BTC Reset or Breakdown? This Signal Says Reset.

ETF Outflows, Whale Distribution, and the Structural BTC Signals That Matter. Perp DEX Wars Deconstructed and the Early Map of 2026’s Crypto Stack.

We longed BTC at 90.1k during peak fear and closed the move for a +40% gain.

While the market panicked, we trusted our TA signals and the result is another high-conviction win executed exactly by the playbook.

Using the calls from this newsletter and the Telegram group, we’re going to win this cycle.

The best way to support me is to share this newsletter. Thank you!

Hey Friend!

This week felt like the market finally hit that point where everyone sighs, checks the chart, closes the chart, reopens the chart “just to confirm it still sucks,” and then goes for a walk. Momentum is dead, vibes are in the gutter, and even the perma-bulls sound like they’re negotiating with the universe.

And honestly? This market does suck right now. There’s a decent chance we get more pain in the short term, whether that’s another dip or a few more weeks of sideways chop that slowly erodes the will to live.

But once sentiment gets this close to rock bottom, you at least get a silver lining: there simply isn’t much room left for emotions to fall. And historically, that combo has pointed to two reliable outcomes:

A reversal usually hits within 2–3 weeks

Terrible sentiment doesn’t stop new all-time highs from showing up a few months later

Classic playbook: buy when everyone else is fearful, sell when everyone gets brave again.

Let’s get into the broader picture and how to set up for the coming week!

️ ⚡ On today's Episode:

📈 Market Update – BTC exchange reserves hit all-time lows as ETFs flip from steady buyers to aggressive sellers. LTHs unload $70B, macro kills sentiment, volatility spikes, and Fear & Greed sinks to 15 — same panic as $74k, at much higher prices. ETFs dump $2.59B in November, whales offload 714k BTC, leverage unwinds, and basis traders derisk instantly. Meanwhile “permanent holders” absorb 159k → 345k BTC — major structural strength under the chaos.

🐂 Alpha Insights – Deep dive into the 2025 Perp DEX Wars: the real scoreboard (OI, not volume), why Hyperliquid still owns 63% of real risk, and how Lighter, EdgeX, and Aster stack up. Plus: six macro + product trends shaping the road to 2026 — Prediction Markets PMF, ML model monetization, Neobank Wars, the DeFi-to-AI feedback loop, and the coming Dynamic DeFi era.

The current state of the market.

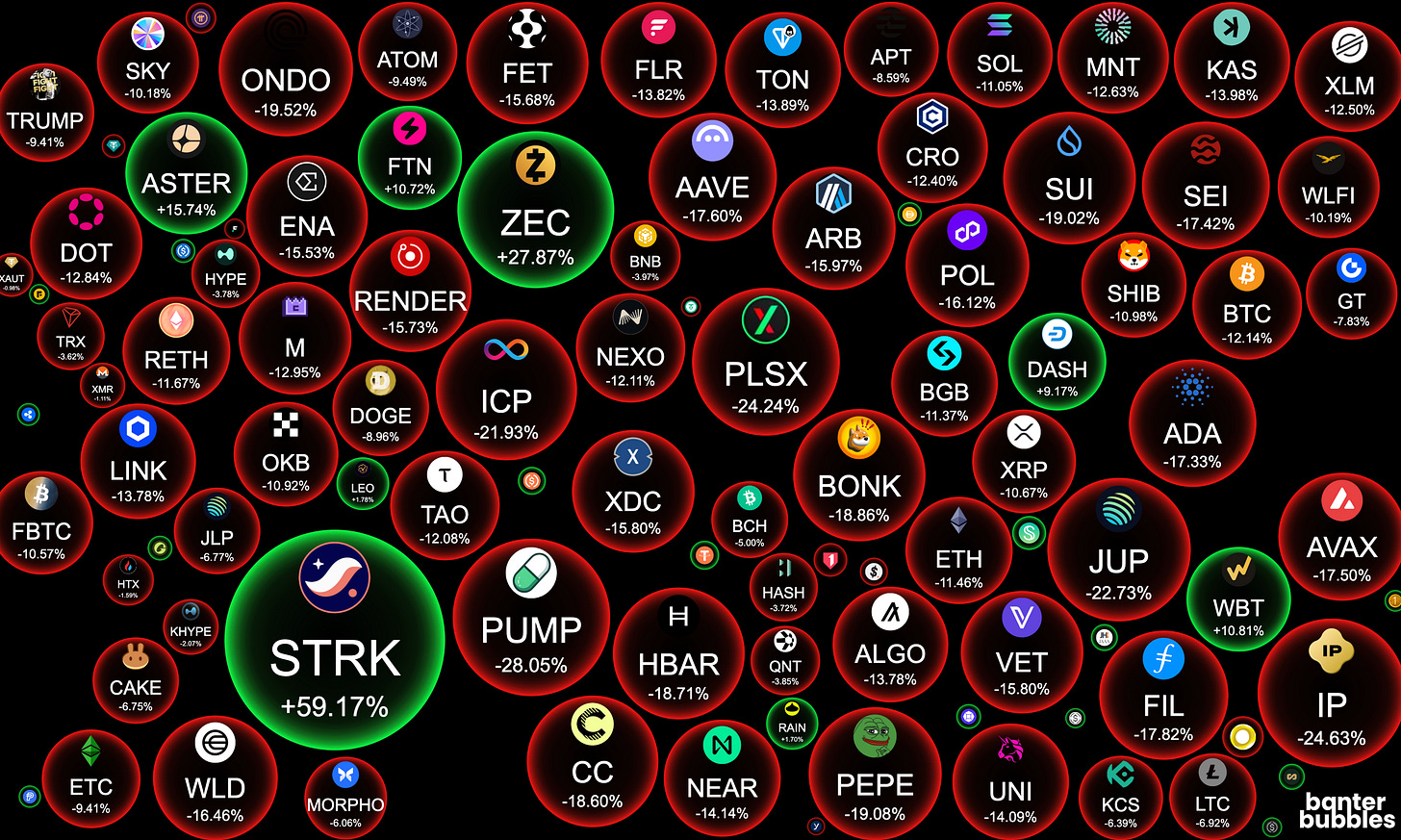

Weekly Crypto Bubbles

→ Privacy (ZEC) combined with L2 tech (STRK) outperforming this week

Market Overview

BTC Exchange Reserves Hit All-Time Lows

Exchange reserves are now at their lowest point ever, which is telling considering how much selling we just lived through. Heavy outflows + collapsing reserves means one thing: Sellers swung hard, threw everything they had, and eventually will run out of ammo.

Here’s what actually drove the price move.

ETF Buyers Became Sellers

For most of the year the ETF flows were a consistent bullish price driver — steady inflows, clean price support.

In November ETF investors went full villain arc and sold $2.59B in BTC so far.

We saw $869M in net outflows last thursday across US spot BTC ETFs, the second-worst day since launch. The only uglier one was the February flush that knocked BTC from $94k to $86k.

ETFs were the reliable buyers on the way up. Turns out they’re also incredibly efficient sellers when the macro tone shifts.

Net flows stayed negative — clear sign passive demand stepped off the gas.

And yes, the basis trade is still the largest force in that market. Institutions long ETF + short CME aren’t “bullish”; they’re collecting funding. When things wobble, they de-risk instantly and without emotion.

Strong narrative on the way up, clean mechanical selling on the way down.

Whales: Unloading in size

While ETFs did their thing, the big on-chain holders were hitting the sell button too.

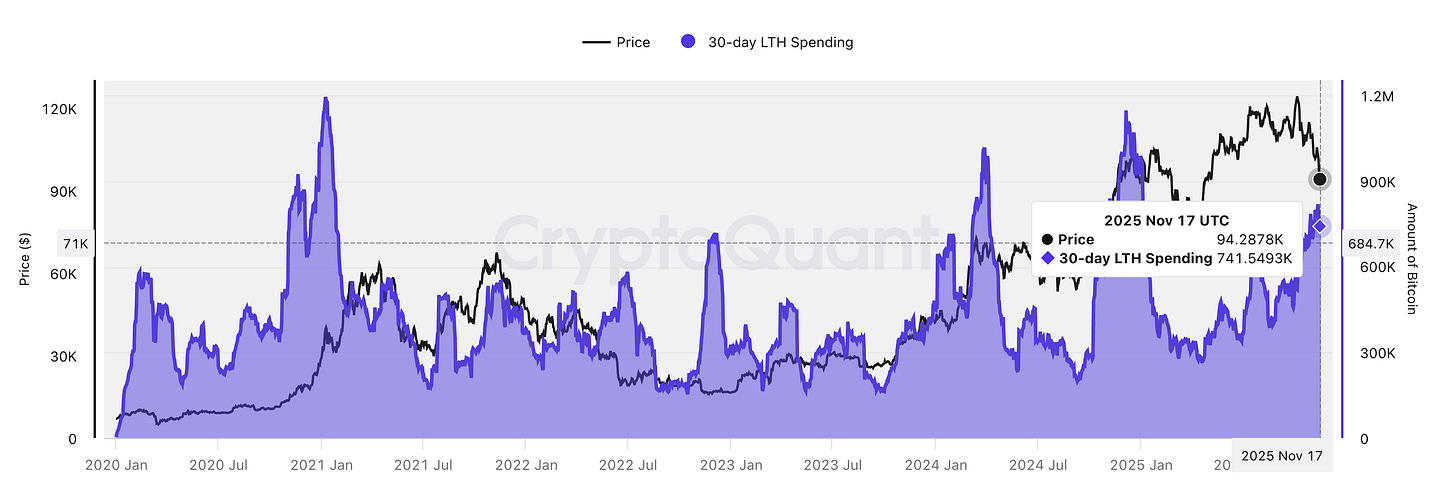

Over the last 30 days, 714,000 BTC — about $70B — was distributed by long-term holders (LTH).

That’s the largest LTH sell month since January 2025.

Large wallets were de-risking into strength while liquidity is still decent.

Macro + Fed: The “drive-without-a-dashboard” moment

The macro side delivered the rest of the pain.

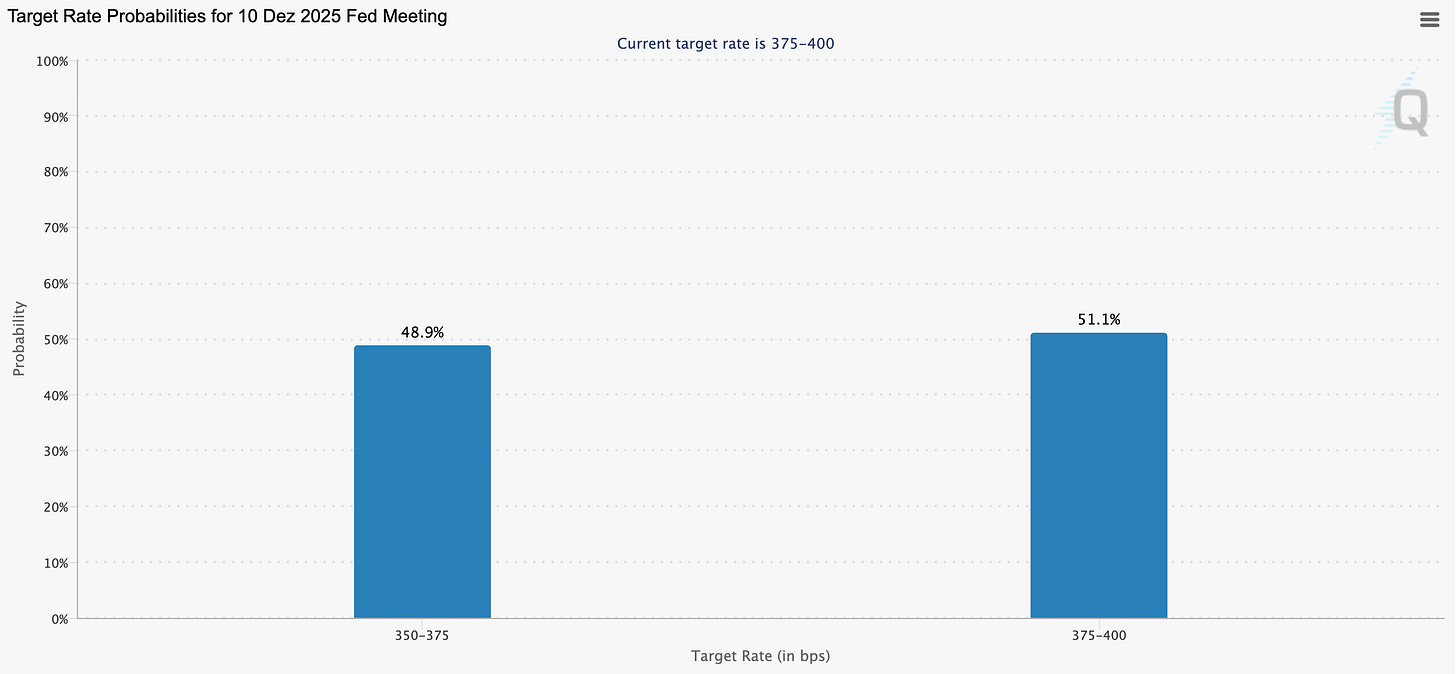

Rate-cut expectations evaporated in a week. Markets went from “December cut is basically guaranteed” to “actually we might not get one at all.” That alone makes every risk asset feel heavier.

Then the US government shutdown delayed CPI and jobs data, leaving the Fed guessing.

Policy makers don’t love guessing.

Inflation stuck at 2.7%, employment softening, no fresh data, and an FOMC meeting that suddenly looks like a coin toss. When the Fed flies blind, the market prefers to slash exposure.

Equities bled. Volatility spiked. Global leverage unwound as a group.

Crypto, as usual, just did it with leverage and is down bad.

Are we in a bear market?

Price action definitely feels like one, but higher-timeframe structure isn’t broken.

BTC still holds the April 2025 swing low at $75.5k, and nothing about this move resembles the former halving cycle meltdown.

This cycle isn’t following the old script:

BTC ran to six figures, corrected ~25% so far, not 70%.

A trillion vanished in a month, yet we’re miles above 2022 bear market territory.

Spot ETFs exist. Revenue-generating DeFi exists. Tokenized treasuries, AI x crypto infrastructure, real on-chain payments — all part of the landscape now.

The market is acting more like it’s in a mid-cycle regime shift than the start of a three-year winter. But nobody knows for sure.

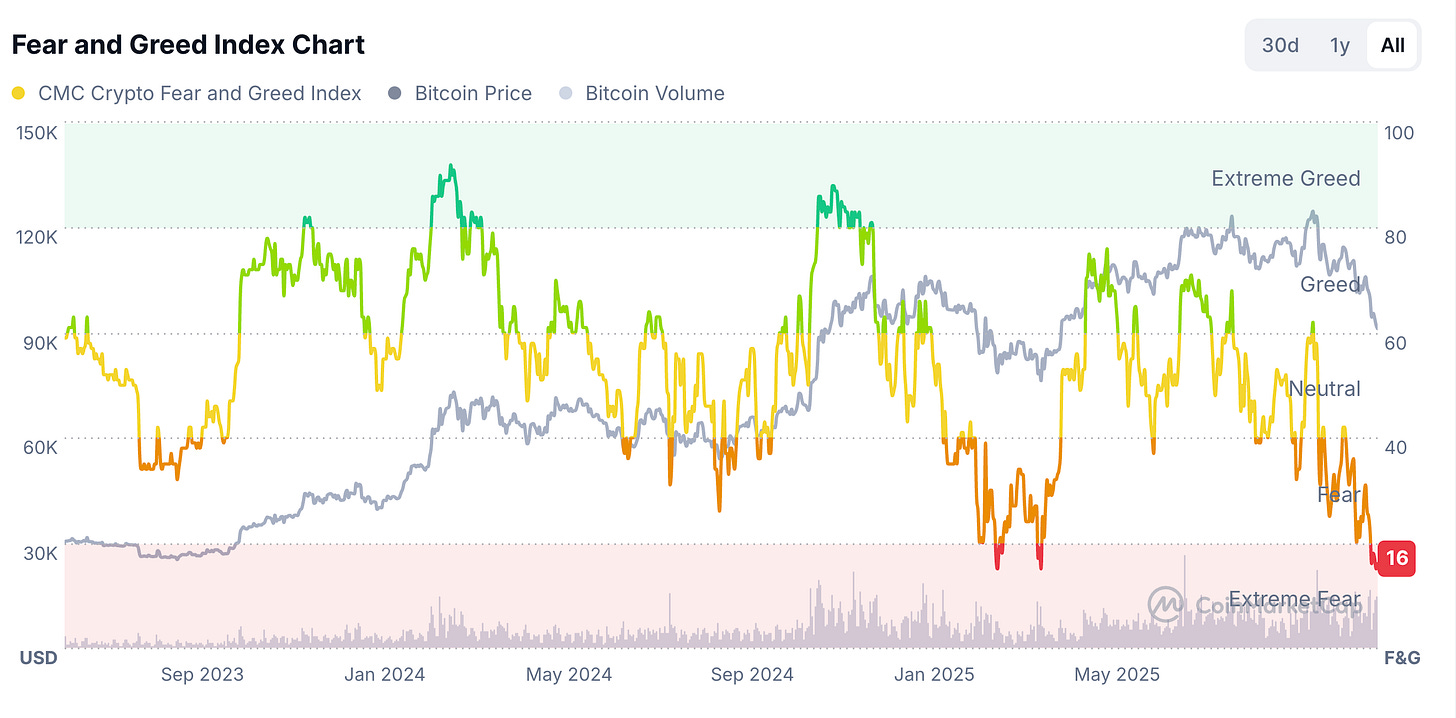

Fear & Greed: Hitting the same levels as the $74k panic

Fear & Greed printed 15, that’s the same level we hit earlier this year when BTC was trading at $74k.

Same fear, much higher price.

Combine that with:

$1T+ wiped from market cap since Oct 7

$1.8B in liquidations this month

volatility ripping through every asset class

This is a proper sentiment reset and so far not a structural breakdown.

And the underlying ecosystem refuses to die on cue:

ETFs continue shaping long-term flows

on-chain revenue keeps showing up

stablecoin usage stays strong

AI + payment rails keep integrating crypto infra

governments and funds remain active participants

Annoying for bears, inconvenient for perma-bulls, but very on-brand for a mid-cycle reset.

The Reset Is Supported by Structural BTC Metrics

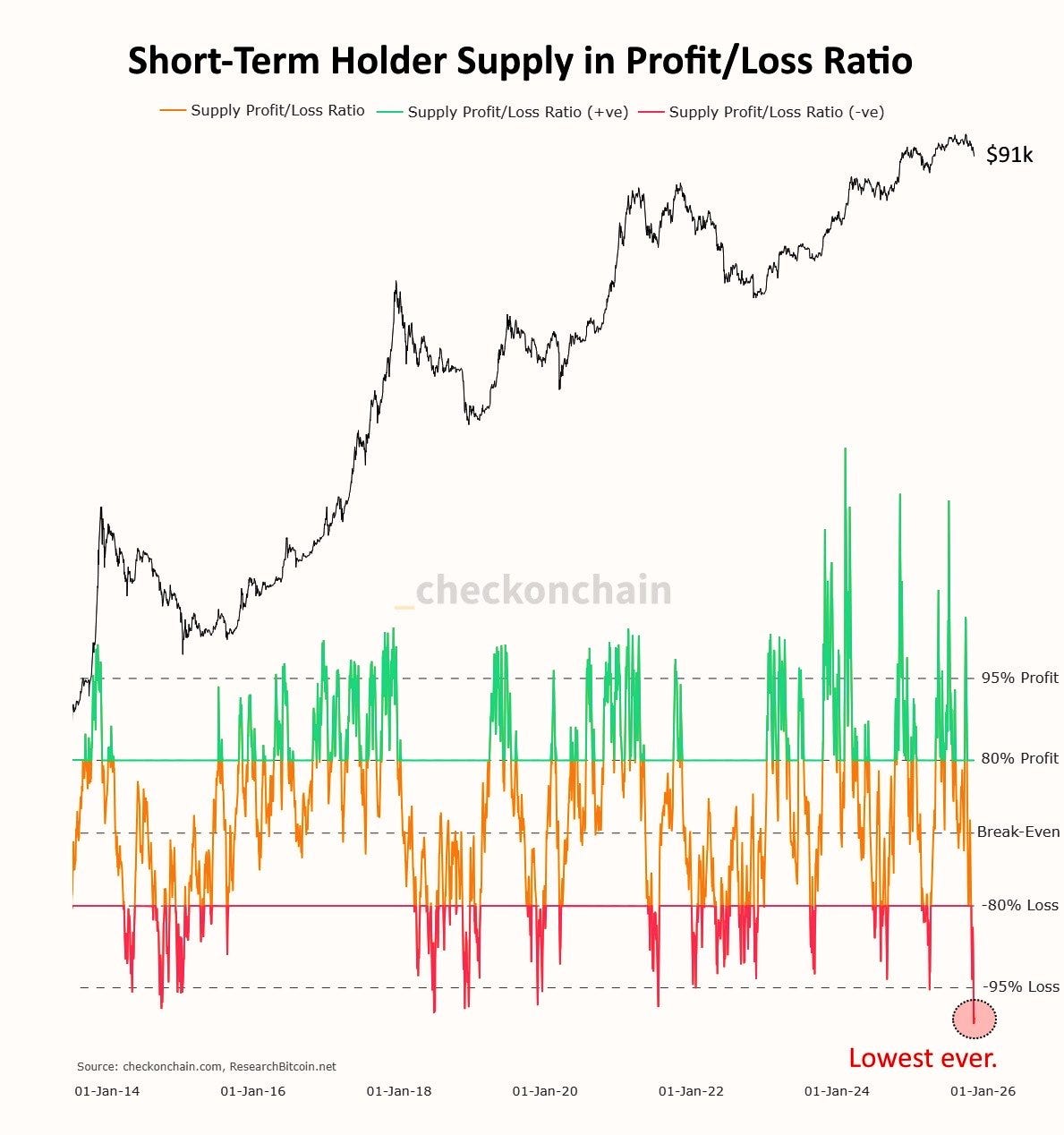

Short-term holders are getting hit with some of the largest losses we’ve seen this cycle. Their profitability just dropped to the lowest level ever recorded, even lower than the FTX capitulation window in November 2022.

Historically, these flushes tend to create proper opportunities rather than long-term tops. Price weakens, weak hands tap out, and supply resets.

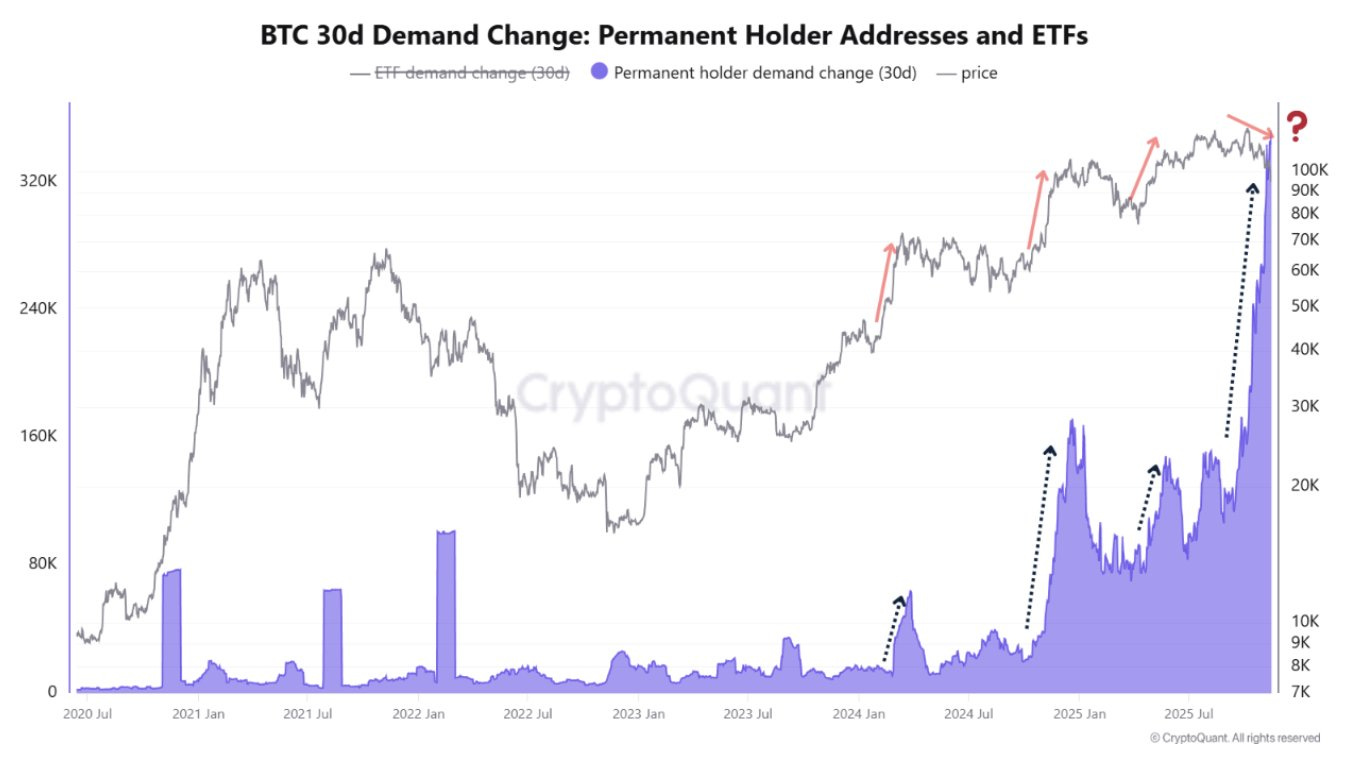

At the same time, long-term holders keep doing the opposite of everyone else: they’re buying more. CryptoQuant’s data shows BTC absorbed by “permanent holders” jumped from 159k BTC to 345k BTC since October 6 — the largest increase in recent cycles.

Normally, that kind of absorption shows up near local tops: strong hands vacuum supply, squeeze the market, push price higher, then distribute weeks later. This time, the signal flipped. Strong hands are loading up while price is trading like a bottom, not a top.

That creates a simple two-path setup:

Supply absorption → rally

Strong hands scoop up forced selling, short-term holders capitulate, and a supply squeeze kicks off once outflows slow. It’s the classic “smart money buys the puke” structure.

One more flush before trend continuation

If price breaks lower, it forces the last remaining weak bids out of the market. The accumulation becomes early rather than wrong, but the market still needs another wash before stabilizing.

Either way, the signal is clear:

Long-term capital is stepping in while short-term sentiment is blowing up.

How to approach this crazy market without getting smoked

For traders, this is not a playground for hero-size leverage.

Daily ranges alone can liquidate positions that would’ve been fine six months ago.

Shrink size

Cut leverage

Treat it like a scalper’s market

Don’t get married to anything that moves fast and promises the world

For investors, the filter is simple:

Usage — real activity or just hype

Durability — survives a boring market or evaporates without hype

Time — comfortable holding for 6 months without sweating

If an asset fails any of these, it’s probably a trade pretending to be an investment.

And for sanity: Don’t let the chart manage your emotions.

This part of the cycle is designed to drain your energy. Staying cool is alpha.

Where this leaves us

Retail never really returned in size this cycle.

Most new money came from institutional structures, ETF flows, and players running basis trades.

Crypto stacked leverage on top of that foundation, macro flipped, whales sold, ETFs reversed, and the structure could crack soon.

Now we’re sitting at a fork:

If crypto stays a closed-off casino for insiders, we slide into a long bleed.

If real usage wins — payments, consumer apps, tokenized treasuries, AI x crypto rails, on-chain games — this looks like a heavy reset before the next expansion.

The market is voting on that right now.

Our edge comes from knowing our role, sizing accordingly, and focusing on the projects that still matter even if we chop sideways for a year.

Good opportunities I discovered.

Alpha 1: The 2025 Perp DEX Wars — The Metrics That Actually Matter

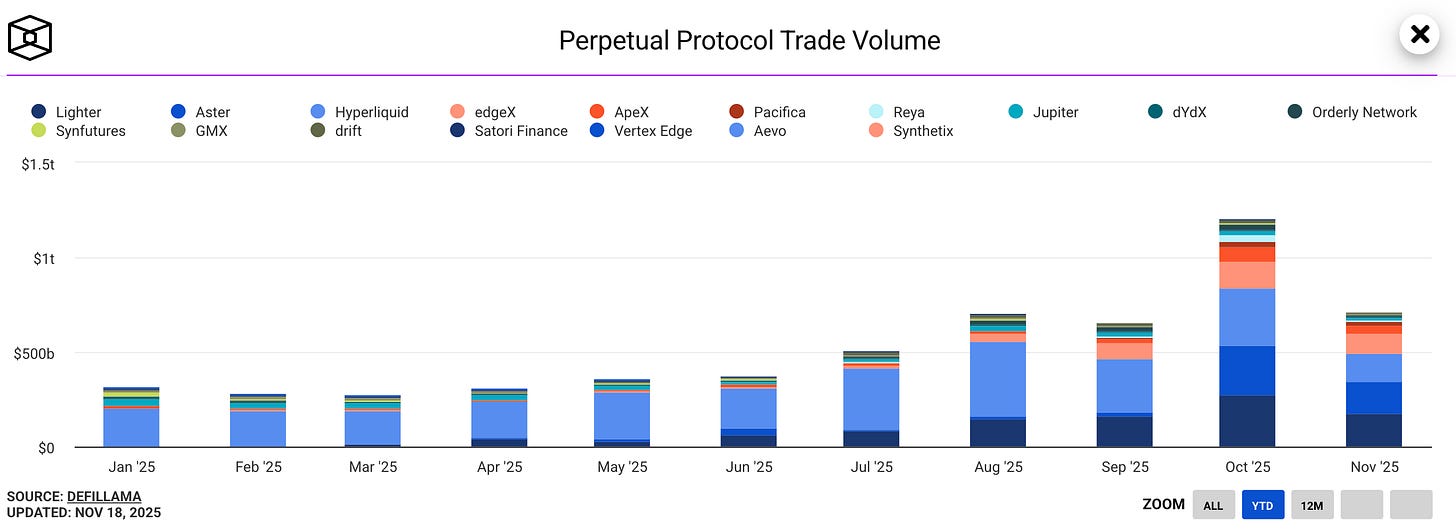

Perp DEXs became the biggest narrative in DeFi this year. October alone cleared $1.2T in on-chain perp volume — a new record — and the market finally has four real contenders instead of one.

Hyperliquid dominated the entire first half of 2025, peaking at 71% market share. But by November, new players gained significant market share (mostly due to airdrop farming though):

The current volume share is a head to head race without a clear winner:

Hyperliquid: 22.7%

Lighter: 22.4%

Aster: 22.2%

EdgeX: 16.8%

Looks like a Hyperliquid lost a lot of market share… until you look at the one metric that isn’t farmable: Open interest.

The metric that tells the truth: Open Interest

Volume is easy to manufacture with wash trading.

Capital left open overnight is not.

This is the latest OI snapshot:

Hyperliquid: $7.7B

Aster: $2.2B

Lighter: $1.6B

EdgeX: $706M

Hyperliquid holds 63% of all OI — more than the other three combined.

The OI/Volume ratios supports the idea where capital is sticky and real usage happening:

Hyperliquid: 0.64 (strong, sticky capital)

Aster: 0.18 (incentive-driven)

Lighter: 0.12 (points farmers going turbo)

EdgeX: ~0.1 (still in incentive phase)

This is the cleanest mental model:

Volume = primarily a farming metric that can be gamed

Open Interest = where real money sits

On that basis, Hyperliquid is still king.

Hyperliquid — still the backbone

Custom L1, CEX-grade execution, perfect uptime during the $19B liquidation day, and the only venue where OI actually sticks.

Add the 21Shares HYPE ETP listing, and it’s clear institutions view this as the “CME of on-chain perps.”

For traders it’s so far the most reliable venue.

For investors is got the most mature token model.

Aster — big numbers, big questions

Aster exploded in September — 2,800% token pump, $70B+ daily volume, CZ-backed, multi-chain, the whole circus.

Then DefiLlama delisted them after catching 1:1 volume correlation with Binance, refusal to share data, and 96% of tokens in six wallets.

For traders: fun short-term venue, but treat it like a casino table.

For investors: avoid this.

Lighter — elite tech, farmers everywhere

ZK-verified trades, Ethereum L2 security, zero fees, Thiel/a16z backing — Lighter is the is the best-looking new app chain.

But also:

Outage during the October crash

LLP lost money

Volume/OI at 8+ (pure points meta)

TVL inflated by pre-TGE farming

The tech is really good.

The current user base is mostly airdrop hunters.

For farmers: strong opportunity pre-TGE if they’ve got massive capital

For investors: wait until after the token launch to see who stays.

EdgeX — the professional’s venue

Institutional DNA via Amber Group, StarkEx performance, tight spreads, and real revenue ($509M annualized).

During October’s meltdown:

Zero downtime

eLP vault profitable

LPs earning some of the best yields in the sector

Still smaller market share, but growing cleanly without scandals.

For traders: solid CEX-like experience with self-custody.

For LPs: consistent returns.

The simple playbook

Hyperliquid → size, reliability, and the only real long-term bet (HYPE)

Lighter → zero fees, points farming; wait for post-airdrop before touching LITER

EdgeX → CEX-quality execution, strong mobile UX; EGX could become a post-TGE slow cook

Aster → only for traders who know exactly what they’re signing up for; not an investment

Bottom line: the perp DEX field is crowded, but only Hyperliquid holds the bulk of real risk. Lighter is incentives, EdgeX is institutional consistency, Aster is hype with footnotes. Follow the capital that sticks.

→ My bet is on the leader as we’ve seen it so many times this cycle. Winners gonna win and Beta mostly sucks.

Alpha 2: The Road to 2026 – 6 Trends Shaping the Next Year

2025 looked like the year crypto should’ve performed really well — new president, pro-AI, pro-digital assets — but instead we got an incredibly choppy market. The October flash crash didn’t help.

But the macro tone is stabilizing, the contagion is fading, and a handful of real trends are forming the spine of 2026.

1. Prediction Markets finally hit real product-market-fit

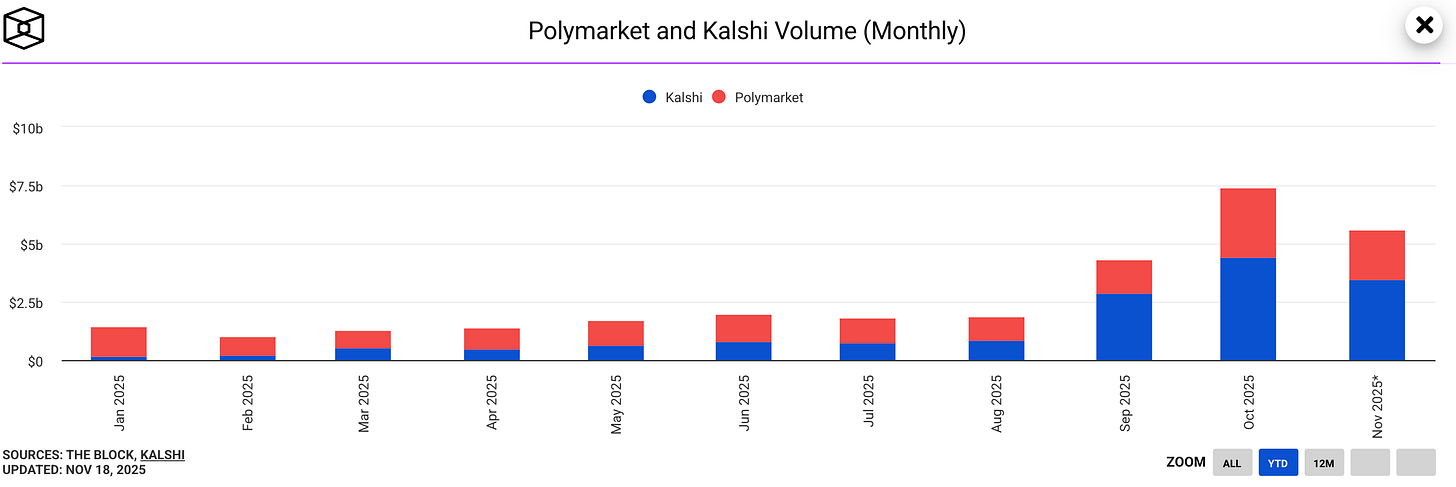

Prediction markets (PM) turned Yes/No into actual fun. Monthly volume of Polymarket and Kalshi hitting $7.5B says the product isn’t niche anymore.

Hedging, speculation, airdrop protection, portfolio hedges — PMs became the “options for normal people,” and it’s sticking.

2. Prediction Markets as a playground for ML teams

This is where some innovation happens. Prediction markets accidentally became the perfect testbed for AI.

ML teams can plug in their models, bet real money, see instantly if their signals work, and earn token incentives on top.

Sportstensor acts as a liquidity-provider layer on Polymarket, turning prediction markets into an open competition. Anyone can submit signals, and the top performers earn alpha tokens. These best-performing signals feed back into Sportstensor’s own predictive engine.

Synth operates like a high-frequency prediction fund. It uses its models to bet on short-term crypto price movements inside PMs and has shown early results like 500% ROI in a month.

Sire is building a sports-focused alpha vault using Bittensor Subnet 44 Score data. Early test runs show more than 600% PnL, and the product is preparing for public launch.

Billy provides sports analytics and automated betting tools, and the team is finding edge specifically in supplying liquidity for Parlay bets on Kalshi, with plans to scale a treasury and return value to token holders.

And because PM platforms want more liquidity and better forecasts, they reward these teams with points and tokens. Good models get paid twice: once from winning bets, and again from incentives.

This is why ML teams are piling in. It’s one of the only places where you can test your model, prove your edge, and monetize it instantly.

3. The Neobank War begins

Crypto cards went from novelty to full-blown battlefield. EtherFi, Tria, Avici, UR and 20+ others are fighting over the same users with cashbacks, yields, and perks.

You need to know though: Most aren’t real banks — they’re pretty front-ends sitting on top of someone else’s license.

UR (Mantle L2 product)is the outlier: Swiss oversight, seven fiat rails, genuine bank-grade infrastructure. If 2025 was about launching cards, 2026 is about who actually becomes a bank.

→ EtherFi have an excellent product and I am using the card with 3% cashback on my daily expenses while getting 10% yield on stables. Try it with my referral link!

4. Breakout apps are finally obvious

Trading, predicting, yield, stablecoins, tokenization — these aren’t just narratives anymore, they’re actual usage funnels. Hyperliquid won perps, launchpads like Pum Fun exploded, PMs went viral and RWAs hit Wall Street.

The industry finally has products people get and need. It feels like the breakout of one of these use cases is very near.

5. Crypto AI finding real PMF

Crypto finally built the rails AI actually needs.

Standards like x402, ERC-8004, programmable wallets, metering systems, and verifiable compute give AI agents a safe way to act on-chain.

In practice:

x402 + ERC-8004 let agents talk to smart contracts like APIs

Programmable wallets let them move money automatically

Metering/billing tracks what they use and pays for it

TEE + ZK proofs keep their outputs verifiable and add guardrails so agents can’t hallucinate actions or go rogue

Put together, this stack makes AI-human collaboration possible: agents can work 24/7, take actions safely, and settle everything on-chain with guardrails in place.

6. DeFi is entering its “Dynamic” era

DeFi’s old model was static — you set a strategy and hope the market doesn’t move against you. The next wave is Dynamic DeFi, where AI adjusts everything in real time.

Allora feeds ML signals straight into DeFi protocols so positions can rebalance automatically. Giza uses AI to manage capital across strategies. Almanak lets AI agents create new vaults on the fly.

It’s basically traditional finance risk systems plugged into DeFi, but running nonstop and without human lag.

What 2026 likely looks like

AI builds DeFi.

DeFi powers AI.

Prediction markets feed the models.

Stablecoins carry the transactions.

Neobanks bridge both universes.

We see crypto turning into real infrastructure.

If you want to actually be ready next time the market collapses, and find excellent entries into your favorite coins and tokens join Premium.

Here’s what you get:

📈 Ultimate Exit Strategy – Know when to take profits and avoid becoming fresh exit liquidity.

📰 Premium Weekly Newsletter – I go deeper than CT threads and boring YouTube summaries.

📊 2× Weekly Trade Updates – Real trades. Real setups. In real time.

🧠 Stoic Mindset Coaching – Because you can’t win if you’re trading emotionally.

👨💼 Community Vote Deep Dives – You choose what I research. Zero shills, just signal.

💬 Daily Premium Support Chat – Ask me anything. Literally.

If you’ve been riding the newsletter for free and getting value, this is the next level. Your edge is waiting.

Airdrops

A CEX-Like Experience For DeFi

DeFi App is a one-stop wallet we all wish existed years ago. I’ve been test-driving it, and let’s just say, it delivers on UX.

Multi-chain swaps are seamless.

Trading perps with self-custody is really smooth.

Add in gasless transactions and a fiat on ramp with many options, and this feels less like a dApp and more like a consumer fintech product that’s actually fun.

More Airdrops:

Axiom is a Solana trading bot that generates a ton of revenue and offers perps vis Hyperliquid. Their points program is a good airdrop opportunity.

Hyperliquid Season 2

Hyperliquid continues to dominate decentralized perpetuals with over 75% market share. For the HyperEVM & Season 2 airdrop, one of the best and easiest strategies is using Upshift's HyperBeat Ultra HYPE vault. It dynamically allocates capital across HyperEVM DeFi protocols using delta-neutral strategies and funding arbitrage.

You earn points across 7 different protocols plus around 6% APY in HYPE here.

Polymarket Speculation

Polymarket is one of the rare crypto apps that checks all the boxes: real use case, strong traction, solid revenue model. If they launch a token and run an airdrop, it could be massive. Simple strategy: Place bets on near-certain outcomes to generate volume while minimizing risk or hedge your bets on a second account / platform. I’m using limitless.

That’s it for today’s episode, thank you for being here!

Till next time, stay safe!

The permanent holder absorption data from 159K to 345K BTC is extemely bullish. When smart money accumulates this aggressively while short term holders capitulate, it usualy marks a local botom rather than continuation breakdown. Your 90.1K long call was perfectly timed with the sentiment reset.