The Biggest Liquidation in Crypto History (And Why It Matters)

Altseason Delayed, Not Dead: How to Reposition Now.

The best way to support me is to share this newsletter. Thank you!

Hey Friend!

If you went outside this weekend, congrats! You missed crypto’s version of a flash crash apocalypse.

BTC nuked –$20K in a single day, taking $380B market cap with it. The entire crypto market bled $800B in hours. That’s the biggest liquidation event in crypto history, even bigger than FTX and Terra/ Luna combined.

And yet… we’re back above at a market cap of $3.9 trillion. Higher than we were at the end of September. Like nothing even happened. You either got liquidated or you’re more bullish now. No in-between.

What caused it? Wrapped assets, thin books, Trump/Xi trade war drama, maybe a dash of whale games. But also? A reminder that not everything broke. Aave ran smooth, Solana stayed fast, and a few tokens actually pumped.

Let’s break it all down and see who walked away with their clothes still on.

️ ⚡ On today's Episode:

📈 Market Update – The $800B Crypto Nuke: BTC dumped $20K in 24h, total mcap cratered from $4.1T → $3.3T → back to $3.9T. Biggest liquidation event in crypto history ($30–40B).

🐂 Alpha Insights – Leverage gone, fundamentals intact. The next meta isn’t onchain memecoins, it’s narrative safety: privacy, neobanks apps, and real use cases.

The current state of the market.

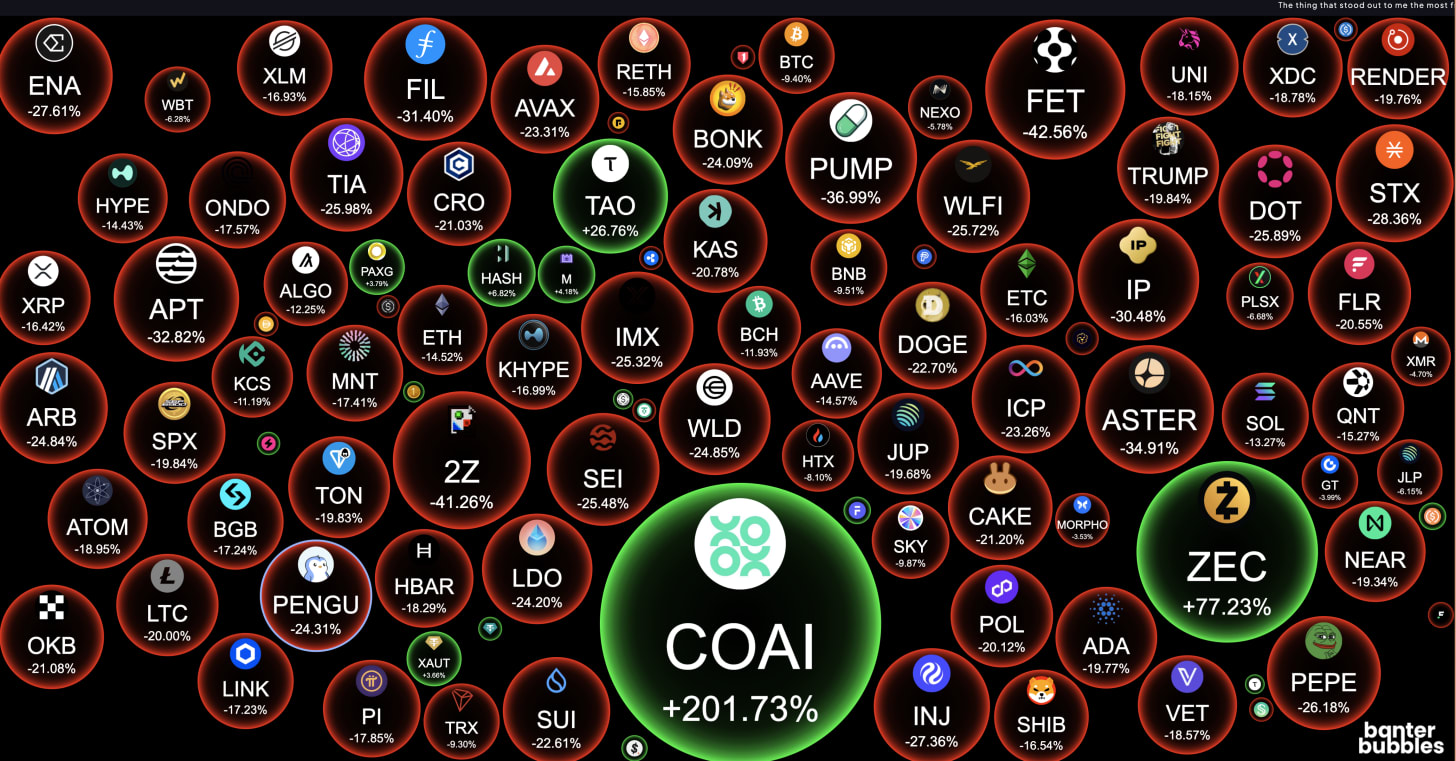

Weekly Crypto Bubbles

Market Overview

What moved the markets?

Weekend Crash: The $800B Nuke

It felt like 2018. But with more zeros.

BTC: –$20K in 24h

Total Market Cap: $4.1T → $3.3T → back to $3.9T

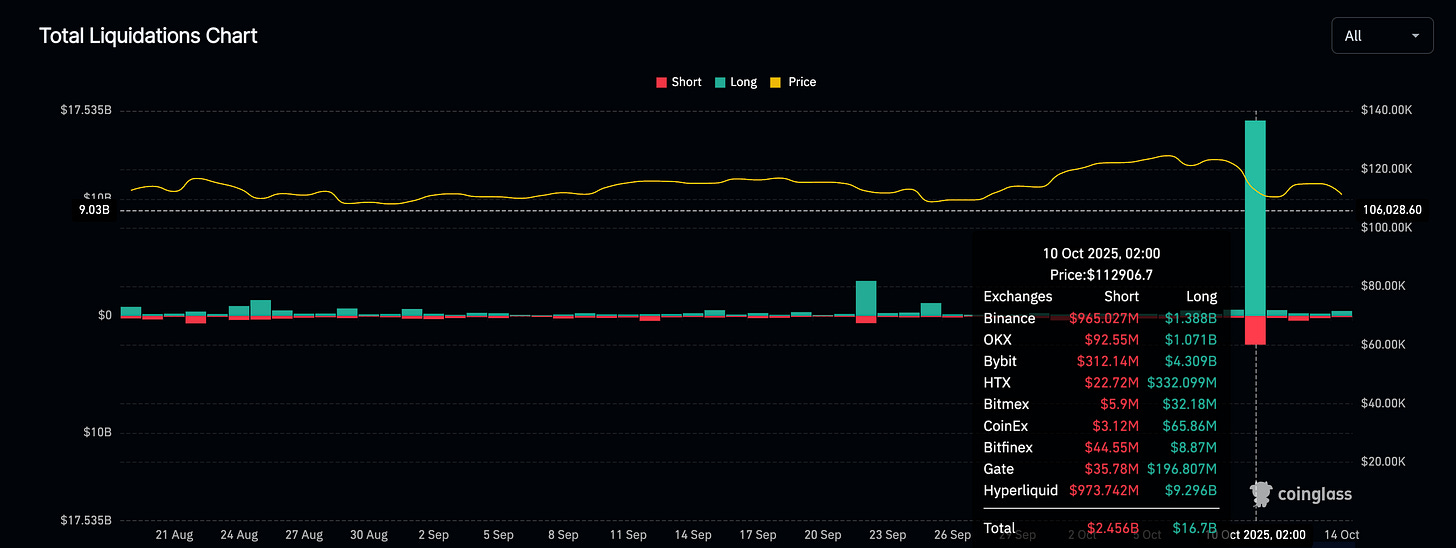

Liquidations: At least $16B, realistically ~$30-40B, largest ever

So what triggered this whole mess?

1. Trump x China Trade War Redux

Trump went tariff-maxi again. 100% on China, cancelled meetings, called Xi names (probably). Markets flipped. S&P dropped $1.2T in 40 minutes. Crypto followed.

2. Wrapped Assets Got Nuked

Binance’s BNSOL, wBETH, and USDe all fell apart:

wBETH traded 88.7% below ETH.

BNSOL dipped to $34.9.

USDe crashed to $0.65 (Binance only).

Why? These illiquid wrappers were used as collateral on leveraged positions. When they dumped, margin calls triggered… and then came the cascade.

3. Leverage + Thin Liquidity = Kaboom

Weekend. Low volume. Everyone levered.

$500M–$1B in forced liquidations turned into more than $20B by end of day.

4. Coordinated Manipulation?

Binance was the main one affected. The crash hit just days before Binance’s new risk engine was going live. Some whales shorted big just before the tariff tweet.

No proof. But you don’t need a tinfoil hat to be suspicious. After all Binance had an enormous influence on the big crashs last bull market (Terra/Luna and FTX).

The Aftermath: Still Cautiously Bullish

Tariff drama? Temporary. Trump negotiates like a wrecking ball, but he usually walks it back.

Contagion risk? Always possible. But no signs (yet) of major firms imploding.

Sentiment? Shaken, but not broken. And we’re still up from September.

ATHs within months still looks doable. The market flushed leverage. Fundamentals haven’t changed.

But Altseason or “up-only” isn’t a magical button you press and then ride to generational wealth. This crash was violent — altcoins dumped 50–80% in an hour. Fresh retail investors that we need for a (selected) altseason are gonna see that and will certainly not ape their life savings into the market.

We are not in 2020 anymore. That rally came after massive QE, 0% interest rates, and people locked indoors with stimulus checks and nothing to spend them on. Context certainly matters here.

Here’s what I do believe:

1/ The long-term outlook is fine.

2/ The short-term? Still messy. Don’t be surprised if we revisit parts of this weekend’s wick. It’s how real bottoms form.

3/ Let’s see how legacy markets open and if any contagion creeps out. We’ve likely been set back a bit. That’s okay.

This isn’t a call to sit on your hands forever. But it is a reminder that you usually have more time than you think. Let the market show its hand. Watch, reassess, then act.

Oh, and while everyone was panic-selling or getting liquidated…

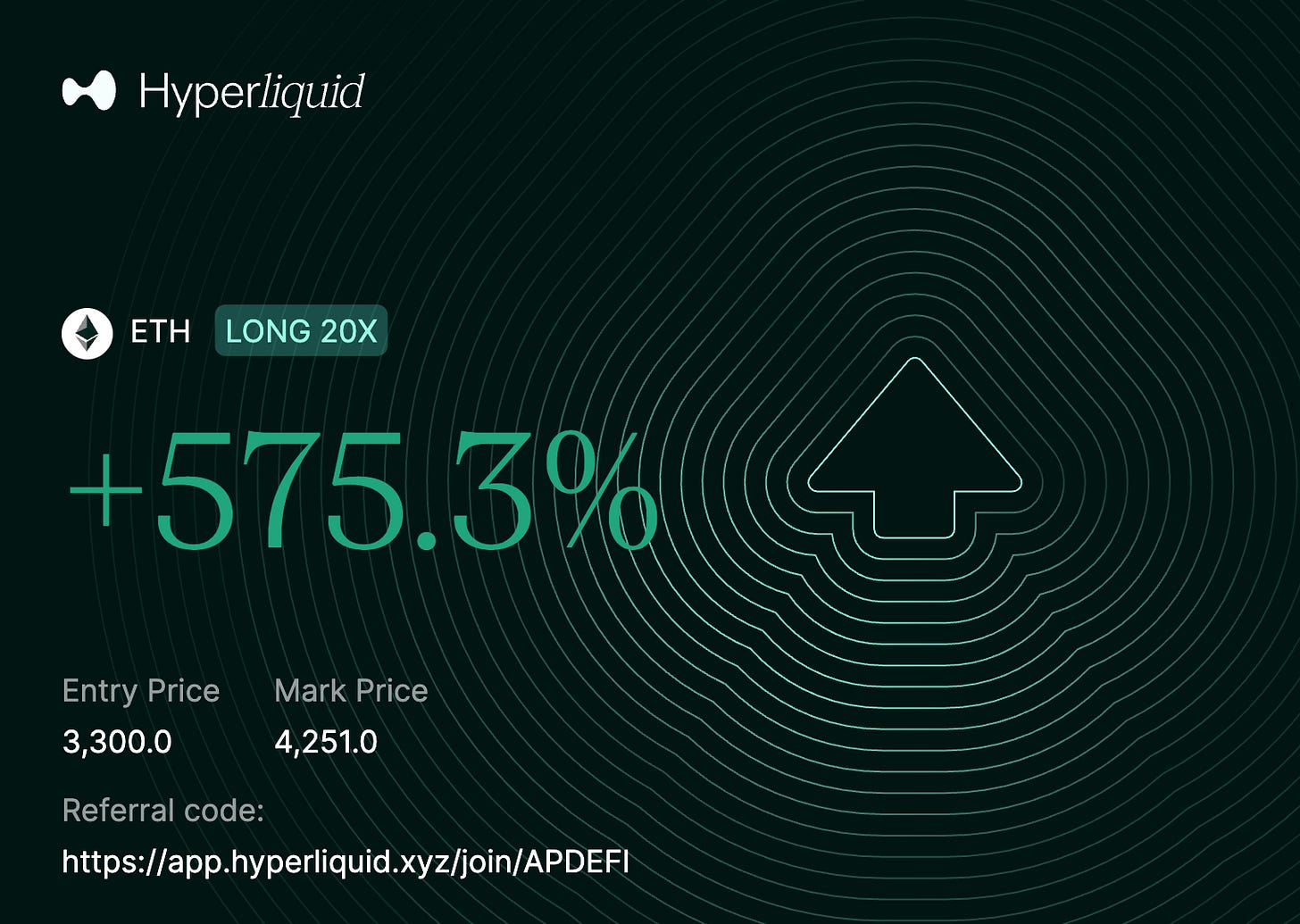

I made a +575% trade with an ETH long in the middle of the crash.

No, I’m not flexing (okay, maybe a little). But it worked because I stuck to a strategy setting orders at the most important target zones. My system caught the dump, positioned into strength, and exited clean. It’s the same system I use every week — and I break it down inside the premium alpha section.

If you want to actually be ready next time the market collapses, here’s what you get:

📈 Ultimate Exit Strategy – Know when to take profits and avoid becoming fresh exit liquidity.

📰 Premium Weekly Newsletter – I go deeper than CT threads and regurgitated YouTube summaries.

📊 2× Weekly Trade Updates – Real trades. Real setups. In real time.

🧠 Stoic Mindset Coaching – Because you can’t win if you’re trading emotionally.

👨💼 Community Vote Deep Dives – You choose what I research. Zero shills, just signal.

💬 Daily Premium Support Chat – Ask me anything. Literally.

If you’ve been riding the newsletter for free and getting value, this is the next level. Your edge is waiting. Come grab it.

Good ideas I discovered.

Alpha: The Next Meta Isn’t Gonna Be Onchain

Forget trying to guess the next memecoin meta or rotating into another SOL ecosystem perp DEX. Those plays need frothy onchain activity, which just got axed by billions in liquidations. That crowd’s either broke or shook.

Traders are craving safety now. Not just “number go up” safety, but narrative-level safety — products that offer actual utility.

I’m looking at:

Privacy protocols (e.g., $RAIL)

Neobank-style apps with sticky usage ($MNT)

BTC dominance plays that feel “blue-chip” but still have narrative fuel

2. Top 50 is Basically a Boomer Portfolio Now

There’s no fresh bid for most of the dusty dino tokens in the Top 50. They’re controlled by teams, market makers, and bored retail with no exit plan.

This is a huge opportunity.

Instead of farming breadcrumbs from 2021 bags, think:

What tokens are already listed on CEXs or Robinhood that retail can actually buy right now?

Think:

$ZORA – massive upside for a cultural play that’s already listed and moving

$HYPE – not listed yet, but would absolutely melt faces if it shows up on Binance or Robinhood

The key is to front-run that listing liquidity. Because that’s where attention has to flow — retail isn’t bridging to L2s for some obscure farm.

3. Redirect Capital to Where Users Actually Are

TL;DR: Now is the time to rotate out of dead networks and into thriving apps and infrastructure that people are actually using or will soon discover.

It’s not about gambling harder. It’s about reallocating smarter.

Alpha 2: Hix0n’s Confidential

If you want a straight to the point newsletter full of calls, new projects, airdrop farms, memecoin and DeFi moonshots, then Hix0n’s Confidential is the place for you. I can really recommend his take (if you’re comfortable with high risk).

That’s it for today’s episode, thank you for being here!

Till next time, stay safe!