PREMIUM: Are We Repeating Late 2021 And Who Wins This Cycle?

A Fragile Market Searching for Its Next Catalyst.

Maple Finance’s SYRUP is one of the most comfy spot longs this cycle and we just bought more! Since the call we are up 11% and this won’t be the end of this story!

Using the calls from this newsletter and the Telegram group, we’re going to win this cycle.

Hey Friend!

Last day of October. Thank God. Usually this month’s crypto’s lucky charm, but this year it’s been a slow-motion rug or maybe even worse, a sideways grind that drained everyone’s patience.

Markets freaked after Trump’s 100% China tariff tweet on the 10th. One headline, a trillion gone. Since then it’s been mostly good news — Xi talks, a U.S. visit confirmed, even a rate cut — yet nobody wants to touch crypto risk assets.

The market still looks stunned.

Anyway, October’s done. We survived, hopefully, the worst month of the year. Manifesting a calmer, greener November ahead.

Let’s zoom out and look at the broader picture and how to set up for the week ahead.

️ ⚡ On today's Episode:

📈 Market Update – The Fed cut 0.25% and ended QT, but Powell’s tone flipped sentiment fast. No promise of another cut in December — risk assets sold off as 2021 déjà vu hits. BTC long-term holders now net sellers (–104K BTC/month), biggest wave since July. ETF flows flat, market indecisive, but exchange inflows calming = short-term relief for alts.

🔊 Project Updates – Polymarket: Officially confirming a $POLY token + airdrop, following ICE’s $2B investment — prediction markets are going mainstream. 21Shares: Filed for a Hyperliquid ETF, naming Coinbase and BitGo as custodians — a major institutional step for onchain liquidity.

🐂 Alpha Insights – Still long $HYPE: $1B+ annual revenue, 97% payout, and real onchain cash flow make it trade like a high-yield exchange stock — not a DeFi token. Top buyback leaders for 2025: HYPE, LayerZero, PumpFun, Raydium, and Sky — all proving real product-market fit through revenue-funded buybacks and burns.

💎 Portfolio Section – Fresh new buys after stellar earnings across core positions — full breakdown and allocations dropping in the Premium section.

The current state of the market.

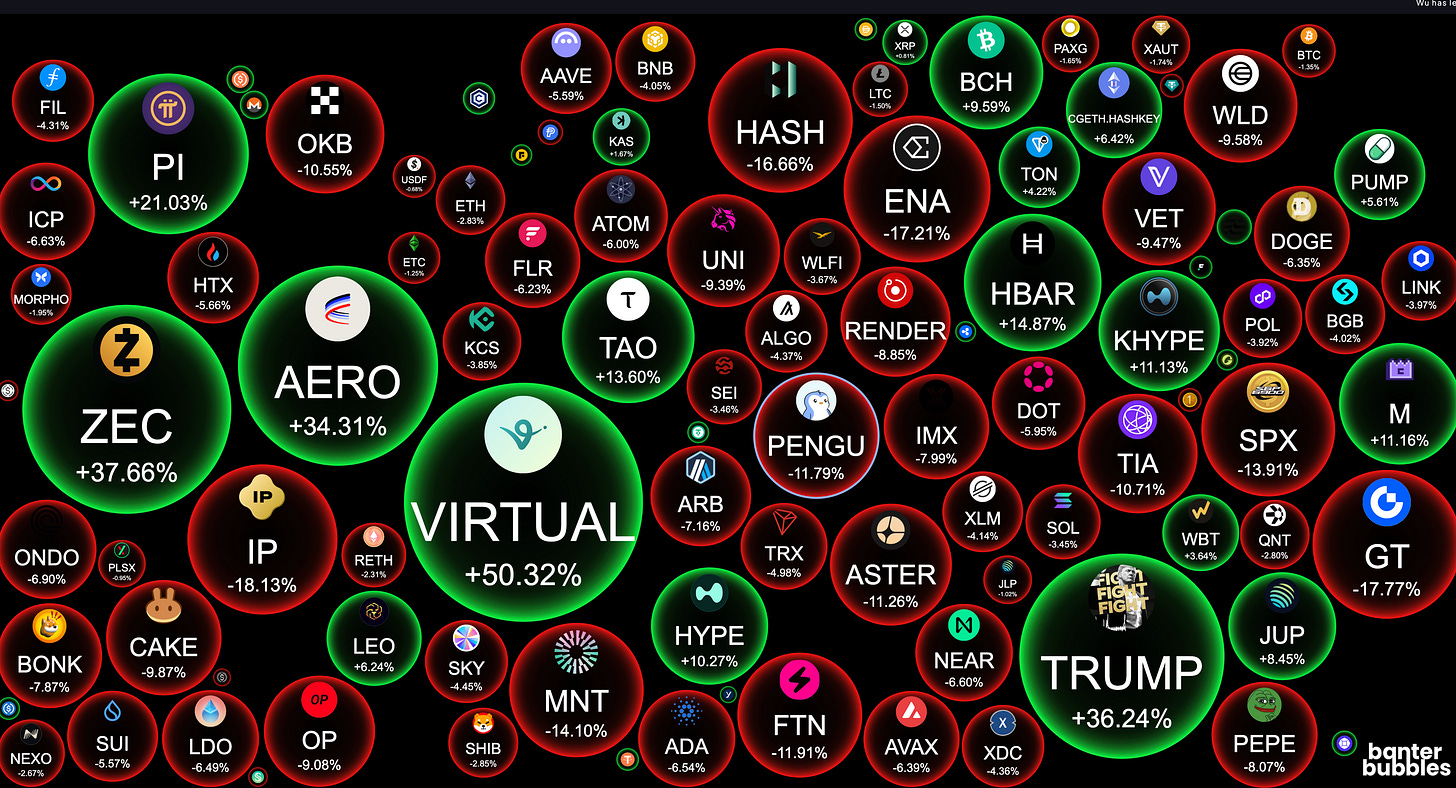

Weekly Crypto Bubbles

→ ZEC, AERO, VIRTUAL and TRUMP outperforming this week.

Market Overview

The week’s big event — the all-important FOMC meeting — started off looking surprisingly friendly. The Fed delivered what everyone expected: a 0.25% rate cut and the official end of quantitative tightening on December 1. On paper, that’s a green light for risk assets.

But then came the fine print — and the mood flipped. Powell made it clear another rate cut in December is far from certain. Labor markets and inflation haven’t improved meaningfully, and the government shutdown could drag on growth.

Even Trump’s upbeat comments about his talks with Xi couldn’t stop the selloff that followed.

Across social media, the mood’s starting to feel eerily like late 2021 — the tail end of the last cycle. The permabulls are painting every chart with hopium, calling for a “lengthened cycle.” Meanwhile, the bears left are staring at the same data and seeing a completely different story.

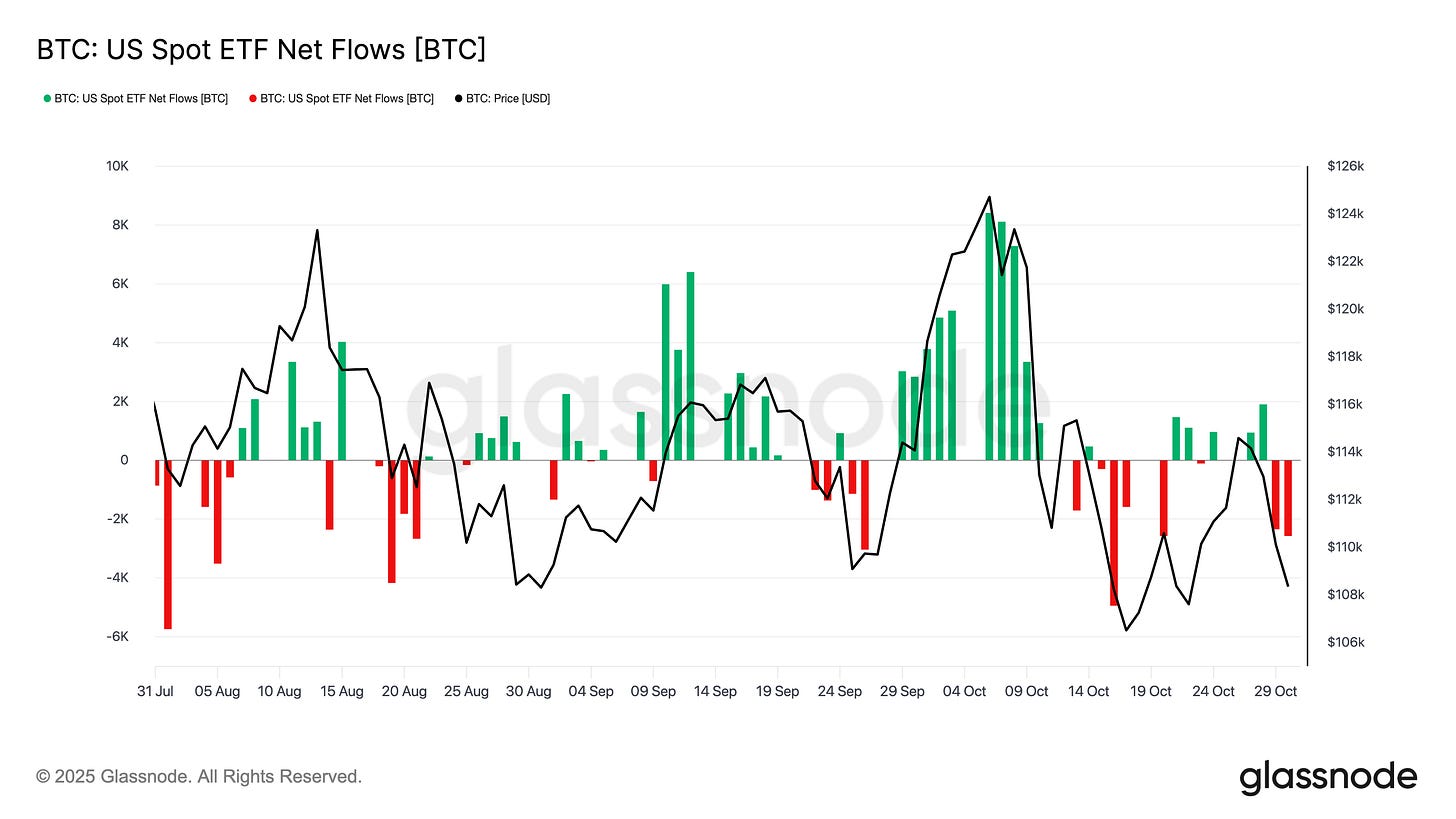

BTC ETF flows show that indecision clearly. Spot BTC funds are oscillating between inflows and outflows, mirroring how uncertain everyone feels.

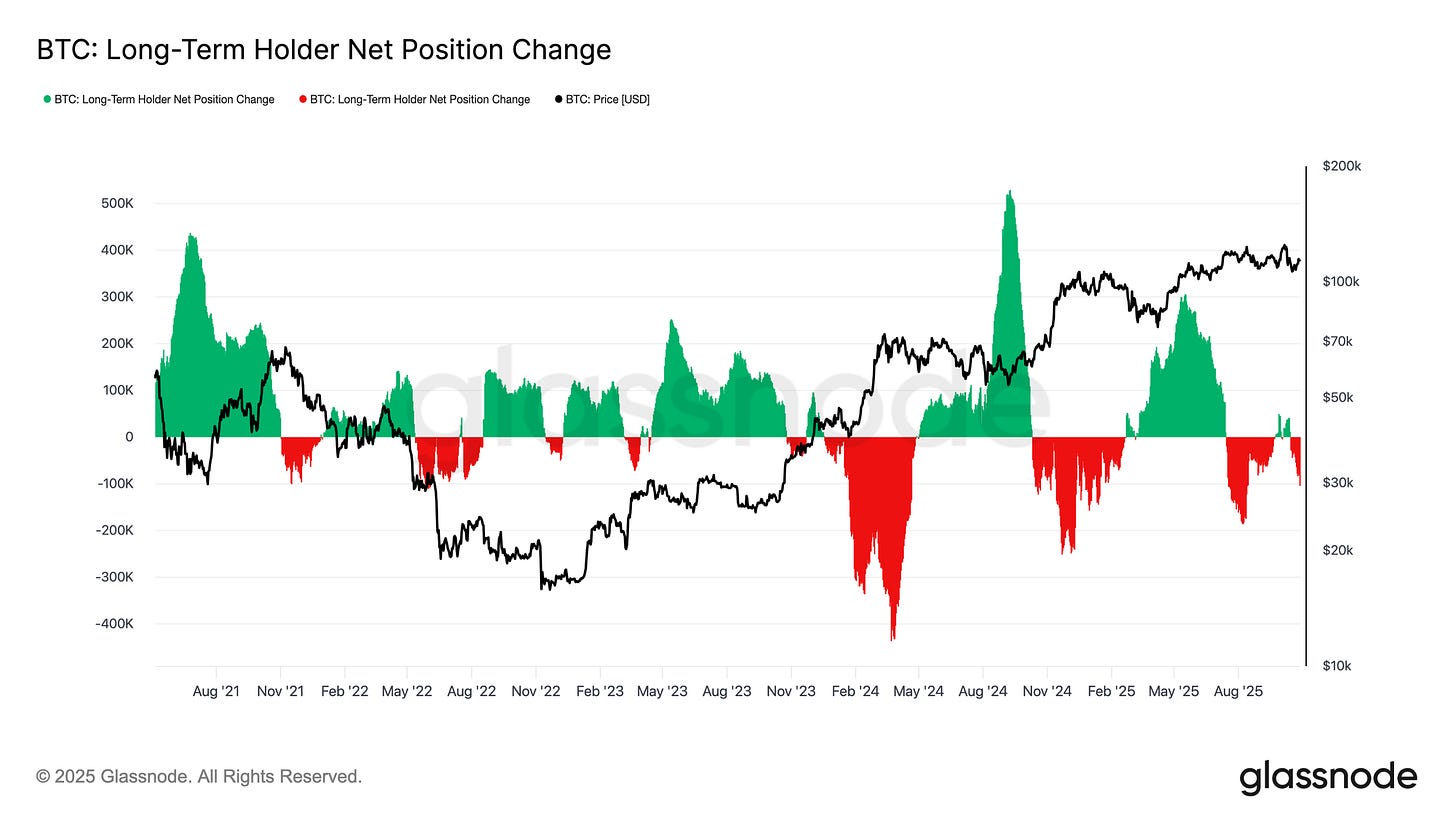

Long-Term Holders Distribution

Even long-term holders — until recently steady accumulators — have flipped back to selling.

Persistent selling by long-term holders continues to weigh on market structure. The Long-Term Holder Net Position Change has declined to –104K BTC per month, showing the most significant wave of distribution since mid-July.

This ongoing sell pressure aligns with the broader signs of exhaustion seen across the market, as seasoned investors continue to realize profits into weakening demand.

Historically, major market expansions have begun only after long-term holders transition from net distribution to sustained accumulation. Therefore, a return to positive net inflows within this cohort remains a key prerequisite for restoring market resilience and setting the foundation for the next bullish phase. Until such a shift occurs, distribution from long-term investors will likely keep price action under pressure.

From a cyclical standpoint, BTC’s clock is ticking. And all this is happening while:

Equities are printing new all-time highs

Gold is collapsing or consolidating, depending on your lens

Bitcoin keeps chopping sideways

“Uptober” clearly didn’t deliver, so now the market’s praying for November’s seasonality — historically the strongest month for BTC. But let’s be honest: this cycle’s been rewriting every old rule, and seasonality might not mean much anymore.

Market Pulse

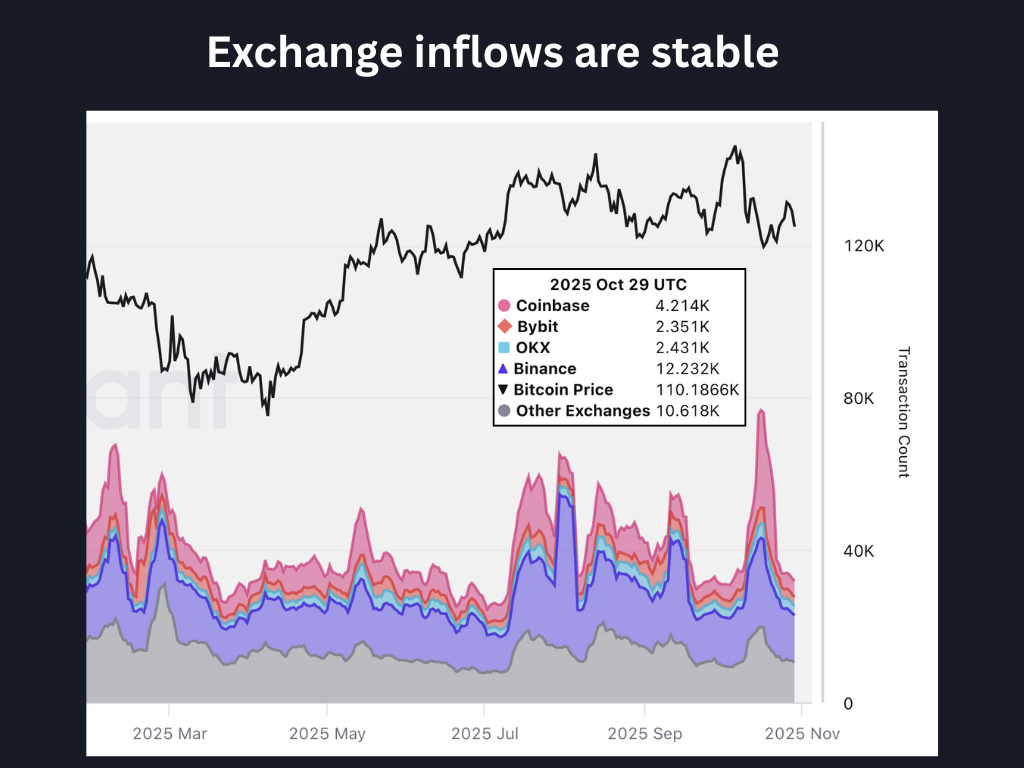

Exchange inflows continue to stay normalized — a small but welcome sign of stability. After weeks of elevated deposits hinting at panic-selling, the data now shows a calmer flow across major exchanges.

→ Translation: for the moment, altcoins are safe from another major flush.

I’m tracking this chart daily and will update you on Telegram if the trend turns. Think of it as our early-warning radar — if exchange inflows start spiking again, it’ll be time to move more risk-off.

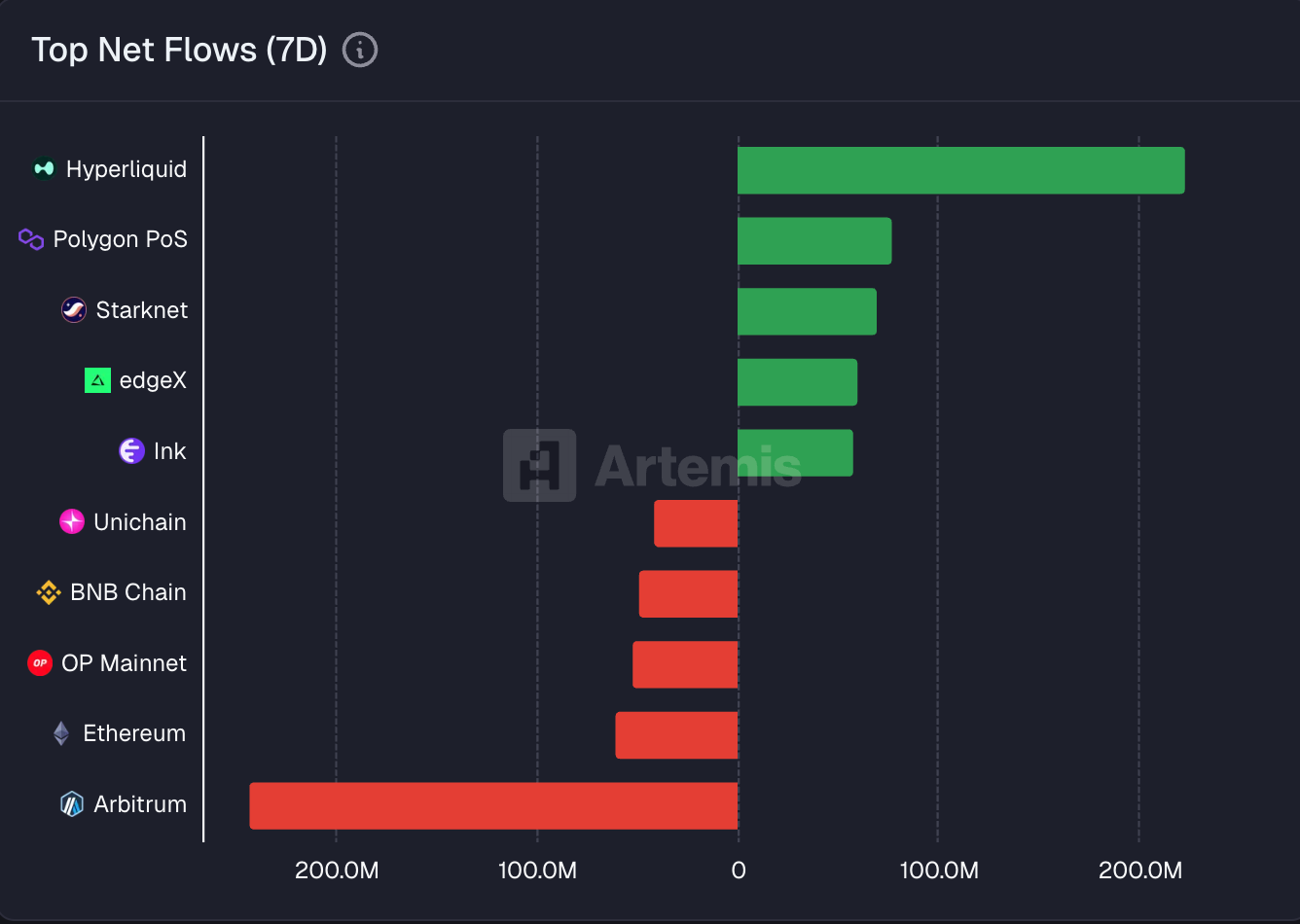

Capital rotation is shifting toward Hyperliquid again with 223M net inflow on the weekly, where most of the airdrop farming and trading is happening right now. A strong sign that our Hyperliquid thesis is still in play.

Crypto News

📈 Ethereum Activity at All-Time Highs

Ethereum’s firing on all cylinders. Daily transactions and active addresses just hit record levels — over 1.6M per day, according to Token Terminal. And gas fees are practically free at around $0.01. More activity, less cost — ETH’s running smoother than ever.

💸 Western Union Launching Stablecoin on Solana

Western Union’s officially going crypto-native. The payments giant announced USDPT, a USD-backed stablecoin launching on Solana, issued by Anchorage Digital Bank. The goal: make cross-border transfers instant and cheap. Rollout is slated for H1 2026.

🚀 First Altcoin ETFs Hit U.S. Markets

Bitwise kicked things off with BSOL, the first spot Solana ETF, saw inflows of $55M on day one and crossing $70M on day two. ETFs for Litecoin (LTC) and Hedera (HBAR) followed, with ~$1M and ~$8M in volume respectively.

The biggest updates across top crypto projects.

Polymarket confirms native POLY token + airdrop

Polymarket’s CMO, Matthew Modabber, officially confirmed that the platform will launch its own POLY token, with an airdrop already in the works. The timing couldn’t be more strategic — Polymarket’s fresh off attracting institutional capital and partnership talks, following the $2B investment from ICE, parent company of the NYSE.

→ Why it matters: Prediction markets are going mainstream, and a native token could solidify Polymarket’s position as the on-chain odds layer for real-world events.

21Shares files for Hyperliquid ETF

Another day, another win for the Hyperliquid crowd. 21Shares just filed for a Hyperliquid ETF, naming Coinbase and BitGo as custodians — the second such filing after Bitwise’s proposal in September. Over the last 24 hours, HYPE saw $528M–$748M in trading volume, which Nansen calls “extremely healthy” for its market cap. Institutional participation is rising across both spot and perps, with smart money adding longs above $48.

→ Why it matters: If HYPE clears $51, we’re likely looking at an ATH retest for the poster child for DeFi-native liquidity.

Good opportunities I discovered.

Alpha 1: How Do We Value Base (and add it to Coinbase’s valuation)? 💭

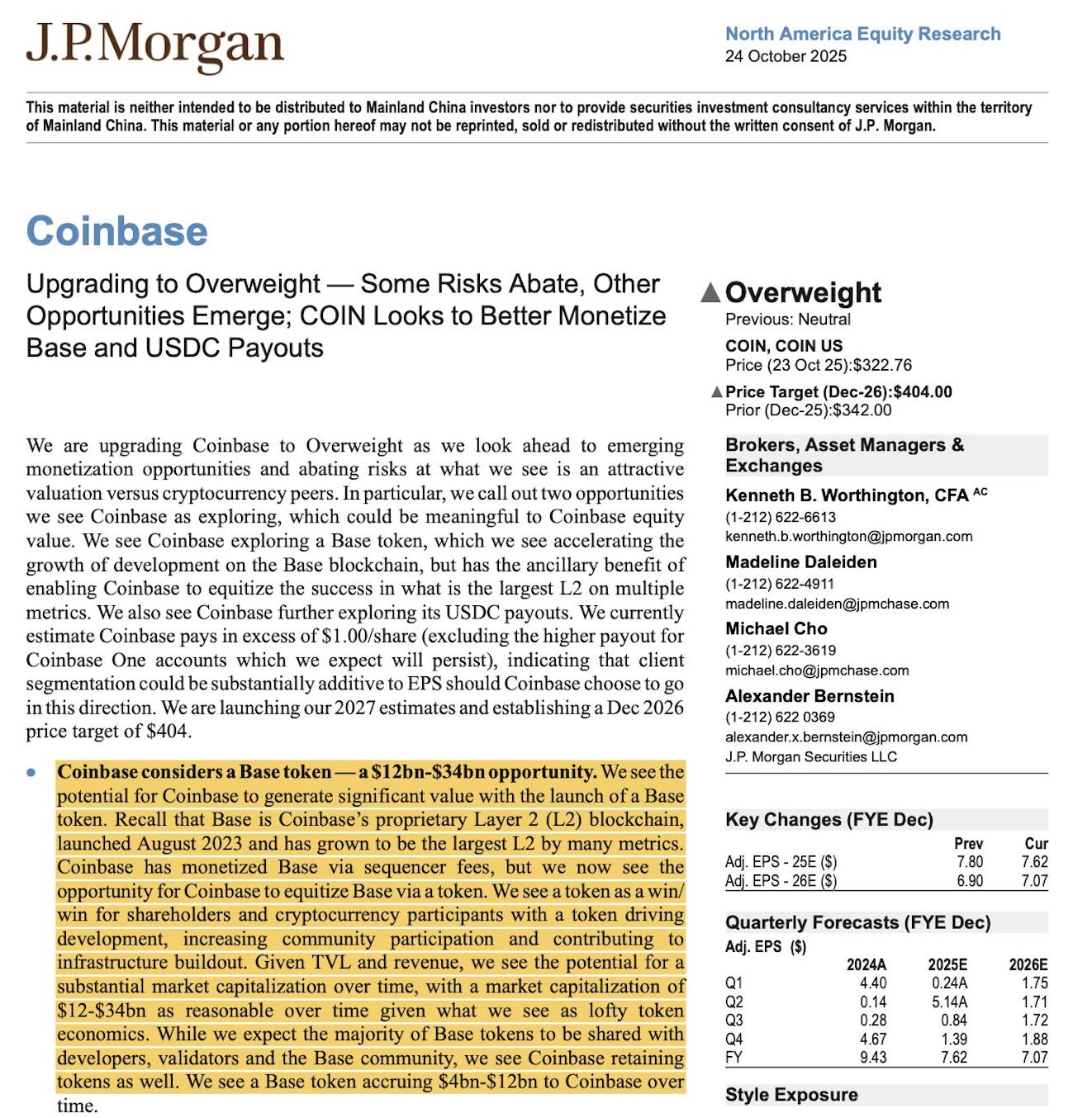

Every few cycles, there’s a moment where crypto and Wall Street shake hands. J.P. Morgan just had one of those moments — the North America research team published a full valuation framework for Base, Coinbase’s Ethereum L2, pegging it at a $12–$34B market cap opportunity and adding $4–$12B to Coinbase’s own equity value. Their new price target: $404 by Dec ‘26, up 12% from today.

That’s not just a bullish take on Base — it’s a milestone for how traditional finance is starting to value blockchains.

The Problem:

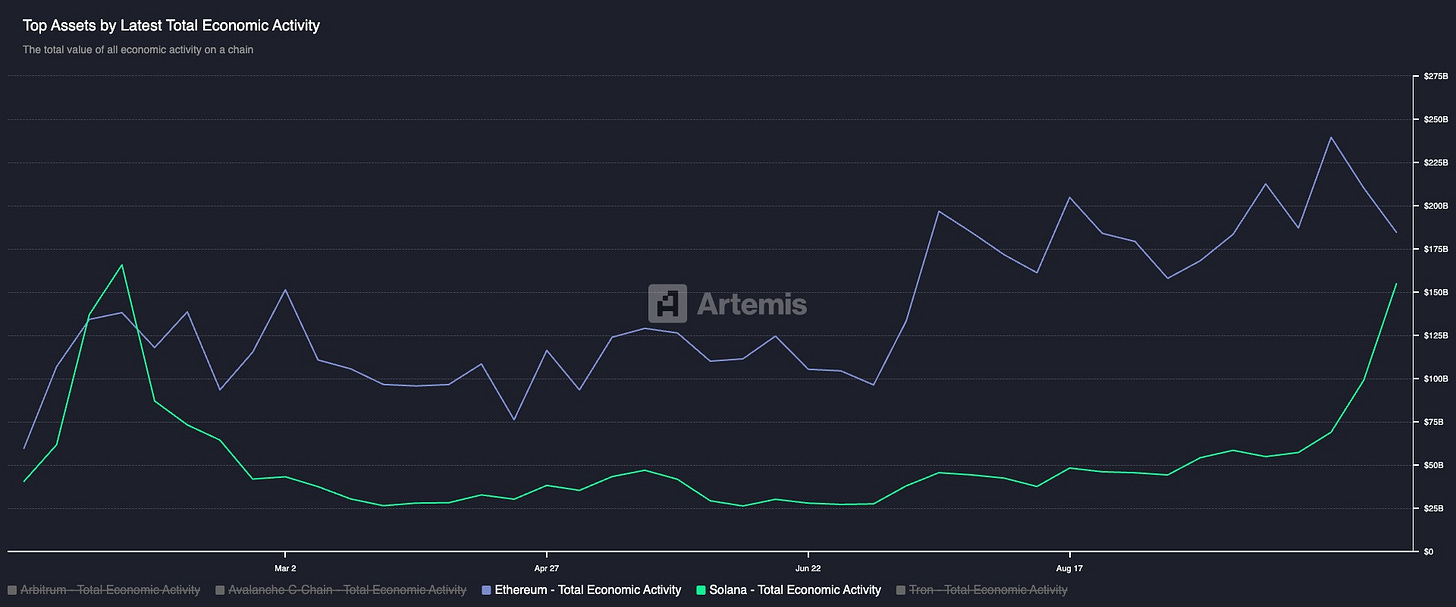

For years, analysts have tried to value L1s using developer activity, daily active addresses, or TVL. But those metrics don’t capture the full economic picture. What’s emerging now — thanks to research from Artemis Analytics — is the concept of Total Economic Activity (TEA): an aggregated view of all value flowing through a chain’s ecosystem.

That shift matters. It moves valuation away from vanity metrics toward something closer to GDP for blockchains.

The JPM View on Base:

Base runs on the OP Stack and currently doesn’t have a token (yet). It earns transaction fees every time users swap, stake, or bridge — say, a $0.02 fee to trade on Aerodrome. Part of that fee goes to Ethereum for data + settlement, and part to Optimism. The rest — the sequencer revenue — goes straight to Coinbase’s bottom line.

Right now, Base’s metrics speak for themselves:

870k DAUs, down from May’s 2.4M peak

~80M daily transactions, trending up

~$5B TVL — near ATH

~$135M annualized user fees

That makes Base the #4 chain by users, #3 by transactions, #4 by TVL, and #5 by revenue.

Using that data, JPM valued Base at 85x–241x revenue run rate, which — compared to peers like Ethereum, Solana, and Binance Smart Chain — is actually reasonable. Median blockchain valuations sit around 216x MC/revenue and 272x FDMC/revenue.

→ Translation: Base might look expensive by TradFi standards, but it’s right on par for crypto.

The Bigger Question:

What’s the right metric to value a blockchain? Revenue alone might miss the point.

Take Tempo, a payments-focused chain that raised $500M at a $5B valuation. If it captures most stablecoin volume but charges minimal fees, should it be worth less — even though it processes more real economic activity?

Or look at Ethereum: fees are down 82% in 3 years, yet ETH’s price is up 167%. Lower costs = higher activity = stronger network. The market seems to reward economic gravity, not just fee extraction.

The Alpha:

Wall Street’s now running DCFs on Base. That’s huge. But the real evolution will come when both buy-side and sell-side agree on what “value creation” means for blockchains. It’s not just fees — it’s how much real-world economic flow a chain enables.

→ Base may be the first L2 to get a proper Wall Street valuation. It definitely won’t be the last. One more reason to farm this airdrop like crazy. If you want to know how, check the alpha in these two recent newsletters:

If you want a straight to the point newsletter full of calls, new projects, airdrop farms, memecoin and DeFi moonshots, then Hix0n’s Confidential is the place for you. I can really recommend his take (if you’re comfortable with high risk).

App of the Week: Fomo 🧠

For those living on-chain, Fomo is fast becoming the go-to platform for serious cross-chain traders. Think of it as the social layer of on-chain trading — one dashboard that lets you bridge, swap, and follow top wallets across multiple chains without ever leaving the interface.

The magic here is speed and visibility. You see where smart money moves, can mirror trades, and manage your own portfolio with full on-chain transparency. And unlike most DEX aggregators, Fomo actually feels built for active traders, not DeFi tourists.

It’s also shaping up to be a promising airdrop farms right now. Load up your wallet with USDC, start trading, and you’re already positioning yourself for potential rewards once the platform token goes live.

→ Start here!

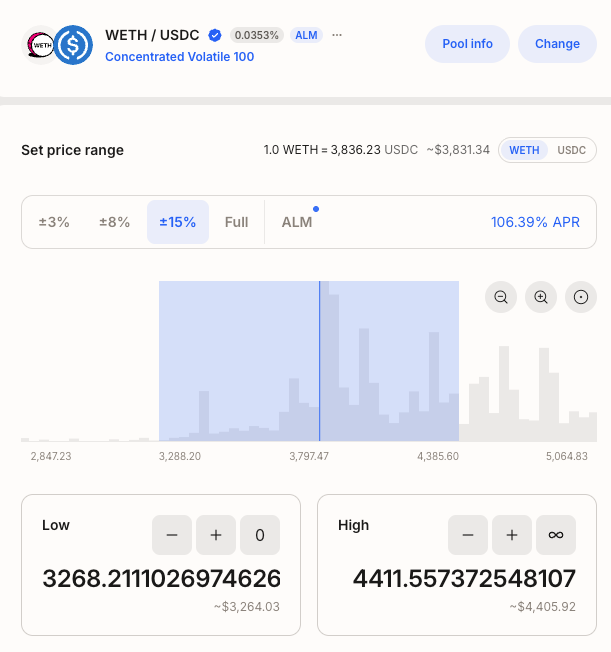

Farm of the Week: WETH / USDC on Aerodrome 🚜

Before we dive into the numbers — quick refresher. Yield farming with concentrated liquidity means you’re acting as the market maker. You deposit two tokens into a price range, and traders pay you fees when swapping between them. The tighter your range, the higher your potential yield — but also your risk. If price moves outside your range, your liquidity stops earning and you’re left with more of the losing token. That’s impermanent loss, and it’s the main danger of these farms.

Now, the setup: Aerodrome has become the liquidity engine of Coinbase’s Base network. With volatility and DEX volume both spiking, the WETH/USDC pool is one of the best spots for yield right now and it can be an important factor in the Base airdrop!

If you are overexposed ETH like me and betting on volatility, it’s a good strategy to DCA in and out of positions with concentrated liquidity.

Currently, it’s paying around 106% APY, driven by trading fees and incentives. The pool uses a 30% ETH price range, letting LPs earn on broader price swings while reducing the risk of falling out of range.

Here’s how to get started:

Go to Aerodrome’s WETH/USDC pool page

Pick your range: 15% for steady yield and wider coverage, or 3–8% if you want higher yield but tighter risk (caution here, you need to know what you do)

Add ETH + USDC, connect your wallet, and deposit

Risk Level: Medium — returns are good, but remember, your PnL depends on where ETH trades inside your chosen range.

So let’s get into the juicy Premium stuff:

If you want to actually be ready for the end phase of this bull cycle you should check out Premium

Here’s what you get:

📈 Ultimate Exit Strategy – Know when to take profits and avoid becoming fresh exit liquidity.

📰 Premium Weekly Newsletter – Deep, independent market analysis. No fluff, no filler. Just the best narratives, data, and edge.

📊 2× Weekly Trade Updates – Real trades. Real setups. In real time.

🧠 Stoic Mindset Coaching – Because you can’t win if you’re trading emotionally.

👨💼 Community Vote Deep Dives – You choose what I research. Zero shills, just signal.

💬 Daily Premium Support Chat – Ask me anything. Literally.

If you’ve been riding the newsletter for free and getting value, this is the next level.

Keep reading with a 7-day free trial

Subscribe to Adrian's DeFi Alpha to keep reading this post and get 7 days of free access to the full post archives.