It`s Arbitrum Season 2.0

ARB surged over 12% in a single day, breaking past the $2 threshold with remarkable momentum. Definitely no financial advice, just insights based on my own journey in DeFi.

Hello there Crypto Enthusiasts,

busy with work and personal projects? Let me help. I’ve been navigating the DeFi space since 2020, and I love sharing what I learn.

These are the advantages you will get in each newsletter:

The key developments leading to an investment idea

My Token Watchlist

3 DeFi opportunities.

All packaged in a 5-minute read. No sponsored content, no trading chaos. Just insights based on my own journey in DeFi.

Let’s make the most of your time!

Key Developments

Shedding light on the recent significant developments within the Arbitrum ecosystem.

Arbitrum Season 2.0: A fresh episode in the Arbitrum narrative. Arbitrum's Short-Term Incentive Program (STIP): A catalyst for around 50 projects, with a grant pool of 70 million ARB awaiting distribution to kickstart their growth and innovation.

Why should you farm on Arbitrum?

→ Arbitrum is the most important Ethereum Layer 2 solution for DeFi with the highest TVL (total value locked).

→ Arbitrum has seen a 7d net inflow of 73M USD.

My Token Watchlist

PENDLE - Pendle is a platform where people can split their crypto investments into two parts: the initial amount they put in & the future profits they expect to earn. They can then trade these parts separately, giving them more flexibility and new ways to make money.

Price: 1.89$

Market Cap: 183m

RWA and DeFi 2.0 play

MCB - MUX protocol is an all-in-one leveraged trading platform offering optimized trading cost, smart position routing, and leveraged boasting, amongst others for traders

Price: 11.10$

Market Cap: 42m

Perp DEX narrative

MOZ - Mozaic is an AI-driven platform designed to optimize cryptocurrency investments through automated portfolio management.

Price. 0.18$

Market Cap: 13m

Strong AI narrative absolute Degen Alpha play

Actionable DeFi Yield Insights

How to Strategize Your Investments:

Safe Bet: Engage in Liquidity Provision on GM pools: BTC / USD and ETH / USD at GMX.io.

Medium-Risk and Reward: Lend and provide Liquidity on Timeswap.io.

Venture Bet: Provide liquidity for traders on JonesDAO.

1. GMX.io GM Pools:

GM Pools:

→ Great yield on BTC and ETH without much impermanent loss.

→ Relatively safe investment to provide liquidity for BTC and ETH traders.

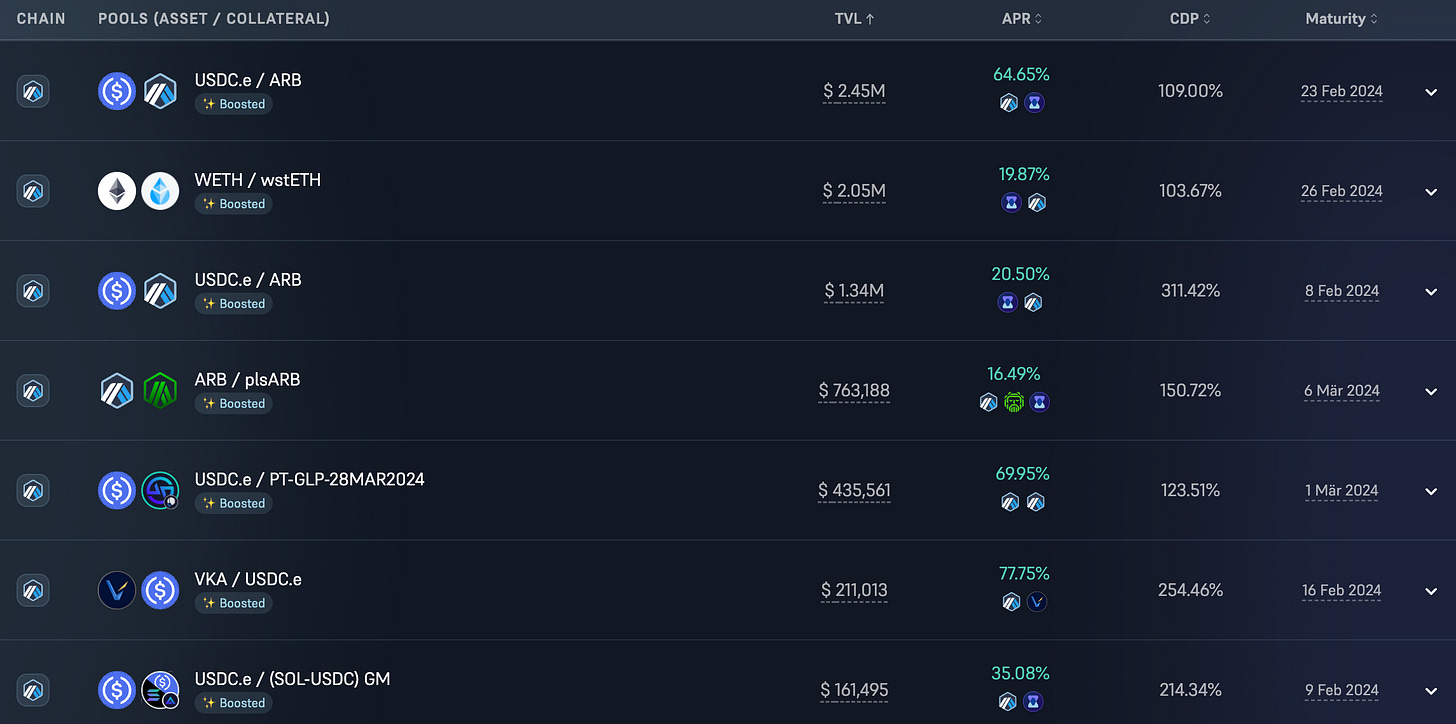

2. Timeswap.io Lending, Borrowing, Liquidity Provision

→ Rewards can be earned by different ways — Lend, Liquidity or Borrow. Rewards will vary for each pool and can be seen on markets page as well as individual tabs

→ Additional yield through TIME tokens can be earned by users by interacting with boosted pools.

→ Great yield on the USDC.e/ARB pool — lenders, borrowers and LP will be eligible for rewards till February 23.

→ Link to strategy: https://app.timeswap.io/#/markets

More info about Timeswap:

3. JonesDAO

→ Jones Liquidity Strategies encompasses a set of strategies that automatically compound & rebalance V3-style LP positions.

→ Provide V3 liquidity to receive a Camelot spNFT that can be staked in a Camelot Nitro pool.

→ This strategy algorithmically allocates tokens to a liquidity pool, collects yield, compounds the yield automatically, and rebalances the ranges. It utilizes DefiEdge as the third-party tool to facilitate the strategy.

→ Link to Strategy: https://app.jonesdao.io/labs

Wrap Up

Key takeaways for your DeFi strategy:

Arbitrum Season 2.0 just started with enhanced activity and engagement.

Ecosystem grants are acting as catalysts for project growth and valuation as well as BTC ETF.

Tailored investment strategies could yield promising results.

Meme of the week

(because a dash of humor always adds a fresh perspective!)

Until next time!

- Adrian