Adrian's DeFi Alpha #24: BTC Dominance Peak | Altcoin Rallye Soon | NEAR | Tether | PRIME | Coinbase | DEAI | Mantle | My Portfolio Revealed

Definitely no financial advice, just insights based on my own journey in DeFi.

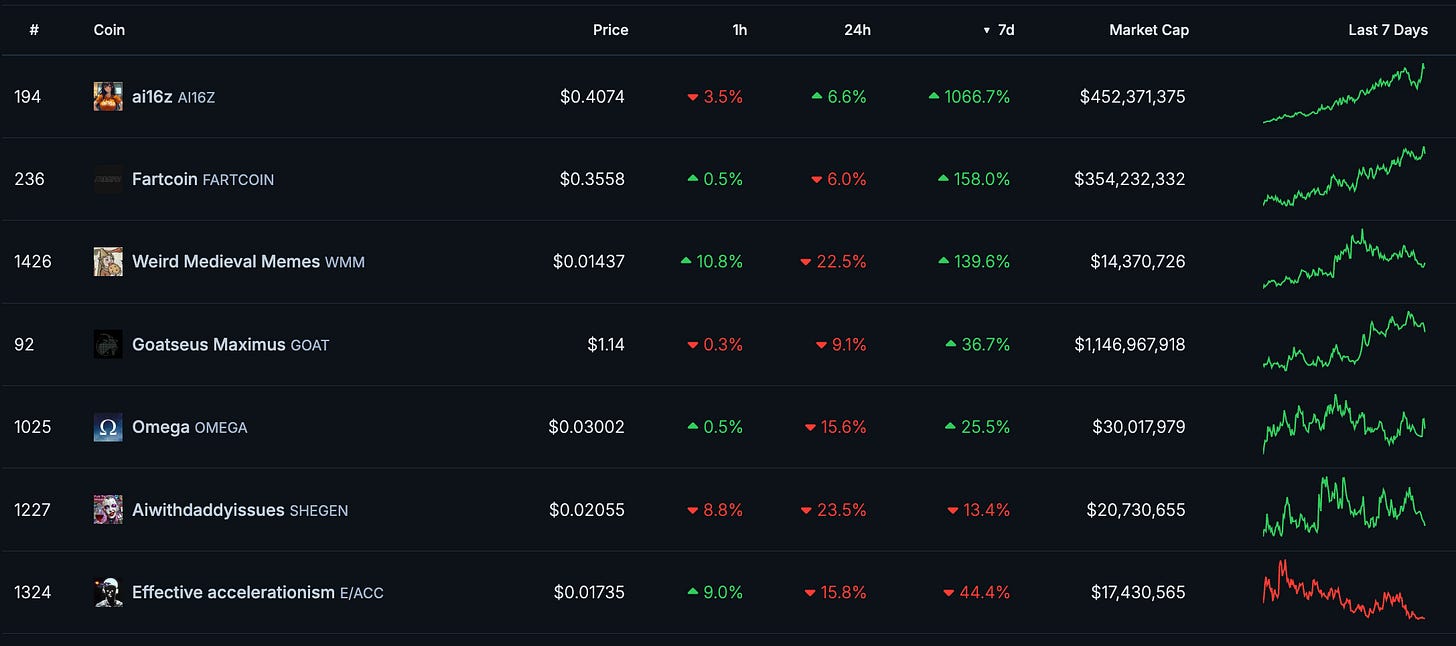

Memes are printing money and clever members of this community made awesome gains this week with the knowledge of this newsletter and my Telegram group:

AI16Z up 1262%, FARTCOIN up 157%, WMM up 136%, PEPE up 80%,

AIOZ up 62%, GIZMO up 57%, BRETT up 56%, PUPS up 41%

Hello Friend!

It’s been an absolutely wild week, and if you are sidelined, you might have missed one of the biggest $BTC moves of the year. Election night kicked things off with $BTC barely below $70K, but in a matter of 8 days, it had smashed through to a new ATH of $93K. The bull run we’ve all been waiting for has finally arrived.

Get ready because this is just the beginning.

Help me improve this newsletter :

️ On today's Episode:

📈 Market Update – How $BTC set the tone, why altcoins are catching up, and what the memecoin mania signals.

💻 Project Updates – NEAR’s AI breakthrough, Tether’s RWA play, and Coinbase’s Index50.

🐂 Alpha on My Portfolio Positions, DEAI and a Mantle DeFi farm

💎 The Premium Section with even more Alpha and all Portfolio, Airdrop & Farming Updates

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global #crypto market cap today is $3.21T, a -0.29% change in the last 24h and a +11.07% increase in the last 7 days. Total trading volume in the last 24h is at $193.0B. #BTC dominance is at 56.30% and #ETH - 11.70%.

🚀 $BTC Rides the Election Wave

Election night was not only about politics but about the future of Crypto and about Bitcoin proving its status as a leading macro asset. As Trump’s odds increased on Polymarket, so did $BTC, mirroring the sentiment shift. In the next days two monster green daily candles and several smaller ones brought us to topping out (for now) at $93K.

This feels eerily quite to December 2020, when Bitcoin was just starting its euphoric bull phase. ETF inflows since Trump’s win have been $4.7 billion while $641 million were sold off the last two trading days.

📊 Bitcoin Dominance: The Pre-Madness Phase

Bitcoin dominance ($BTC.D) has been a critical metric in mapping the market's current cycle. Since 2023 dominance rose toward 56–58%, and spiked to 60%+.

A significant reversal will signal an altseason. As $BTC crossed $80K and retail interest explodes (e.g., Coinbase app downloads are ranking high in app stores), Bitcoin dominance stays near bi-weekly resistance at 62–63%. This zone could mark the turning point. Once rejected, dominance is expected to decline, which will finally start the long-awaited altseason.

Strategy:

As soon as we see a reversal, I plan to deploy most of the 10% of my remaining stablecoins into promising altcoins and especially memes. I am showing my top picks in the alpha section of this newsletter.

My exit strategy involves a complete shift out of the market when dominance hits ~43% by the cycle’s peak.

Credits: Analysis by ZeroIkaa

Altcoins: The Waiting Game

$ETH briefly shined, with ETHBTC moving from 0.035 to 0.041 as optimism around the “ETH 3.0” narrative peaked. But let’s be honest, Justin Drake’s Devcon speech deflated hopes quite fast. A 2029 roadmap for meaningful upgrades doesn’t exactly scream bullish. That said, $ETH ETF inflows are finally starting to show some life, so don’t count it out just yet.

The surprise altcoin winners post-election? Retail loves dinosaur coins:

$XRP pumped +90%, fueled by hopes of SEC respite under a Trump-led administration.

$ADA doubled, with rumors of Charles Hoskinson advising Trump acting as rocket fuel.

$HBAR, $LTC, and $CRO all saw big moves, with retail volume driving the action.

And then there’s $DOGE—the ultimate meme king. The Trump-Musk announcement of the Department of Government Efficiency (D.O.G.E.) sent the oldschool dog coin almost to the moon, hitting $0.42 before cooling off. Consolidation here looks healthy, and I fully expect $DOGE to remain a top meme pick for months as the D.O.G.E. narrative builds.

Memecoins: Retail’s Playground

Memecoins have officially entered the mainstream stage. Robinhood and Coinbase listings for $PEPE and $WIF showed that exchanges are leaning into retail’s love for low-float, high-FDV tokens. Binance research even called memecoins a reflection of modern finance’s intersection with culture. If you’re still fading memecoins, it’s time to rethink—they’re here to stay and THE outperformes of this cycle.

Some highlights:

On-chain $D.O.G.E. pumped from a $10M market cap post-election to $300M, peaking at $500M (it’s also available on Solana and Moonshot).

$BONK, listed on Coinbase, is up +80% in a week, riding the dog-coin coattails.

$PEPE looks like its got more in it, given its stronger volumes compared to $WIF.

→ Memecoins are the perfect narrative trade for retail—easy to grasp, and they move fast. While fundamentals are non-existent, the opportunity is real.

2. Project Updates

What dApp and project updates you need to know in the fast-paced world of crypto

You can find the links attached to the images

✈️ NEAR Protocol’s Cross-Chain AI Assistant

NEAR Protocol is integrating AI into Web3. Unveiled at the Redacted Conference in Bangkok, the NEAR.AI Assistant is an interesting cross-chain AI agent.

Here’s what it can do:

Current Capabilities: The AI Assistant already helps launching memecoins and enables seamless web purchases using fiat.

Upcoming Features: NEAR.AI will soon handle Web2 integrations like booking flights and ordering takeout—bridging decentralized and traditional systems.

Near Intents: A cutting-edge feature enabling cross-chain transactions and asset swaps across blockchains like Bitcoin, Ethereum, and Arbitrum.

Open Source Potential: Developers can expand its functionality, making NEAR.AI a versatile tool for use cases in DeFi, e-commerce, and beyond.

The NEAR ecosystem continues to evolve, and this Assistant positions the protocol as a leader in practical AI and cross-chain applications.

🏦 Tether’s Hadron Platform

Tether enters the real-world asset (RWA) tokenization game with Hadron:

Tokenization Simplified: Hadron supports the creation and management of tokenized assets, including stocks, bonds, and commodities.

Compliance First: Features like KYC, AML, and regulatory tools bridge the gap between on-chain solutions and centralized exchanges.

Multi-Blockchain Support: The platform integrates with Bitcoin Layer 2 solutions like Liquid and smart-contract-enabled blockchains.

Phased Rollout: Starting with fiat-pegged stablecoins and commodity-backed tokens, Hadron aims to expand into complex, basket-collateralized products.

With the RWA narrative gaining traction, Hadron could cement its place as a cornerstone for tokenized finance.

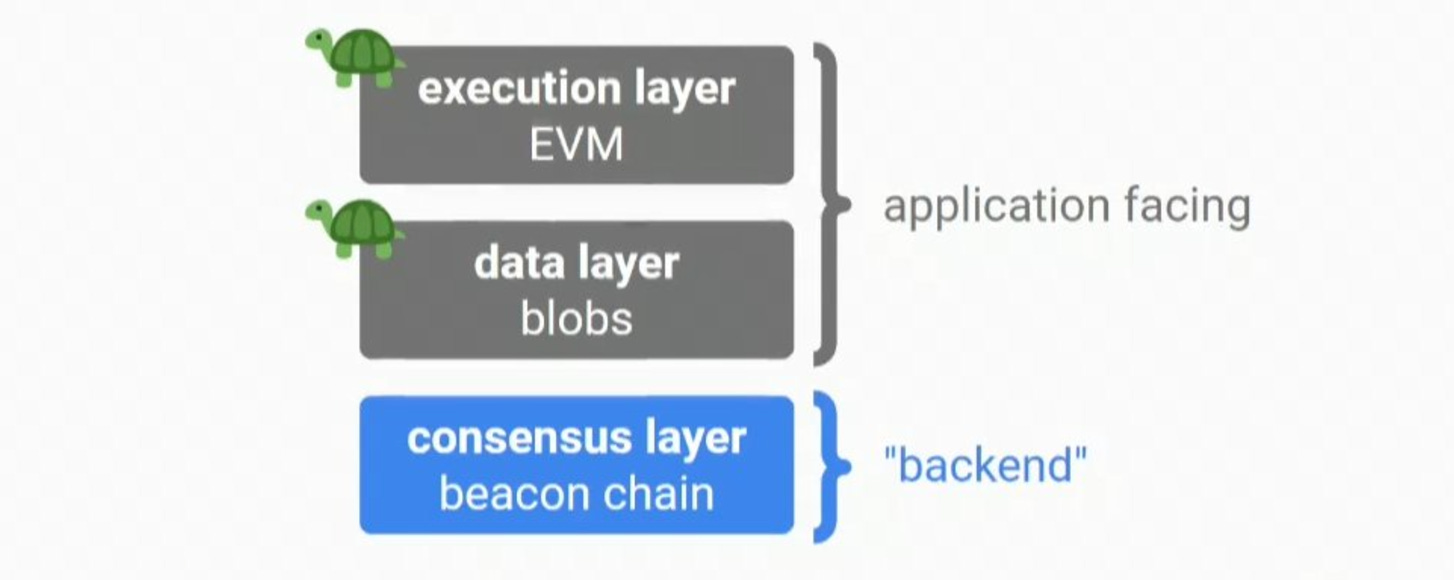

⚡ Ethereum Beam Chain

Ethereum Beam Chain is making waves with its focus on streamlining Layer 2 and sidechain compatibility. It promises improved scalability and interoperability without compromising Ethereum’s security and decentralization.

Key Advancements:

Faster Block Production: Optimized processes for higher transaction throughput and reduced latency.

Enhanced Staking: More efficient and inclusive mechanisms for securing the network.

Quantum-Resistant Cryptography: Future-proofing Ethereum against emerging computational threats.

🌍 Parallel: Lower Sell Pressure on PRIME

The founders of @parallel have taken a significant step to ensure long-term alignment with the success of the PRIME ecosystem. Since June 10, 2024, all $PRIME founder tokens have been fully locked. Here’s the latest update:

3-Year Cache Extension: To address concerns about a one-year unlock, all cached tokens in @AIWayfinder have been extended to the maximum cache period of three years.

10-Year Unlock Structure: As announced by the foundation, all cached, liquid, and unvested founder tokens will now unlock over a 10-year contract, releasing 10% annually. This restructuring is being implemented with guidance from @EchelonFND.

This decision solidifies founder commitment to the long-term success of the studio, economy, and community.

→ Bullish if you got a bag like me.

🛠️ Zerion: Gasless

Zerion announces gasless L2.

🧪 Babylon’s Phase-2 Testnet and Cap-3 Launch

Babylon is ramping up for its Cap-3 launch and Phase-2 Testnet this December.

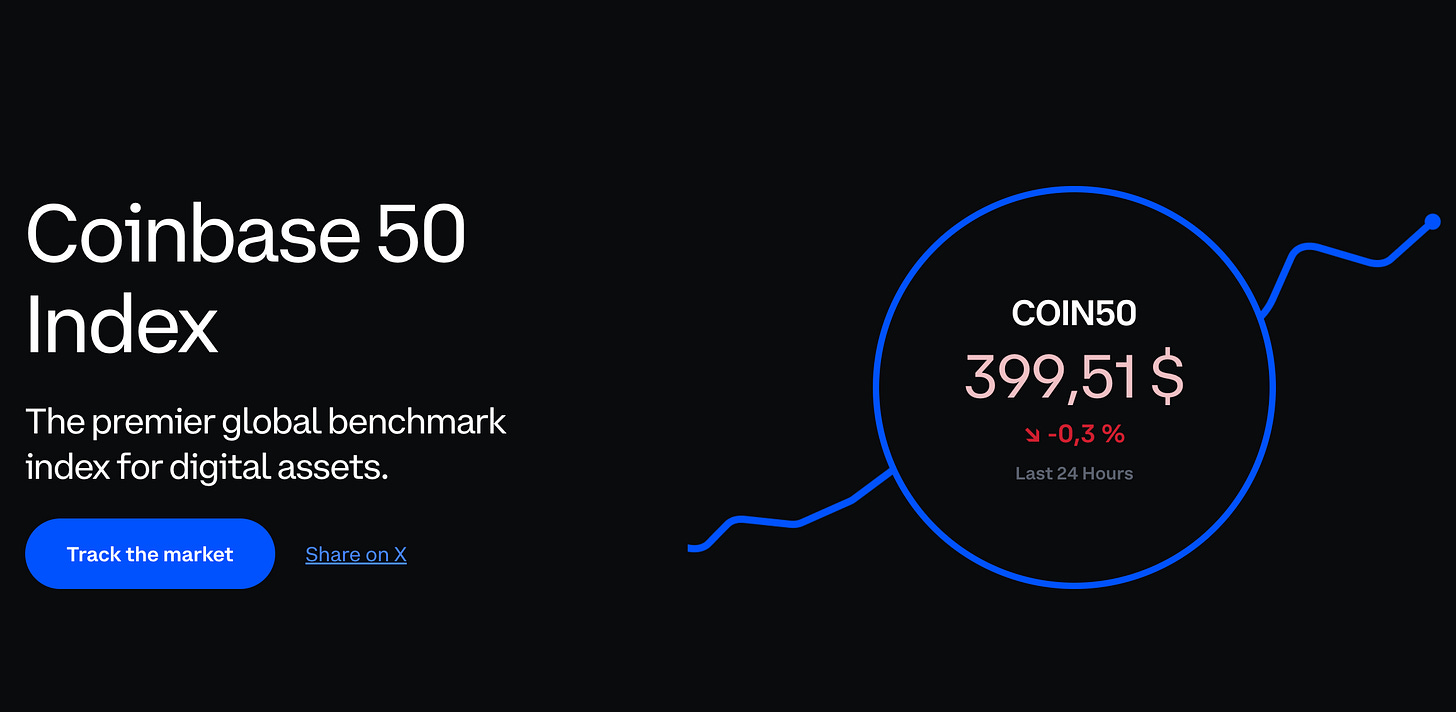

📈 Coinbase 50 Index (COIN50)

Coinbase launched the COIN50 index, tracking the top 50 largest and most liquid digital assets.

This index excludes pegged and exchange tokens, focusing instead on assets with strong fundamentals and market transparency.

These are the top components:

🌀 Lens Protocol V3

Lens Protocol unveiled its Developer Preview of V3, a modular, scalable infrastructure for decentralized social applications. Key features include:

Customizable Accounts

Transferable Usernames

Membership-Based Groups

Curated Feeds

Built on zkSync and AvailProject, Lens V3 is an interesting candidate to become king of decentralized social media.

🎨 ICYMI: OpenSea V2 Redesign

OpenSea teased a major V2 redesign with a points system and potential retroactive rewards. Speculation around an OpenSea token has fueled excitement within the NFT community.

🌌 ZKsync Ignite Program

ZKsync governance has approved the Ignite Program, allocating 325M $ZK tokens to incentivize protocols in its ecosystem.

→ This will give us new DeFi farming opportunities, I’ll keep you up to date.

🪂 Linea Airdrop in Q1 2025

3. Alpha Section

Good projects and opportunities I discovered

Portfolio Alpha

I typically share these only in the premium section and on telegram but thought what the heck. These are ideas what a crypto portfolio could look like. Keep it simple, don’t collect altcoins like Pokemon that you can’t follow up with.

Click on the images to get more info on Coingecko

AI Memecoin Portfolio

→ I have the highest conviction in: Goat and Fartcoin.

→ FARTCOIN and AI16Z are my biggest positions due to the extreme pump in the last days.

Memecoin Portfolio

→ PUPS, RETARDIO, KEKEC and MOG are my biggest positions.

AI Portfolio

→ TAO, PEPECOIN, DEAI, PRIME are my biggest positions.

You will get daily updates on my portfolio positions on Telegram

Alpha 1: 💡 $DEAI – AI Gem with Explosive Potential

In crypto, timing is everything, and the meta is crystal clear: Memes and AI. While memecoins like $PEPE, $BONK, and $WIF have collectively added $20–30B in value, AI coins have yet to follow. A massive rally in AI-focused tokens should be coming soon with the broader altcoin season and the release of GPT-5 by OpenAI.

Here’s why $DEAI could go 5–10x, summarized into 3 sections:

⚙️ The Tech

$DEAI, powered by Zero1 Labs, is a low-cap gem with excellent tech.

Infrastructure: Zero1 Labs uses an Orbital PoS (Proof of Stake) chain called ‘Cypher’ and a new encryption standard that drastically reduces costs for developers.

Cost Comparison: Building on $TAO Subnets costs ~$2M, while Zero1’s Cypher tech delivers the same performance for just $50–100.

Efficiency: Think of this as the Ethereum PoS vs. Bitcoin PoW moment in AI chains—speed, cost-efficiency, and scalability make Cypher a no-brainer for builders.

Zero1 Labs is positioning as the go-to platform for AI apps, offering developers an unparalleled mix of affordability and cutting-edge security.

🚀 Traction & Partnerships

The traction behind $DEAI is second to none, driven by relentless business development efforts and strategic partnerships:

Industry Partnerships: $DEAI is backed by collaborations with top-tier protocols:

$NEAR (NEAR Protocol)

$OCEAN (Ocean Protocol)

$APT (Aptos)

$ATH (Aethir Cloud)

Busy Team: The team has hosted joint events, hackathons, and workshops at major conferences this year. ^1

👥 The Community

We see that memecoins thrive on cult-like followings, AI Crypto projects like $TAO 0.00%↑and $DEAI profit massively from such a following:

18k token holders

Discord Community: One of the most active Discords in the AI space, with interesting events.

No VC Influence: $DEAI is entirely community-funded, with more token holders than many of the biggest memecoins.

🎯 Why I’m Bullish

Locked Tokens: With all future tokens locked for another 10 months, the fully diluted valuation (FDV) is no problem for this bull market.

Perfect Narrative Fit: AI and community are colliding, and $DEAI sits at the center of this lucrative Venn diagram.

Potential Nvidia Partnership: While unconfirmed, the possibility of Zero1 Labs joining Nvidia’s startup program is a game-changer. No other low-cap project can compete with this level of potential institutional affiliation.

Low Market Cap at 75m and bullish chart:

Alpha 2: Super Strategy for Earning High Yields with Infinit Labs, Mantle, and Ethena Labs

Here’s a robust farming strategy to maximize yields with a mix of stable and volatile assets, using Infinit Labs, Mantle, and Ethena Labs. This method uses multiple layers of rewards, including liquidity mining, staking yields, and airdrops.

TL;DR

Mixed Yield Option: USDT + USDe + mETH + cmETH → 60% – 108% APR

Stable Yield Option: USDT + USDe → 49%-97% APR

This strategy is ideal for users looking to earn high returns with a mix of stable yields and exposure to Ethereum price action, plus potential airdrops from several DeFi protocols.

Step 1: Deposit USDe on Init Capital

To begin, bridge some ETH to Mantle blockchain via jumper.exchange or any other bridge and convert your capital to USDe and deposit it on Init Capital to borrow USDT. With a collateralization ratio of 2:1, you can use USDe to borrow half that amount in USDT, unlocking liquidity for the next steps.

Rewards:

Sats from Ethena Labs: For every USDe deposited, you earn 20x Sats, incentivizing your holding.

Stones from Infinit Labs: USDe deposits earn 1x Stones while the borrowed USDT earns 2x Stones.

Stones from Infinit Labs can vary in value, ranging from $0.00066 to $0.00133 based on the FDV (from $250M to $500M). With the Token Generation Event (TGE) anticipated within the next 90 days, there’s potential for future appreciation.

What is Infinit Labs?

Infinit Labs is building a DeFi abstraction layer that enables DeFi protocols to launch and scale effortlessly across multiple Layer 1, Layer 2, and modular blockchains. By holding Stones, you’re gaining early exposure to a foundational project in the DeFi ecosystem.

Step 2: Deploy Borrowed USDT

Option 1: Yield-Generating Liquidity with mETH and cmETH

Swap 50% of your borrowed USDT for mETH and 50% for cmETH.

Provide Liquidity on MerchantMoe with the mETH and cmETH pair.

Yield Breakdown:

mETH Staking APY: 3.4%

cmETH APY: 3.4%, with additional rewards from Eigenlayer, Karak Network, SymbioticFi, and Veda Labs.

LP on MerchantMoe: 20x COOK Powder per day per ETH, plus transaction fees from liquidity provision.

Each COOK Powder unit translates to 0.68 COOK, with the COOK token currently priced at $0.025. This results in an approximate 8% additional APR from Powder rewards alone, making this position yield significantly higher.

Note: This position exposes you to ETH price volatility, but rewards from Eigenlayer and other networks provide additional potential for yield.

Option 2: Stable Pair Liquidity with USDT and USDe

For a lower-risk approach, consider providing USDT/USDe liquidity on MerchantMoe to earn 1% APR. This option provides stable yields with no exposure to ETH price risk, which may suit conservative yield farmers better.

Total Yields and Returns

Assuming a $10,000 allocation, here’s what you’d earn with each option:

Option 1: Yield from Mixed ETH Exposure (mETH + cmETH)

Rewards Summary:

Infinit Labs:

Stones: 10,000 per day for USDe and 10,000 per day for USDT, totaling 20,000 Stones daily.

APR from Stones: ~$13.2 to $26.4 per day, translating to an APR of 48%-96% on your USDT and USDe holdings.

Mantle & mETH Protocol:

ETH Staking Yield: 3.4% base APR.

COOK Airdrop: 8% APR from COOK Powder rewards, with potential for price appreciation.

Trading Fees on MerchantMoe: Approximately 1%.

Total APY (Option 1): 60% – 108%, plus additional rewards and airdrops from Eigenlayer, Karak Network, SymbioticFi, and Veda Labs.

Option 2: Stable USDT/USDe Pair Liquidity

If opting out of ETH exposure, provide liquidity in USDT/USDe.

Infinit Labs Stones: 10,000 daily Stones for both USDe and USDT deposits, maintaining 48%-96% APR.

USDT/USDe LP on MerchantMoe: 1% APR.

Total APR (Option 2): 49%-97% APR.

Summary & Key Takeaways

This multi-layered DeFi strategy leverages stable yields, ETH price exposure, and a range of airdrop rewards for maximum returns. Depending on your risk tolerance, you can choose between:

Option 1: Higher yields with mETH/cmETH and exposure to ETH price movement.

Option 2: A stable USDT/USDe strategy for lower, more predictable returns.

By looping this strategy, you can amplify your yields while accumulating Stones and Powder rewards, positioning yourself for a potential TGE boost and ongoing DeFi rewards.

Airdrop Alpha of the Week

Airdrop Farming Priority:

Currently not farming a lot of airdrops. Doing the occasional Hyperlane, Wormhole, Jumper and Bungee bridging activities and some Berachain activities.

Hyperlane → New route in the airdrop guide on Notion

Wormhole

Bungee

Berachain → Check my guide

SUI Eco (Bucket, Aftermath, Haedal)

Corn

SolvBTC

Babylon

Lombard

CoreDAO

Pell

Tool of the Week

BullX is a powerful trading terminal for memecoin traders, offering advanced tools to simplify trading across multiple blockchains like Solana, Ethereum, and Binance Smart Chain—all from one platform.

With features like quick buys, limit orders, and automated trading, BullX makes it simple to execute trades efficiently. The clean, intuitive interface allows users to filter by platform, blockchain, or token type, and real-time market data—including "New Pairs" and "Pump Vision"—helps you spot trends early.

→ I am using BullX for all my risky memecoin trades recently and like it a lot.

→ You can use my link to start.

Watchlist for the Week

Thanks for reading, friend! Stay safe!

Adrian

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

We are buying more memes with huge potential.

Of course I’ll show as always what coins I bought and sold this week and keep you up to date with our portfolios.

Keep reading with a 7-day free trial

Subscribe to Adrian DeFi to keep reading this post and get 7 days of free access to the full post archives.