PREMIUM: Whale Accumulation or Exit Liquidity? Read the Data.

BTC’s Compression Zone, DeFi Buybacks, and the Rise of Prediction Markets and Privacy Coins.

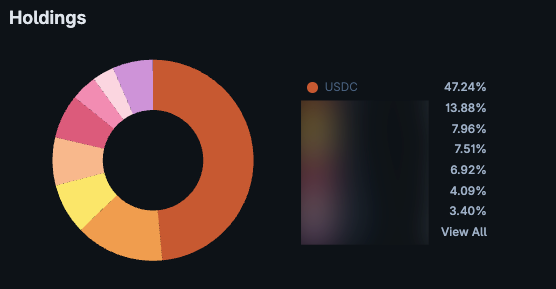

We are sitting comfortably with 47 percent of our portfolio in stablecoins enough dry powder and safety net in one. That gives us the freedom to buy when others panic or stay protected when the bull run fades. We are playing offense and defense whenever we need.

Using the calls from this newsletter and the Telegram group, we’re going to win this cycle.

Hey Friend!

The bears are out again. Feeds full of red charts, panic threads, and the 4-year-cycle crowd finally feeling validated. They’re selling, calling the top, and congratulating themselves for being “disciplined.”

And to be fair… the evidence gives them ammo. Bitcoin has dipped below $100K, even sliding under its 50-Week moving averages, a level that, in past cycles, marked bear market territory after 2 consecutive weekly closes below. For now it remains support though!

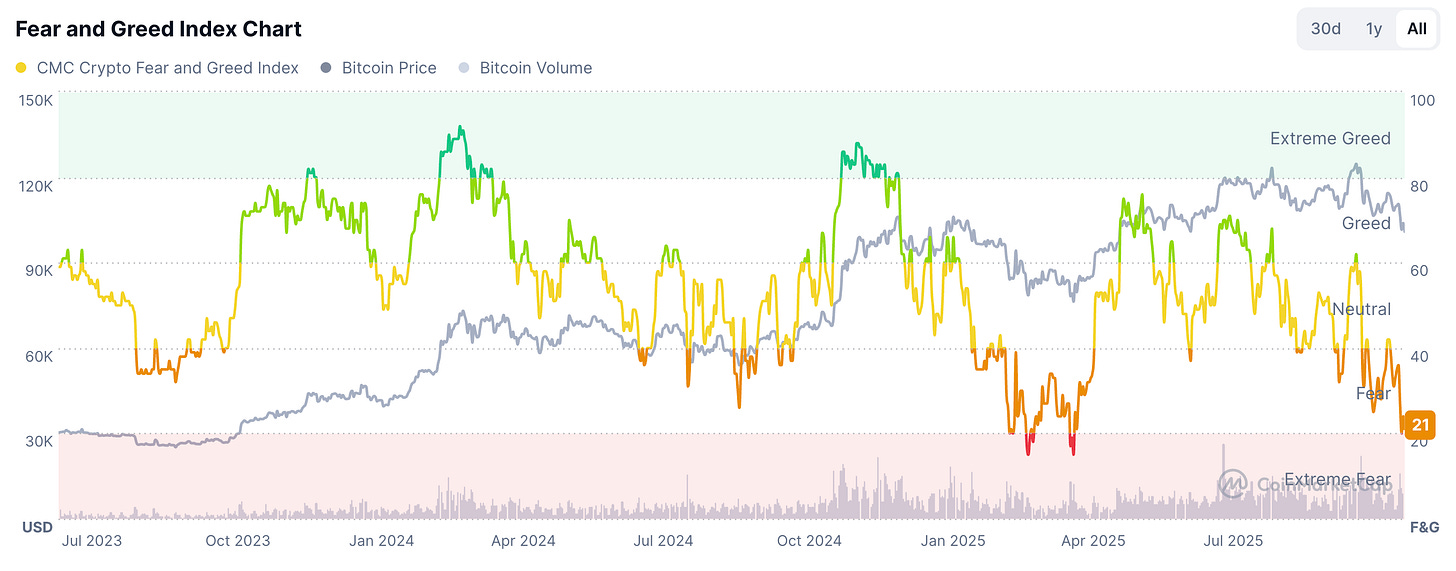

Sentiment has turned sharply, maybe even darker than after the Terra or FTX collapses. The Fear & Greed Index is at 21 brushing up against extreme fear, typically a good time to buy on the dip as long as we remain in a bull market.

It’s now Q4 2025, and by historical rhythm, the clock is ticking. The 4-year cycle purists believe the top is in, and calls to “buy the dip” could prove reckless if this really is the start of the downtrend.

But markets rarely move in straight lines, especially in this cycle. In my experience, these are the moments that separate real investors from the crowd. When conviction dries up and fear floods the timeline, the best opportunities arise.

I don’t have a crystal ball, nobody does, but we do have history, context, and discipline. Whether this is the end of the run or just another deep breath, the game remains the same: Stay calm, stay liquid, and think in probabilities, not headlines.

Let’s zoom out and look at the broader picture and how to set up for the week ahead.

️ ⚡ On today's Episode:

📈 Market Update – Bitcoin keeps grinding between 100K–120K, frustrating both sides. Short-term holders are capitulating again while long-term conviction still holds. Supply in loss is rising — historically the setup before major rebounds. Still looks like a mid-cycle correction, not a bear market.

🔊 Project Updates – DeFi goes corporate: Aave, EtherFi, and Jupiter DAO all approve $50M+ buybacks, signaling a shift toward real value return. Google Finance integrating Polymarket and Kalshi brings prediction markets to the mainstream. Monad mainnet confirmed for Nov 24 — the next-gen EVM contender enters the arena.

🐂 Alpha Insights – Kamino Finance offers 12% APY on its Stripe-backed CASH stablecoin market — one of the cleanest yield plays in DeFi right now. Meanwhile, Railgun ($RAIL) revives the privacy narrative with ZK integrations and tight tokenomics — a good setup worth watching.

💎 Portfolio Section – Teasing our latest move: an add to the overlooked crypto + AI hybrid positioned for a catch-up rally. Full thesis and entry strategy available in the Premium Edition.

The current state of the market.

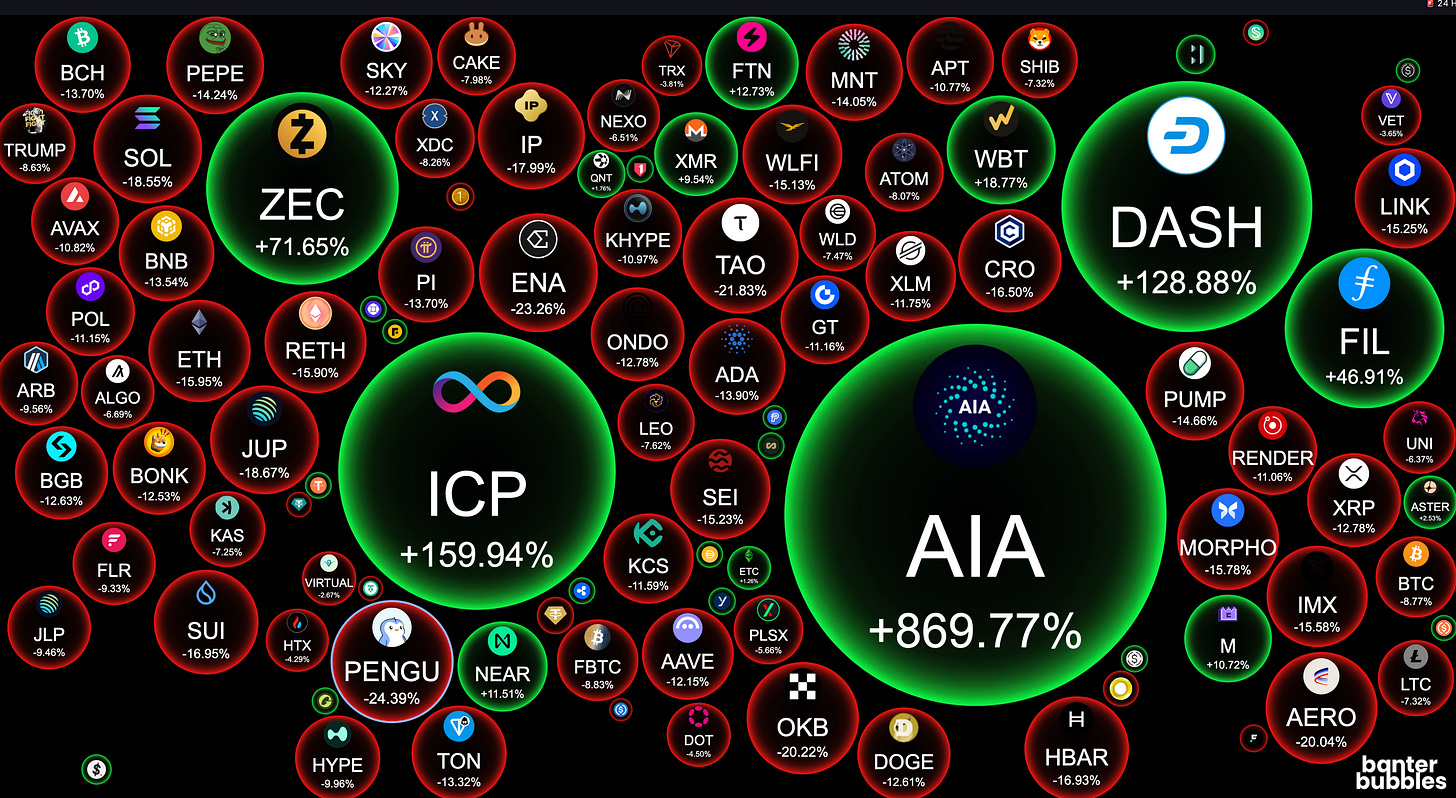

Weekly Crypto Bubbles

Market Overview

Since July, Bitcoin has been locked in a slow, grinding range between 100K and 120K. Every bounce fades, every dip gets caught, and the result is a market that feels like it is grinding investors down one candle at a time. As November begins, the chart leans slightly bearish, but it is far too early to make that call with confidence.

The uptrend will only break if this month closes below support. Until then, what looks like weakness on the daily chart might just end up as a long wick on the monthly chart. That remains the optimistic view, with buyers still having a window to step back in and keep the structure intact.

The bearish case is simple. If 126K was the top, then 2026 could bring a slow, draining reset and a long bear market. I still see that as the less likely path, because Bitcoin has historically delivered its strongest runs toward the end of the year, even when sentiment turned negative.

For now, I am holding my BTC position. My base case is one more strong move higher before the eventual downturn begins in 2026. The AI-fueled rally in the large cap stocks will not carry risk assets forever, but until the charts confirm otherwise, this still looks like a mid-cycle correction, not the start of a bear market.

Market Pulse

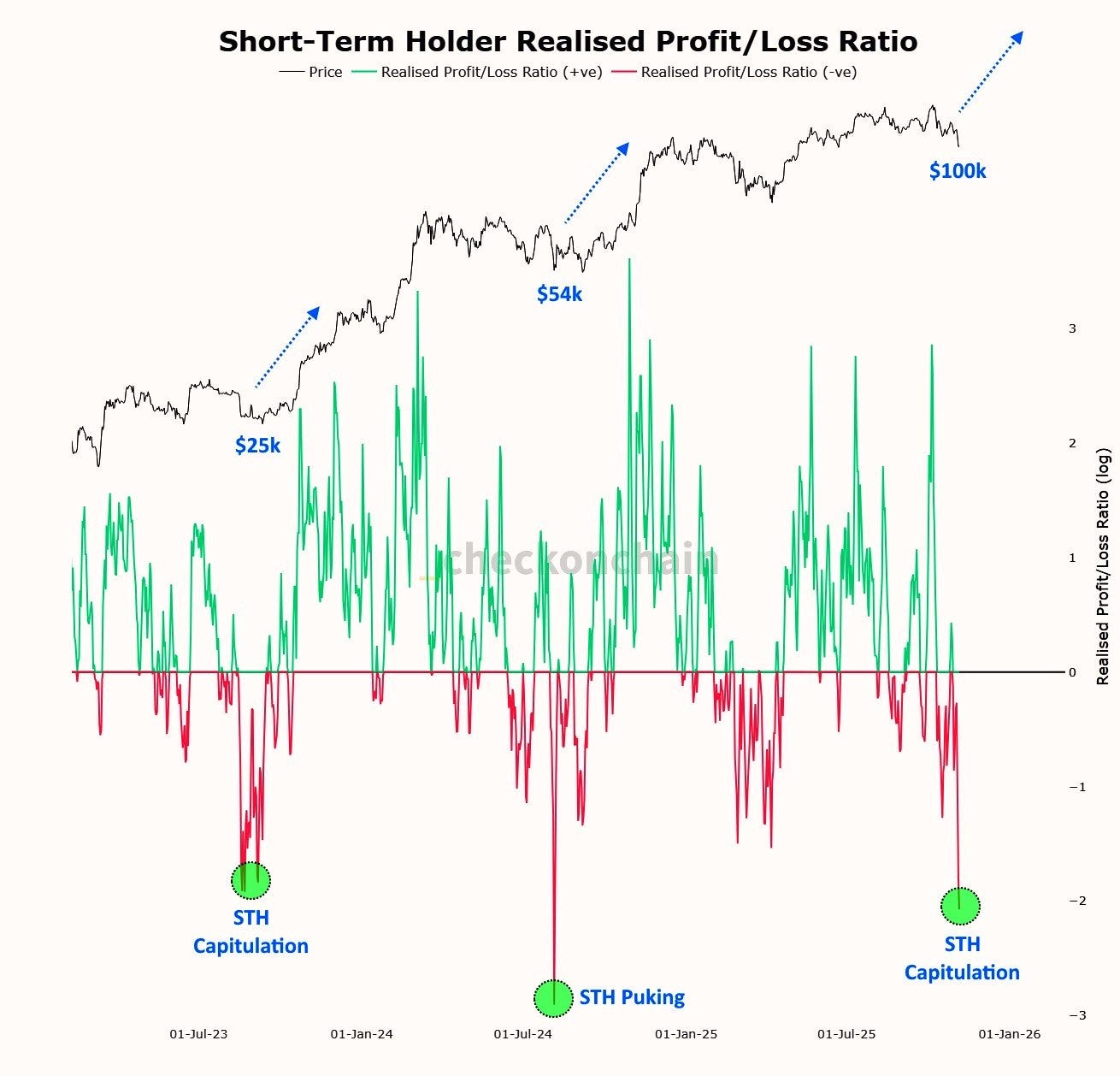

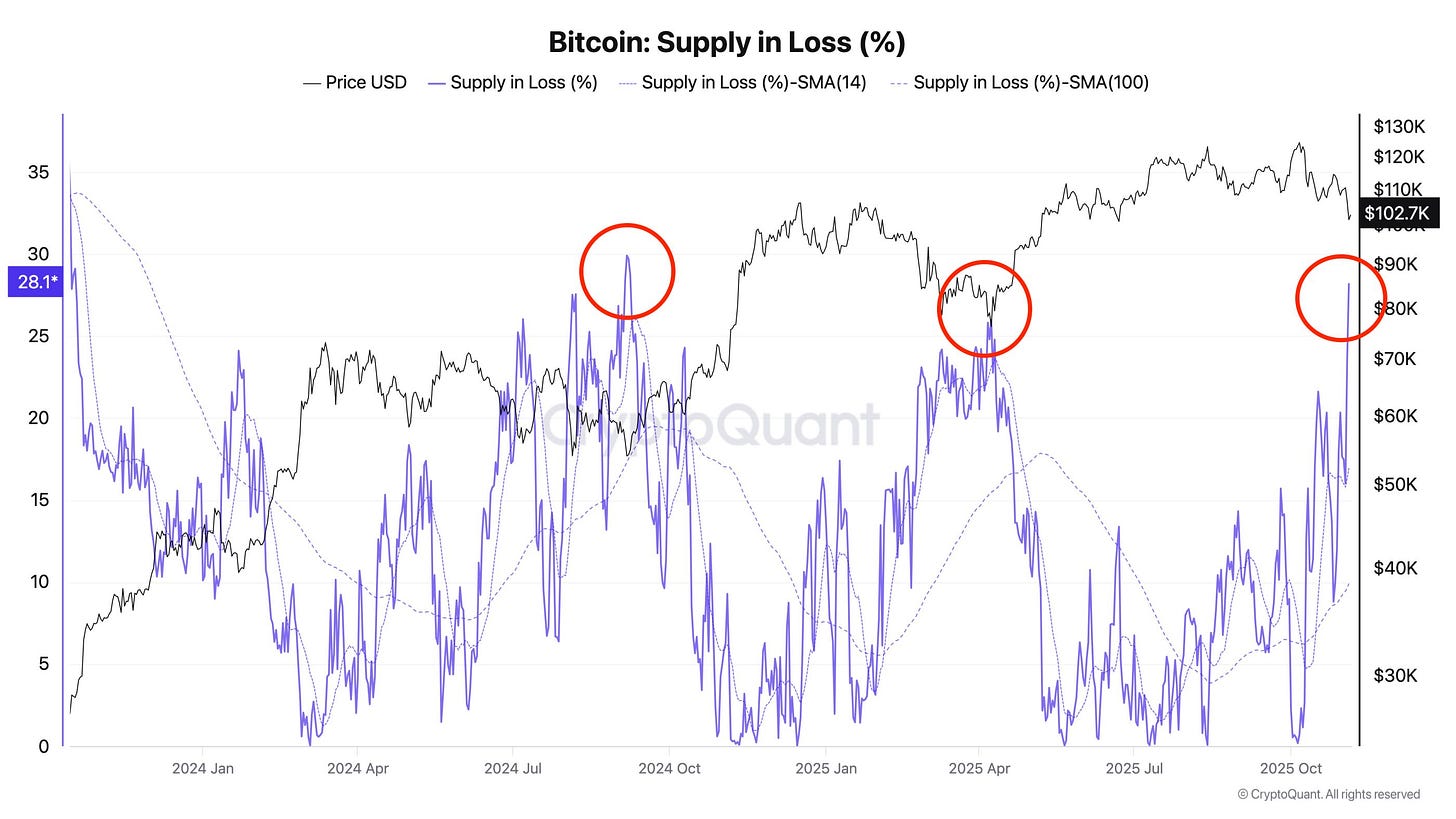

What’s fueling bearish price action are short term holders that are once again realizing losses. It is the same pattern we saw in 2023 and again in 2024, when weak hands exited and conviction holders absorbed supply. Each time, Bitcoin eventually doubled once the panic selling faded.

A full one hundred percent rally from here may be ambitious, but a move back toward 120K to 130K seems reasonable. If real euphoria returns, 150K is still within reach before momentum cools.

This data supports this idea. Bitcoin supply in loss is climbing again, a metric that has consistently marked major accumulation zones previously.

We saw it after the tariff shock in April and again during the 2024 correction, each time followed by a significant rally. When enough holders sit on losses, the market tends to reset. That collective pain often becomes the fuel for the next leg higher.

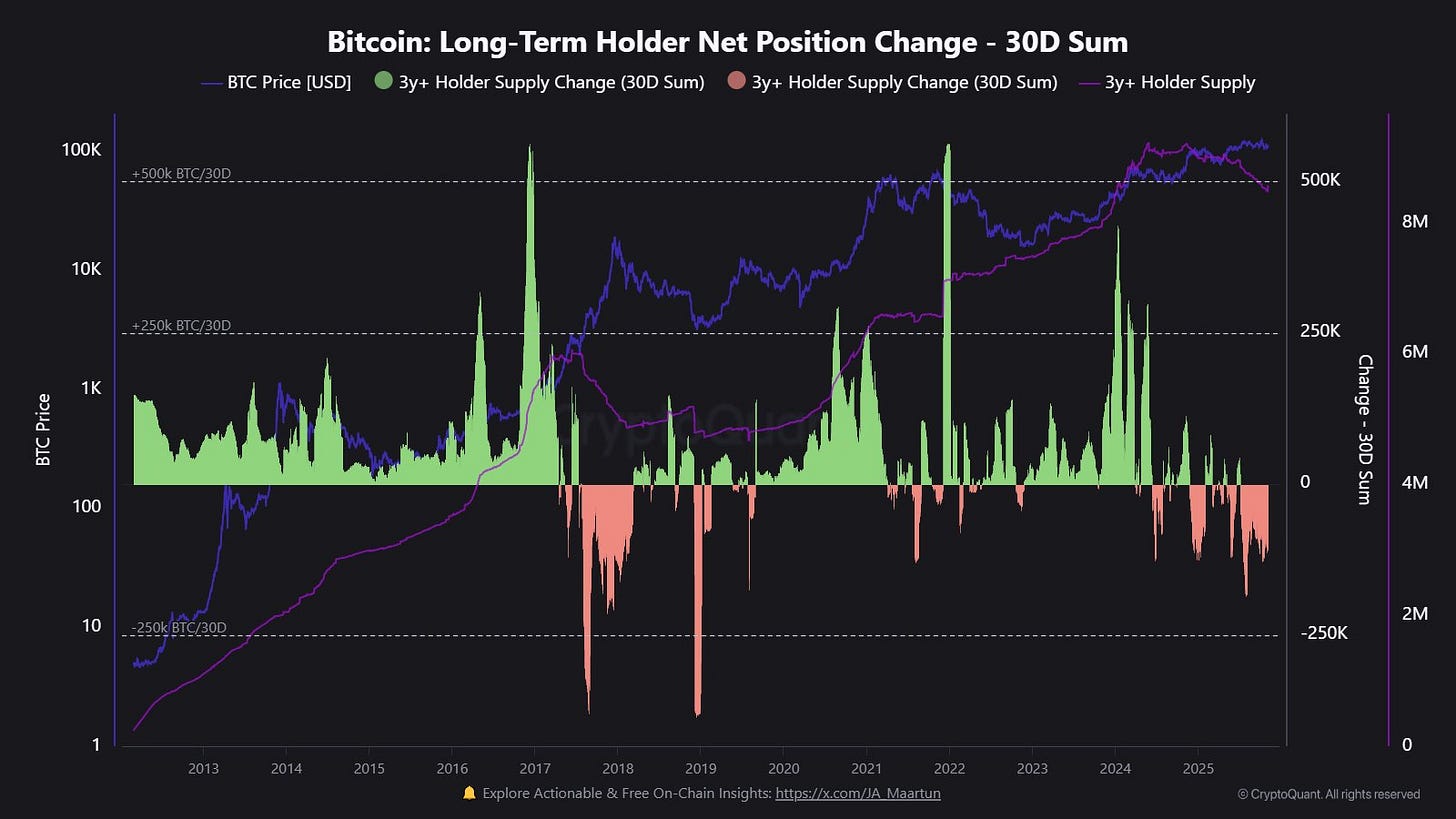

There is something concerning happening though. Even the long-term holders, those who have held for more than three years, have started to sell. More than 730k BTC from that cohort has moved in since May 2025, a clear sign that some of the strongest hands are taking profit or rotating. It does not necessarily signal a top, but it adds a layer of caution.

Altcoins

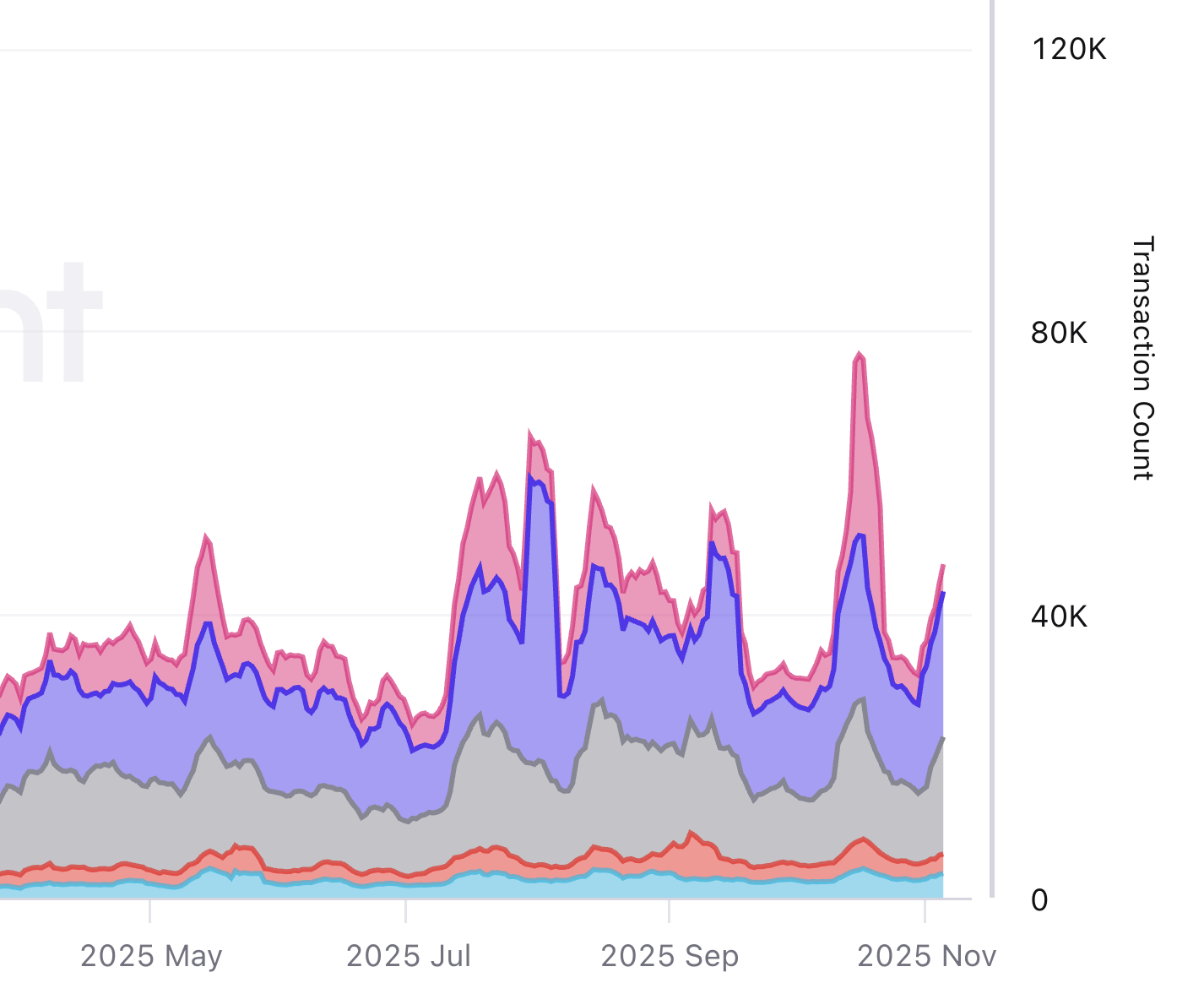

A quick note on altcoins. Transaction flows into exchanges are rising, which is never a healthy sign. The current wave of panic seems to be fueling forced selling across the smaller caps, while only a few select names are managing to hold up in this environment. Liquidity is retreating, and until confidence returns, alt performance will likely remain weak.

I’m tracking this chart daily and will update you on Telegram if the trend turns. Think of it as our early-warning radar — since exchange inflows start spiking again, it is time to move more risk-off.

→ Overall, the high time frame still leans toward patience. Weak hands are leaving, long-term conviction remains, and history suggests one more strong move could unfold before the real top forms. The difference this time is that even some veterans are trimming exposure. The market feels mature, heavy, and strategic, not euphoric at all, it could be preparing for the next chapter.

Why remain bullish?

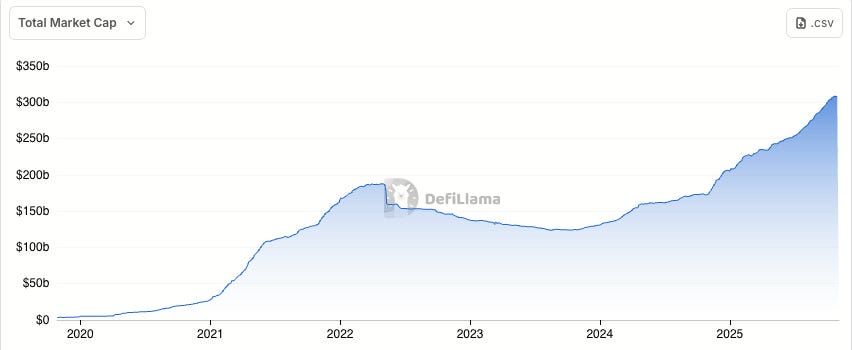

On the bullish side, fundamentals across crypto are improving, showing that real blockchain usage continues to expand beneath the noise.

Stablecoin supply has climbed to 308 billion dollars, this growing onchain liquidity and settlement activity makes TradFi extremely jealous of crypto.

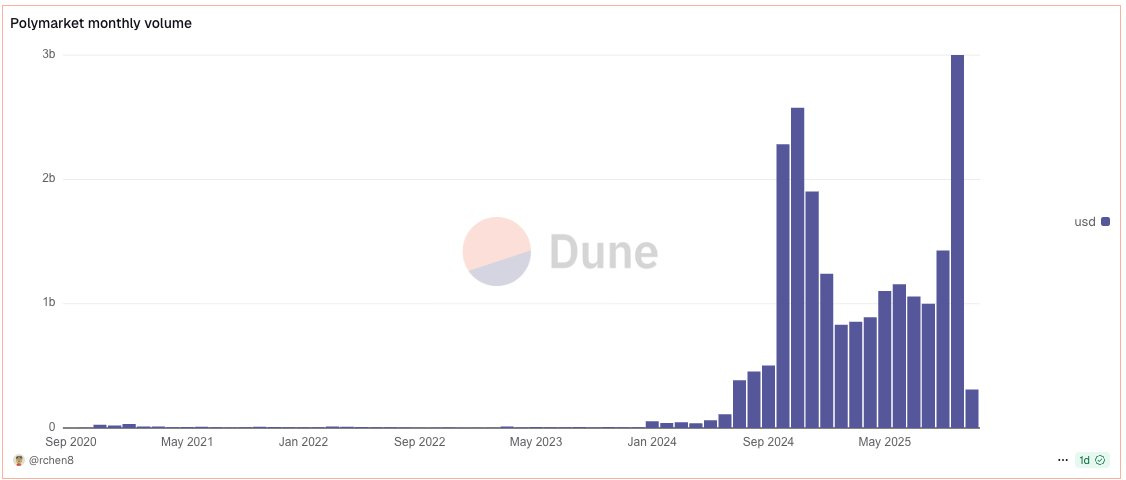

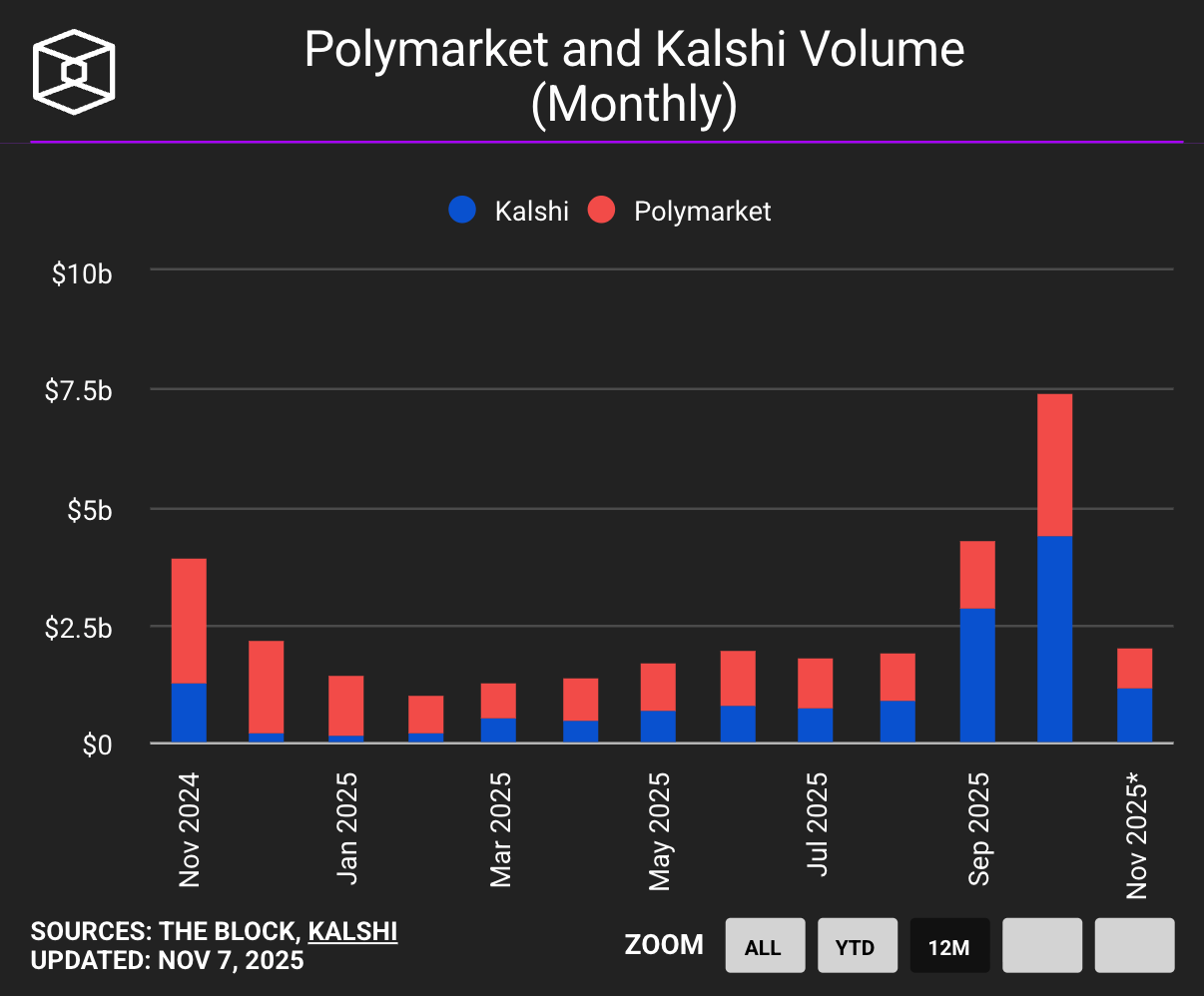

Polymarket reached three billion dollars in trading volume in October, proof that prediction markets are moving beyond niche speculation into real user adoption.

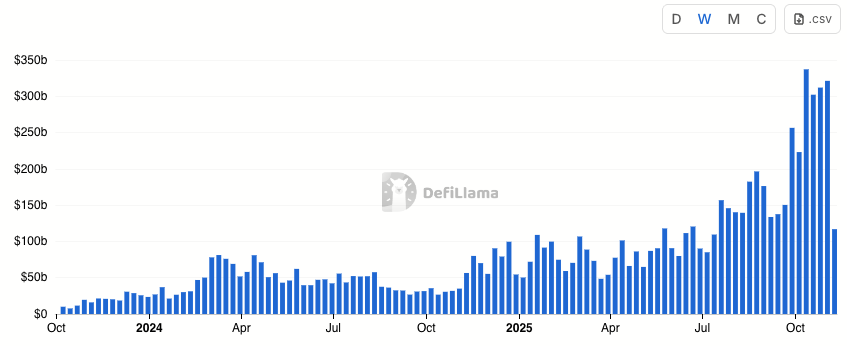

Perpetual futures volume hit 1.3 trillion dollars in the same month, a reminder of how deeply crypto markets are profiting from risk appetite. Speculation remains a big part of the use case.

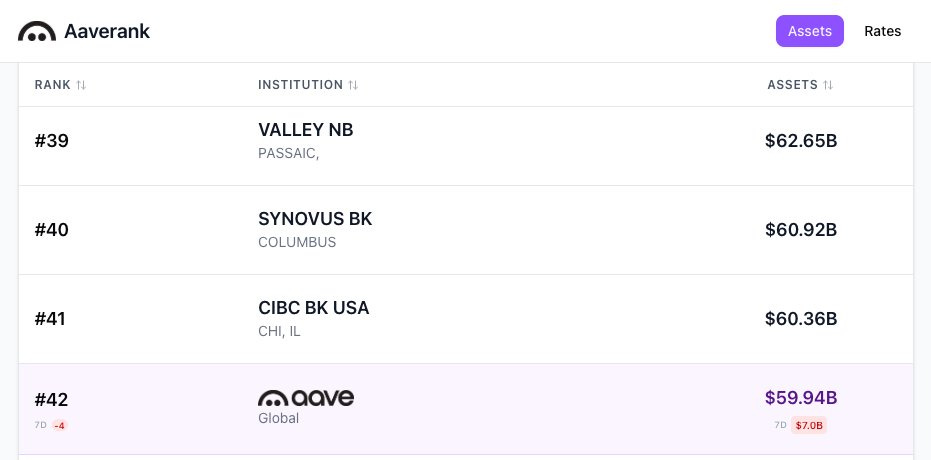

And Aave, with 60 billion dollars in assets under management, is now operating at a scale comparable to mid-sized banks.

→ You see: Not all is bad, beneath the surface real use cases are forming and crypto remains a success story. When in doubt, zoom out!

The biggest updates across top crypto projects.

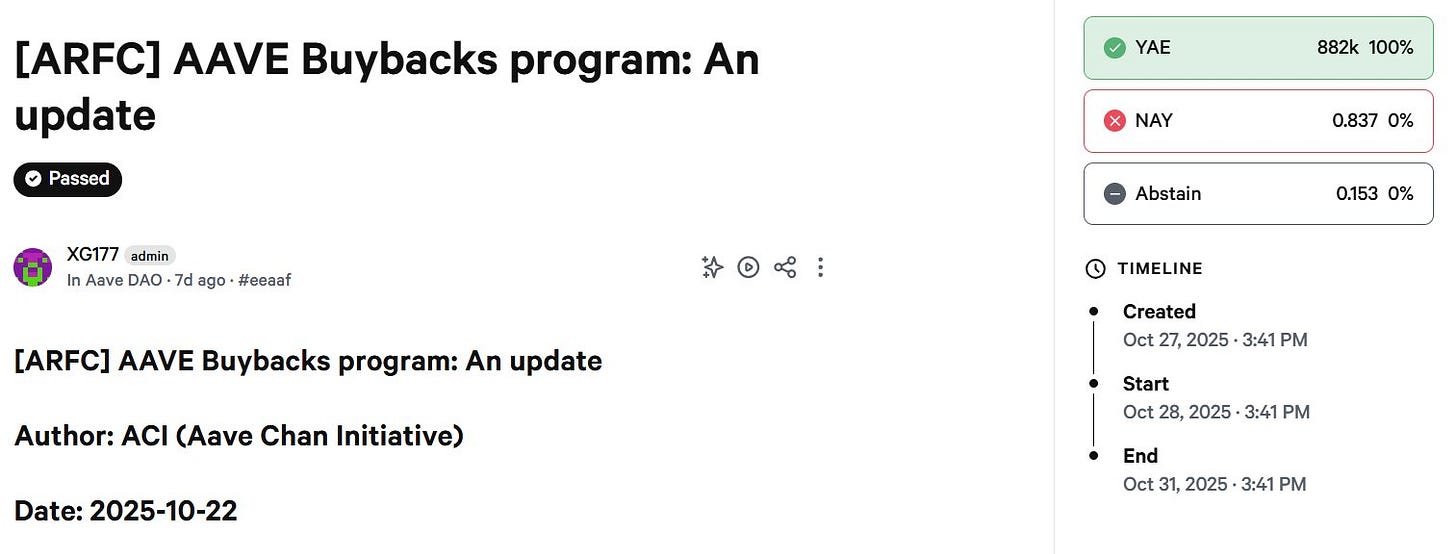

Buybacks are one of the most interesting narratives across major DeFi protocols as value is directly being returned to token holders instead of just chasing growth-at-all-costs.

Aave approved a 50 million dollar buyback program. The move signals confidence in its long-term revenue model and aims to support AAVE’s price while redistributing value to the community.

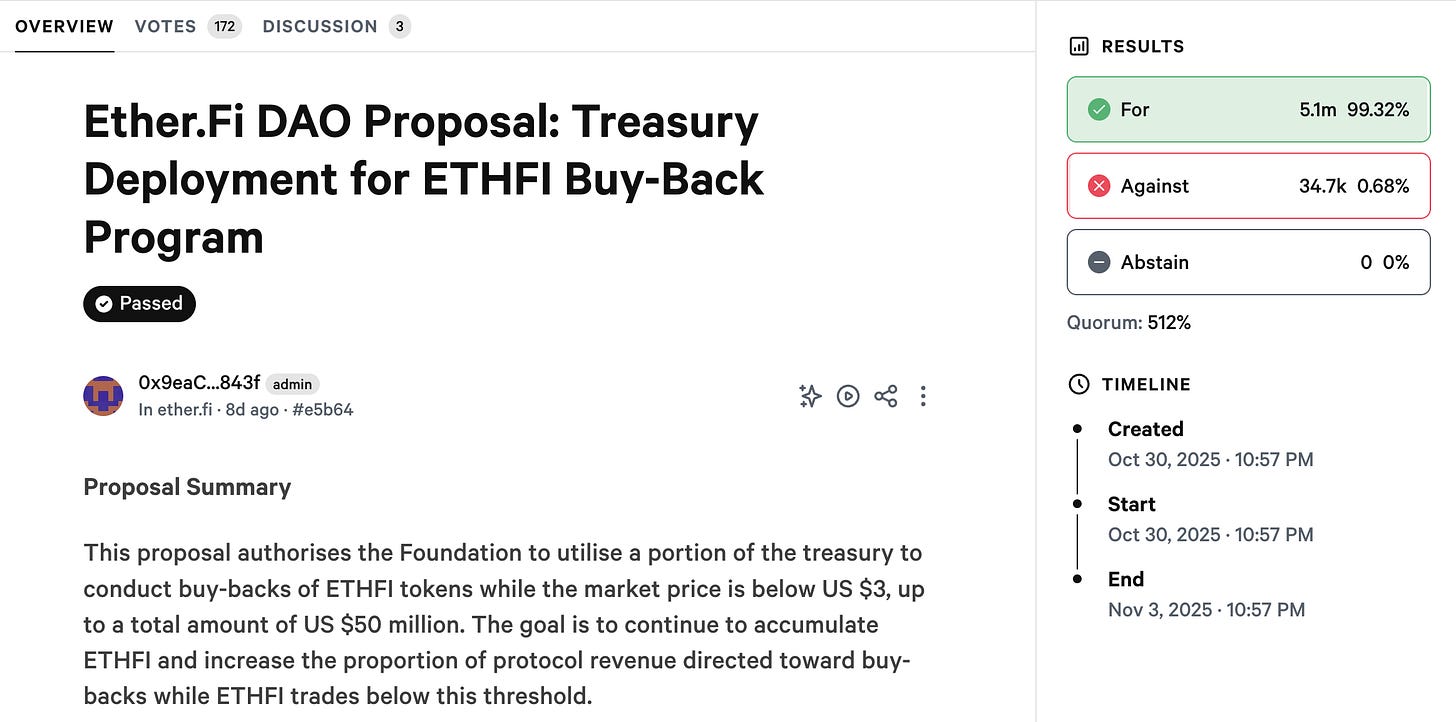

EtherFi DAO passed a proposal to use their treasury for a $50m token buyback. The goal is to reduce circulating supply and strengthen community alignment ahead of future growth phases.

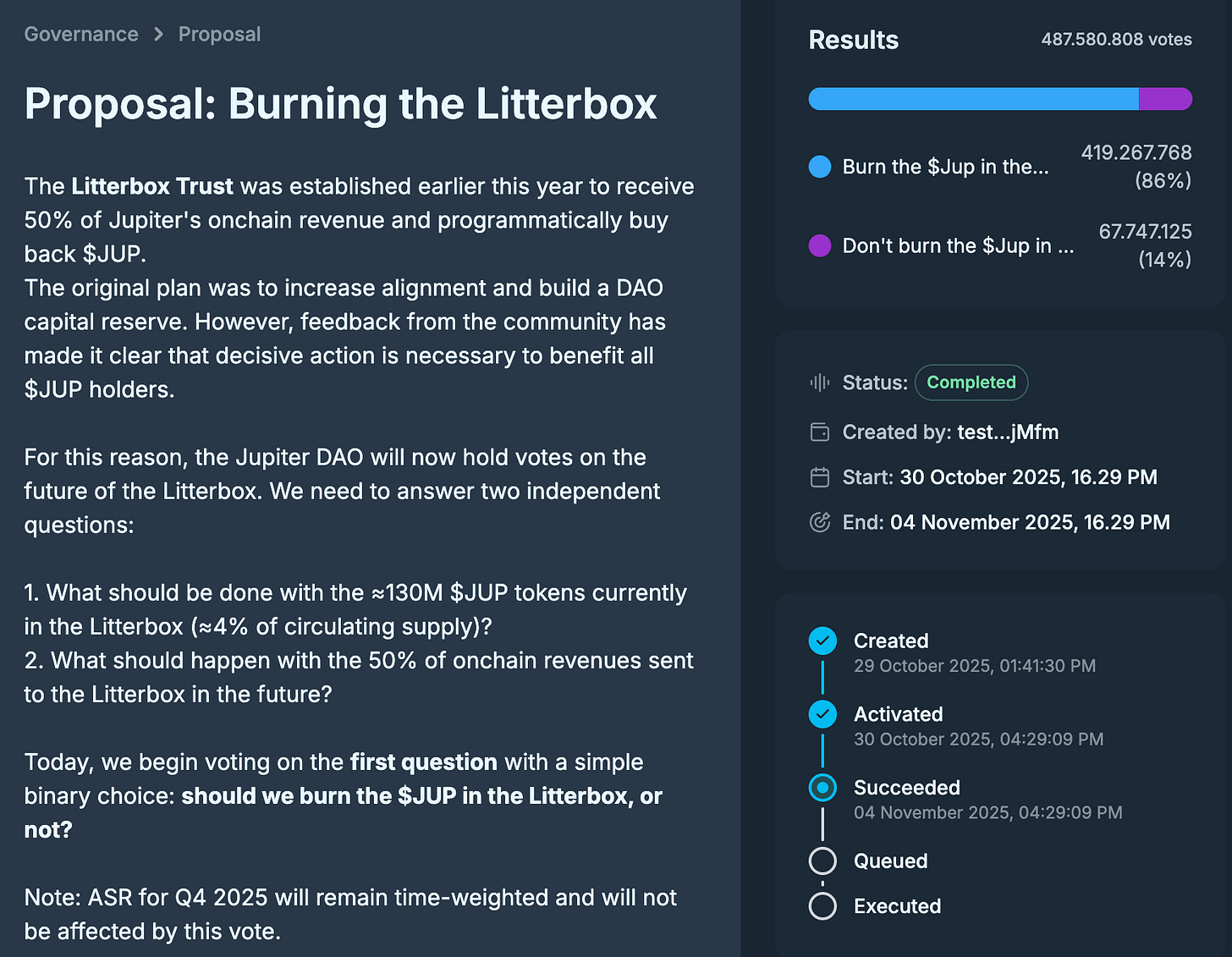

Jupiter DAO voted to burn JUP tokens accumulated from its previous buybacks (4% of circulating supply). Instead of holding them in reserve, the DAO opted to permanently remove them from supply, tightening token liquidity and reinforcing its long-term price narrative.

Across the board, these moves show a clear trend: Protocols are evolving and token buybacks can be considered a sign of a crypto project maturation and a moat to competitors. To me this underscores again that long term altcoin investments might only make sense in protocols that earn, buy back, and burn.

Google Finance will soon integrate Polymarket and Kalshi prediction market data directly into search results, starting with Labs users. This feature will let people query future events and see how market-implied odds evolve over time, effectively turning prediction markets into a live sentiment layer for the web.

Polymarket recently secured a 2 billion dollar investment from Intercontinental Exchange, valuing it at 9 billion dollars, while Kalshi raised 300 million dollars at a 5 billion valuation from Sequoia and Andreessen Horowitz. Both platforms hit record activity in October, with Kalshi leading in monthly volume at 4.4 billion dollars.

→ Why this is hot: Google’s move validates prediction markets as a new class of financial data — blending crypto, markets, and collective intelligence into something the mainstream can finally see and use.

Monad has officially set its mainnet launch date for November 24th, this is one of the most anticipated releases of the year. Known for its high-performance EVM architecture and parallel execution design, Monad aims to deliver true scalability without sacrificing Ethereum compatibility.

Good opportunities I discovered.

If you want a straight to the point newsletter full of calls, new projects, airdrop farms, memecoin and DeFi moonshots, then Hix0n’s Confidential is the place for you. I can really recommend his take (if you’re comfortable with high risk).

Alpha 1: 12% Yield on Kamino Finance (Solana)

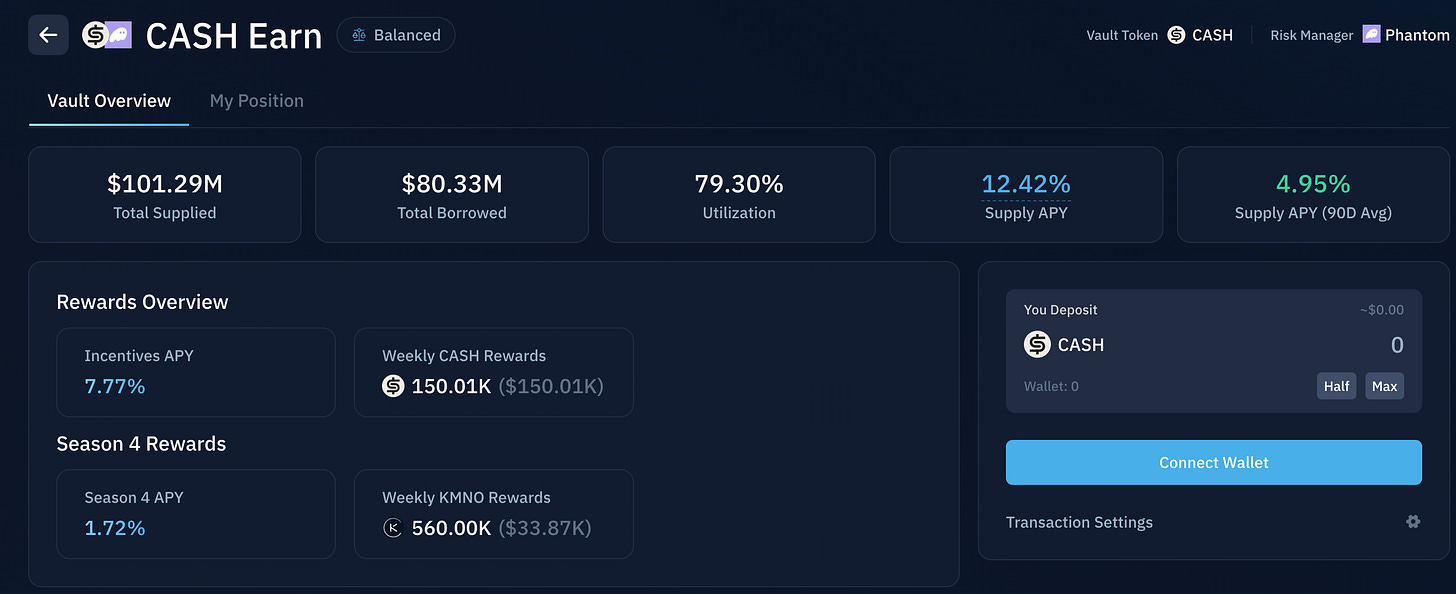

There is an interesting stable yield opportunity on Solana that deserves attention. Kamino has launched lending for CASH, a regulated stablecoin backed by Bridge and soon to be accepted by Stripe, currently offering around 12 % APY to lenders.

How to get started:

Visit kamino finance app

You are in the CASH Earn market

Choose your amount, approve, and deposit

If you do not yet have CASH, you can swap into it directly on Jupiter.

How it works:

CASH is a regulated stable managed by Bridge (a company acquired by Stripe), designed to connect TradFi and DeFi flows with institutional-grade compliance.

The yield is generated from borrowers paying interest to lenders, while the Earn vault allocates CASH across other Kamino money markets to optimize returns.

High utilization (around 80%) is a sign of efficiency. Liquidity is being actively used and lenders are earning higher rates. If utilization temporarily hits 100 percent, withdrawals pause until borrowers repay, but Kamino’s rate curve keeps the market liquid.

Why this is hot:

Kamino’s CASH market combines real-world compliance with DeFi-native yield. An 12 percent return on a regulated stablecoin, backed by an issuer that is about to integrate with Stripe, is a rare mix of legitimacy and performance. It is one of the few yield plays right now that could scale both inside and outside crypto’s usual boundaries.

So let’s get into the juicy Premium stuff and our latest Buys!

Yes it’s two great opportunities!

Here’s what you get:

📈 Ultimate Exit Strategy – Know when to take profits and avoid becoming fresh exit liquidity.

📰 Premium Weekly Newsletter – Deep, independent market analysis. No fluff, no filler. Just the best narratives, data, and edge.

📊 2× Weekly Trade Updates – Real trades. Real setups. In real time.

🧠 Stoic Mindset Coaching – Because you can’t win if you’re trading emotionally.

👨💼 Community Vote Deep Dives – You choose what I research. Zero shills, just signal.

💬 Daily Premium Support Chat – Ask me anything. Literally.

If you’ve been riding the newsletter for free and getting value, this is the next level.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.