The Stablecoin Supercycle Begins: Plasma, USDai, and What’s Next

BTC Bounce, Institutional ETH Buys, and a Deep Dive on Plasma’s 32x Token & USDai’s Hidden ICO

The best way to support me is to share this newsletter. Thank you!

Hey Friend!

“Every adversity you face in life is a test. It’s just training. Life isn’t meant to be easy, it’s meant to be challenging so you actually grow. What we all tremble at is for the good of those it happens to.” — Seneca

Think of Hercules. He didn’t get strong by lounging in a spa. He got strong because he was tested again and again. Markets are the same. They’ll knock you down, shake you up, and make you question if you’re even in the right game. But that’s exactly the point! It’s the struggle that sharpens us!

This week, Bitcoin clawed back losses, ETH saw big institutional accumulation, and a new chain is pulling in billions of liquidity. Plenty of noise, plenty of opportunities and plenty of tests.

Let’s dig in.

️ ⚡ On today's Episode:

📈 Market Update – BTC rebounds to $113.4K, ETH climbs to $4,170 as the market bounces back from last week’s bloodbath. Altcoins flash green and ETF optimism builds. Bitmine buys up $1B in ETH, becoming the most aggressive treasury buyer. Ethereum ETF flows turn around sharply. Plasma stablecoin chain hits $6.2B TVL in a week.

🐂 Alpha Insights – Alpha Insights – $XPL’s 32x rise, Plasma’s killer launch, and USDai’s secret presale window via Allo points. Why this ecosystem is the new airdrop goldmine.

The current state of the market.

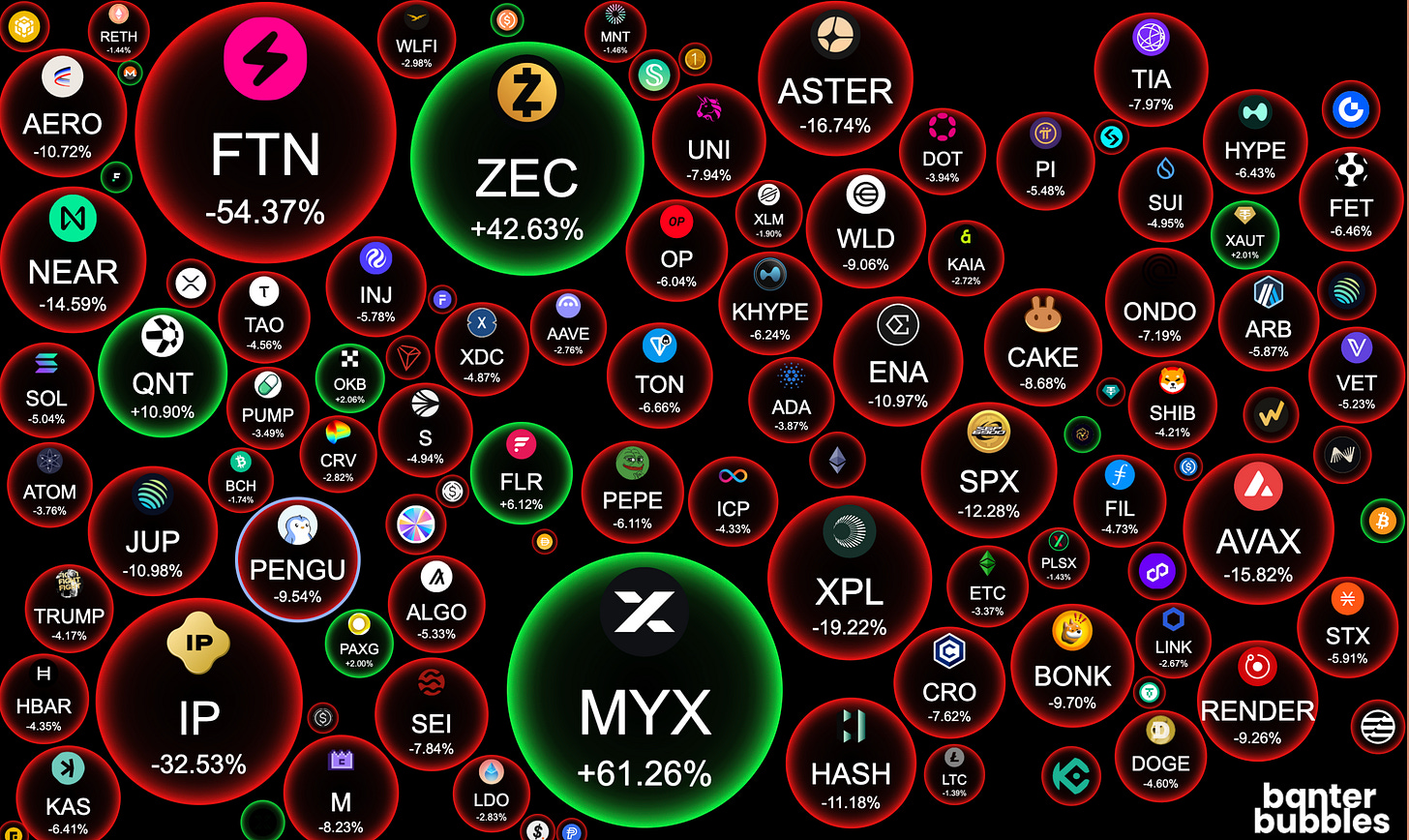

Weekly Crypto Bubbles

→ $MYX, the token for MYX Finance, a decentralized perpetual derivatives exchange on BNB Chain looks a bit like a fake pump. No real fundamentals behind it.

→ $ZEC the token of privacy chain Zcash pumped due to CrossPay rollout on September 16 which enables shielded ZEC transfers across 20+ chains, this enhances privacy.

Market Overview

Bitcoin’s having a decent bounce-back week. We dropped hard last week but but are now recovering. BTC’s back at $113.4K, up 1.2% in 24h.

ETH followed with a +1.4% move to $4,170, and altcoins across the board are back in the green.

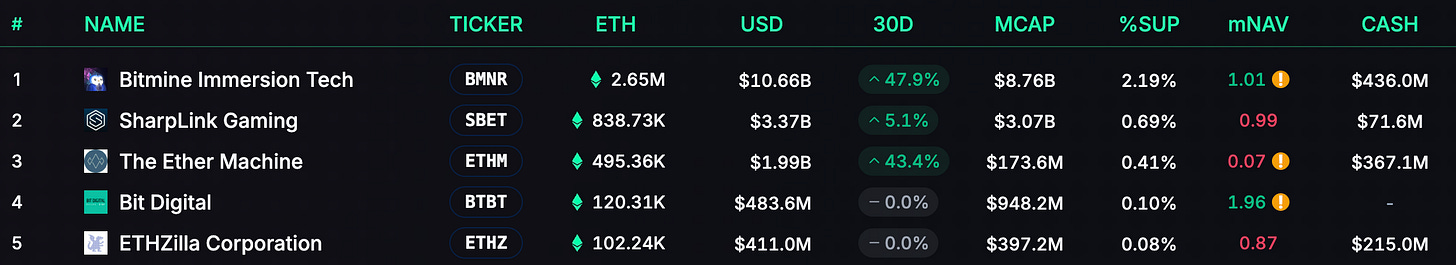

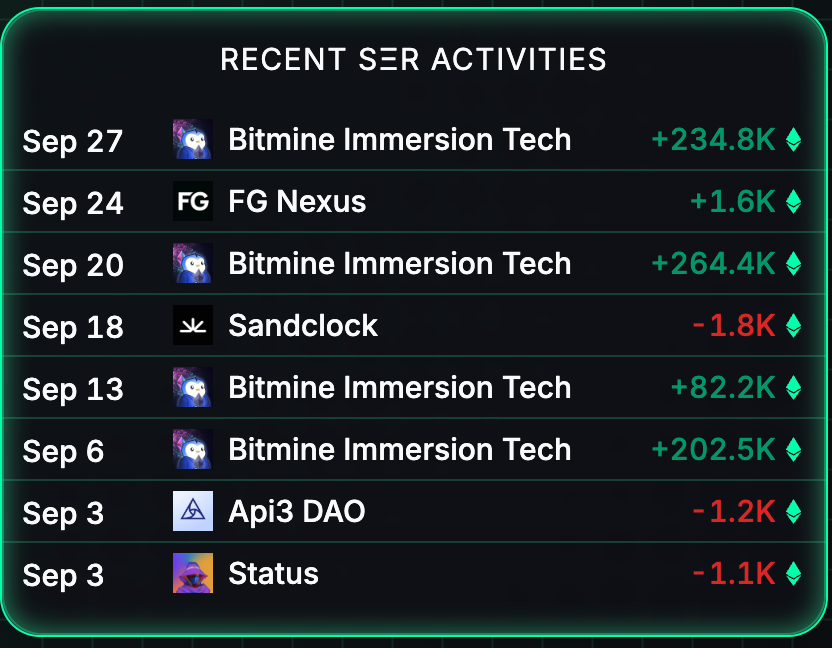

What’s interesting is ETH saw about $1B in accumulation from Bitmine, the biggest Digital Asset Treasury Company for ETH — real money stepping in.

Bitmine is reliably accumulating each week huge amounts of ETH, we’ll continue to monitor this as institutional flows were the price driver of the last leg up of ETH.

Bitmine seems like the strongest DAT because of Tom Lee — the OG permabull from Fundstrat and a former J.P. Morgan guy. He took over as Bitmine’s chairman earlier this year, called ETH “the next Bitcoin,” and set a target to scoop up 5% of total ETH supply. Since June, Bitmine’s stock has pumped over 1,100%.

On the BTC Treasury side we are seeing weakness though. MicroStrategy added just $20M to their stack and might be running out of dry powder.

Market structure still looks solid. Bitcoin dominance is above 58%, but it’s been trending lower since June. The small bounce in dominance over the past few weeks ideally fades here. A reversal would line up nicely with altcoin rotation.

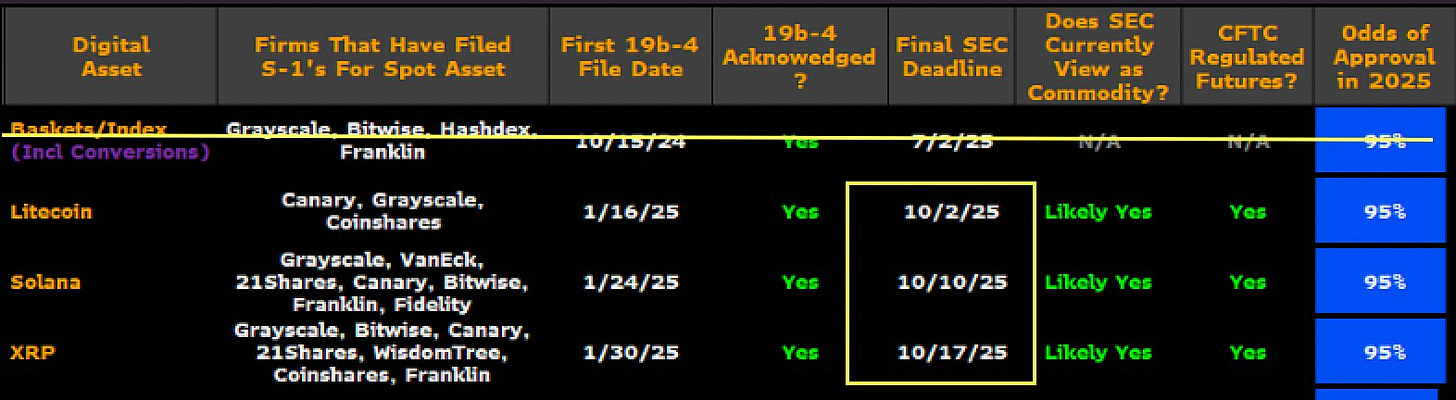

Altcoin ETF decisions incoming

We’ve got three deadlines coming up:

• Litecoin – Oct 2

• Solana – Oct 10

• XRP – Oct 17

Bloomberg’s giving them a 95% shot at approval. That’s… high. Plus, ETF docs keep getting revised, which usually means the SEC and issuers are working through the details.

Still ETH’s ETF launch reminded us that approvals don’t always move markets unless there’s real money behind them. So we should not assume instant fireworks but can see this as additional confluence for a bullish altcoin outlook in Q4.

Onchain data leans bullish

Under the hood, the signals are stacking up:

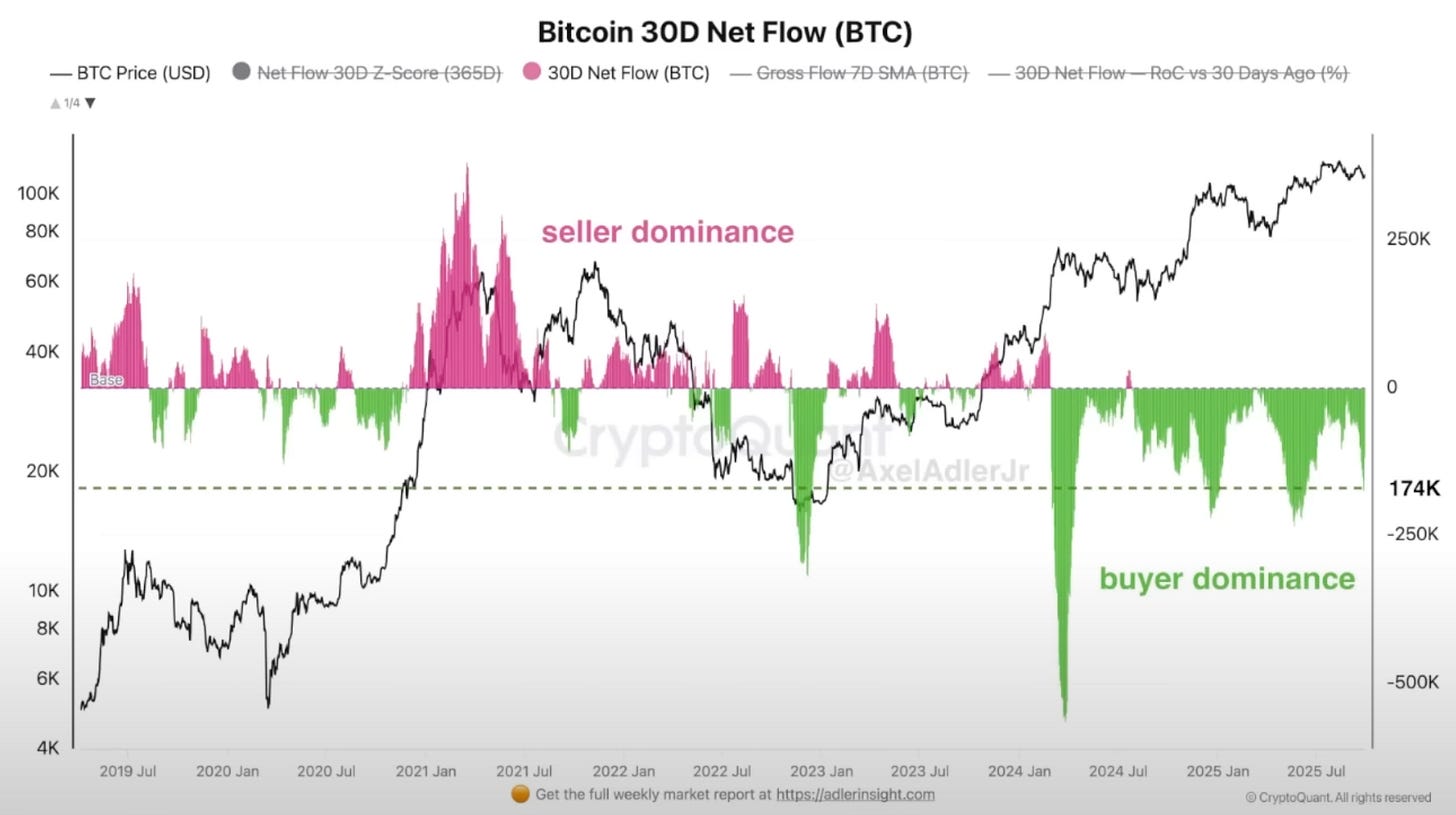

• BTC netflows turning positive, buyers are dominating

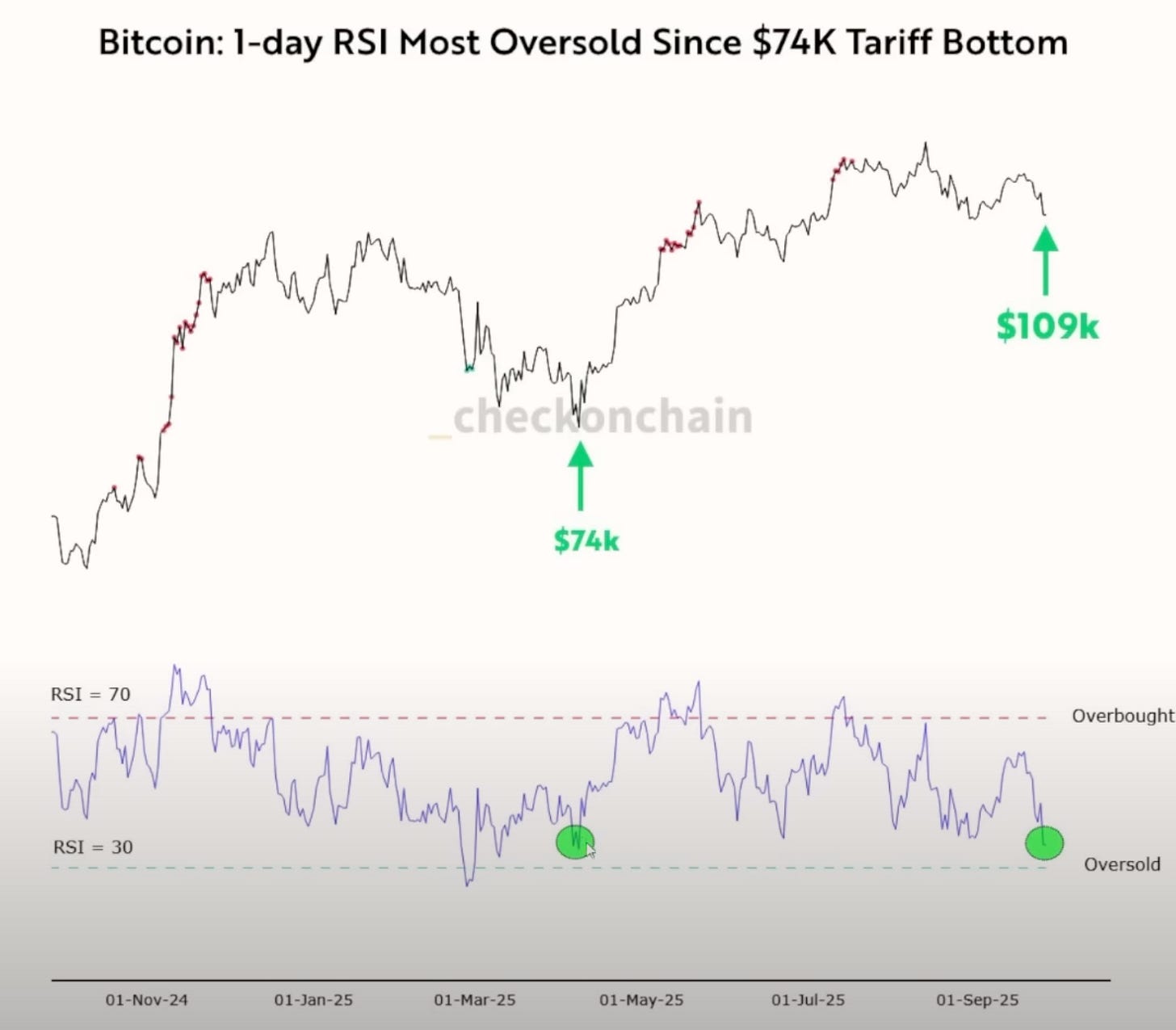

• The daily RSI hit deeply oversold levels, matching the zone we saw at the $74K bounce. That’s typically where reversals start — and price is already reacting.

We just timed a very good entry for the first $40k allocation in our $100k crypto portfolio with the goal to 2x till the end of this bull market. Go Premium and join it live! All info in the Portfolio section of:

Premium Alpha: How I’m Positioning Now for a 2x This Cycle

·The best way to support me is to share this newsletter. Thank you!

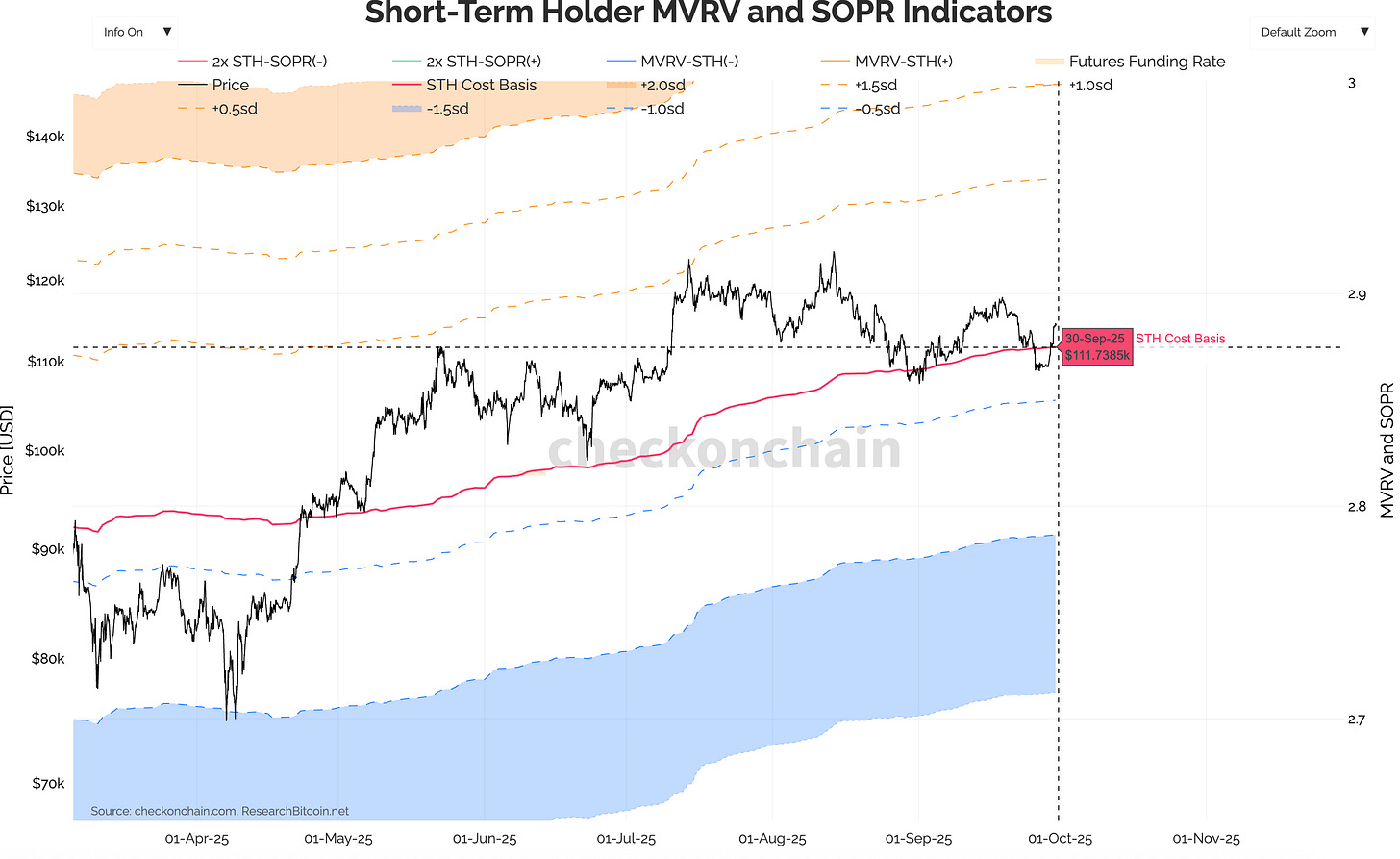

For BTC the key level to hold is $111.7K — that’s the short-term holder cost basis (= the average acquisition price of bitcoins held by investors who bought within the last 155 days). A daily close above is solid. A weekly close would be even better.

Liquidity & resistance zones

Golden pocket is sitting at $114.4K–114.7K — expect friction there as we just got rejected.

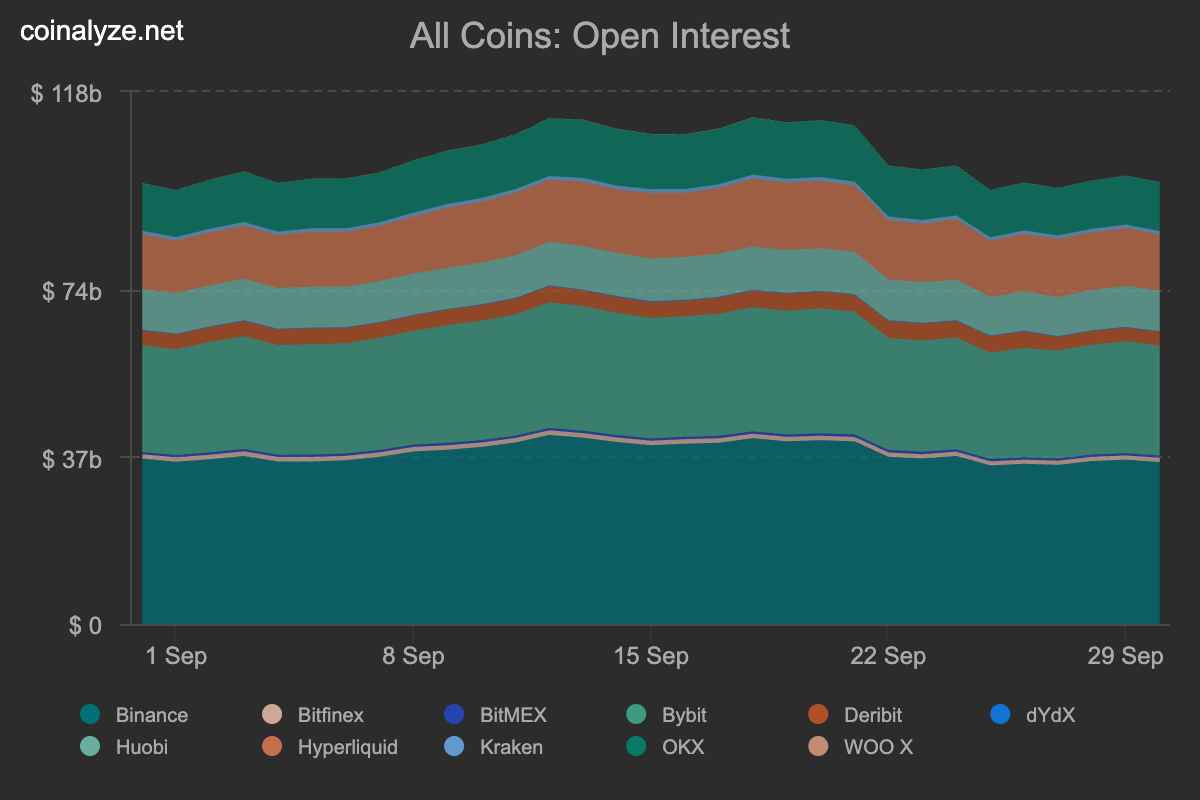

Futures look healthier now (open interest down, leverage flushed).

But spot demand is still weak. Until that shifts, any rally’s on shaky legs.

→ This recovery is good, but the spot market needs to show up. We’re still in a broader uptrend and no major structure has been broken.

Market Pulse & Flows

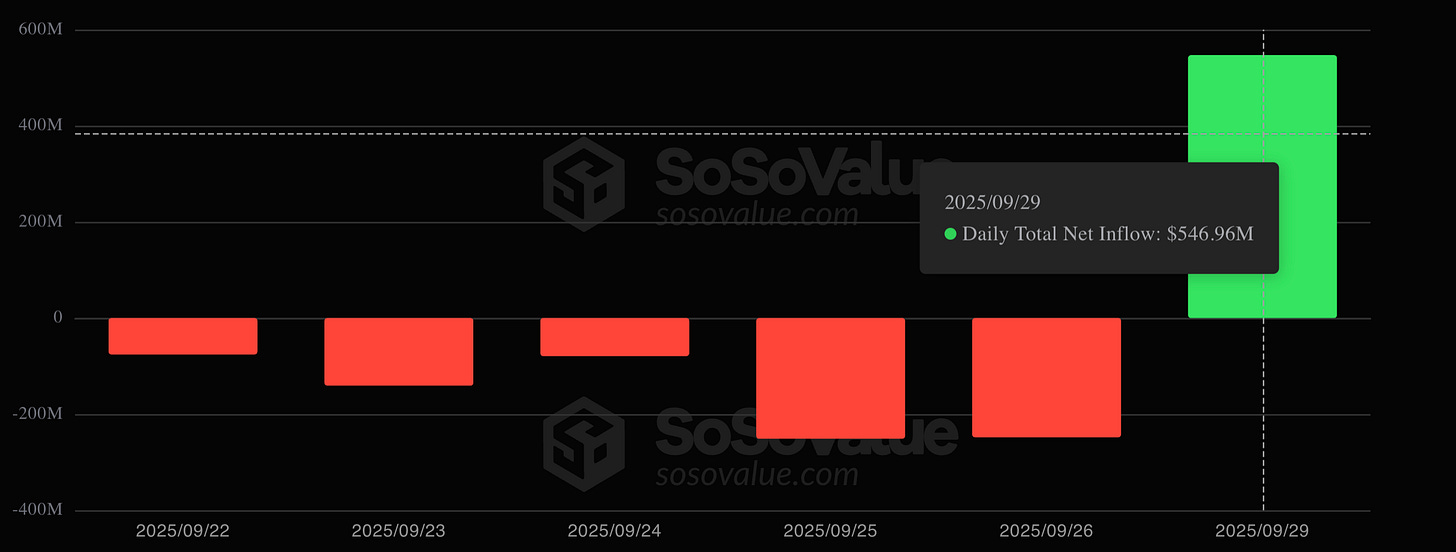

Ethereum ETFs saw nearly $800 million worth of outflows last week, the worst such week since the funds began trading in July of last year but they had a massive $546M inflow yesterday.

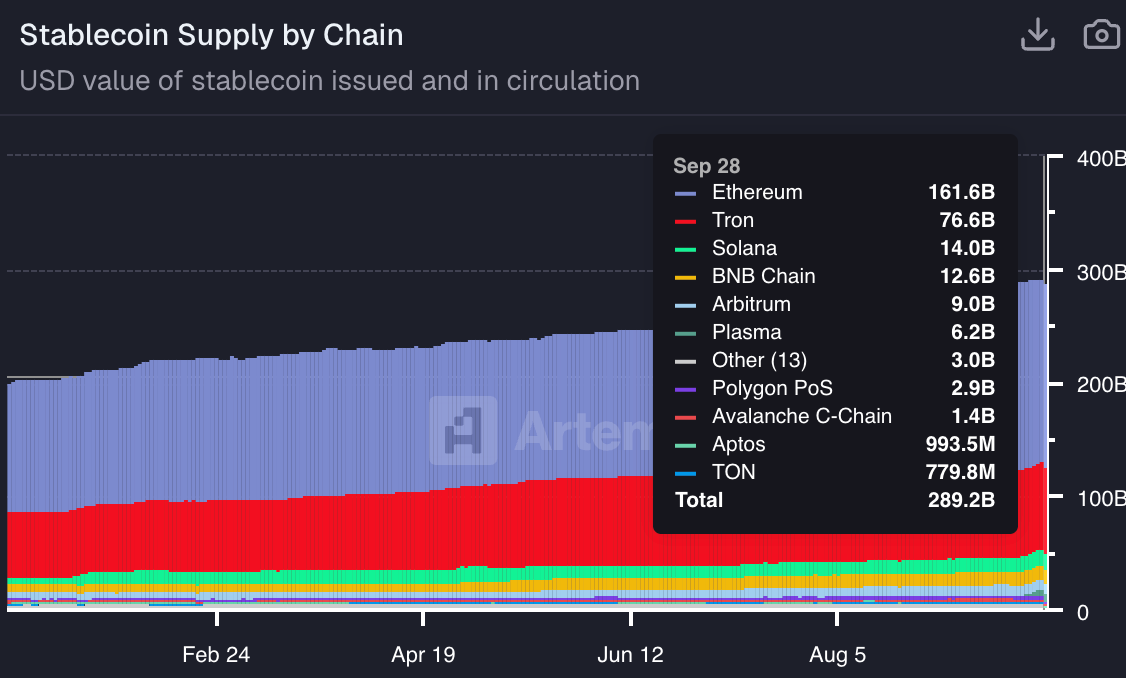

Onchain stablecoin supply keeps expanding rapidly this year, and Plasma, a new player, has already hit $6.2B. That scale makes it worth a closer look, both the project itself and the opportunities building around its ecosystem.

Good opportunities I discovered.

Alpha 1: Hix0n’s Confidential

If you want a straight to the point newsletter full of calls, new projects, airdrop farms, memecoin and DeFi moonshots, then Hix0n’s Confidential is the place for you. I can really recommend to subscribe (if you’re comfortable with high risk).

Alpha 2: Plasma — The Stablecoin Chain

Plasma recently got all the attention. A brand-new L1 that went live a few weeks ago, and somehow it already is everywhere.

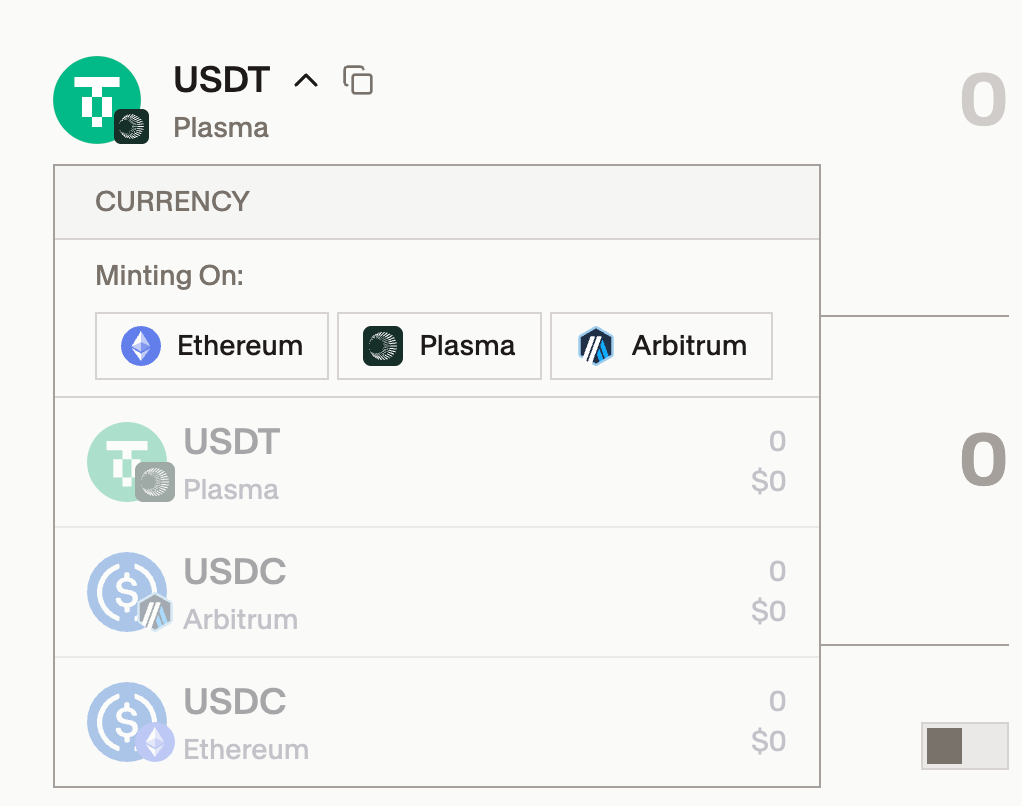

The pitch is simple: Plasma is the stablecoin chain. That’s its niche. It’s built for stablecoin users, with 1k TPS today, scaling to 10k in the future. Full EVM compatible. Easy for devs. Only Plasma runs validators right now, but decentralization is on the roadmap.

The token, $XPL, was one of the top performers this week. Presale was $0.05. At launch, it ripped to $1.68 — that’s a 32x return for anyone who was early. ATH cooled off since, but the stablecoin narrative didn’t.

Why it worked:

Perfect launch → Aave and other big protocols were live day one. Incentives were flowing before mainnet even launched. The total market size is already $6.65B.

Liquidity magnet → Plasma TVL hit $6.5B in week one, already overtaking Base.

Clear angle → Stablecoins are crypto’s killer app. $300B supply, $27.6T volume in 2024, more than Visa + Mastercard combined.

Plasma’s trying to position $XPL as the easiest way to get exposure to that whole sector.

The Positives:

Tether’s backing — Tether is the biggest stablecoin issuer (58%+ share). They invested in Plasma, which makes it a proxy play for some. But Tether also backs a rival chain (Stable), so the thesis isn’t pure.

Free USDT transfers — This is big. Tron dominates stablecoin settlement because it’s cheap. Plasma is making simple USDT sends free. That pulls in the exact users who move billions: Market makers, PSPs, remittance shops.

Plasma One app — An upcoming stablecoin-native super app. Save in dollars, earn yield, make payments, swipe a debit card. Targeting 10% yield on base balances and 4% cashback. → (Still with waitlist)

Challenges are obvious. Circle (Arc), Stripe (Tempo), Tether’s own Stable, plus Solana and ETH aren’t going anywhere. And Plasma’s “confidential transactions” promise is half-baked compared to fully private competitors like Payy.

Still, short-term? Plasma has momentum. $XPL’s market cap is $1.95B, while other new L1 tokens like $ASTER trade at $2.8B. Ecosystem farming is live and already paying.

Current top yields:

Plasma Lending vault → 8%+

USDT0 supply on Fluid → 10%+ APR

USDT0/USDe Curve Pool → 13%+ APR

Opportunities follow liquidity. And right now, all the liquidity is on Plasma.

But there’s a better opportunity to farm…

The real opportunity: $USDai

If you’re looking for where the Plasma ecosystem could really cook, it’s $USDai.

USDai is a new stablecoin launching natively on Plasma. It’s infrastructure-backed, generating yield from a mix of T-bills and AI compute loans. The farming happens via allo points.

Right now, you can earn allo points that determine how much of the USDai governance token ICO you’ll be able to buy later. It’s a bit like the Plasma presale round two.

Ways to get exposure:

Theoretically you could buy and hold USDai on Plasma — lowest risk, steady allo points.

and use USDC on Ethereum or Arbitrum to buy it here.

but the TVL cap has recently been raised from $250M to $500M, and the new maximum cap has been reached in less than an hour due to the large demand.

So instead we could:

Bridge USDC to Arbitrum (use Jumper Exchange)

Go to Silo Finance and deposit USDC to the sUSDai (19 Nov 2025) · USDC market

In this way, we will get a 6% lending APR + 10x USDai points. You can track the USDai’s Allo points you obtained on the USDai website.

or

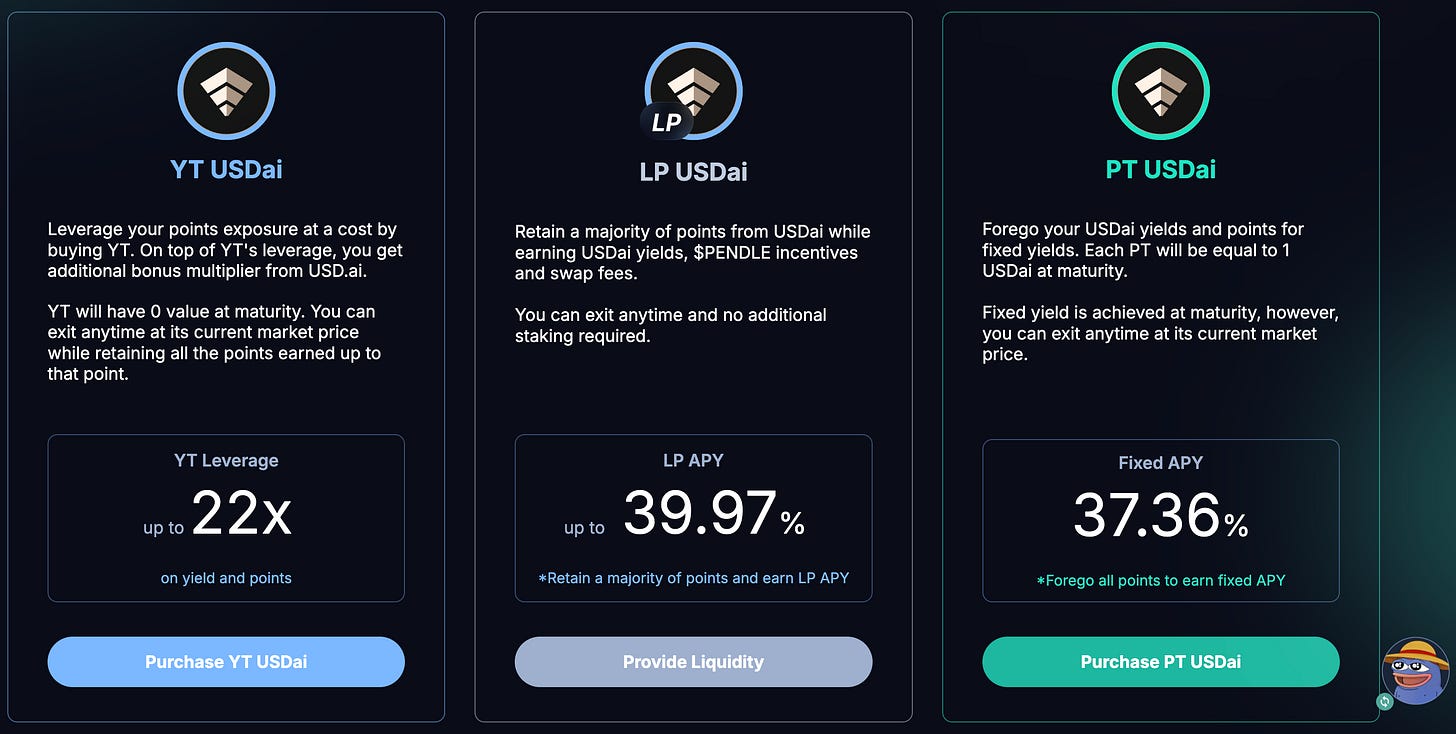

Buy USDai YTs on Pendle (Arbitrum) — these rack up allo points about 22x faster, but they carry more risk as this goes to zero and is a bet to get as many points as possible. You should know what you are doing with YTs! → Link

LP and PT yields are also extremely juicy with 39% and 37% APY.

If extremely bullish on the project is makes sense to run both. Hold some USDai as the safe base, and stack USDai YTs for a faster track into the ICO allocation.

This is essentially a presale window disguised as a stablecoin launch, and it’s one I’m personally quite interested in. Given that USDai raised over $15M in funding, has an active CT community, and its TVL cap is reached, I think it has the potential to do a good airdrop.

📈 Ultimate Exit Strategy → clear frameworks to secure profits when the top is near. No more bag-holding into the next winter.

📰 Premium Weekly Newsletter → exclusive market updates, fresh narratives, and deeper alpha insights to position you ahead of the herd.

📹 2× Weekly Market Update Videos → skip the endless charts, get the exact signals that matter delivered straight to you.

📊 2× Weekly Trading Updates → real-time strategies and portfolio moves to help you capture gains and maximize this bull cycle.

🧠 Stoic Mindset Coaching → practical tools to keep calm when the market goes manic and everyone else loses their head.

🧑💼 Weekly Community Vote → YOU decide which project gets the deep dive next. No shills, no noise, just alpha.

💬 Premium Daily Support Chat → personal access to me for questions, strategy tweaks, and sanity checks in real time.

👉 Don’t just read along — get the playbook, the tools, and the community that makes the difference between surviving and thriving in this cycle.

That’s it for today’s episode, thank you for being here!

Till next time, stay safe!