Adrian's DeFi Alpha #37: Virtuals Reset & Where AI Capital Is Flowing Next

Definitely no financial advice, just insights based on my own journey in DeFi.

The altcoin market saw a dip and there are huge opportunities to buy some gems this week. With the knowledge of this newsletter and my Telegram group we are outperforming in this bull market:

Hello Friend!

Less than a year ago, market sentiment was at "extreme greed" when Bitcoin was at $70K. Fast forward to today: Bitcoin is trading at $98K, yet sentiment has flipped into "fear." The last time the market felt this cautious was in early October of last year when BTC was at just $62K.

So, what happened?

A combination of events over the past few months has drained liquidity, increased uncertainty, and exposed the emotional nature of the retail-driven crypto market:

Trump’s Memecoin – Post-election, crypto natives were hyped, expecting a pro-crypto administration. But Trump’s memecoin launch sucked liquidity out of the broader market, leaving many altcoins struggling.

Lackluster Strategic Bitcoin Reserve Announcements – Hopes for a U.S. Bitcoin reserve have been met with slow action and underwhelming details, leading to disappointment.

AI & Tariff Scares – The "Monday Deepseek AI scare" and the early February “Tariff Scare” led to the largest liquidation event in history— at least $2.2B wiped out in a single weekend.

Altcoin Carnage – BTC dominance has climbed back above 60%, leaving most of the market—especially altcoins and memecoins—down 50-75% from their highs. Investors who were overweight altcoins are now questioning whether "altseason" will ever return.

️ On today's Episode:

📉 Market Update – Bitcoin's trading in a tight range ($90K–$108K) amid rock-bottom altcoin sentiment signals a contrarian buying opportunity via slow DCA; meanwhile, gold nears $3K/oz as safe-haven demand surges, and Bitcoin, decoupling from altcoins, is rising like digital gold, spurring institutional interest; all while altcoin inflation (notably on Solana) dilutes value, pushing capital toward BNB, with Sonic and Berachain emerging as key liquidity hotspots.

💻 Project Updates – VaderAI’s new EAO is shaking up AI fundraising on DeFi, with fresh plays like @AskBillyBets. Cookie DeFAI Hackathon shows us the next innovations.

🐂 Alpha Opportunities – Coinbase: The elite, diversified play—benefits every blockchain winner. Their numbers? Insane EPS, revenue, and growth metrics that outpaced analyst expectations by miles. Virtuals: Riding the AI agent boom with 231x gains in 2024, despite the market reset. Real utility will be the key to their next phase.

💎 The Premium Section with even more Alpha and all Portfolio, Airdrop & Farming Updates

1. Market Update

Highlighting the key developments in Crypto and their implications.

Weekly Crypto Bubbles

The global #crypto market cap today is $3.35T, a -0.74% change in the last 24h.

Bitcoin’s Resilience vs. Altcoin Pain

Despite all the fear, Bitcoin has held strong, trading in a defined channel between $90K and $108K for the past three months. But this period of consolidation hasn’t translated into a positive sentiment shift—most of the market remains in drawdown.

Looking at data across the top 200 assets by market cap, very few have outperformed BTC in the last 90 days. Altcoin sentiment is at rock-bottom precisely as they trade at range lows—historically a contrarian buy signal.

The takeaway?

👉 When there is blood on the streets, it’s time to buy. A slow DCA strategy could work best.

Is Bitcoin Decoupling from the Crypto Market?

Gold Rush to Safety

Before diving deeper into Bitcoin’s divergence from altcoins, let’s talk about gold.

Gold (XAU) recently hit an all-time high, approaching $3,000 per ounce—nearly doubling in price over the past two years (ok ok it’s just 78% but nearly doubling sounds better :).

The reason?

Geopolitical tensions and trade war risks are driving nation-states and large investors to accumulate gold as a hedge.

BRICS+ countries are slowly shifting away from the U.S. dollar, opting to back their own currencies with gold.

Why does this matter for crypto?

Bitcoin is digital gold. If gold keeps climbing, BTC is likely to follow.

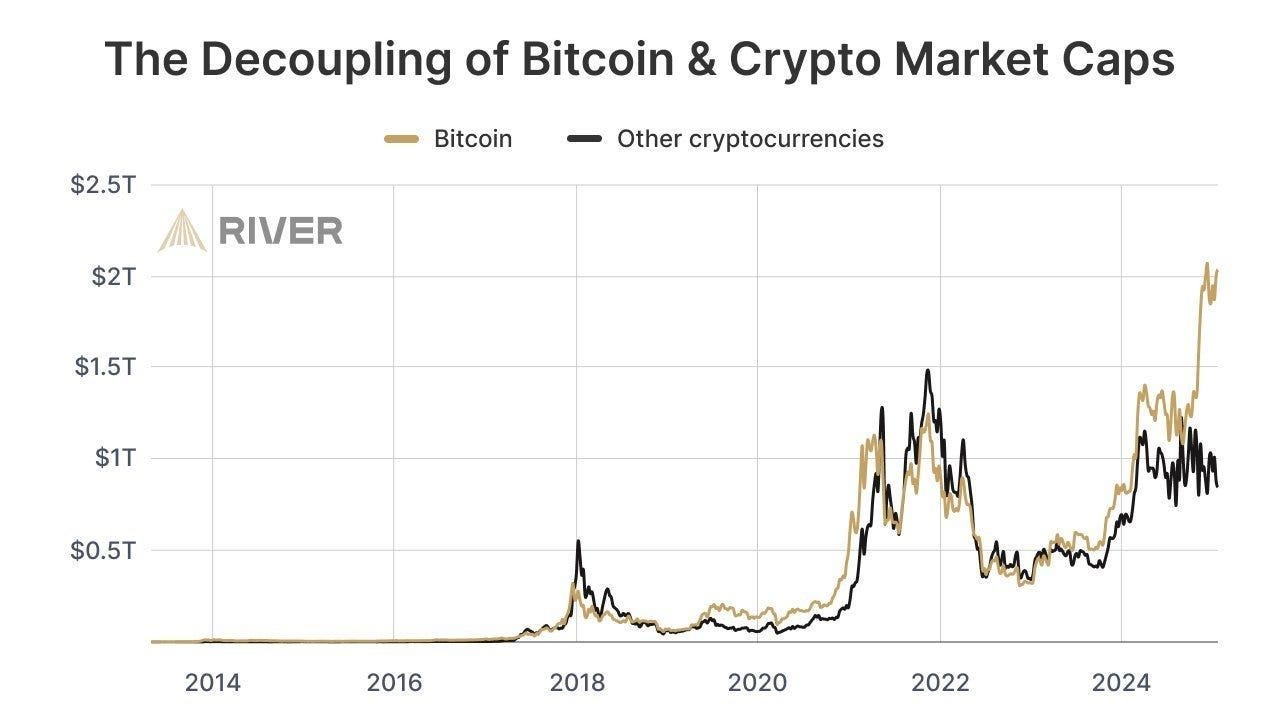

Bitcoin’s Historic Divergence from Altcoins

For the first time since its inception in 2009, Bitcoin has completely decoupled from the broader crypto market.

BTC continues to make higher highs while altcoins trend lower.

This signals that BTC is evolving into a standalone asset class, similar to gold.

This divergence became most apparent after the approval of spot Bitcoin ETFs earlier this year. Institutional adoption has driven BTC to behave more like a macro asset—whereas altcoins remain speculative, liquidity-sensitive plays.

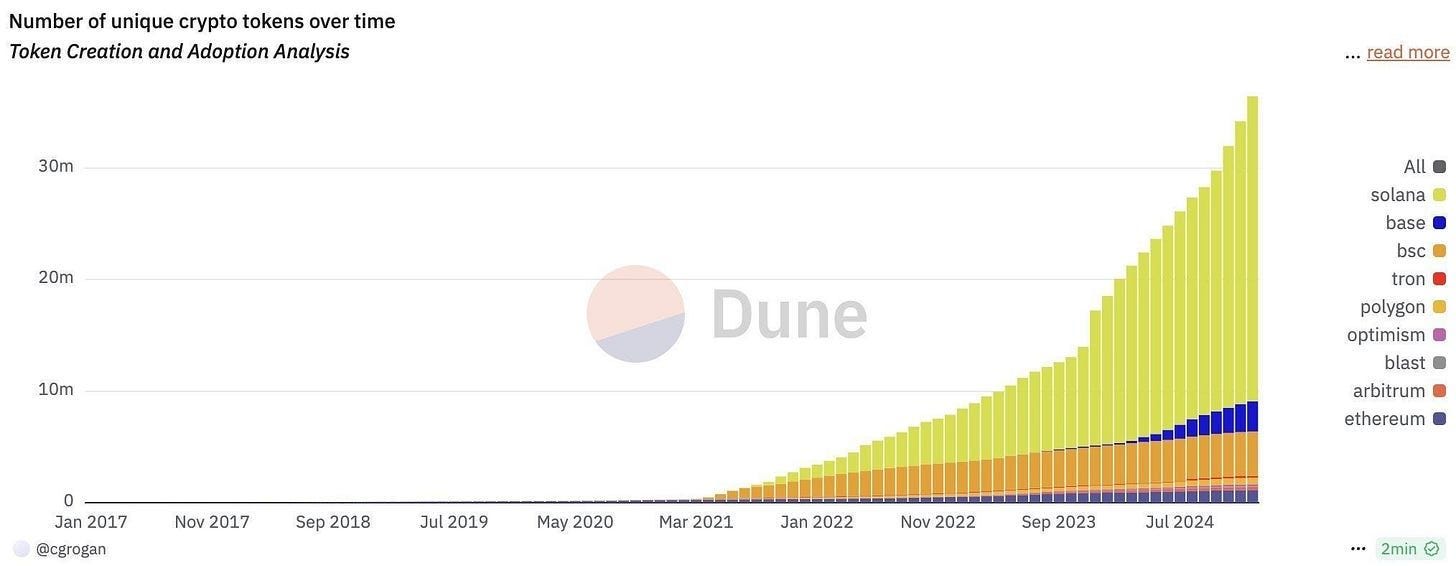

Altcoin Inflation & Dilution

Part of the reason altcoins are underperforming? There are simply too many of them.

The Solana ecosystem alone is minting millions of new tokens per month, while overall liquidity in crypto remains flat.

This creates an environment where money is being spread thinner, making it harder for altcoins to sustain gains.

💡 The reality: You can’t print value into existence. Solana has captured a lot of market share, but at the expense of other alts. Without an influx of new liquidity, most altcoins will continue to suffer.

🌊 Where’s the Money Flowing?

The clear trend right now? Capital is leaving Solana as extraction and scam events continue, with BNB emerging as the biggest beneficiary.

Solana has been the epicenter of memecoin mania, but with so much dilution and rapid insider dumps, liquidity is rotating out.

BNB Chain is seeing inflows, likely due to its retail-friendly ecosystem and lower transaction costs.

Meanwhile, Sonic’s and Berachain TVL is quietly exploding.

Sonic (ex Fantom) is in a local bull market, with TVL skyrocketing compared to last week due to the airdrop campaign.

Berachain is getting more traction after the initial selloff. Check my full guide on it for farming opportunities:

→ These could be two microtrends worth watching—especially if the broader market remains choppy.

2. Project Updates

What dApp and project updates you need to know in the fast-paced world of crypto

You can find the links attached to the images

VaderAI’s EAO: AI Fundraising Goes DeFi

VaderAI just dropped Early Agent Offering (EAO), a pre-sale platform on Virtuals to help AI devs raise cash and build communities.

First launch: @AskBillyBets, an AI sports betting agent on Bittensor’s Subnet 41 (raised 210K VIRTUAL at a $2M valuation).

💡 VaderAI stays one of the most active investment DAOs, one to watch.

Cookie DeFAI Hackathon: No Tokens, No Problem

The Cookie DeFAI Hackathon just shook things up—no token-based projects allowed, forcing real AI-driven DeFi innovation.

AI finance is leveling up: Projects used @cookiedotfun’s DataSwarm API for real-time trading + security.

💡 DeFAI is heating up. This is one of the most exciting AI use cases in crypto to me.

3. Alpha Section

Good projects and opportunities I discovered

Alpha 1: Coinbase

Coinbase is one of the most elite and diversified play in the game. It’s like the golden child that benefits no matter which blockchain wins: Ethereum, Solana, Bitcoin—you name it. Their strength lies in controlling the entire user experience from fiat to on-chain. Think of it as Big Tech meets Big Bank, similar to how Microsoft capitalized on the internet.

Digging into the numbers, Coinbase recently smashed analyst expectations:

EPS: $4.68 vs. $2.11 expected (EPS stands for "earnings per share," which tells you how much profit a company makes for each share)

Revenue: $2.27B vs. $1.84B expected

Their Year-over-Year Growth is wild:

Revenue: Up 138%

Net Income: Up 300%

Transaction Revenue: Up 194%

Subscription Services: Up 71%

Trading Volume: Up 185%

Monthly Transacting Users: Up 24%

These numbers aren’t just good—they’re insane. Coinbase’s diversified products and massive user base make it a play on the entire crypto ecosystem. If you’re betting on crypto’s future, you’re essentially betting on Coinbase.

Alpha 2: Virtuals Changed the Game

Virtuals kicked off the AI Agent boom at the end of 2024, introducing agent tokenization—a new paradigm for community growth, marketing, and user acquisition.

VIRTUAL token actually was the top crypto gainer of the year 2024.

Virtuals made 231x in 2024 which is pretty wild.

Contributing factors were:

24/7 Engagement: AI agents now bootstrap mindshare on CT, replacing human shills.

Fair Launch GTM: Instead of points campaigns, teams now launch agent tokens that double as utility + memes.

No More KOL Marketing: AI agents bring users to your product organically, accelerating adoption.

🚀 The result? Agent token launches went from zero to industry standard in months.

From Boom to Bust: The AI Agent Reset

Early Virtuals agents printed money during the PvE season. But that’s over.

Virtuals market cap peaked at $7.5B–$8B—now? Just $1.7B.

Overcrowding killed momentum: Thousands of agents launched on, making it harder to stand out.

Prices are declining—the market is demanding real utility.

Next Phase: Specialized AI Agents

Virtuals still leads in high-utility agents. The game is shifting from personality-driven agents like Luna & aixbt to task-specific AI.

📌 Virtuals Solana:

@HeyTracyAI – Sports market AI.

@AskBillyBets – Prediction market AI.

@Roboagent69 – AI co-pilot for computer automation.

Virtuals vs. Peers: The Battle for Dominance

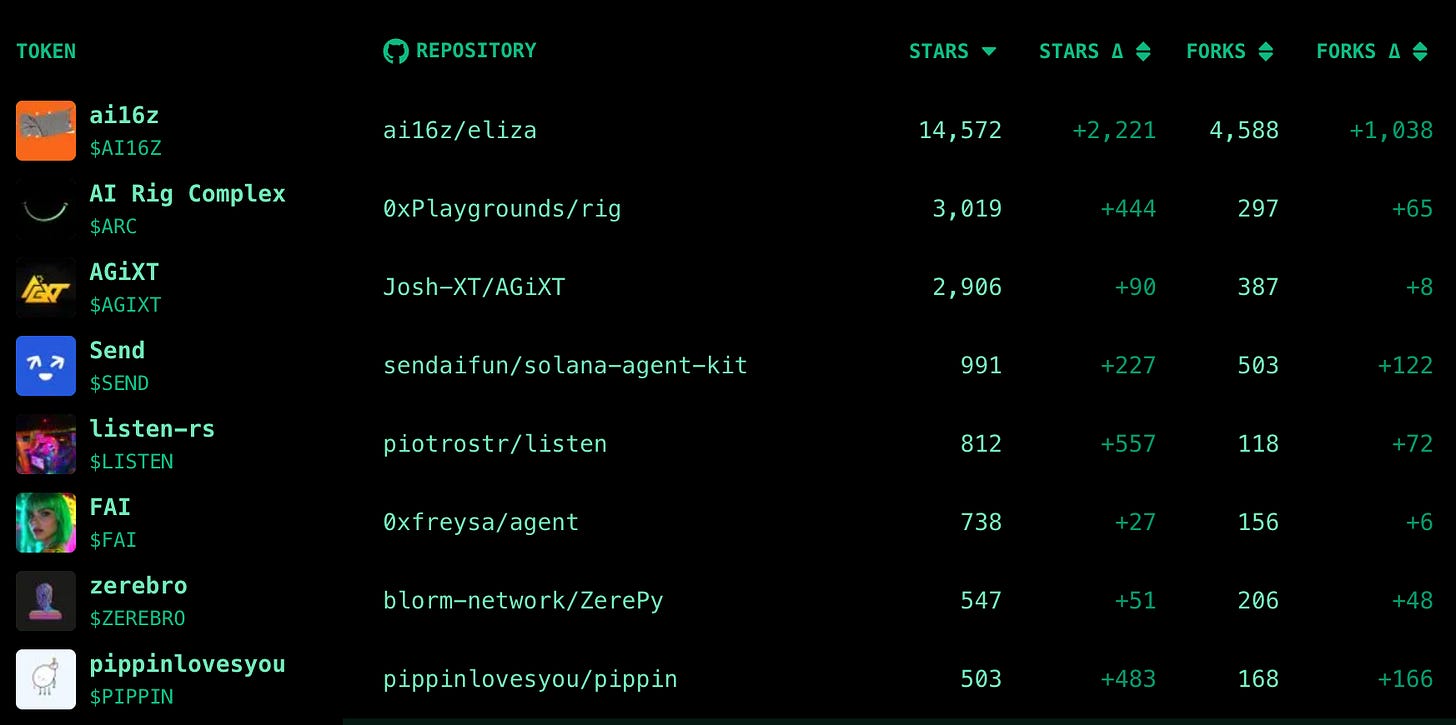

👀 Open Source Competitors are catching up:

@ai16zdao – Open-source first, ElizaOS 14.5K GitHub stars.

@arcdotfun – 3K GitHub stars launched Arc Forge launchpad, but faced sniper issues.

During the last 30 days ARC, LISTEN and PIPPIN saw a good amount of stars and forks (copies) increase (delta shown above).

🔑 Why Virtuals Could Still Win:

Highest number of quality teams.

Built-in launchpad + ecosystem dominance.

Leading AI agent distribution channel.

👉 Competitors must show real revenue to overtake Virtuals. That’s a tough ask.

What’s Next? Follow the Liquidity

💸 The recent $LIBRA pump-and-dump drained $100M+ from the market.

Capital is fleeing. No one wants risk right now.

Weak teams are getting wiped out.

🚀 What survives?

Agents with real utility.

Teams using AI agents to enhance their actual product.

Ecosystems with the most quality AI agents.

💡 When fundamentals come back into focus, so will Virtuals.

I’m still bullish and will keep buying the dip on AI agents with real catalysts.

📚 Good Reads

Hyperevm Guide – A deep dive into Hyperliquid’s HyperEVM.

🔗 Read hereBerachain Strategy Guide – How to position yourself in the Berachain ecosystem.

🔗 Read hereThe Psychology of a Bagholder – Why people refuse to sell, even when they should.

🔗 Read here

You will get daily updates on the market and my portfolio positions on Telegram.

Adrian's Premium Alpha:

Everything Adrian can’t share in the Public Newsletter: Portfolio Updates, Early Projects/Small Caps, Investment Theory

GM GM readers of Adrian’s Premium Alpha,

Some agents start to come back and we are seeing a slight recovery in the market.

Let’s find out which Agentic Investment DAOs have potential in this weeks premium.

And as always, I’ll keep you updated on our portfolios.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.