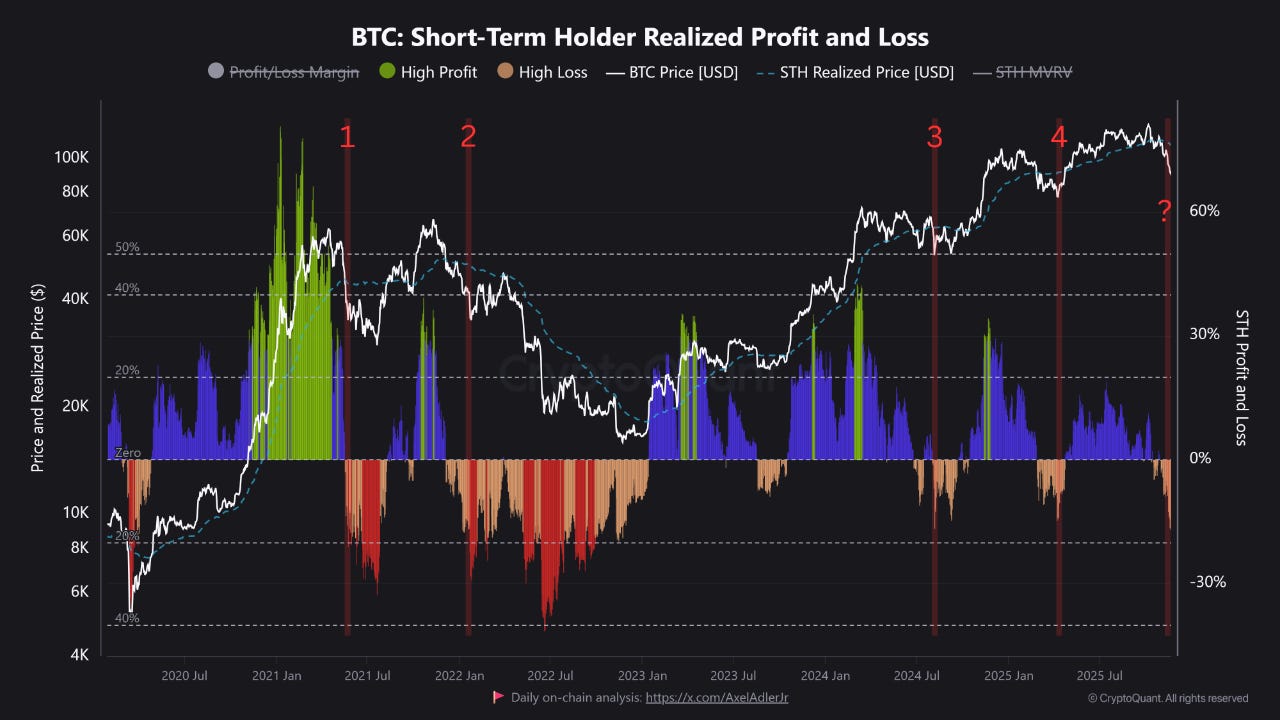

Still, the short term picture has more texture. We see clear signs of capitulation among short term holders. Realized losses for coins held less than 155 days have accelerated fast. Short term holders are selling at heavy losses, and the spike in realized loss is comparable to the major correction points in 2021 and mid-2024 and April 2025. The price is currently sitting below the short term holder realized price at 109.2k, which means most recent buyers are underwater and panic-selling.

Historically this kind of capitulation often marks a local bottom as long as price quickly reclaims the short term holder cost basis. When it fails to do so, it often signals a deeper bearish phase and sometimes confirms the start of a bear market. That is the line in the sand to watch.

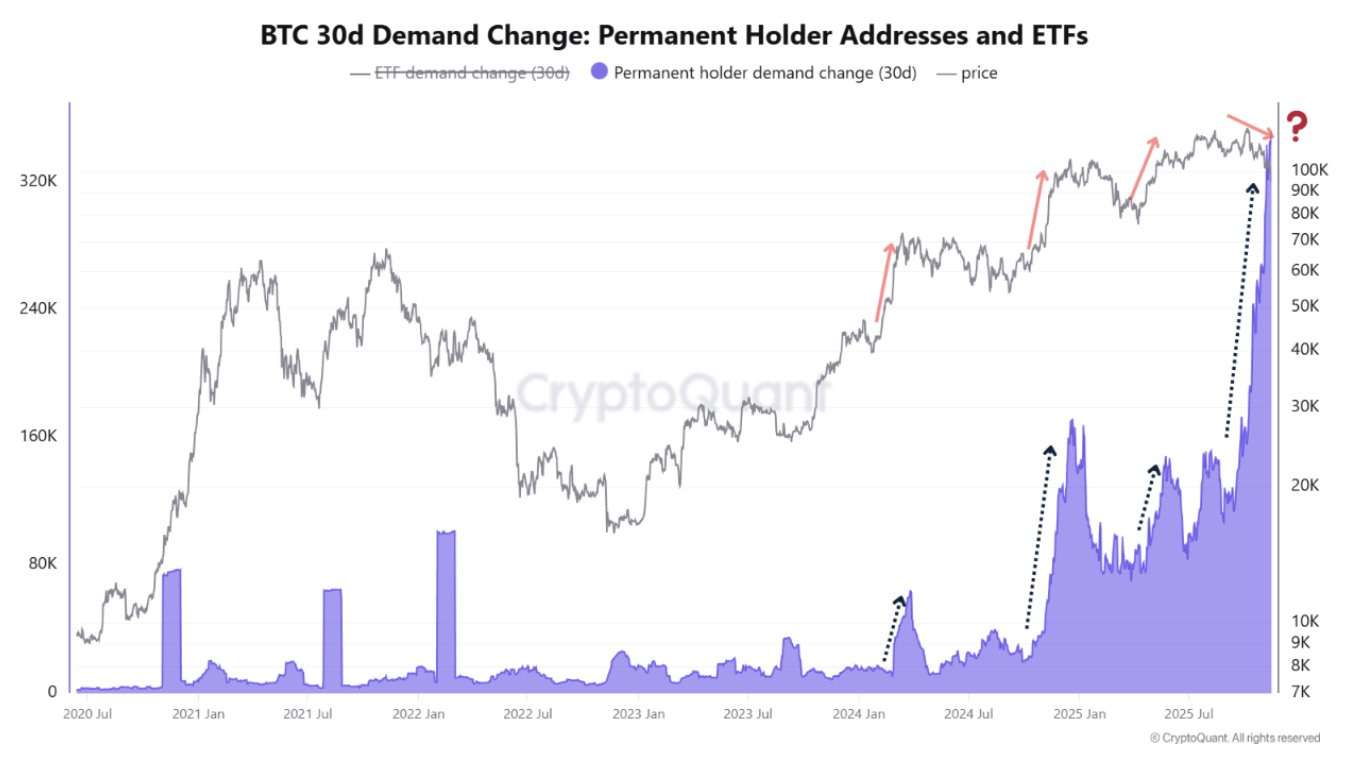

The selling from old BTC whales has not stopped. The rotation from older long term supply toward newer hands is still underway. At the same time, demand from permanent holders is rising decisively, which gives us a mixed but not hopeless setup.

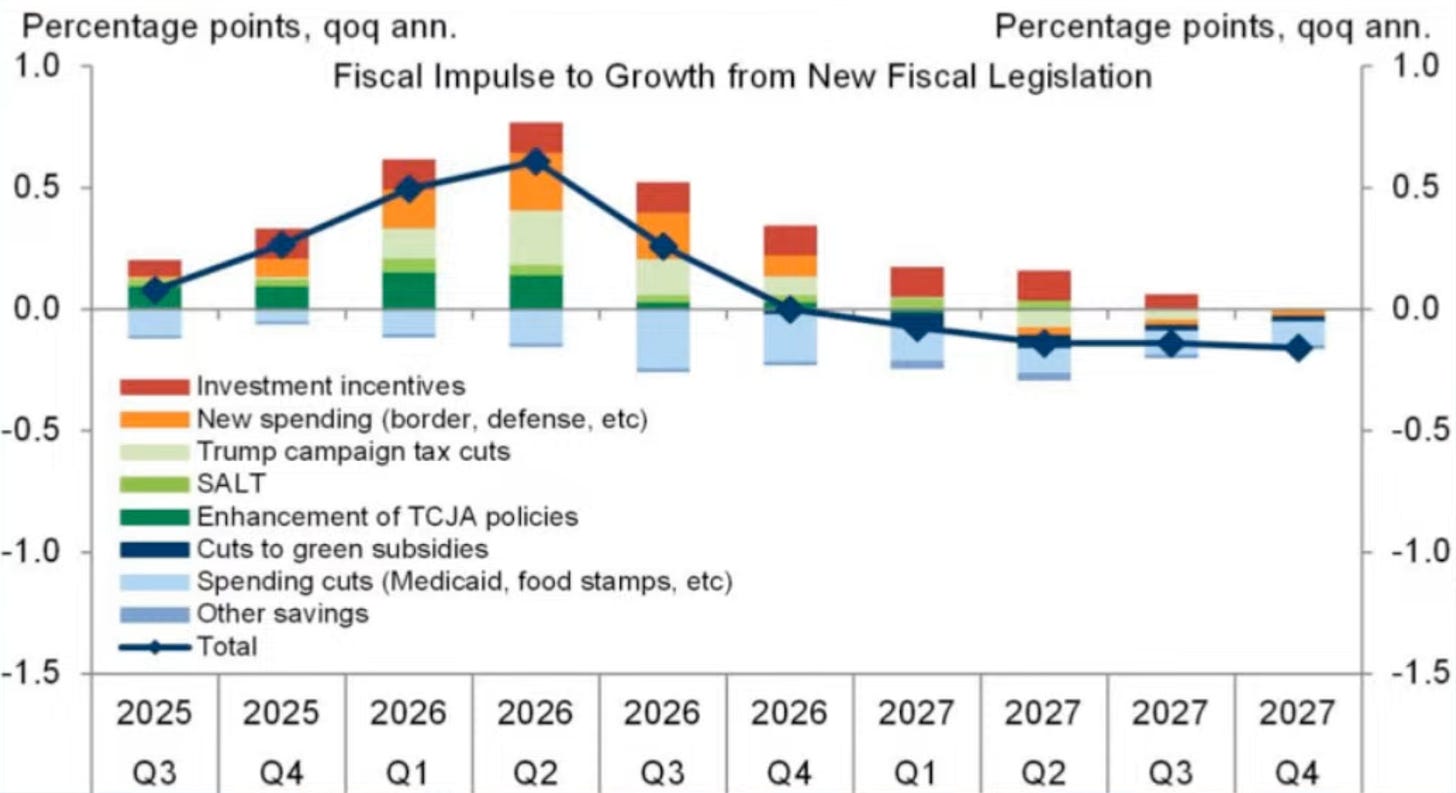

Now the bullish counterweight. Macro is not dead, and 2026 still lines up with real tailwinds rather than hopium.

The AI bubble hasn’t even cracked yet, and as long as capital keeps chasing that narrative, risk assets stay alive. Trumps Big Beautiful Bill policy strengthens the economy in 2026. Fiscal impulse from new legislation peaks in early–mid 2026, driven by investment incentives, new spending and tax cuts. That combination pushes the total impulse well above zero through Q1 and Q2 of 2026 — exactly the kind of background where growth assets breathe again.

On top of that, stimulus checks would add roughly a two percent demand boost straight into consumer risk appetite. Midterms bring the usual political instinct to keep markets calm. And the tariff ruling adds another layer of predictable policy that capital loves to front-run.

Zoom out and you see a simple dynamic. We are either at the end of a mid-cycle flush or the opening stage of a bear market. The next weeks will show which way the market goes.

Altcoin Market Pulse

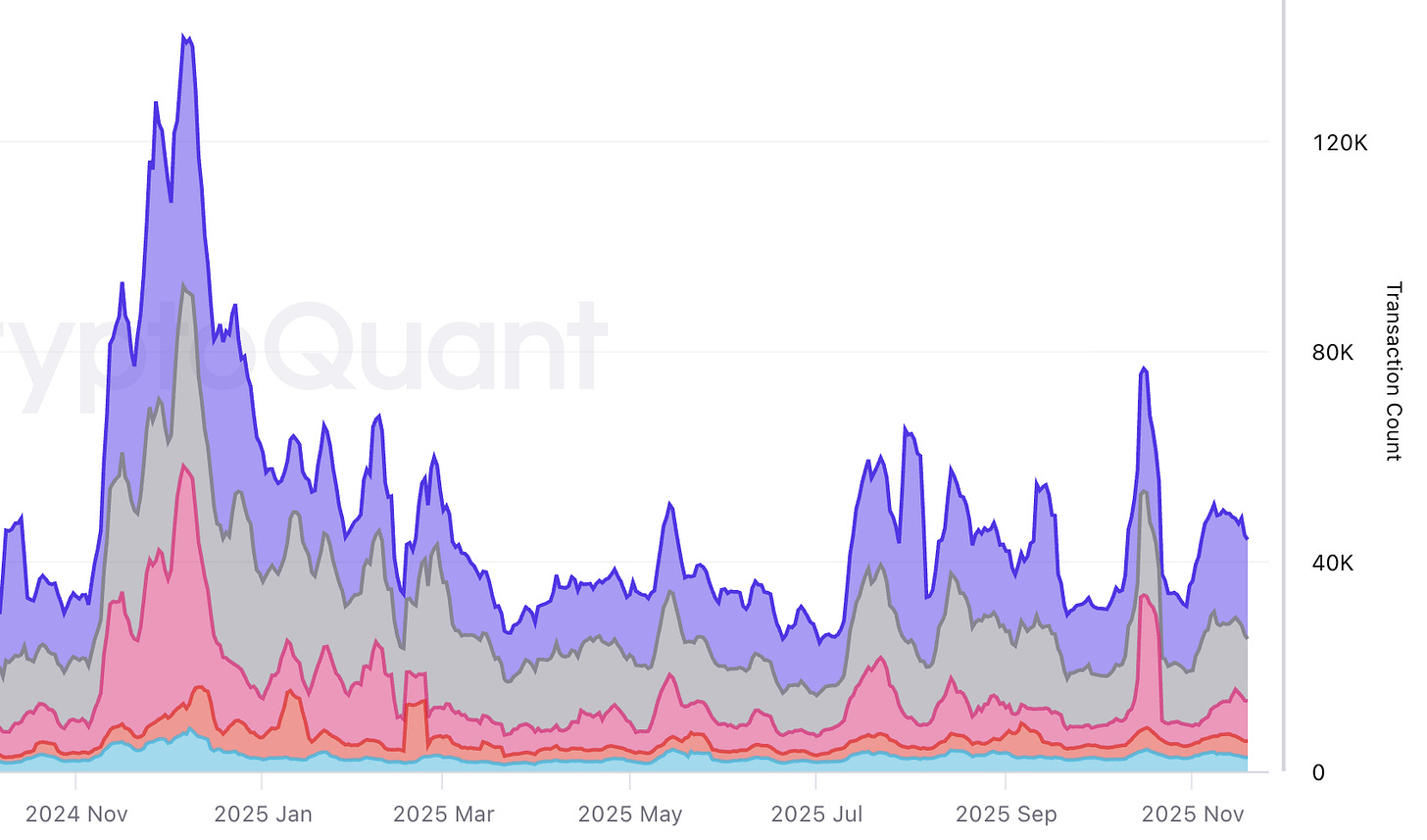

Altcoin flows into exchanges are elevated, but they are still far from the kind of extremes that usually mark a full-on risk event. You can see it directly in price action. Most of the stronger altcoins are holding up almost in lockstep with BTC rather than breaking down harder. There’s no broad rush for the exits yet. In other words, pressure is there, but real capitulation hasn’t started.

I’m tracking this chart daily and will update you on Telegram if the trend turns. Think of it as our early-warning radar — if exchange inflows start spiking again, it’ll be time to move more risk-off.

The biggest updates across top crypto projects.

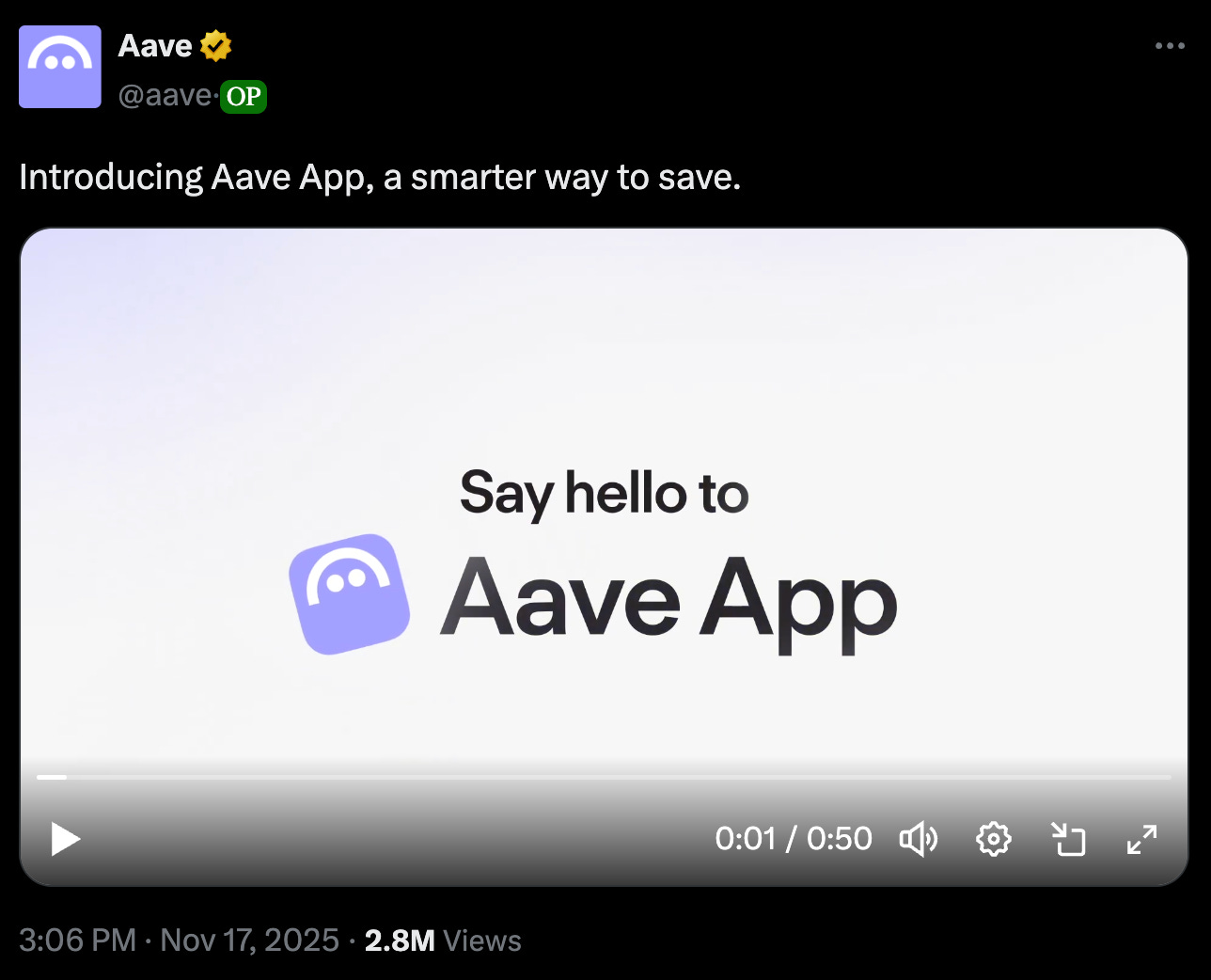

Aave Savings App

Aave just dropped a preview of its upcoming savings app, and on iOS is already looks really cool. You can join the waitlist here.

Key highlights:

• Up to 9 percent interest

• Insurance-backed protection up to 1 million dollars

• Support for more than 12,000 bank cards

• Biometric recovery if you lose access

• Withdrawal whitelist to avoid fat-finger mistakes

• Interest compounding every second

• No minimums and zero extra fees on bank transfers

Clean, simple, consumer-first. An app like this could really bring crypto to the masses, hidden behind a nice user interface.

MegaETH: USDm Pre-Deposit

The USDm pre-deposit bridge opens on Tuesday, November 25th, with a tight and simple structure.

Key points:

• Eligibility is limited to users registered on Sonar for the $MEGA sale who aren’t in Restricted List countries

• KYC is required since deposits are used to mint USDm through regulated contracts

• Only one wallet can be used, and it must be the verified Sonar wallet

• Pre-depositors earn credit toward the Rewards Campaign

• No individual caps, but the overall limit is 250 million dollars

• Window closes once the cap is hit or right before MegaETH Mainnet

• You receive USDm 1:1 on MegaETH mainnet day one

• Only USDC on Ethereum is accepted

• No early withdrawals, deposits will be visible onchain

This campaign is likely quite competitive. A small allocation makes sense if you are bullish on MegaETH. The ecosystem certainly has potential.

→ More info in FAQs on deposit page

Good opportunities I discovered.

Alpha 1: Pump.fun: The Factory Behind the Memecoin Machine

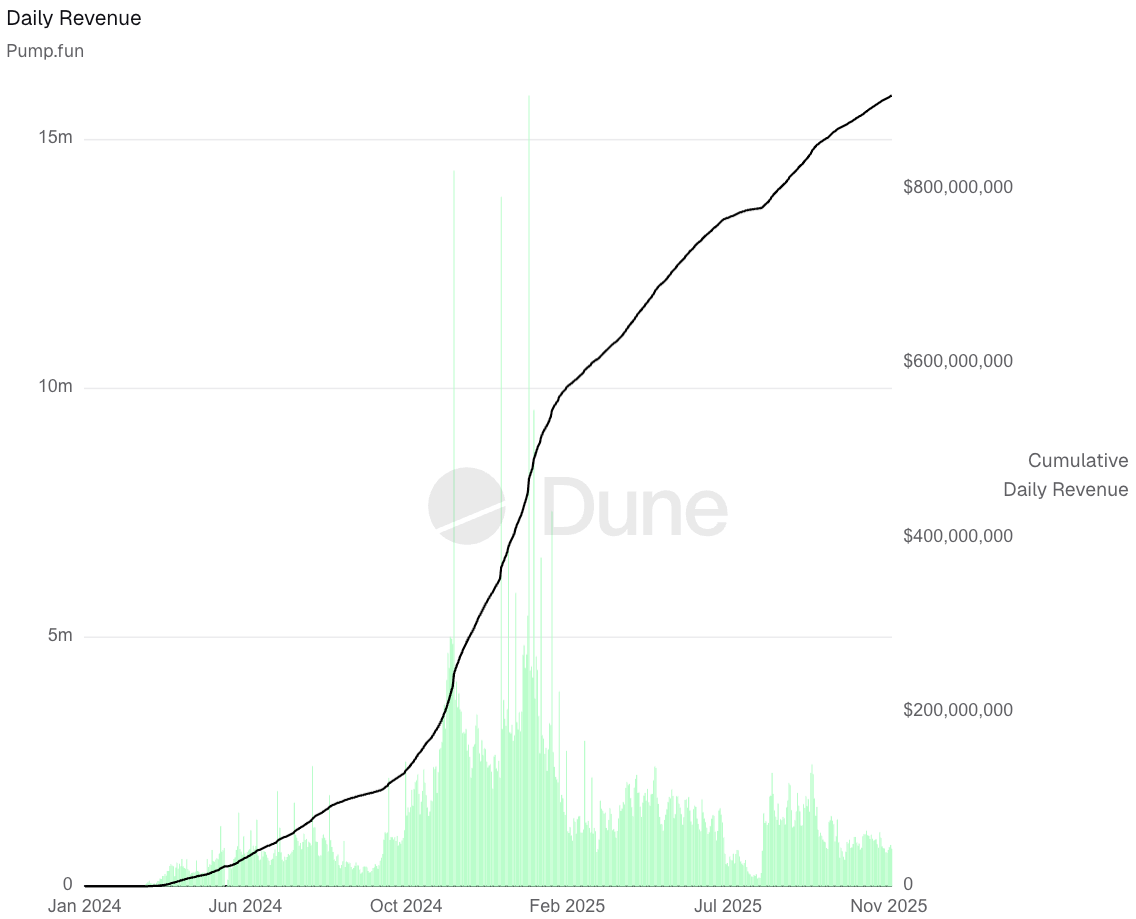

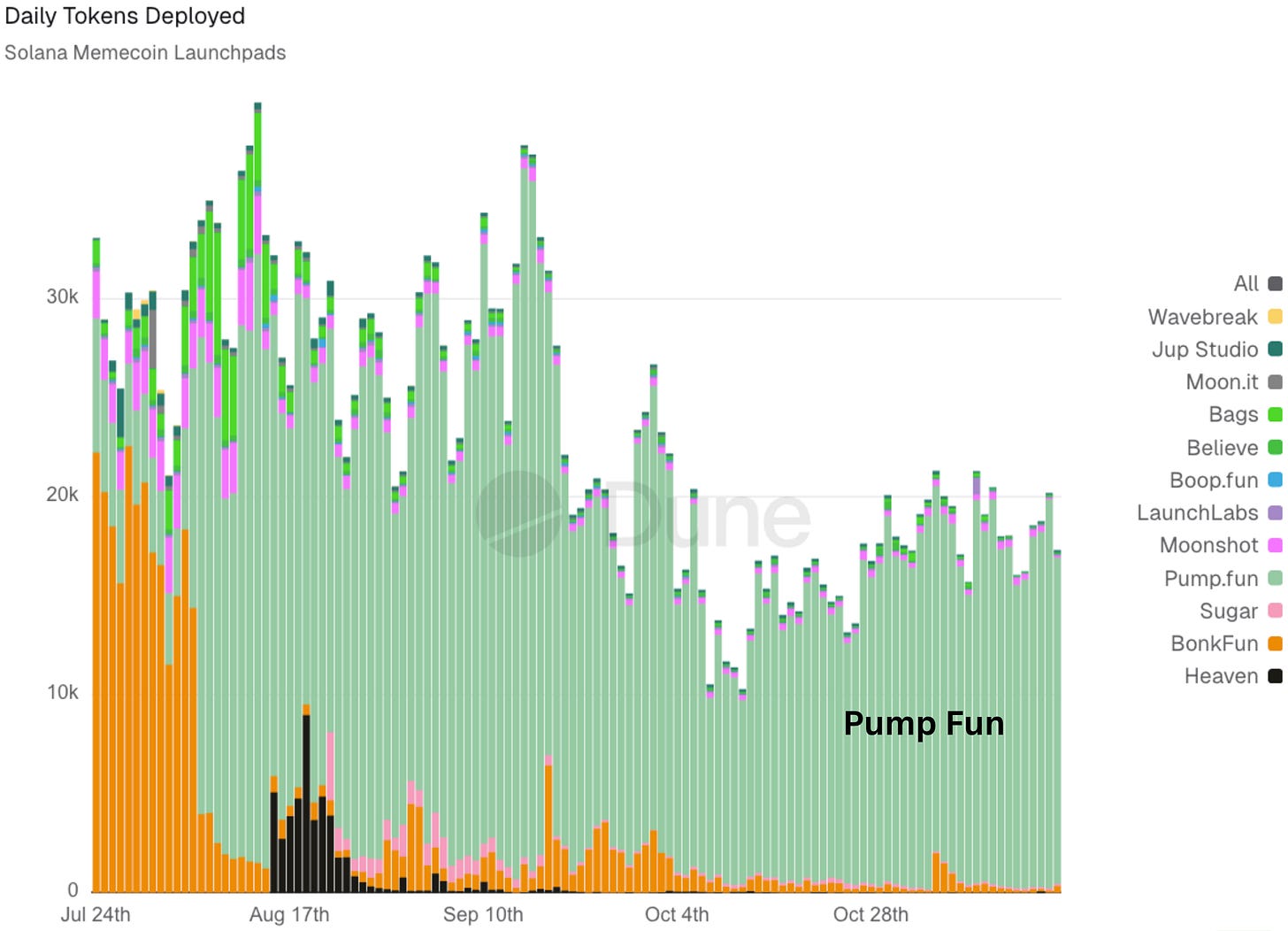

Pump.fun industrialized the memecoin meta. In a sector built on speed and absolute insanity, it created a factory. And in doing so, it became one of the most profitable apps in crypto history.

This alpha focuses on what matters right now for PUMP.

The Core Insight

Pump.fun turned memecoin creation into a one-click behavior. No coding, no setup, no knowledge needed. Upload a picture, type a name, hit Create — and a token is born. The bonding curve makes these launches “fair”, and once a coin hits around 65k market cap, it “graduates” to PumpSwap.

It powered the Solana memecoin supercycle.

Then the hype cooled. Launches declined. Revenue dipped. Most people are writing memecoins off.

But Pump.fun is building something bigger.

1 | Padre (Terminal) Acquisition

Pump.fun owned the launch side. Padre (now Terminal) brings the trading side.

High-speed execution

Multichain support

Clean UX

Cashback incentives

Together they completed the loop:

Launch → Trade → Data → Volume → Fees → Buybacks

A casino where users create the games and play them — while the house takes a fee every time.

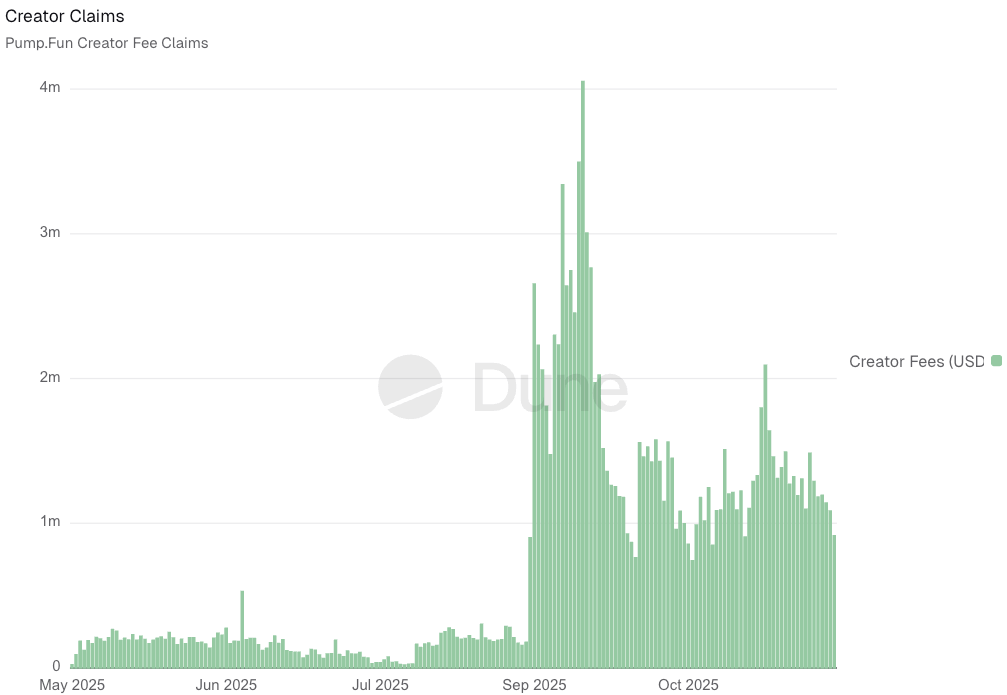

2 | Project Ascend & The Rise of Livestreaming

Ascend flipped creator economics.

Suddenly, streaming on Pump.fun became more profitable than YouTube, Kick, or TikTok. Creators followed the money — gaming streamers, meme creators, crypto influencers.

More creators → more viewers → more tokens → more volume → more revenue → more $PUMP buybacks.

Pump.fun try to monetize on this attention engine. The long term success is dependent on longevity of successful creators on the platform though.

3 | MoonPay Integration

Onboarding was always the bottleneck.

Now anyone can buy SOL directly inside the Pump.fun app and start trading instantly.

No exchanges. No friction. No excuses.

Their cleanest step toward mainstream so far.

4 | Spotlight — The Next Frontier

This is where they get really ambitioned.

Pump.fun doesn’t just want to dominate memecoins. They want to open private equity to retail — a space traditionally gated behind VCs and accredited investor rules.

They call this product Spotlight and this is the goal:

Bring real companies onchain. Let anyone take early positions. Turn everyday users into small-ticket VCs.

If they execute, they won’t just run the casino — they’ll own the capital formation layer behind it.

A gateway into a 10 trillion dollar private equity market.

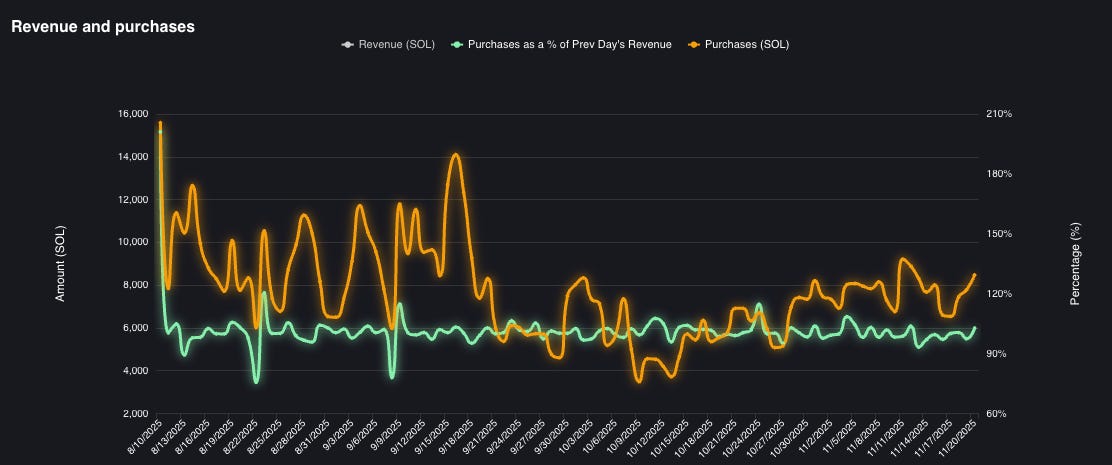

5 | The $PUMP Flywheel

Pump.fun uses almost all revenue to buy back $PUMP — sometimes even more than they make.

At this pace, they could repurchase 25% of circulating supply within a year.

Hyperliquid buybacks are aggressive. Pump.fun is twice as fast.

But supply unlocks matter:

33% unlocks in 2026.

17.6% unlocks this December.

Buybacks can absorb a lot — but not everything. This is the key risk to monitor.

6 | Upcoming Catalysts

• Mayhem Mode + AI Trading

First step into AI-driven token mechanics. Big volume, needs polishing.

• Spotlight’s First Startup Launch

Will set the tone for the entire vision.

• Large December Ecosystem Unlock

Risky, but could fuel another incentive-driven breakout if used smartly.

The Thesis

Pump.fun has the one thing every protocol wants:

distribution

Creators, streamers, degens, newcomers, and retail investors — all flowing through the same funnel. The platform mints culture at scale, and now it’s expanding into real-world value.

The memecoin meta was act one.

Act two is about owning the entire onchain distribution stack.

If you want a straight to the point newsletter full of calls, new projects, airdrop farms, memecoin and DeFi moonshots, then Hix0n’s Confidential is the place for you. I can really recommend his take (if you’re comfortable with high risk).

So let’s get into the juicy Premium stuff:

If you want to actually be ready for the end phase of this bull cycle you should check out Premium

Here’s what you get:

📈 Ultimate Exit Strategy – Know when to take profits and avoid becoming fresh exit liquidity.

📰 Premium Weekly Newsletter – Deep, independent market analysis. No fluff, no filler. Just the best narratives, data, and edge.

📊 2× Weekly Trade Updates – Real trades. Real setups. In real time.

🧠 Stoic Mindset Coaching – Because you can’t win if you’re trading emotionally.

👨💼 Community Vote Deep Dives – You choose what I research. Zero shills, just signal.

💬 Daily Premium Support Chat – Ask me anything. Literally.

If you’ve been riding the newsletter for free and getting value, this is the next level.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.