Why Liquidity, Not Inflation, Now Drives Everything

AI, Liquidity, and Onchain Momentum: The Real Market Pulse.

Hey Friend!

The U.S. banking system is back under pressure. Overnight funding demand has surged to its highest level since December 2020, a clear sign of tightening liquidity beneath calm market headlines. At the same time, Bitcoin slipped below $104k, with over $1 billion liquidated in a single day. Altcoins followed, deep in red across the board.

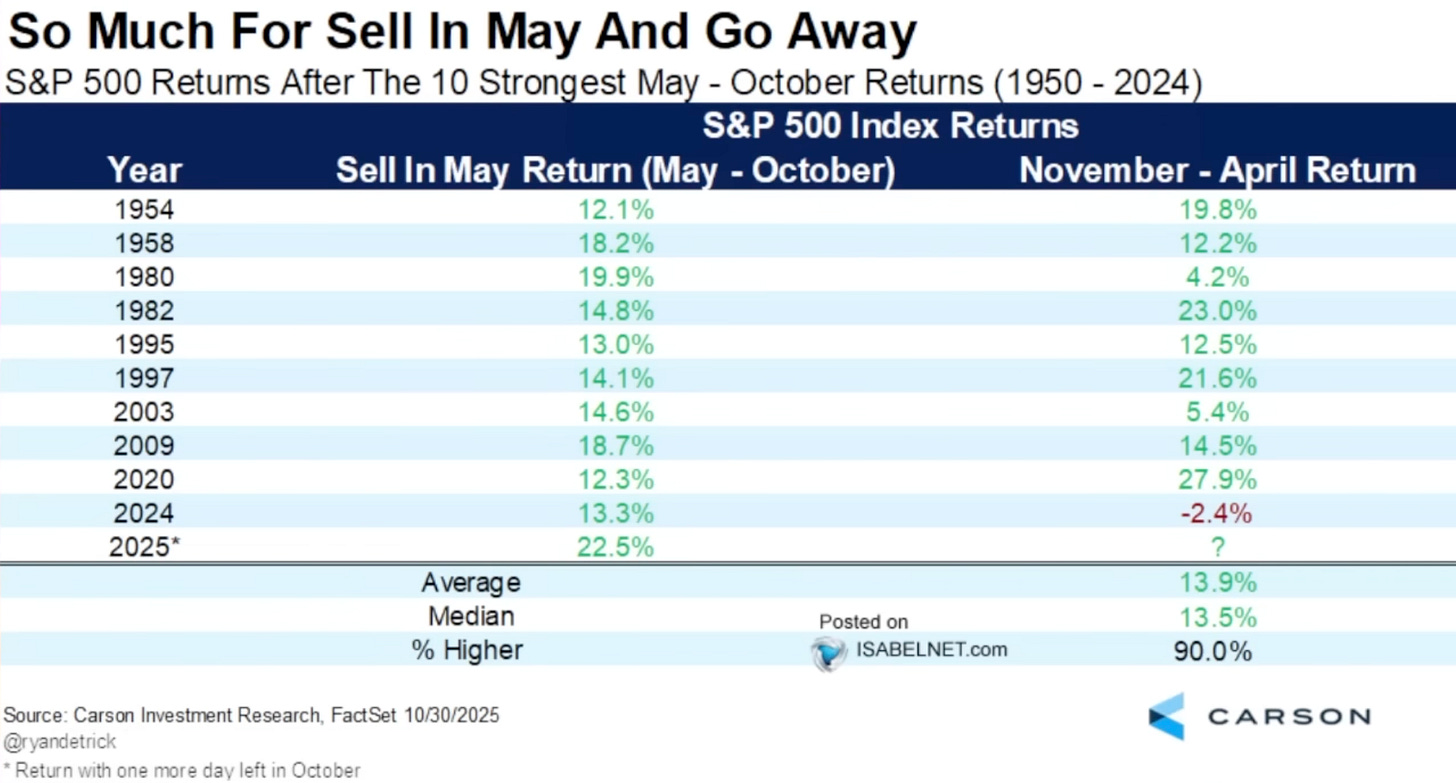

On the surface, equities remain strong. Between May and October, the S&P 500 had its best run since 1950.

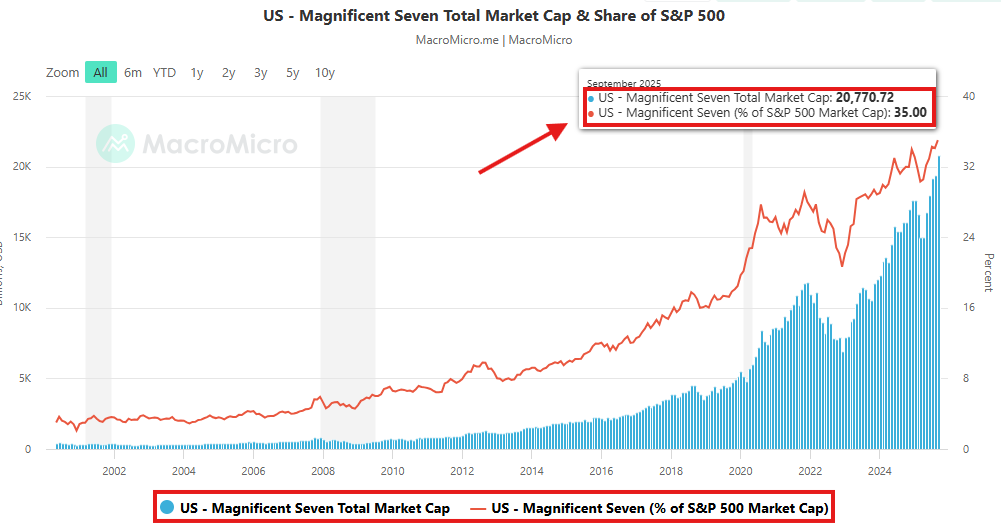

The rally is powered almost entirely by the “Magnificent 7” tech stocks.

For the first time in history, the Magnificent 7 stocks are now worth over a combined $20 TRILLION. This means that these 7 stocks alone now account for a record ~35% of the S&P 500.

Underneath, liquidity stress is spreading through the banking system. The contrast defines the current macro picture: One half of the economy inflated by AI optimism, the other half slowly running out of oxygen.

Let’s get into the broader picture and how to set up for the coming week:

️ ⚡ On today's Episode:

📈 Market Update – Liquidity pressure is rising fast — the Fed added $30B in short-term support, the biggest since 2008. QT ends soon, not because inflation’s fixed, but because the system’s breaking. Bitcoin mirrors the squeeze with ETF outflows (-$946M), while Solana defies gravity with $421M inflows via new U.S. ETFs. Liquidity, not inflation, is the real macro driver now.

🐂 Alpha Insights – Onchain capital is rotating into AI & DeFi ecosystems:

Virtuals on Base: DAO-approved, performance-only rewards send $VIRTUAL +30%.

GAME: Core asset of the Virtuals economy — strong conviction, real traction.

SEDA: Hyperliquid’s oracle layer burning supply with every data call.

The current state of the market.

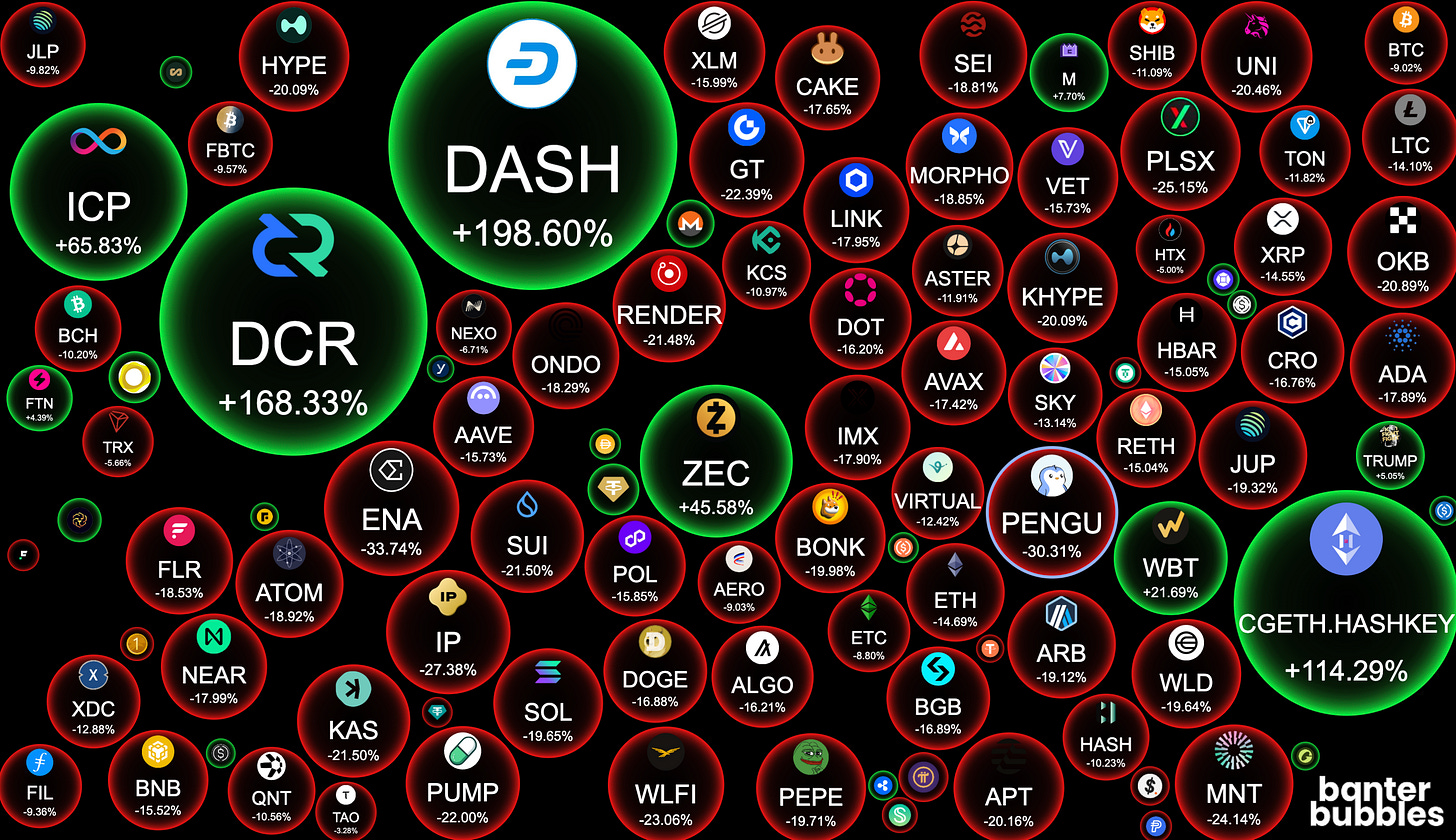

Weekly Crypto Bubbles

→ We are down bad but at least privacy coin DASH saw a nice pump.

Market Overview

Liquidity pressure is building again, even if the headlines still look calm(ish). Overnight funding costs in the U.S. banking system keep rising, and the Fed has already stepped in. Last week, it added around $30 billion in short-term liquidity — the biggest move since the 2008 crisis. It’s not being called QE, but it serves the same purpose: Keeping banks from running out of cash.

QT, the Fed’s balance sheet reduction, is almost done. It will likely end by December, not because inflation is fully under control, but because the system can’t handle more tightening. That marks a turning point. The Fed needs to cut rates, and liquidity is no longer drained either.

→ The tightening phase seems to be ending. The question now: Is it already too late?

Stocks still look strong on paper. The S&P 500 just had its best May–October run since 1950. But this strength comes from a very small group. The Magnificent 7 — Apple, Microsoft, Google, Amazon, Meta, Nvidia, and Tesla — now make up about 35% of the index, worth more than $20 trillion combined. The rest of the market is far weaker.

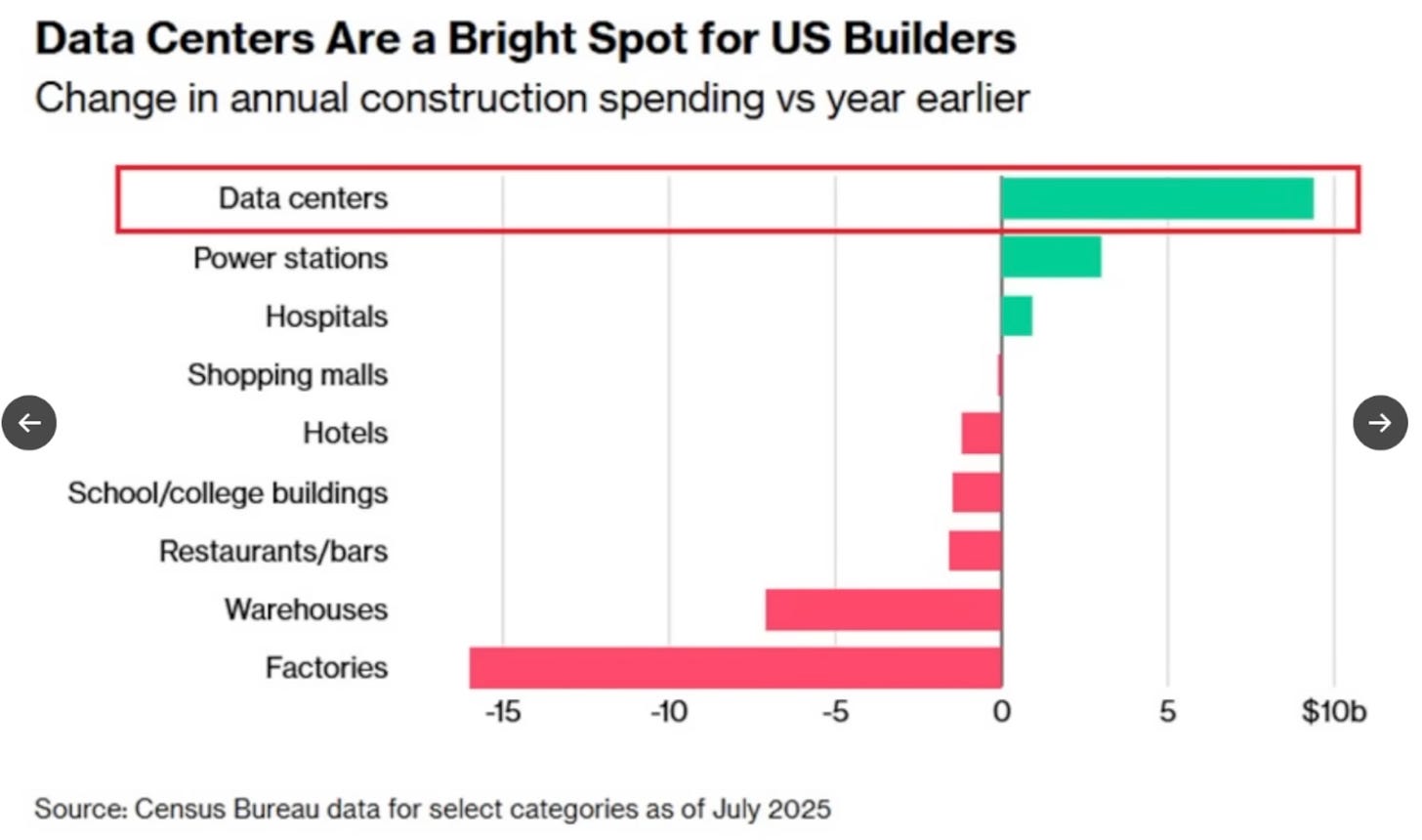

Investment is flowing almost entirely into AI-related areas like data centers and chip production, while spending on factories and warehouses is falling.

Consumer and retail stocks are down between 10% and 80% this year.

The U.S. economy is increasingly built around one story: AI growth. That focus looks powerful at first, but it leaves the system unbalanced — strength concentrated in one corner, weakness everywhere else. Over time, that kind of setup builds a bubble.

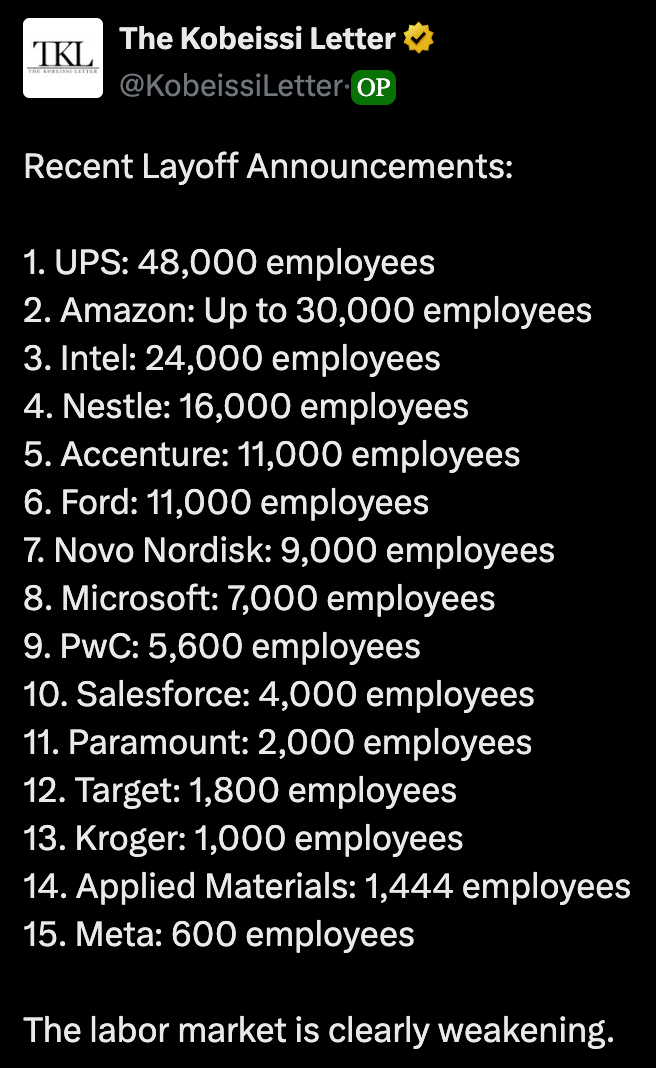

The labor market is starting to show cracks. Big layoffs are spreading across major employers — Amazon (30,000), Intel (24,000), UPS (48,000).

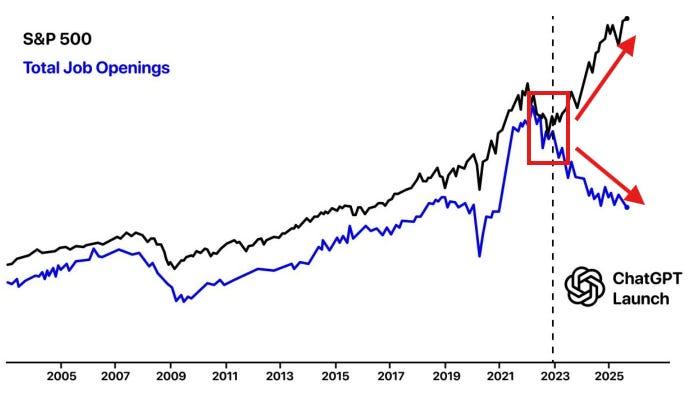

Unemployment has climbed to 8.1%, and job creation is slowing overall. Companies are protecting profits through automation and efficiency, not through growth and there’s no more correlation of the S&P 500 and job openings due to AI.

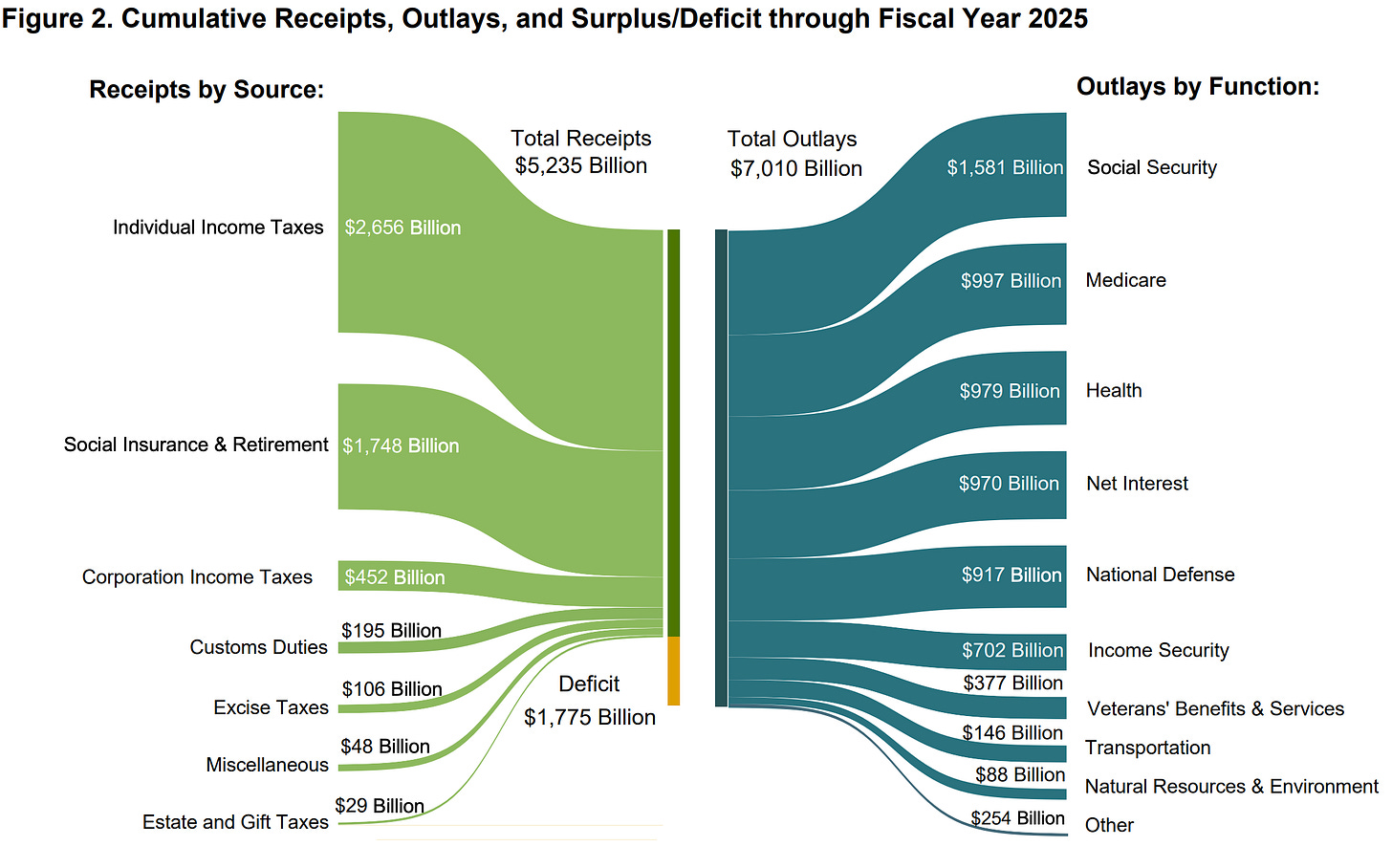

That shift hits the government’s finances directly. Income taxes — the main source of U.S. federal revenue — depend on steady jobs and rising wages. When employment slows, tax receipts fall.

The U.S. deficit is already about $1.775 trillion, and interest payments are nearing $1 trillion per year.

To fill the gap, the Treasury keeps issuing more debt, which pulls more liquidity out of the banking system.

The macro loop is clear. Less liquidity weakens growth. Weak growth increases deficits. More deficits require more debt. Eventually, the Fed has to step back in with new liquidity to keep the system stable.

Inflation is no longer the biggest problem — liquidity is. Fiscal stress and slowing growth are pushing policymakers toward a softer stance, whether they admit it or not. The pattern looks like late 2019: first cracks in funding markets, then emergency support, and eventually new liquidity injections.

Bitcoin’s price reflects this tightening. When liquidity dries up, it struggles. When liquidity returns, it’s usually first to recover. The current weakness is a mirror of dollar scarcity. Once the Fed and Treasury are forced to act again, Bitcoin is likely to benefit before most other assets.

For the week ahead, the key things to watch are bank funding data, Treasury debt issuance, and any hints from the Fed about repo operations. These moves in liquidity are what really drive markets right now. Everything else is just noise.

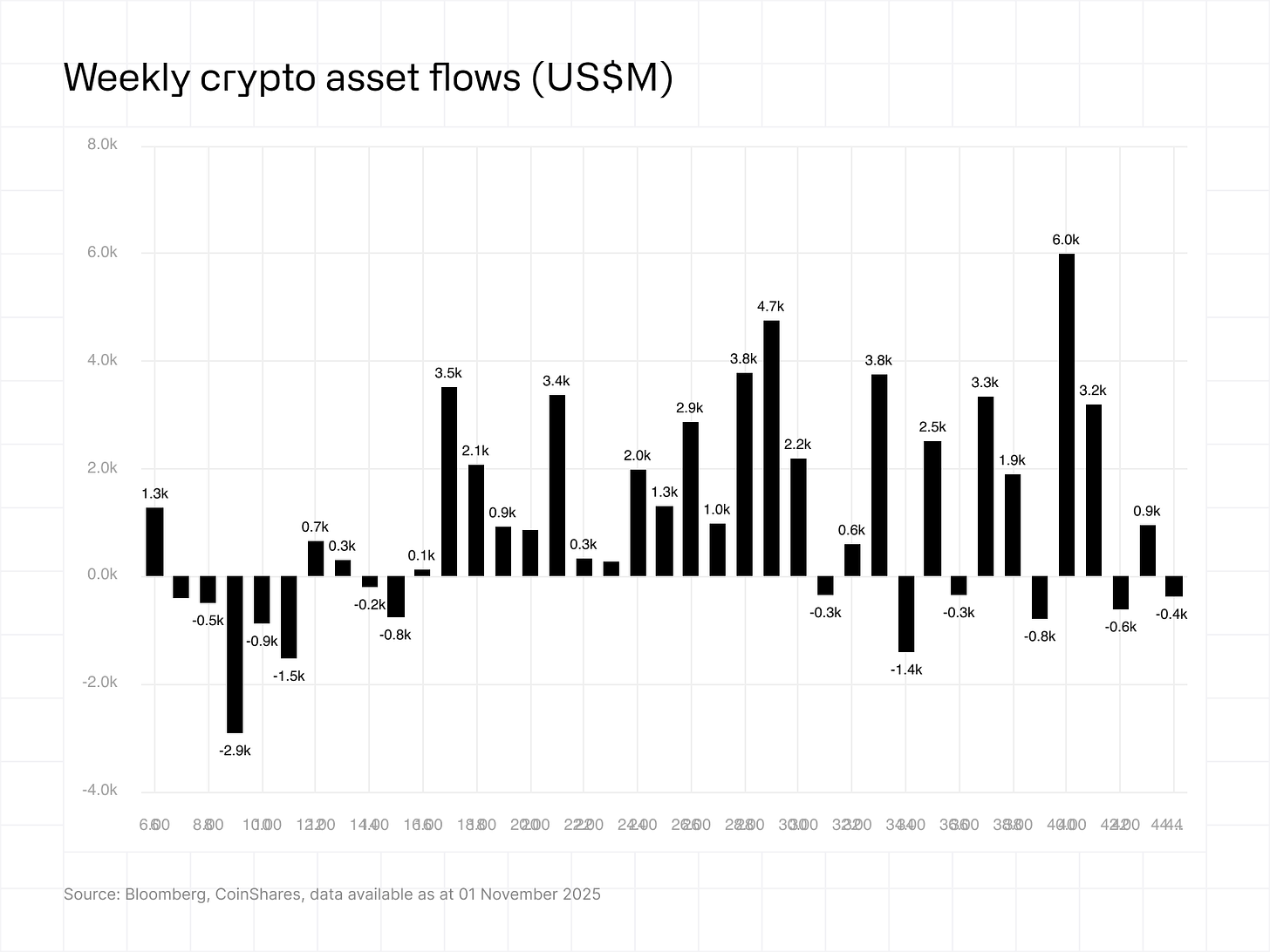

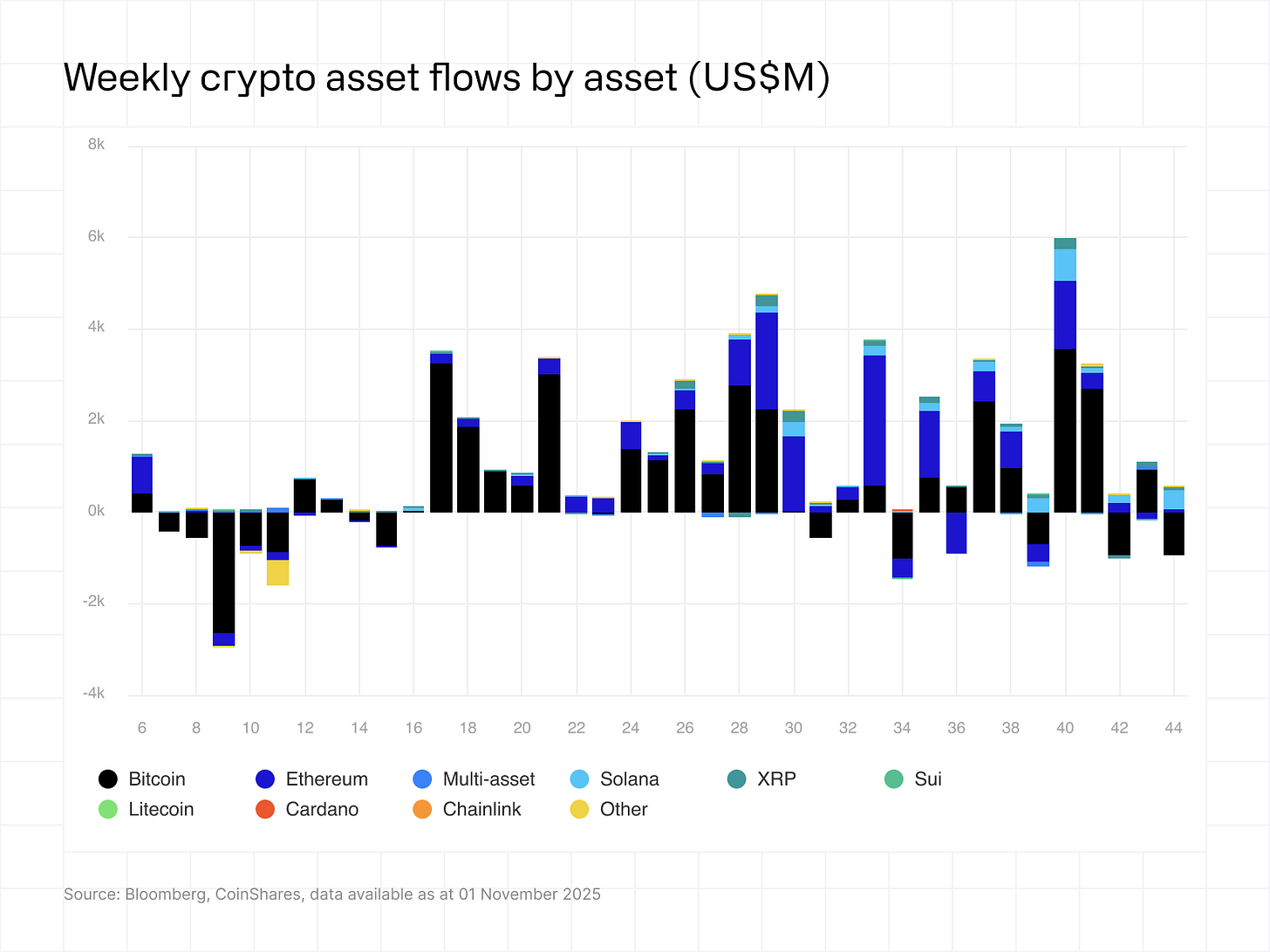

Asset Flows — Investors Step Back as Liquidity Tightens

The shift in tone from the Fed is already showing up in capital flows. Digital asset investment products saw US$360 million in outflows last week, as investors reacted to Jerome Powell’s hawkish comments despite the recent rate cut.

His reminder that another cut in December is “not a foregone conclusion” kept markets uneasy.

The outflows mirror what’s happening in the broader liquidity picture. U.S. funding markets are under pressure, and risk appetite is cooling. The U.S. alone saw $439 million in redemptions from digital asset products, the bulk of which came from Bitcoin ETFs. Bitcoin remains the asset most sensitive to changes in liquidity and rate expectations, and it showed that again last week with $946 million in outflows.

In contrast, flows in Solana told a very different story. Solana attracted $421 million in inflows, the second largest on record, driven by strong demand for newly launched U.S. Solana ETFs.

The data fits the larger macro pattern. As liquidity tightens, investors reduce exposure to high-beta assets like Bitcoin but selectively add to narratives with growth potential. Once the Fed signals that liquidity support will return, positioning is likely to flip quickly. For now, the focus is on defense — holding cash, trimming leverage, and waiting for confirmation that the liquidity cycle has turned.

Market insights and good opportunities I discovered.

BTC Still Sets the Tone

Bitcoin continues to trade in a fragile zone. The key levels to watch remain $110k and $103k. Above 110k, liquidity supports the market. Below 103k, volatility could accelerate into another broad flush.

Bitcoin Dominance is creeping higher again. If it starts rolling over below 59%, that’s your signal that altcoins are reclaiming momentum.

→ Until that reversal, stay defensive.

But of course I still got some ideas for outsized returns in case the market turns.

Alpha 1: Virtuals on Base Takes the Spotlight

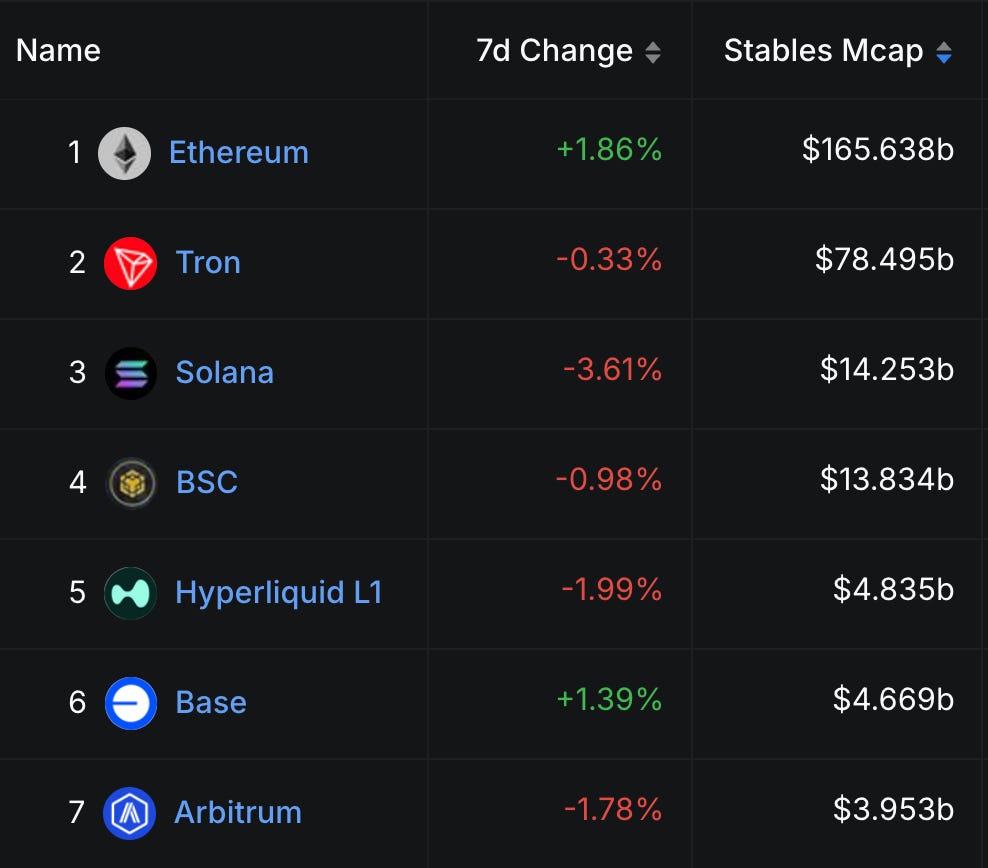

Among the top 7 chains, Ethereum and Base are leading stablecoin supply growth this week. The 7-day data from DeFiLlama tells the story: fresh stables are pouring into the chains, even as broader crypto sentiment remains cautious.

The reason for certainly sits right at the center of the Base ecosystem — Virtuals Protocol.

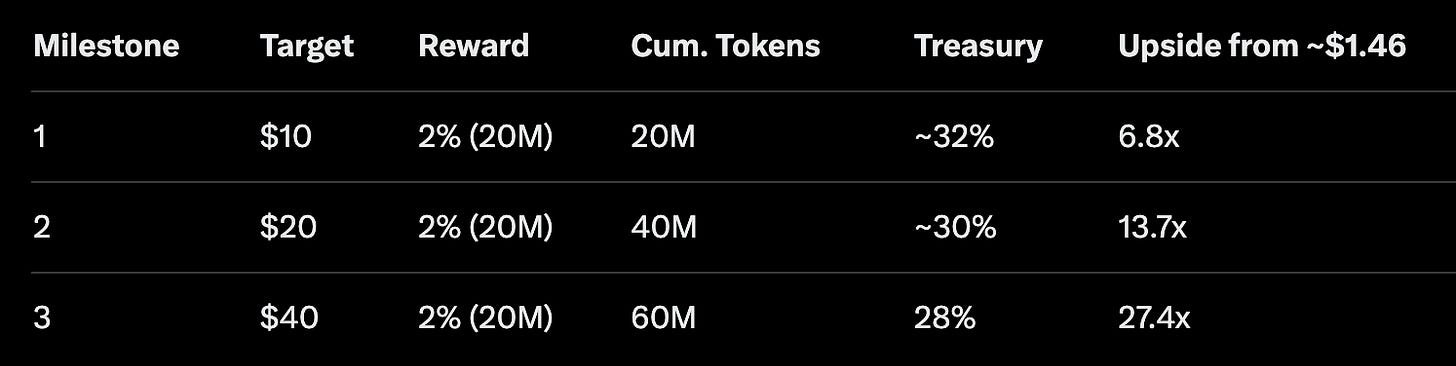

Virtuals Protocol’s “Incentive Alignment for Core Contributors” DAO proposal is one of the cleanest governance moves of 2025. The idea: reward the core team (Virgen Labs) only if the $VIRTUAL price sustainably rises — no new tokens, no dilution, just performance-based unlocks from the DAO’s existing treasury.

The plan sets three milestones:

$10 → 2% of supply (20M tokens)

$20 → +2%

$40 → +2%

Vesting runs for 36 months, fully on-chain, with a $10M daily volume floor to prevent short-term manipulation.

At today’s price (~$1.46), none of the targets are close, but the market liked the message — the vote’s approval sent $VIRTUAL up 30% in a day. It told investors that the team is betting on its own execution, not easy unlocks.

The upside is massive if milestones are hit and the design also protects the treasury (down from 34% to 28% max).

Alpha 2: GAME – The Clear Virtuals Ecosystem Leader

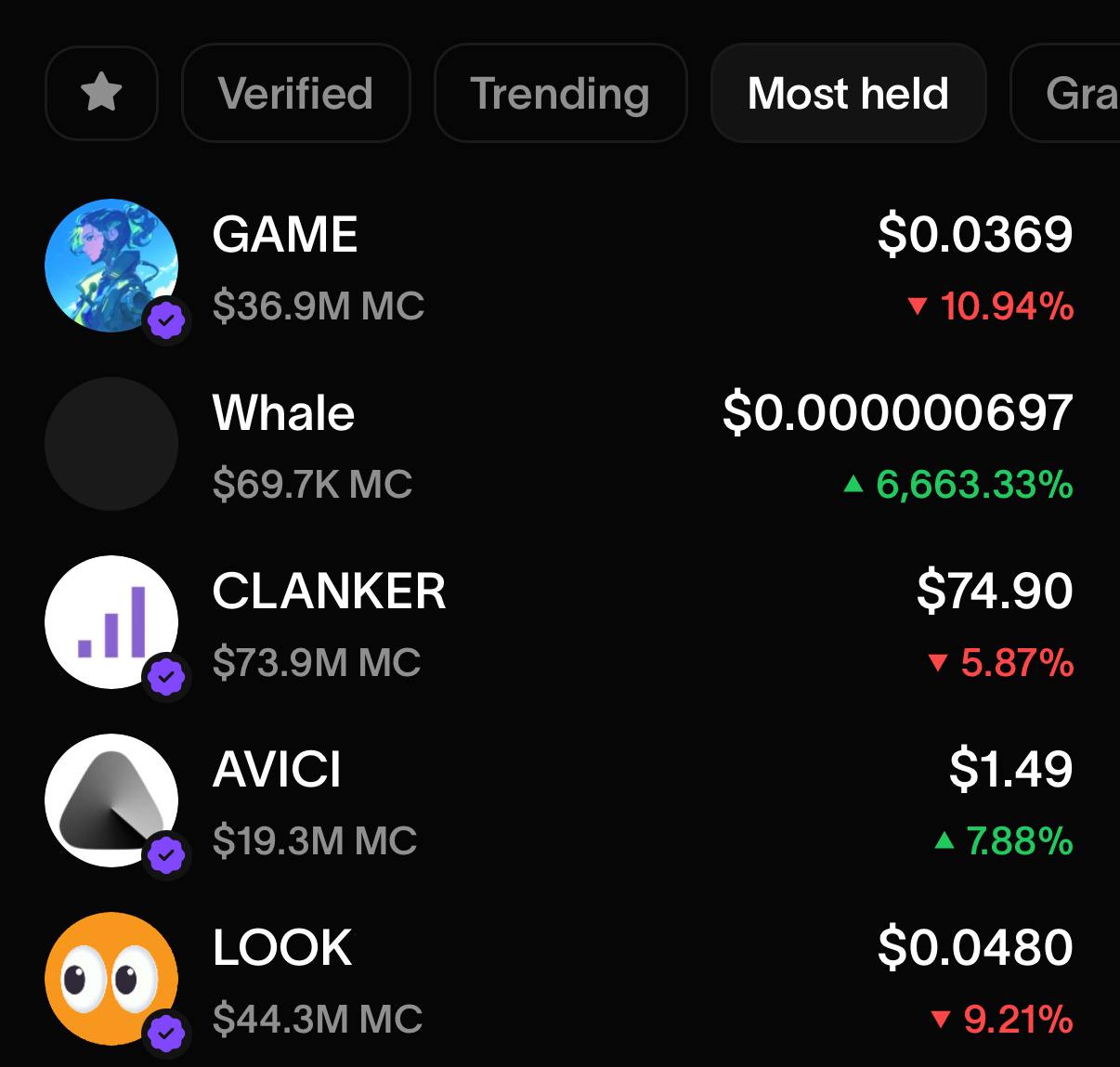

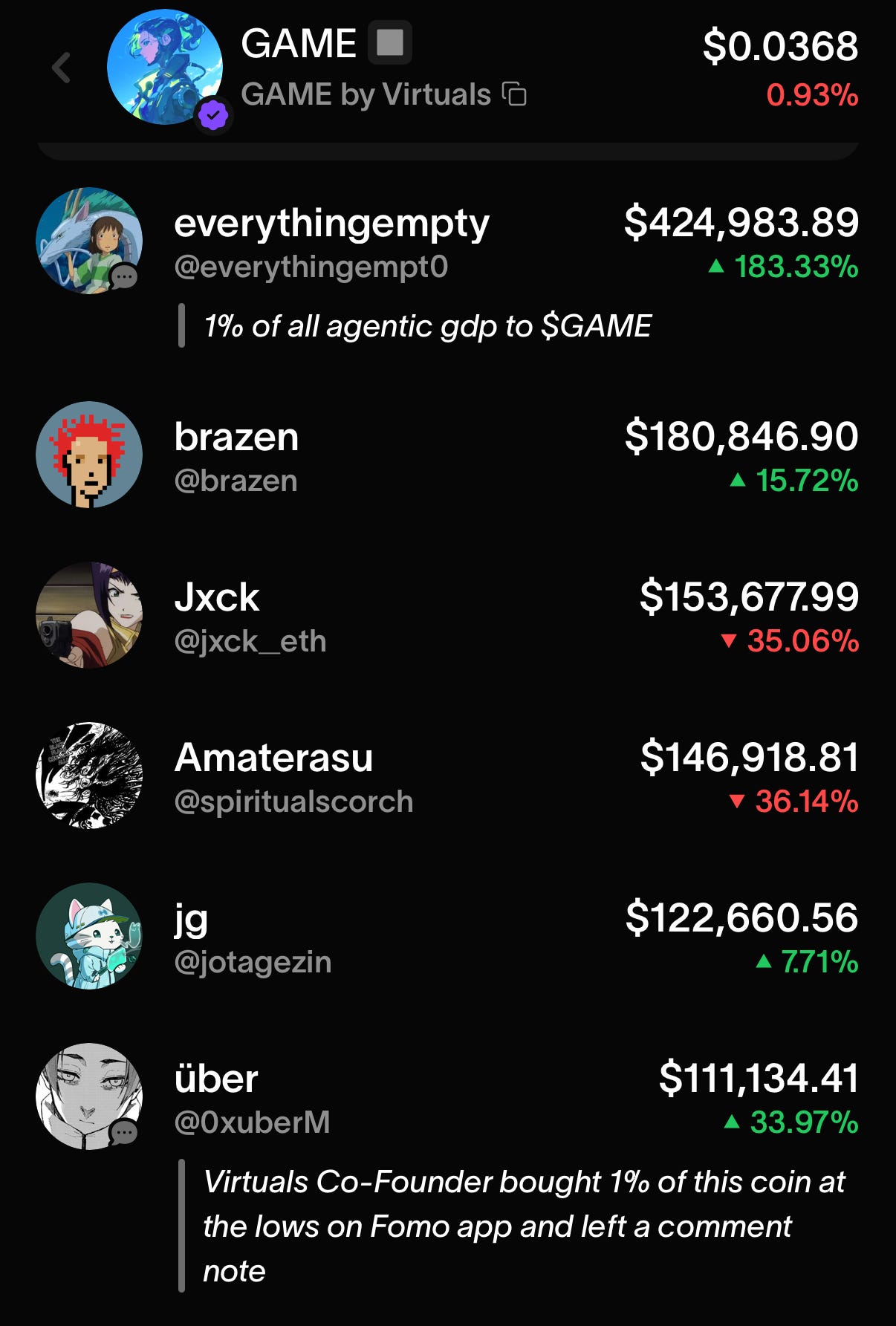

Within the Virtuals Protocol ecosystem, one name continues to stand out — GAME. It remains the most-held token on FOMO app where successful traders like to show off their skills.

Everything inside Virtuals flows through GAME. As demand for AI-native applications grows, so does the need for its underlying fuel. Community sentiment is strong, conviction is visible, and the ecosystem effect is starting to compound. Traders who tracked GAME early, like everythingempt0, caught the bottom and are now setting the tone for what’s next.

→ GAME is a clean bet on the VIRTUALS onchain AI economy. I am beginning to build a position here around the 0.618 FIB and am willing to continue to buy the dip. Speculative bet though, size in accordingly.

→ You can buy the token here on Cow Swap.

→ If you prefer a mobile app, try FOMO or DeFi App for small positions.

Alpha 3: SEDA on Hyperliquid

The onchain crowd has shifted focus to projects that are actually building market infrastructure — data, execution, and automation layers.

SEDA is the fast AI oracle powering Hyperliquid’s HIP-3 upgrade. HIP-3 lets anyone create custom futures bets (e.g., elections, stocks). SEDA feeds real-time data from trusted sources (similar to Chainlink). Every data request burns SEDA tokens, shrinking supply as usage grows.

Momentum isn’t just speculative here. The protocol is beginning to attract the same early-stage cult energy once seen around Chainlink in 2019. There’s a reason SEDA’s ticker keeps showing up on many DeFi watchlists.

→ I am building a SEDA position as well and bought it on Base. No surprise if we tap the 0.618 FIB again, so lower prices are on the table.

→ You can use an aggregator like Cow Swap to buy the token.

→ If you prefer a mobile app, try FOMO or DeFi App for small positions.

The Bigger Picture

Liquidity is tight, the Fed is hesitant, and macro uncertainty still lingers. Luckily onchain capital isn’t waiting for Powell but rotating into ecosystems that actually generate usage and data.

The alpha right now lies in following where onchain liquidity flows, not where it retreats.

Base is for the moment the chain of choice for active capital.

Virtuals has achieved genuine traction with community-driven governance.

SEDA is becoming the oracle standard for data-driven AI infrastructure.

GAME remains the core bet on the growing AI-agent economy.

If you want to actually be ready next time the market collapses, here’s what you get with Premium:

📈 Ultimate Exit Strategy – Know when to take profits and avoid becoming fresh exit liquidity.

📰 Premium Weekly Newsletter – I go deeper than CT threads and regurgitated YouTube summaries.

📊 2× Weekly Trade Updates – Real trades. Real setups. In real time.

🧠 Stoic Mindset Coaching – Because you can’t win if you’re trading emotionally.

👨💼 Community Vote Deep Dives – You choose what I research. Zero shills, just signal.

💬 Daily Premium Support Chat – Ask me anything. Literally.

If you’ve been riding the newsletter for free and getting value, this is the next level. Your edge is waiting.

That’s it for today’s letter, thank you for being here!

Till next time, stay safe!